May 15th, 2023 | 07:50 CEST

Correction in Greentech shares Varta and Nordex - Manuka Resources becomes a gamechanger

The goals of the climate protectionists are being delayed. With the Building Energy Act unlikely to arrive until 2025, the construction of the Tesla Gigafactory in Brandenburg will also be further delayed. Tesla has determined that the 300 hectares of factory space officially approved in 2022 is not quite enough. However, the latest planning for 400 hectares is meeting with resistance, especially from environmental groups. The municipalities are accused of planning chaos and failure to comply with environmental regulations. The climate-neutral future requires tremendous efforts because time is pressing. The stock market also seems to have run too far on many issues and urgently needs a break from its permanent upward trend. Pay attention to the following stocks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , NORDEX SE O.N. | DE000A0D6554 , Manuka Resources Limited | AU0000090292

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nordex - In search of profitability

Hamburg-based wind turbine expert Nordex is facing a home-grown problem. The high number of old projects weighed on the Company in the first quarter. What would be a blessing for many companies is a burden for the power plant manufacturer, as the many old contracts were agreed upon without corresponding adjustment factors to the new price world. 50% higher upfront costs and ongoing supply chain problems have pressured the entire industry for many months.

Despite delivering ever more powerful turbines, profitability has hardly improved so far. Although sales rose by a good 30% to EUR 1.2 billion, Nordex posted a loss of almost EUR 215 million on the bottom line, around 40% more than in the same quarter of the previous year. In an initial assessment, analysts described the figures as weak, with Jefferies even calling it a disappointing start to the year. However, they are now positive about the outlook: CEO Blanco expects a stronger second half of the year as the situation improves with each new contract. Accordingly, the EBITDA margin in 2023 is expected to be in the corridor of -2 to +3%, although in Q1, it starts at a low of minus 9.5% compared to minus 4.3% in the final quarter of 2022.

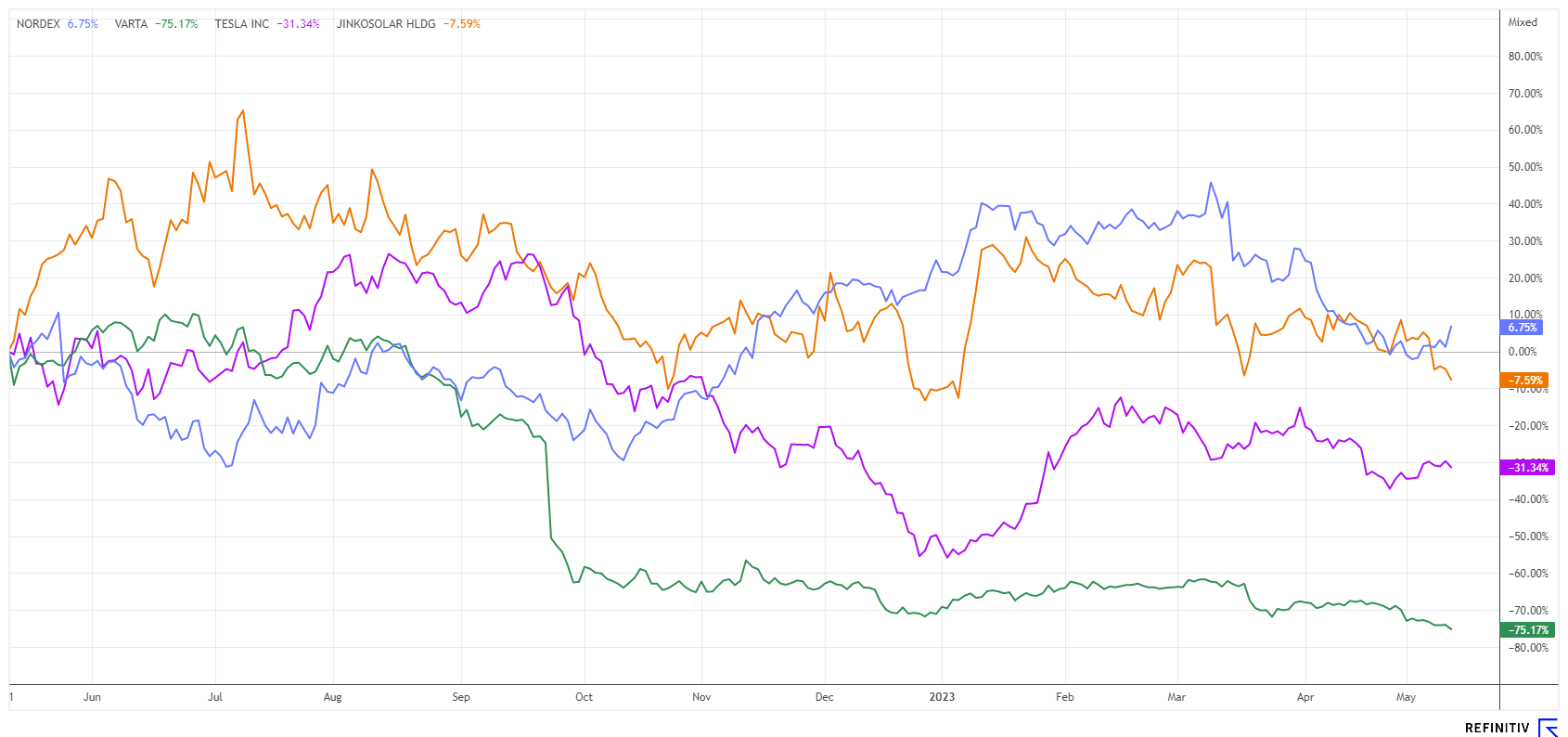

After a rollercoaster ride, the Nordex share is now back at EUR 11.30, a good 27% below its high for the year of EUR 15.58. With a valuation of EUR 2.5 billion, it is currently trading at around 40% of sales, yet only 4 out of 10 analysts on the Refinitiv Eikon platform give it a buy rating with an average 12-month target price of EUR 14.45. From a chart perspective, the value must not fall below EUR 10, otherwise, trouble threatens.

Manuka Resources - The gamechanger in the portfolio

In the current climate debate, the most important thing is to develop marketable products that are already produced under sustainable principles in their creation. This is anchored in the so-called Supply Chain Act and is becoming mandatory for raw material companies. However, only mining companies that implement ESG criteria above and beyond the required level and thus make a voluntary, active contribution to environmental and climate protection will be eligible. Therefore, the metals urgently needed for climate change must be mined cleanly and with the smallest possible CO2 footprint.

The Australian commodities company, Manuka Resources Ltd from New South Wales, not only owns two very promising projects in gold and silver with historical production but is also positioning itself in the area of critical metals with the acquisition of a large vanadium project (STB) completed in 2022. Recently, the new chief geologist, Phil Bentley, was brought on board and is expected to optimise metal exploration so that in the future, they can generate enough cash flow for internal financing with smaller production. Unfortunately, the contract prices for silver are currently below the world spot market prices, which makes production not very profitable.

Manuka's work in 2023 will focus on expanding the STB vanadium project because its extraordinary volume of resources means it could address 15% of the world market in the future. To this end, it has already invested USD 50 million in a preliminary feasibility study, and a mining licence for 5 million tonnes per year is also part of the deal. Drilling at Mt Boppy Deeps to evaluate an underground mine development is expected to begin in the second half of 2023. Manuka's share price has recently suffered somewhat from the general weakness of junior shares in the resources sector. However, at AUD 33.5 million, STB's future battery and Greentech metals project is undervalued. Large producers like Rio Tinto and BHP are constantly on the lookout for promising expansion projects. This puts Manuka Resources clearly in focus.

Varta - Still in correction mode

Varta shareholders now need hope as well as patience because the statements of the management on the last publication of figures sounded anything but positive. Falling prices for microbatteries, stagnation in the e-mobility sector in the V4Drive area, and at the same time, an increased purchase of raw materials are putting pressure on the margin. Now there is also the threat of high-wage settlements. In the meantime, Varta has agreed on a restructuring concept with its major shareholder and the financing banks. Around 800 full-time jobs are to be cut, half of them in Germany over the next two years. Worldwide, Varta employs about 4700 people, but how the announced job cuts will be implemented is still unclear, according to the IG Metall trade union.

The current plight is attracting short sellers. Booth Bay and SHI Partners are now the front-runners among the shorties, with a combined stake of over 3%. One can only hope that a quick turnaround will eventually force these investor groups to cover their positions. However, at EUR 19.35, the Varta share crashed to a new 5-year low last week. Of the 10 remaining analysts on the Refinitiv Eikon platform, none recommend a buy, and the average price target is EUR 23.74. All one can do here is light a candle and hope for improvement.

Not all Greentech companies can shine with profits in the current environment. The framework factors in Germany, in particular, with the world's highest raw material and energy costs, are making business calculations difficult in the face of international competition. From this perspective, Nordex and Varta are very speculative investments. Manuka Resources remains an attractive, hopeful value focusing on strategic metals.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.