August 6th, 2025 | 07:30 CEST

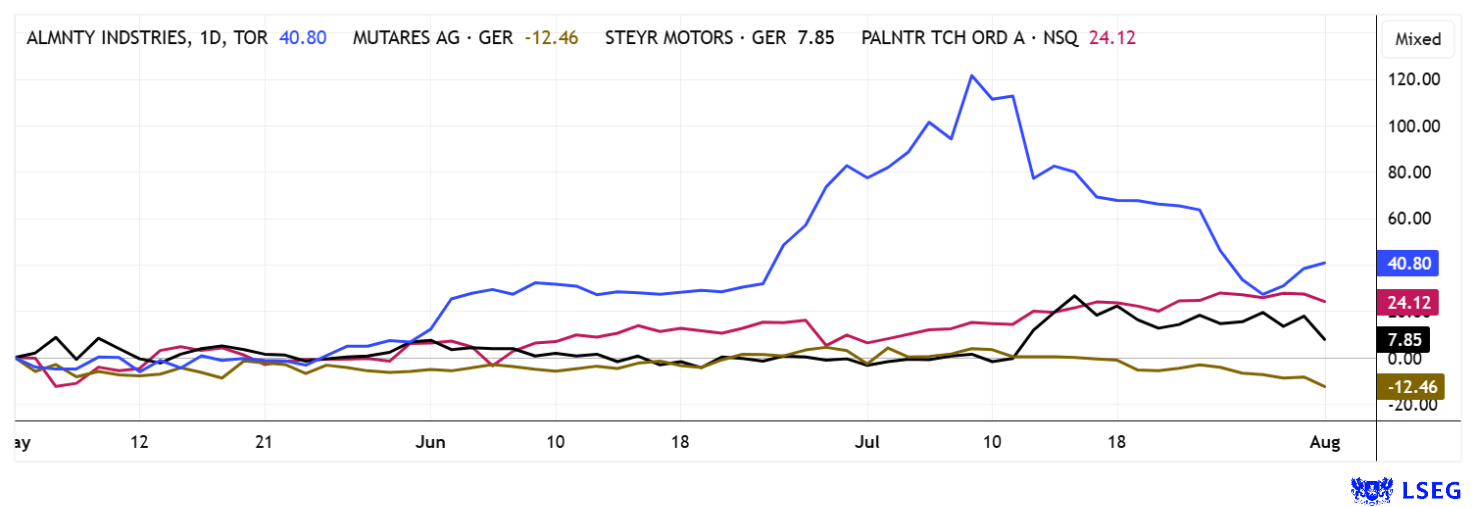

DAX celebrates, Palantir sets the pace! Strong rebound for Almonty, Mutares, and Steyr!

It is earnings season, with over 200 quarterly reports coming in from around the world every day. Investors are focusing heavily on revenue growth at defense companies. This is because they should benefit significantly from the lavish contracts awarded by NATO and other defense-oriented countries. The environment remains unstable, and geopolitically, anything is possible. However, defense stocks have often risen so far that the hoped-for earnings figures for 2027 to 2030 are already reflected in today's prices. But the rally continues! After a sharp correction at Almonty Industries, many are delighted to have a cheaper entry point into the tungsten expert, as strategic metals are high on the shopping list, especially in the defense sector. The problem is that they are scarce and difficult to obtain. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , ALMONTY INDUSTRIES INC. | CA0203987072 , STEYR MOTORS AG | AT0000A3FW25

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir Technologies – Over the Rainbow

What a quarterly result! Palantir Technologies continues its rapid growth, fueled by the ongoing AI boom. Analyst expectations were significantly exceeded in terms of both revenue and profit. The Company raised its forecast for 2025 as a whole once again and is now aiming for revenue of up to USD 4.15 billion, once again significantly above the previous consensus estimates of around USD 3.9 billion. Business with US companies is growing particularly strongly, up 93% to USD 306 million. CEO Alex Karp's goal is to reduce dependence on government contracts. Nevertheless, big deals are also on the horizon here: the US Army is currently reviewing a mega deal worth up to USD 10 billion. In Europe, too, for example in Germany, the software is the subject of political debate. The AI-supported platform "Gotham" is controversial because of both its efficiency and data protection concerns. The share price has more than doubled in the current year and is currently trading at a price-to-earnings ratio (P/E 2025/26) of around 212. Investors are thus not only valuing the current business, but also the high future growth potential. Thanks to its strategic positioning in the defense, intelligence, and business analytics sectors, Palantir remains one of the most exciting but also most polarizing tech companies on the NASDAQ. All that remains to be said here is: The trend is your friend!

Almonty Industries – After the correction comes the rebound

It seems to be over! The recent slump in Almonty's share price is now a thing of the past. It highlights the irrationality of the stock market, because despite two financial super events, such as the Nasdaq listing and an oversubscribed capital increase of USD 90 million, the share lost almost 40% within a few days and was temporarily trading below CAD 5. However, it was able to defend the important support level at CAD 4.60. The decisive factors for further valuation development are not only general market turbulence caused by intensified trade conflicts between China, Russia, and the West, but also the positioning of tungsten as a critical metal for the defense, aviation, and high-tech industries. According to NATO, tungsten is one of the most important raw materials in the security industry; China controls around 70% of production, but recently reduced its export quotas. This is a clear turning point for Western suppliers!

Almonty is establishing itself as a key alternative to the Chinese monopoly. With its latest cash injection, the Company is expanding its mines, constructing a smelter to become the first fully integrated Western source of tungsten, and pushing ahead with its key Sangdong project in South Korea. Initial supply contracts with US defense contractors, the relocation of its headquarters to the US, and the appointment of Brian Fox, an experienced US CFO, strengthen its industrial positioning. Its low valuation compared to MP Materials also fuels merger speculation. Analysts have understood the story: GBC AG sees the target price at CAD 8.50, Alliance Global Partners at EUR 5.84, and Sphene Capital raised its target from CAD 5.40 to CAD 8.40 in July. Buy!

Learn more about the tungsten business in the latest interview with GBC analyst Matthias Greiffenberger on Stockhouse: Link

Mutares and Steyr Motors – Stake in Steyr Motors further reduced

Only marginally involved in defense, but no less interesting, are Mutares and Steyr Motors. Mutares is pursuing a clear growth strategy and gradual reduction of its stake. After initially reducing its stake in Steyr Motors from 70.9% to around 40% in the first quarter of 2025, mutares recently broadened its shareholder base through further share placements, generating gross proceeds of around EUR 74 million. Steyr Motors, one of the leading engine manufacturers, is currently focusing on international expansion in the defense sector. The Company delivered an impressive performance in the last quarter with a 26% increase in revenue and a significant improvement in earnings, which continues to position Steyr Motors as an attractive target for strategic and institutional investors in the defense technology sector.

At the same time, Mutares is under pressure from an ongoing audit by BaFin. The German financial supervisory authority has set its sights on the annual financial statements for 2023, as there are concrete indications of violations of accounting regulations. At its core, the issue concerns incorrect information on the remaining term of receivables from affiliated companies and an incomplete management report on the further economic development. Mutares already came under criticism in the spring due to the late submission of its audited 2024 financial statements and was temporarily removed from the SDAX index. Mutares has announced that it intends to resolve the BaFin issue by the end of October 2025 at the latest. Investors sent the share price down to EUR 20, but it has since risen again to EUR 27 in recent days. Mutares is interesting from a speculative perspective, while Steyr Motors is ambitiously valued.

The arms and defense sector is back in the spotlight. While Almonty and Palantir have gained strongly in recent days, Steyr Motors and Mutares are taking a short breather. If the stock market continues to perform well, the selected stocks will remain in demand.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.