August 7th, 2024 | 11:40 CEST

CRASH - AI and high-tech now on a silver platter! Amazon, LVMH, VCI Global, Cogia, A2Z Smart Technologies, and Super Micro Computer

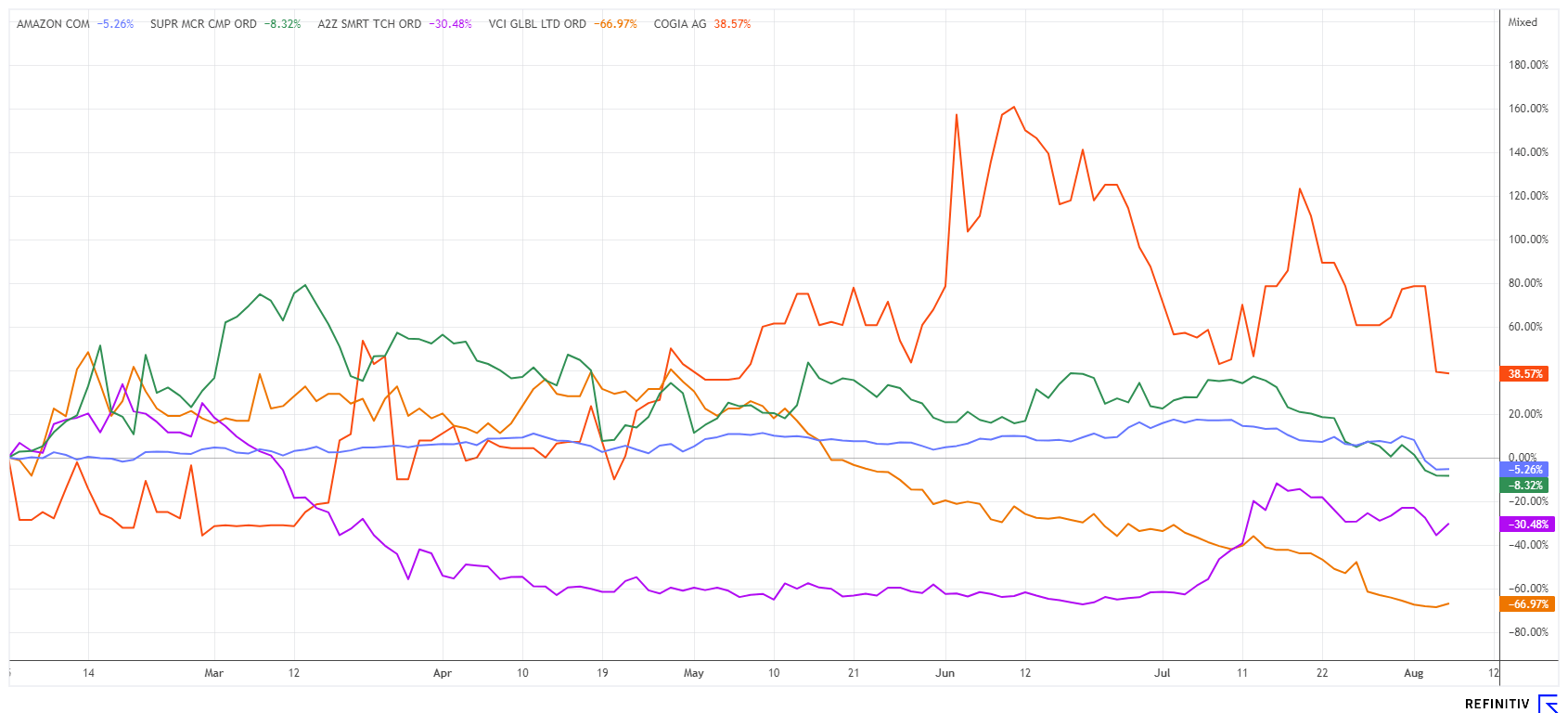

Finally, a clear correction, say some; oh my goodness, say those who bought in recent weeks. The historical pattern is repeating itself. Attractive splits in the high-tech, followed by a new all-time high, and then the crash. Nvidia and especially the so-called "Magnificent Seven" have already had a first-class run with 100% returns in 2024. Now, the question is: can this euphoria be repeated? What is crucial now are also the cash reserves of traders and how much valuable capital has actually been lost in the recent collapse. US investment banks have done a quick calculation: USD 2.5 trillion in market capitalization was wiped out in just 48 hours. But as we know, money does not just disappear - it ends up somewhere else! We select interesting shares that offer more excitement at a reduced level!

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

AMAZON.COM INC. DL-_01 | US0231351067 , LVMH EO 0_3 | FR0000121014 , Cogia AG | DE000A3H2226 , VCI GLOBAL LIMITED | VGG982181031 , A2Z SMART TECHNOLOGIES | CA0022091049 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Amazon and LVMH - Weak figures, crumbling share prices

There are increasing signs of a recession. Consumer figures are also showing a marked summer weakness. Disappointingly, Amazon reported revenue of USD 148 billion, which is around 10% higher year-over-year but lower than the average estimate of analysts of USD 158 billion. Despite a solid increase, the high expectations were not met. One bright spot was the performance of the AWS cloud division, which reported revenue growth of 19% and earnings of USD 26.3 billion. AWS thus contributed 18% of total revenue and 63% of Amazon's operating income.

Not without surprise, AWS is growing faster than the rest of Amazon's business despite strong competition from Google, Microsoft, and Oracle. To meet the growing demand for computing power for AI models, Amazon plans to significantly increase its investments in 2024, particularly in Nvidia GPUs to support AI enterprise solutions. The share price has fallen by around 16% since Friday, August 2. Experts on the Refinitiv Eikon platform see an average 12-month price target of USD 220 for Amazon. This means there is 38% potential again.

The French luxury goods group LVMH is also showing signs of a slowdown. With quarterly revenue of EUR 41.7 billion, the Company also fell slightly short of market expectations of EUR 42.2 billion. Less disposable income and changing consumer preferences are putting pressure on the otherwise robust luxury market. The analysts at Jefferies reacted with a certain degree of skepticism and lowered their "Hold" price target from EUR 710 to EUR 690. At EUR 621, the share price in Paris yesterday was a good 30% below its high for the year.

A2Z Smart Technologies - More shopping with artificial intelligence

The Israeli-Canadian company A2Z Smart Technologies is generating growth despite declining consumer sentiment. The highlight of the A2Z business model is the on-site activation of purchase requests. A means to the end is a smart self-checkout shopping cart that uses an intelligent algorithm, touchscreen and other technologies to store shared consumer wishes and even points out forgotten items on the shopping list. In this way, "Cust2Mate" optimizes the retail shopping experience by scanning purchased products and enabling payment in a familiar shopping cart. At checkout, it is simply a case of "Select and Go," and the payment process is carried out using the stored credit or customer card. Long, frustrating checkout queues are now a thing of the past!

The smart big data and AI functions, which optimize business operations in the background and positively impact low margins in the retail sector, can almost be described as revolutionary. The installation of "Cust2Mate" not only leads to a more efficient shopping experience for customers but also to less unused shelf space and staff requirements, as well as advanced command and control options for store managers. On-the-go promotions and coupons further increase the average shopping basket.

A product launch was announced yesterday. The new generation of intelligent shopping carts, "Cust2Mate 3.0", will be used by the customer Franprix in Paris. Franprix is a leading grocery chain that operates over 600 stores in France. The market launch is part of a framework agreement with IR2S, a renowned integrator of advanced retail technologies, which provides for the placement of 30,000 intelligent shopping carts at renowned retail chains in France by 2026. The 3.0 shopping carts offer connected store features that even combine online and physical shopping to integrate exclusive promotions and personalized product recommendations.

According to studies, the market for smart shopping carts was worth EUR 1.76 billion in 2023 and will continue to grow by more than 25% per year. A2Z Technologies should benefit greatly from this. More than 50% of the approximately 51.5 million shares are held by the founders, management, and institutional investors. A market capitalization of EUR 24 million is nothing compared to the technological lead the Company has achieved. Therefore, the current tech sellout is a welcome opportunity for initial positioning.

VCI Global Ltd and Super Micro Computer - A bouquet of good news

The business of VCI Global (VCIG) is just as high-tech and AI-driven. The capital market and tech expert for Nasdaq listings has interesting investments in the fields of artificial intelligence and secure communication. The business focuses on IPO advisory, fintech, AI, robotics, and cyber security. In total, around 30 companies have already been successfully accompanied to the stock exchange from Malaysia. Of course, VCI has also successfully listed itself and carried out a dual listing in Frankfurt a few weeks ago.

One of the biggest deals in the Company's history can be generated for VCI Global from the TalkingData investment, as the well-known player is already on board with the global leaders Google, Yahoo, L'Oréal, PepsiCo, and Nike. In this deal, VCI Global is joining the Chinese Softbank arm SB China Venture Capital (SBCVC). VCIG also gains exclusive rights to TalkingData's data AI products and services across Southeast Asia, expanding the Company's presence in the fast-growing data analytics sector. The proceeds from this listing transaction could become the largest deal in VCI Global's history.

Last week, the Company announced that it had joined the AI Computing Alliance ("AICA"). This is a joint initiative led by Enlight Corporation. Also on board are Nvidia partner Super Micro Computer, as well as Fortinet and other well-known tech players. This alliance will jointly establish high-speed AI Computing Centers (AICCs) and advance the AI ecosystem. The first AICC will be established in Taiwan. With 256 units of NVIDIA H200 Tensor Core GPUs generating a total of 93 PFLOPS of AI computing power, this AICC will rank about 15th in the world in terms of AI computing power, making it one of the fastest data centers in Asia. With the AICCs, Allianz aims to provide world-class AI services to governments, financial institutions, and enterprises. The entry into the world of high-performance computing fits perfectly into the recently announced joint venture with the German AI tech specialist Cogia, which specializes in customer technologies and secure communication solutions. The joint project is called "AiSecure" and is expected to be listed on the NASDAQ in 2025/26.

This alliance will jointly establish high-performance computing data centers (AICCs) and advance the AI ecosystem. The first AICC will be set up in Taiwan. With 256 units of NVIDIA H200 Tensor Core GPUs, generating a total of 93 PFLOPS of AI computing power, this AICC will rank approximately 15th worldwide in terms of AI computing power, making it one of the fastest data centers in Asia. Through these AICCs, the alliance aims to provide top-tier AI services to governments, financial institutions, and businesses. The entry into the world of high-performance computing complements the recently announced joint venture with the German AI tech specialist Cogia, which focuses on customer technologies and secure communication solutions. The joint project, "AiSecure," is expected to be listed on NASDAQ in 2025/26.

Following the tech sellout in recent days, the shares of VCI Global, Cogia, and Super Micro Computer (SMCI) are available at heavily discounted prices. SMCI was still trading at just under USD 900 in July and fell below USD 600 at the beginning of the week. The small caps VCI Global and Cogia can be purchased for EUR 0.28 and EUR 0.43 respectively. The NASDAQ launched a major counterattack yesterday. It had lost a whole 2,000 points or 11% in the previous three trading days. Technically, the market is currently heavily oversold. However, volatility is likely to remain very high.

High-tech shares are attempting a turnaround. A 5-day sellout caused prices to plummet by over 10% after the Japanese Nikkei index also suffered historic losses. An interesting phase of bottom fishing has now begun for dynamic investors. Medium-term investors should take a closer look at the fundamental indicators.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.