February 1st, 2024 | 07:45 CET

Combustion engine versus battery! BYD, Altech Advanced Materials, Mercedes and VW in focus

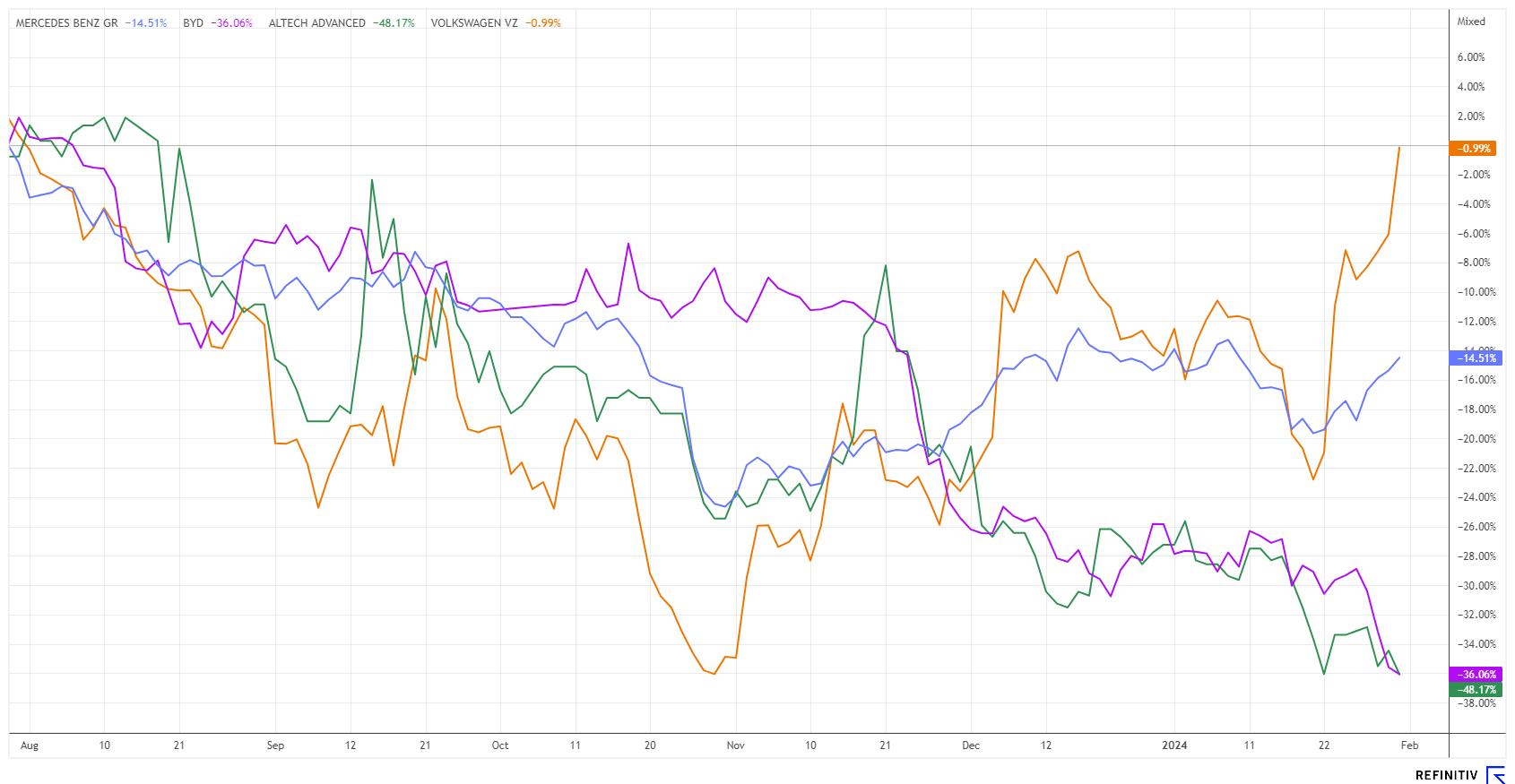

The year 2024 is going like clockwork for the high-tech sector so far. Anything smelling of "Artificial Intelligence" is being valued significantly higher on the stock market with relatively little scrutiny. In the DAX 40 Index, this has notably affected Siemens and SAP and the topic of armaments, which in turn catapulted Airbus and Rheinmetall into new realms. Things are even more dynamic on the Nasdaq, where Microsoft and Nvidia, in particular, are causing a sensation. However, e-mobility, particularly favoured by the Berlin traffic light coalition, is stumbling due to the abolition of the environmental bonus in December 2023. Customers are again opting for domestic combustion engines and Chinese e-imports. We analyze the current opportunities for investors.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , Altech Advanced Materials AG | DE000A31C3Y4 , MERCEDES-BENZ GROUP AG | DE0007100000 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - When will the share turn around?

Despite excellent prospects for vehicle sales in Europe, the shares of the Chinese technology giant "Build Your Dreams" (BYD) have come under fire. On a 12-month basis, the popular public stock has already lost almost 30% and is down 100% from its all-time high of around EUR 42.

Meanwhile, plans for the Company's own vehicle plant in Europe are taking shape. BYD signed a preliminary land purchase agreement in Hungary yesterday. BYD aims to accelerate the development of products with localized European attributes through local production. After the strong performance at the IAA in Munich last September, this is now a logical step.

With a 2024 estimated P/E ratio of 18.5, the stock is no longer expensive, considering the estimated growth of approximately 15% per annum. Thirty-four analysts on the Refinitiv Eikon platform recommend "Buy", with an average target price of CNY 308, equivalent to EUR 39.40. Although this represents almost 100% potential, the share could still slip into the strong support zone of EUR 15 to 17 from a technical perspective. After all, demand for e-vehicles in Germany continues to decline.

Altech Advanced Materials - This will be an exciting year

The share price of Frankfurt-based holding company Altech Advanced Materials is currently consolidating at a high level. This is hardly surprising, as the stock was one of the high-flyers among the "battery stocks" in 2023. While Varta is still struggling with its corporate restructuring, the Altech managers now have both the feasibility study and new equity on board.

CEO Uwe Ahrens is setting the bar high for the coming years, as the Silumina Anodes coating process is to be launched at the Schwarze Pumpe site in Saxony in addition to the existing pilot plant for the new sodium-based CERENERGY® battery in the future. The feasibility study from the end of 2023 considers an annual production of 8,000 tons of metallurgical silicon refined with aluminium oxide to be possible with an investment volume of EUR 112 million. In addition to the outstanding approvals, the Company assumes it will be able to obtain the necessary loans, state and federal guarantees and other subsidies in good time. The establishment of production and the necessary ramp-up should be completed in 36 months. If all goes well, this project will generate the first cash flows for Altech in 2027.

The battery market is on the move and has several innovations in store for the coming years. Fortunately, German engineering skills are still in demand. Anyone investing in Altech now is doing so with a market capitalization of around EUR 50 million. Although the share has already become much more liquid, we still recommend setting a limit.

Mercedes-Benz Group and VW - German Environmental Aid fails in court

Despite all the bids and decisions from Brussels, the Mercedes-Benz Group communicated early on that it would only sell e-cars by 2030 if market conditions allow. The Stuttgart-based company is, therefore, keeping all options open for the shorter horizon. At the end of 2023, Group CEO Ola Källenius also declared that he had further plans for combustion engine production and wanted to make the decision to abandon the classic drive system dependent on customers.

Board members of Deutsche Umwelthilfe had, therefore, taken legal action and wanted to ensure that the Stuttgart-based car manufacturer was no longer allowed to sell cars with combustion engines from the end of October 2030. The Stuttgart Higher Regional Court dismissed the lawsuit brought by Deutsche Umwelthilfe (DUH) against Mercedes-Benz for understandable reasons. German manufacturers are, therefore, still allowed to both produce and sell combustion engines until 2035.

Although the EU Commission has de facto banned the sale of new cars with classic combustion engines from 2035, it has granted a special regulation for e-fuels. However, Deutsche Umwelthilfe wants to ensure that combustion engine production is banned much earlier and intends to take the matter to the Federal Court of Justice. In this case, they prefer to rely on the fact that the lawyers of Mercedes-Benz, BMW and VW will present better arguments and that the court will be more likely to follow the European guidelines. Both Mercedes-Benz and VW are currently trading at a 2024 P/E ratio of 4 to 5 and pay out dividends of around 8%. German technology has rarely been cheaper on the stock market.

The enlightened citizen wants both combustion engines and e-technologies on the market. Because consumers want to be able to decide, free from ideology, which propulsion system they prefer. Hopefully, economic rationality will prevail again in Berlin regarding technology openness from the fall of 2025. Therefore, investors should keep an eye not only on battery favourites but also on the good old automotive stocks.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.