February 12th, 2026 | 08:00 CET

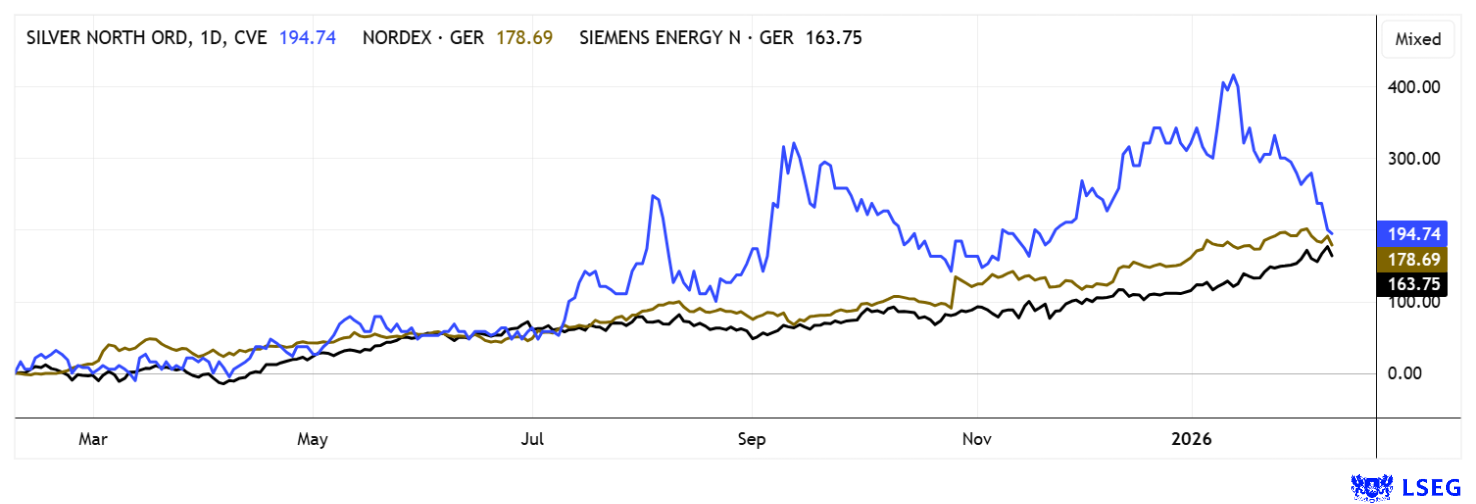

Critical raw materials are becoming scarce! Silver makes a new attempt to reach USD 100 - Silver North, Nordex, and Siemens Energy in focus

January brought the situation surrounding critical metals to a head. Copper, tungsten, and palladium reached new highs, and precious metals were also in high demand. Experts suspect significant distortions in derivatives, which led to astonishing increases in the value of silver and gold. Although silver is systematically classified as a precious metal, it has blossomed into a sought-after industrial metal over the past 10 years. Its extremely good electrical properties, thermal conductivity, and corrosion resistance make it irreplaceable in high-tech and defense applications. Silver has long been used in the field of alternative energies, with demand exceeding supply by a factor of 1.5. And then there are the speculators, who also want a piece of the pie. This means that all eyes are clearly focused on the sky. What portfolio changes make sense?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SILVER NORTH RESOURCES LTD | CA8280611010 , NORDEX SE O.N. | DE000A0D6554 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Silver North – High-grade discoveries meet structural silver bull market

While many commodities fluctuate cyclically, silver is currently undergoing a structural role change with far-reaching implications for producers and explorers. The metal represents both monetary security and key industrial technology! This is a rare combination that gains particular momentum in periods of macroeconomic uncertainty. At the start of 2026, a tense geopolitical situation will coincide with high government deficits and accelerated electrification of the economy, significantly broadening the demand base. At the same time, supply will remain limited as new projects are slow to come on stream and existing mines struggle with declining ore grades. The resulting physical shortage is reflected in declining inventories and increased activity on the futures markets.

In this environment, exploration companies with high-grade projects in established mining regions are gaining strategic importance. Silver North Resources is focused on Canada's Yukon, a long-established silver jurisdiction with existing infrastructure and a mining-friendly regulatory framework. The 100% controlled Haldane Project is immediately adjacent to a producing mine and is increasingly coming into focus after new drill results confirm a contiguous mineralized system along the Main Fault. Structurally controlled silver-gold-lead-zinc mineralization has been identified across multiple sections, showing both lateral and vertical continuity. Of particular note is a 9.10-meter section averaging 428 g/t silver and 0.73 g/t gold, including a high-grade core of 2.80 meters grading over 1,000 g/t silver with significant base and precious metal content.

Further drilling yielded additional mineralized intervals with very high lead and zinc grades in some cases, underscoring the polymetallic value potential of the system. The combination of multiple interlinked structures within the Main Fault Zone indicates a complex but well-developed vein system that offers scope for resource definition. Following completion of the 2025 program, management is working on a detailed structural interpretation to more precisely define the next drill targets. An airborne geophysical survey is initially planned for 2026, the results of which will be directly incorporated into the further exploration strategy.

On the financial side, Silver North has significantly increased its operational capacity with the successful completion of an oversubscribed financing round of approximately CAD 11.6 million. The combination of traditional units and flow-through components allows for efficient financing of planned exploration expenditures while strengthening the balance sheet. A significant portion of the funds is earmarked for qualifying exploration work until the end of 2027, providing planning security for several years. With solid capital resources, high-grade drill results, and a clear project pipeline, Silver North is strategically well-positioned to realize substantial value appreciation potential in the current silver cycle. Silver North's stock (ticker: SNAG) has consolidated somewhat in recent days and offers new interesting points of action in the range of CAD 0.28 to CAD 0.31!

Stockhouse host Brieanna McCutcheon interviews Executive Chairman Mark T. Brown about the progress of the Haldane Project.

Siemens Energy – Faster, higher, further!

The example of Siemens Energy clearly shows how far the stock market can really play out current trends. Just over two years ago, the share price was at a low of around EUR 6, and the company even had to apply for state guarantees to stem the financial difficulties of its Spanish subsidiary, Gamesa. However, that is all water under the bridge. Today, Siemens Energy is one of the top performers in the global electricity market in terms of storage, transmission, and generation. The Munich-based company has successfully positioned itself as a key provider of physical infrastructure for an electrified economy. Above all, the sharp rise in electricity demand in the US, particularly from data centers and AI applications, is leading to an accelerated expansion of high-voltage grids, transformers, and grid control technology. The announced billion-dollar investments in new and existing US locations are strategically consistent, but tie up considerable capital and will only contribute to earnings in the medium to long term. In the short term, they increase operational complexity and dependence on a stable political and regulatory environment.

The LSEG expert consensus has not yet been able to process the latest developments accordingly and has been stuck at a 12-month price target of around EUR 138 for weeks. Metzler and Baader are targeting a price of EUR 150, and yesterday the share price climbed to just over EUR 160. If that does not make you dizzy, set a stop at EUR 152.80 to secure your dream return. Siemens Energy's annual general meeting is on February 26, where there will be an update on the outlook.

Nordex – Analysts are divided

Nordex can also look back on an exceptionally dynamic share price performance. The Hamburg-based company is strongly project-oriented and is currently benefiting noticeably from the revival of investment appetite in the European onshore wind sector. Extensive new orders at the beginning of the year point to solid capacity utilization and increase the predictability of future revenues. The increasing share of modern, high-performance turbine models and the systematic expansion of the higher-margin service business are strategically significant. Maintenance and operational management contracts ensure recurring revenues and dampen the earnings fluctuations that have weighed on the company in previous years. Nevertheless, Nordex remains sensitive to price pressure, raw material costs, and potential regulatory adjustments to subsidy regimes.

However, a great deal of optimism already seems to be priced into the stock market. The valuation based on expected earnings for 2026 is well above the long-term average and implies a sustained increase in profitability. The analyst consensus target of EUR 31.7 published on LSEG suggests that experts see rather limited upside potential in the medium term. The upcoming company figures on February 26 could provide some impetus. If momentum and news flow slow down, partial profit-taking appears sensible from a risk perspective.

Hard to believe! Dream returns with silver and energy stocks. Who would have thought that 12 months ago? However, caution is now advised. While rising metal prices are having a negative impact on processors' margins, ongoing discussions about the silver shortage are causing turmoil in the precious metals sector. Once again, this shows how important sophisticated diversification is for a portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.