December 20th, 2023 | 07:00 CET

COP28 a toothless tiger? Nel ASA, Klimat X, Nvidia, and Plug Power in the climate change check!

Another earth-shattering climate conference is behind us. The outcome was as sobering as it was predictable. Around 200 countries were able to agree on measures to reduce fossil fuels, but the Gulf states insisted on their right to continue the business model of oil and gas production that has been successful for decades. This makes it clear that the availability of fossil fuels will continue on a large scale because the BRICS states, such as Russia, China, India and Brazil, will continue to exploit their fossil resources unabated. Incidentally, international conflicts only work with fuels and not with battery-powered drives. So, if you consider the wars in Ukraine and the Middle East with their accompanying environmental destruction, there is no need to invent bans on European diesel vehicles. However, there are a few glimmers of hope for a greener future...

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , KLIMAT X DEVELOPMENTS INC | CA49863L1067 , NVIDIA CORP. DL-_001 | US67066G1040 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - Loss compensation with Nvidia?

Hydrogen values remain on the sidelines as order intake declines. Most recently, Nel ASA even had to accept the cancellation of a large electrolyser order, which again increased the pressure on the share. After numerous reclassifications, the consensus among many experts turned negative. Just last week, Santander issued a new "Underperform" rating. The Spanish bank lowered its expectations to just 6.16 Norwegian Kroner, the equivalent of EUR 0.54. This price target even hits the current 52-week low from December. With this new assessment, only 6 out of 25 experts on the Refinitiv Eikon platform recommend buying into the Scandinavian stock.

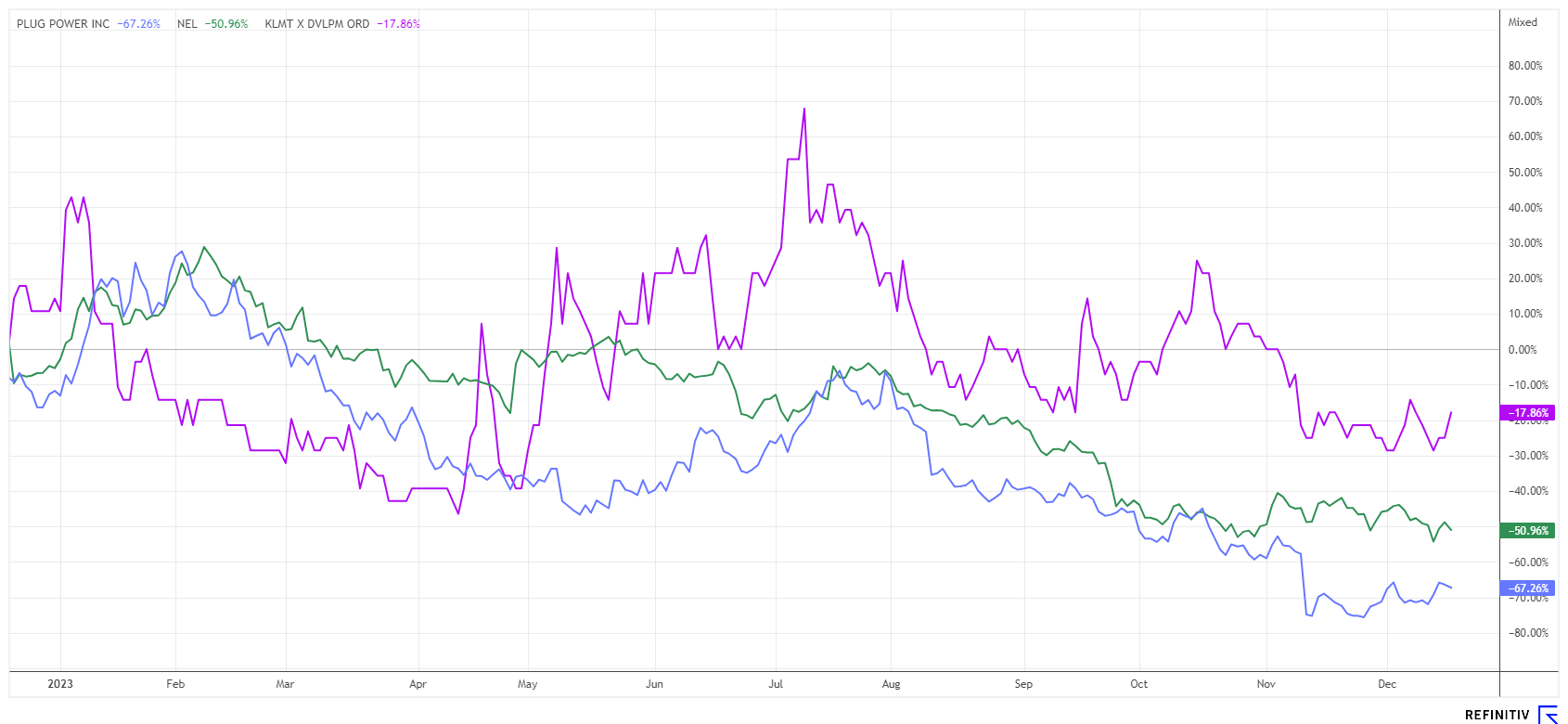

Nevertheless, one wonders why the entire sector has suffered such a severe setback in the fourth quarter. One reason could be found in German tax law, as profits made can be offset against realized losses intra-year. This process happens automatically with the broker's tax file and does not require lengthy declarations to the tax authorities. Since the Nvidia share has gained a full 200% in the last 12 months, and even over 300% with a good entry, the accumulated gains can be elegantly offset against the 57% loss from the Nel ASA share. It is worth noting that we cannot provide tax advice, and this fact is mentioned only incidentally. The legal situation is comparable in other countries, which could explain the current pressure on hydrogen values.

Plug Power - Hoping for a turnaround

**American company Plug Power is also in a state of absolute crisis. 17 out of 31 analysts have downgraded the share in the last 6 months, and there are now only 11 active "Buy" recommendations. At USD 14.65, the 12-month target price reported on the Refinitiv Eikon platform is still in a range that is no longer comprehensible from an analytical perspective. Why the dazzling CEO Andy Marsh still has the favor of analysts remains a puzzle. After a number of misjudgements about sales growth, the Management Board is facing several class action lawsuits from disgruntled shareholders who relied on the growth forecasts at the start of 2023.

Multiple times, Plug Power found itself underwater with its quarterly results, eventually leading to a whopping 70% decline in the stock price. The share price is currently recovering slightly but ultimately reached a low of EUR 3.03 at the end of November. The analysts' price targets are beyond good and evil, on average a good 300% higher. **The so-called "tax-loss selling" will likely continue until the year's end. With Nel ASA and Plug Power, watch out for the moment when the price turns and the momentum accelerates.

Klimat X Developments - BP Carbon Trading becomes the first financing partner

Those engaged in climate change often focus on hydrogen, wind or solar projects. This perspective is usually too narrow a view, as positive effects on the global climate can also be achieved through so-called carbon projects. Essentially, tradable certificates are created by avoiding CO2 production on the one hand, while pricing provides buyers of such certificates the opportunity for a temporary exceedance of emissions. Overall, however, trading in these "pollution rights" enables a gradual reduction in the emission of harmful greenhouse gases.

The Canadian company Klimat X Developments has dedicated itself to offsetting and offers CO2 polluters corresponding investment opportunities in environmental projects that focus on the regeneration of forests and water. Klimat X ensures the protection of forests and mangroves, for example, through clever offers to industry. The business model consists primarily of restoring, protecting or completely rebuilding tree populations as well as green and agricultural areas. The Company has been active mainly in Sierra Leone, Ghana, Suriname and Mexico.

The Company can now boast a huge deal, as it has secured its first financing partner from the UK for a restoration project in Sierra Leone. BP Carbon Trading Ltd, a subsidiary of the British Petroleum Group, is providing USD 2.5 million as part of a financing agreement for the planting and development of 5,000 hectares of degraded land. The land tenure agreements were concluded through participatory mapping and free prior consent with smallholder farmers in Sierra Leone. They are compensated and are also directly involved in benefit sharing. BP Carbon Trading Ltd. conducted a site visit in October 2023. The project documents for third-party validation have been submitted, and the Company expects to complete them in early 2024 in accordance with the new Verra reforestation protocol and CCB Standards.

James Tansey, CEO of Klimat X, commented: "The scale of the climate change challenge is such that we must pursue every available strategy to reduce emissions. According to peer-reviewed research, the loss and degradation of forests has resulted in more than 185 billion tons of emissions, and this project is a leading example of how we can help reverse that damage."

The Company aims to restore over 50,000 hectares of rainforest in a medium-term reforestation plan. To date, the Company has reforested almost 1,500 hectares and mapped over 20,000 hectares of smallholder land. The total project area identified so far has the potential to generate more than 35 million tons of carbon credits for restoration and conservation. According to the Taskforce on Scaling Voluntary Carbon Markets, nature-based solutions have the potential to deliver up to 85% of the total volume of carbon credits demanded by the market by 2030. With the KLX share, interested investors can reflect part of the future potential in their portfolio at a valuation of around EUR 7.5 million. With the resolutions of the COP28 Conference, the share price could soon go through the roof!

Hydrogen stocks were the sell-off model of the year 2023. However, green investments have been back in demand since the COP28 Climate Conference in Dubai. In addition to the low share prices of Nel ASA and Plug Power, the Canadian company Klimat X Developments is also making headlines. The Company's on-site projects lead to the direct absorption of CO2 and contribute to the renaturation of destroyed areas. Highly interesting and a 100% sustainable investment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.