January 27th, 2023 | 11:45 CET

Commodity stocks pick up, Saturn Oil + Gas, RWE, BASF - Forward-looking with high returns

Central and Northern Europe are firmly enveloped in wintry temperatures. BASF AG's balance sheet is just as frosty as the current weather because its subsidiary Wintershall Dea is no longer doing business with Russia. The consequence for BASF is a minus of EUR 1.4 billion. Business is entirely different for RWE, with the figures exceeding analyst expectations. Thanks to the commodity trading division, the Company is doing exceptionally well, so DZ Bank has set RWE at "Buy" with a fair value of EUR 53 per share. Valuable raw materials such as oil and gas are extracted by the Canadian company of the same name, Saturn Oil & Gas. Thanks to a new takeover, their production potential has increased by a whopping 140%.

time to read: 3 minutes

|

Author:

Juliane Zielonka

ISIN:

Saturn Oil + Gas Inc. | CA80412L8832 , RWE AG INH O.N. | DE0007037129 , BASF SE NA O.N. | DE000BASF111

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Saturn Oil & Gas: Increase in production capacity by about 140%

Saturn Oil & Gas has signed an agreement to acquire Ridgeback Resources for CAD 525 million, consisting of CAD 475 million in cash and CAD 50 million in common stock. Ridgeback Resources is a private oil and gas producer focused on light oil in Saskatchewan and Alberta, Canada.

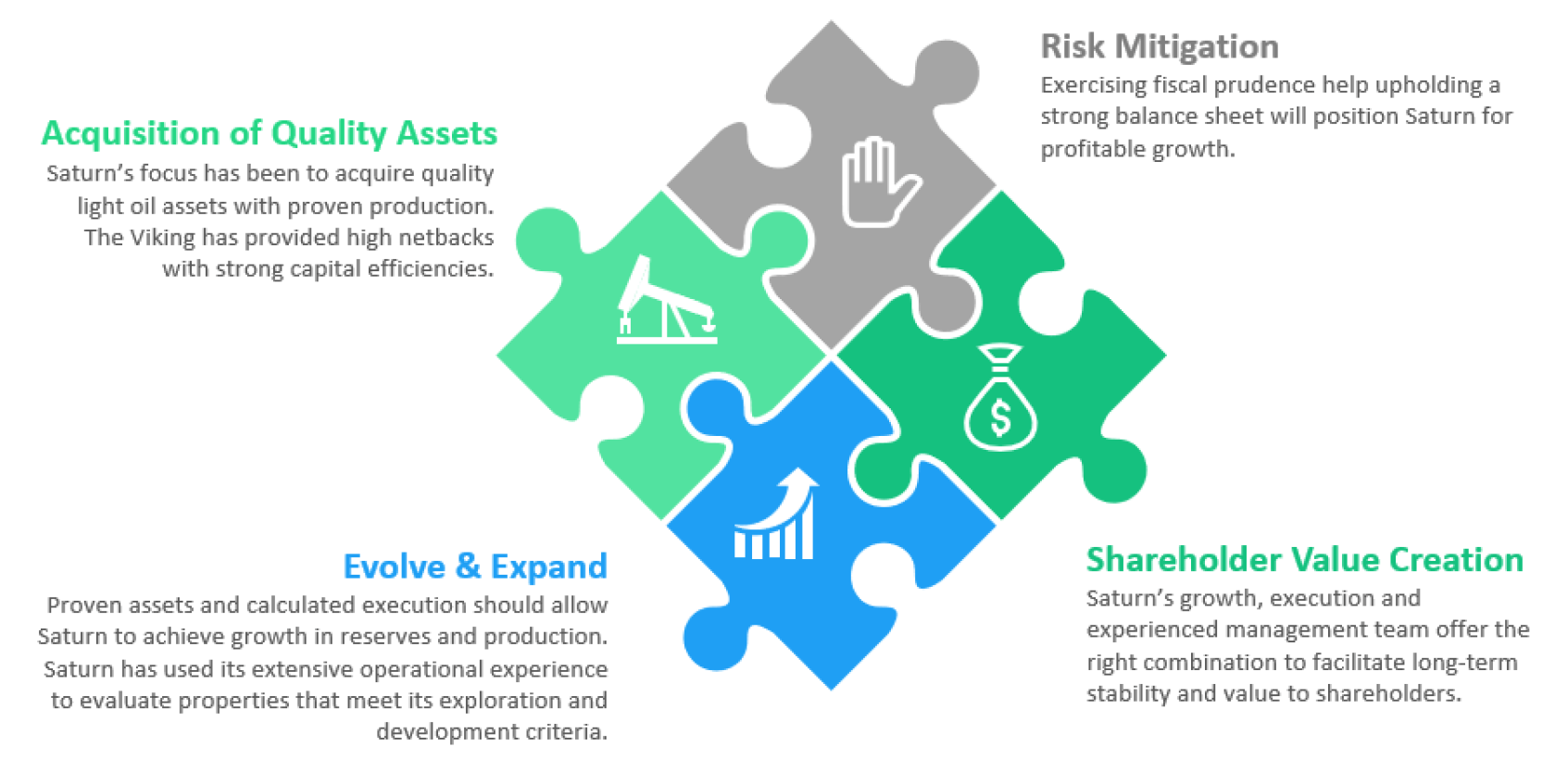

Saturn Oil & Gas Inc. is a Canadian energy company focused on generating positive shareholder returns through the continued development of high-quality light oil assets, supported by an acquisition strategy targeting profitable opportunities.

The acquisition will expand Saturn's pro forma production by approximately 140% to about 30,000 BOE/d of sustainable, light oil-focused, high netback production. The netback measure nets the revenue from the sale of oil and gas against the specific costs required to bring the product to market. This is often expressed as a value per barrel. It essentially shows how much the Company retains from the sale of a single barrel of oil or oil byproducts.

"This transformational acquisition is an important step for Saturn to establish material scale in its Alberta and Saskatchewan operations, where we will leverage our high-quality light oil-focused production that has considerable prospective development drilling inventory, our teams track record of operational outperformance and capital efficiency, a strong hedge book, and supportive strategic equity backers like GMT Capital Corp. and Libra Advisors, LLC to mitigate corporate risk, rapidly deleverage, and sustainably grow in a profitable manner for many years to come," CEO John Jeffrey explained in an interview with the Market Herald.

"The attractive acquisition criteria and compelling economics of the Ridgeback acquisition, combined with our existing portfolio of free cash flow generating assets, will enable Saturn to pay down all corporate debt within three years and ultimately deliver a significant return of capital to enhance shareholder value."

RWE inspires with a strong result, commodity trading division profits

German utility RWE this week reported preliminary full-year earnings for 2022. The result was ahead of CFO expectations, and one justification is that poor wind conditions boosted the use of gas turbines.

**EBITDA is expected to rise 73% to EUR 6.3 billion in 2022, above the high end of the originally forecast range of EUR 5.5 billion, according to the Company.

RWE said its adjusted net income doubled to EUR 3.2 billion. Investors rewarded these results with a buy, with the share price rising 3.3%. Profit at the division responsible for biomass, hydroelectric and gas-fired power plants tripled to EUR 2.4 billion.

Results also benefited from RWE's commodity trading division, the Company said. RWE confirmed that its dividend target for fiscal 2022 would remain unchanged at EUR 0.90 per share. Final figures will be released on March 21.

BASF - Loss of billions due to burst Russia deal

Wintershall Dea, a subsidiary of BASF, will put its Russian business on ice in the future. Chairman of the board Mario Mehren said on January 18 that it was not appropriate to continue operating in Russia. He stressed that the Russian war of aggression in Ukraine contradicts Europe's values and destroys cooperation between Russia and Europe.

Mehren stated that Russian restrictions have made it impossible for Wintershall Dea to continue operating its joint projects in the country as planned. He referred to the Russian president's decrees forcing the joint ventures to reduce the gas price they charge Gazprom, which was issued in December 2022.

In this context, DAX-listed BASF announced that they would post a loss of about EUR 1.4 billion on their account for fiscal 2022. Analysts had previously forecast a profit of around EUR 4.77 billion. The main reason for the high minus is the full-year write-downs on Wintershall Dea amounting to EUR 7.3 billion. In Q4 22 alone, BASF had to write down EUR 5.4 billion due to the deconsolidation of its subsidiary's exploration and production activities. Deconsolidation must be carried out when a parent company sells all or part of its shares in a subsidiary.

Russian operations most recently accounted for 50% of Wintershall Dea's total production. CEO Mehren announced that the Company is now looking to expand its growth into international markets, targeting Norway, Algeria, Argentina and Mexico as potential targets.

At a time of high demand for fossil fuels, Saturn Oil & Gas manages to strike a significant deal to expand its production capacity to around 140%. RWE also knows how valuable commodity companies are at the moment, scoring with excellent business results. BASF is feeling exactly the opposite. Its subsidiary Wintershall Dea has been facing an icy wind since its Russian business was discontinued. For investors, this means looking at alternatives for commodity suppliers. Saturn Oil & Gas can be one of these candidates.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.