August 4th, 2022 | 13:53 CEST

Crash! Which shares are attractive now - TeamViewer, Viva Gold, Infineon

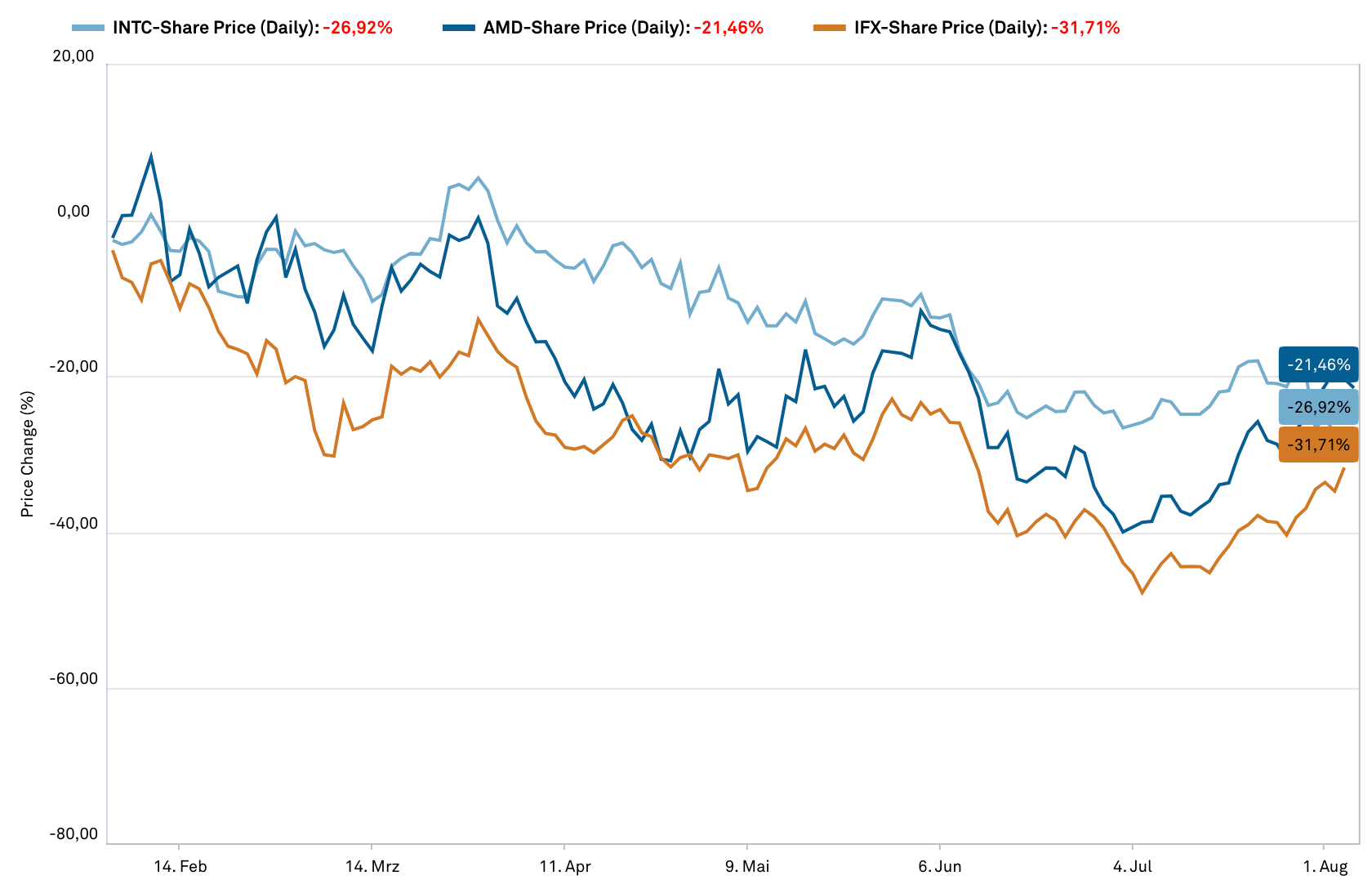

The technology sector has been in a sharp correction for months. The leading technology index from the US alone, the Nasdaq-100, recorded price losses of around 34% up to its low. Since the middle of last month, a countermovement has set in. However, many companies are still at an interesting entry level. Currently, the season for the publication of the figures for the second quarter is also underway. Here it becomes clear which companies you can build on in the future or which title you should remove from your portfolio.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

TEAMVIEWER AG INH O.N. | DE000A2YN900 , VIVA GOLD CORP. | CA92852M1077 , INFINEON TECH.AG NA O.N. | DE0006231004

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Infineon - Forecast increased

The industry can breathe a sigh of relief. As explained in the report, the weak results of the former market leader Intel were probably homemade and not transferable to the broad peer group. That is because, in contrast to the US, Germany's largest semiconductor manufacturer was able to increase both sales and margins with its results for the third quarter of 2021/2022. Operating profit for April to June was EUR 842 million, up 11% on the previous quarter's figure of EUR 761 million. Sales amounted to EUR 3.6 billion, and the operating margin was 23.3%. Internal targets were thus exceeded. Analysts had on average expected sales of EUR 3.42 billion and segment earnings of EUR 727 million.

In addition, the Neubiberg-based Company is again becoming more optimistic for its final quarter and raised its forecast for the third time this year after presenting its figures. Infineon is now targeting sales of around EUR 14 billion and a segment profit margin of more than 23%. At EUR 1.4 billion, free cash flow is expected to be EUR 300 million higher than previously forecast. US investment bank Goldman Sachs reiterated its "buy" rating on Infineon after the quarterly figures, with a price target of EUR 36.50.

Advanced Micro Devices also posted the highest revenue in the Company's history in the second quarter. Revenues rose to USD 6.55 billion. At the same time, the results remained below analysts' estimates, which expected revenues of USD 6.8 billion. AMD sales in its data center chip business climbed 83% to USD 1.5 billion. By contrast, Intel's revenue from the comparable division was down 16% to USD 4.6 billion last quarter. AMD's quarterly profit fell 37% to USD 447 million but was justified by write-downs related to the Xilinx acquisition.

The Americans were cautious with the forecasts for the third quarter. USD 6.6 billion to USD 6.9 billion is the internal target for sales, while analysts expect USD 6.8 billion in consensus. Management is becoming more pessimistic about the PC business and expects losses in the lower double-digit percentage range. Investors acknowledged the not too euphoric statements with discounts of more than 5%.

Viva Gold - The bottom is near

More and more trouble spots are emerging around the world. Thus, the visit of US top politician Nancy Pelosi to Taiwan is likely to worsen relations between the United States and China significantly. On the part of China, manoeuvres are being flown, and further economic sanctions are being imposed. In addition to the war in Ukraine, we are probably facing the next conflict here. Historically, the average investor can hedge against such crises with precious metals such as gold and silver. However, the precious yellow metal, in particular, is seen as the currency to use when geopolitical turmoil hits or the current high inflation gets out of hand.

You can bet on a rising gold price with leverage by buying smaller exploration companies like Viva Gold. Although these companies track the precious metal price, they react disproportionately to its change upwards and downwards. Viva Gold has already undergone a correction. The value has lost about 80% since the peak at CAD 0.48 and has a market value of CAD 9.14 million with a price of CAD 0.11.

Fundamentally, however, the Vancouver-based company's 100%-owned Tonopah Gold Project is doing extremely well. The 4,250-hectare deposit is located on the Walker Lane Trend in Nevada, known for its high mineralization. Nevada was ranked the 3rd best gold deposit in the world by the Fraser Institute in 2021. Just 30km from Tonopah is Kinross' Round Mountain mine, which produced 258,000 ounces of gold in 2021. The project has an indicated gold mineral resource of 394,000 ounces at a gold grade of 0.78 g/t and 206,000 ounces of inferred resources at 0.87 g/t.

The next targets are clearly defined. In addition to a 2000m drill program, with 10 holes primarily in the western and eastern parts of the property, the permitting process and feasibility study are being worked on with determination. Viva Gold is an interesting market participant with potential leverage in a rising gold market.

TeamViewer - Out for Manchester United

The sponsorship agreement with one of the most famous and expensive clubs in the world, Manchester United, was a number too large and costly, as one report states also. Now, after the expiration of the five-year contract, the rip cord is to be pulled. However, TeamViewer is still obligated to transfer around EUR 46 million p.a. to the Red Devils for almost four years, which should continue to weigh heavily on the weakening margin.

When the figures for the second quarter were published, an increase in sales of EUR 241.00 million was reported. Billings rose from EUR 268 million to just under EUR 300 million. By contrast, the EBITDA margin slumped from 54.8% to 47.2%.

The forecast for the full year was presented in a more pessimistic light. Billings are expected to reach the lower end of the range between EUR 630 million and EUR 650 million. Sales are expected to be between EUR 566 million and EUR 580 million, with the EBITDA margin hovering between 45% and 47%. In addition to the market environment, the reasons given here include the withdrawal from the Russian and Belarusian markets. However, with a 1% share of total sales, this is unlikely to be worth mentioning. In the past year, the annual forecasts were corrected downwards three times. The year 2022 is still long in the process.

After disappointing figures from competitor Intel, Infineon was able to present strong figures. In contrast, TeamViewer is struggling with slowing business and expensive sponsorship contracts. In a long-term rising gold market, young exploration companies like Viva Gold are likely to outperform the broad market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.