April 25th, 2025 | 07:10 CEST

Crash or rebound? Tracking the data with Palantir, SAP, MiMedia, and Deutsche Telekom

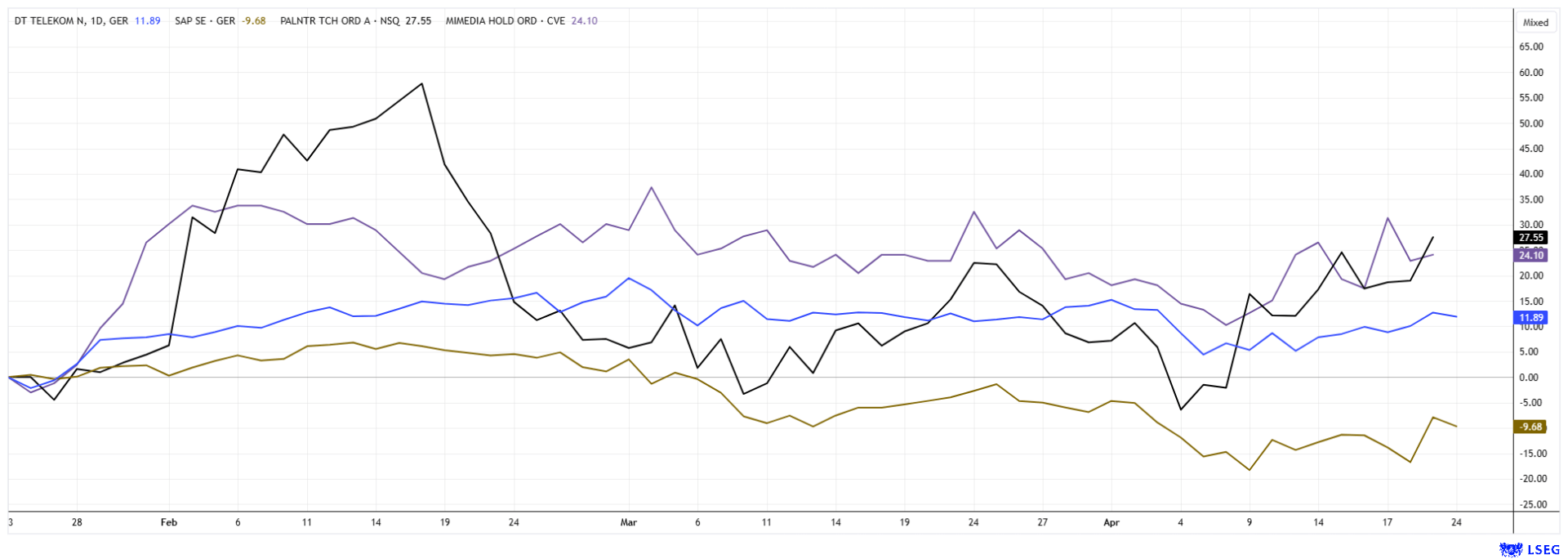

Is the big correction already over? Given historically high liquidity, investors are wondering whether last week's slump marked the end of the road. Stocks such as Nvidia, Apple and SAP have now corrected more than 25% from their highs, something that has rarely been seen in the last 24 months. The NASDAQ is tentatively working its way back up, but the DAX 40 index is gaining momentum. It is now only 1,500 points away from its previous high of 23,476 points. A good strategy could, therefore, be to selectively re-enter the market. However, set clear loss limits for each investment. Here are a few promising suggestions.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , SAP SE O.N. | DE0007164600 , MIMEDIA HOLDINGS INC | CA60250B1067 , DT.TELEKOM AG NA | DE0005557508

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutsche Telekom – A rock in the surf

Keeping track of vacation photos and personal documents is often difficult. Magenta Cloud offers the option of storing and sorting files and scanned paper documents in a central location using the highest security standards. For large telecommunications providers such as Deutsche Telekom, it is essential to offer their customers a storage function. This increases customer loyalty, as switching cloud providers at some point takes a lot of effort. The Bonn-based company performed brilliantly in the latest price correction. From a high of EUR 35.90, it briefly fell to EUR 30, but yesterday, the share price was already back at EUR 32.60. The Company plans to present its first-quarter figures on May 15. Analysts expect stable earnings per share of around EUR 0.46 for Q1, with EUR 2.01 per share for the full year. At the current level, the stock pays a dividend of around 3.1%. With growth of 5 to 8% per annum, a 2027 P/E ratio of 12.7 is not too expensive. Analysts on the LSEG platform also see room for growth to EUR 37.20. JPMorgan is particularly positive, giving the stock an "Overweight" rating and a 12-month price target of EUR 43.

MiMedia – Focus on customer data

Canadian company MiMedia (MIM) is also active in the cloud market, offering a whole range of personalized services. For smartphone users with Android operating systems, it offers a next-generation cloud platform based on artificial intelligence that enables all types of personal media to be backed up permanently and independently of location. Monthly subscriptions range from 500 GB for CAD 7.99 to 2 TB for CAD 15.99, with annual subscriptions saving customers around two months' worth of fees. Interest in the services is huge!

Once stored, users can access their files seamlessly at any time across all devices and operating systems. The platform features the latest technological standards and offers an impressive media experience, robust organization tools, and a wide range of private sharing features. MiMedia works with several smartphone manufacturers and telecommunications providers worldwide, offering its partners recurring revenue streams, vastly improved customer loyalty, and unique market differentiation. Currently, B2B customers are spread across the US and South America, as well as Africa, EMEA, and Southeast Asia. In the first quarter, the Company also made a groundbreaking move by winning blockbuster customer Walmart Latin America.

MiMedia has already signed contracts with additional partners for 35 million installations over the next 24 months. The Company is currently growing very strongly with implemented patent protection after six years of development and investments of more than CAD 50 million. The partnerships generate several hundred million in revenue for its customers, the telecom carriers, and MiMedia, which receives a good margin from these contracts. MiMedia can strengthen customer loyalty and generate recurring revenue through storage subscriptions and mobile advertising. The underlying market is growing strongly and offers innovative providers such as MiMedia, an excellent field of activity. The share price already enjoyed a breath of fresh air in the first quarter, rising from CAD 0.20 to CAD 0.60. There is now some consolidation at that level, but the valuation of only CAD 28.7 million is still very low. The stock showed particular stability in the recent NASDAQ correction of over 20%. Now is the time to buy!

Palantir and SAP – The data business is booming

One of the most dazzling stock market stories of the last five years is Palantir Technologies. The Company, led by CEO and co-founder Alex Karp, specializes in big data analysis and AI services for governments and military clients. Palantir sees itself as a specialist in highly sensitive information, which is used, for example, in the defense of Ukraine or in border surveillance. Public sector clients have generous budgets for such data and pay correspondingly high margins for the coveted services. In 2020, the Company went public at a price of USD 10, and five years later, the share price reached USD 125. In the current correction, the stock slipped to USD 72, and investors had to endure a 45% loss in the short term. As of yesterday, the share price was back up to USD 105, and the first storm seems to have been weathered. The first quarter figures will be released on May 5. The outlook should be encouraging. Otherwise, trouble looms, as the price-earnings ratio for 2025 is calculated at a hefty 182. Logically, the experts on the LSEG platform also see little potential. Only 5 out of 24 give a "Buy" rating with an average target price of USD 91.30. However, this mark has already been exceeded by a considerable margin. Impressive!

The SAP share is priced less spectacularly. Investors looked to the Q1 figures with some trepidation this week. However, the Walldorf-based company was able to dispel most of the doubts about growth and delivered solid results as usual. After a difficult previous year with painful job cuts and geopolitical headwinds, Europe's largest software group is again in impressive shape. Revenue rose by 12% year-on-year to EUR 9.01 billion. The increase in revenue was mainly driven by recurring subscription models and a strong cloud business. Bookings for cloud-based software solutions even rose by 28% for the year as a whole. Earnings per share climbed to EUR 1.52 – a dramatic turnaround compared to the loss of EUR 0.71 in the previous year. Experts had only expected EUR 1.32 in advance. The operating margin also increased to 27.1%. The share price jumped 11% to EUR 241, ending its recent correction. 32 out of 34 analysts on the LSEG platform are positive, with an average 12-month price target of EUR 279.50. The stock can currently still be picked up at a good price in the EUR 235 to 242 range, which is also where important technical lines are located.

Volatility is unusually high at the moment. On some days, there are significant positive or negative outliers. This makes it all the more important for investors to always act with restraint to avoid being caught off guard by extreme swings. While SAP and Palantir have experienced extreme ups and downs, Deutsche Telekom and cloud specialist MiMedia are progressing steadily. The upward trend is likely to resume soon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.