October 2nd, 2023 | 07:45 CEST

CO2 Certificates - The Solution for Climate Change? Nel ASA, Klimat X, Ballard Power and Plug Power in the analysis check!

The transition to a sustainable climate cannot be solely funded by the public. Success depends on private initiatives. It is, therefore, all the more important that inventiveness and entrepreneurial energy in this critical economic sector are also rewarded and promoted. In May 2022, the European Union launched REPowerEU, a billion-dollar program on how to shape the energy future. At the time, hydrogen accounted for less than 2% of energy consumption in Europe and was mainly used to manufacture chemical products such as plastics and fertilizers. The European Commission has proposed producing about 10 million tons of renewable hydrogen by 2030 and importing another 10 million tons to reduce climate-damaging gases. Climate innovations are evaluated differently on the stock market, and we will focus on some key players.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , KLIMAT X DEVELOPMENTS INC | CA49863L1067 , BALLARD PWR SYS | CA0585861085 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - Waiting for the Big Bang

Hydrogen stocks were among the shooting stars in 2021 - but now reality is setting in. The billions in private and public investments are still missing. Nel ASA is also feeling the effects of this. Although it has been able to land good orders again in recent months, the share price has been increasingly underwater. The reason is evident: The H2 pioneer built its first electrolyser as early as 1927, and today, the Company makes just about EUR 200 million in sales. Too little, analysts complain, because costs remain exorbitant and lead to a negative profit statement from quarter to quarter.

On the operational side, however, things do not look so bad. In addition to long-term blockbuster orders to build a 2GW H2 plant in Heroya, Norway, and up to 4GW in Michigan, the order book has reached a magnitude of around NOK 3 billion. By the first half of 2023, Nel could increase its sales from NOK 396 million to a remarkable NOK 834 million, and analysts on the Refinitiv Eikon platform believe that the Norwegians can achieve NOK 1.72 billion by the end of the year. In the current year, another NOK 837 million loss is to be written, and profitability will unfortunately not be reached until 2026.

Investors had long been betting on a dynamic development of the share price, but for 8 months now, the price has been gradually falling from its high for the year of around EUR 1.72. Most recently, the important stop line of EUR 0.98 was also breached. Last week, the share price fell to a new 4-year low of EUR 0.71. Nevertheless, the price-to-sales ratio for 2023 has now decreased from 12 to 8, which is a positive development. Thus, the value remains ambitiously priced, but a countermovement could be due again after the recent sell-off. Short positions should be closed slowly because if the price turns, it will run strongly upward in the short term. The share continues to enjoy high popularity.

Klimat X Developments - Local compensation, Hard to beat

There are other business models to help turn the tide on climate change. Canadian company Klimat X Developments (KLX) is dedicated to compensation and offers CO2 emitters appropriate investment opportunities in environmental projects focused on forest and water regeneration. The current CEO, James Tansey, has a long history of reconciling business and climate in his career. In 2010, he played a crucial role in making the Vancouver Olympics carbon-neutral. As a scientist and professor, he has provided advice and support to wealthy clients on sustainable investments.

Klimat X ensures the protection of forests and mangroves, for example, through clever offers to industry. This is done by generating CO2 certificates. The business model consists predominantly of the restoration, protection or complete reconstruction of tree populations as well as green and agricultural areas. The Company has been active primarily in Sierra Leone, Ghana, Suriname and Mexico. In Guyana, a reforestation project is also used to produce coconut water, generating cash flow and positive social effects by creating jobs in an economically structurally weak region. Funding for such projects is made possible by supplying the relevant emission certificates to the funders of the initiatives.

A good example of success in the field is demonstrated by Klimat X in collaboration with the State of Suriname. There, they have been working on data collection and analysis for mangrove protection and restoration activities covering more than 30,000 hectares since 2022. After six months of fieldwork, two draft project planning documents are expected to be submitted to Verra for inclusion in the certification process as early as the fourth quarter of 2023. Through Klimat X subsidiary Pomeroon Suriname NV, the Company launched sustainable agriculture operations with its own farm. The Company has already sown coconut seedlings and started planting trees on a 3,000-hectare farm site. With an investment of USD 500,000, Klimat X impressively demonstrates how mixed agroforestry and climate protection projects can be reconciled.

There are few investment opportunities on the stock market for truly green projects because those who buy ESG-oriented ETFs, for example, cannot actively shape the composition of their portfolios. When you buy KLX stock, you are directly involved in the projects on the ground and can watch the progress from quarter to quarter. That is the charm of KLX, which currently trades at CAD 0.13 in Canada and is also listed in Frankfurt. With a market capitalization of just under EUR 8 million, the value has not yet rushed away either. The trigger for Klimat X: The market for emission certificates can still multiply due to the politically supported measures!

A detailed interview with CEO James Tansey is available here.

Plug Power and Ballard Power - Investors caught on the wrong foot

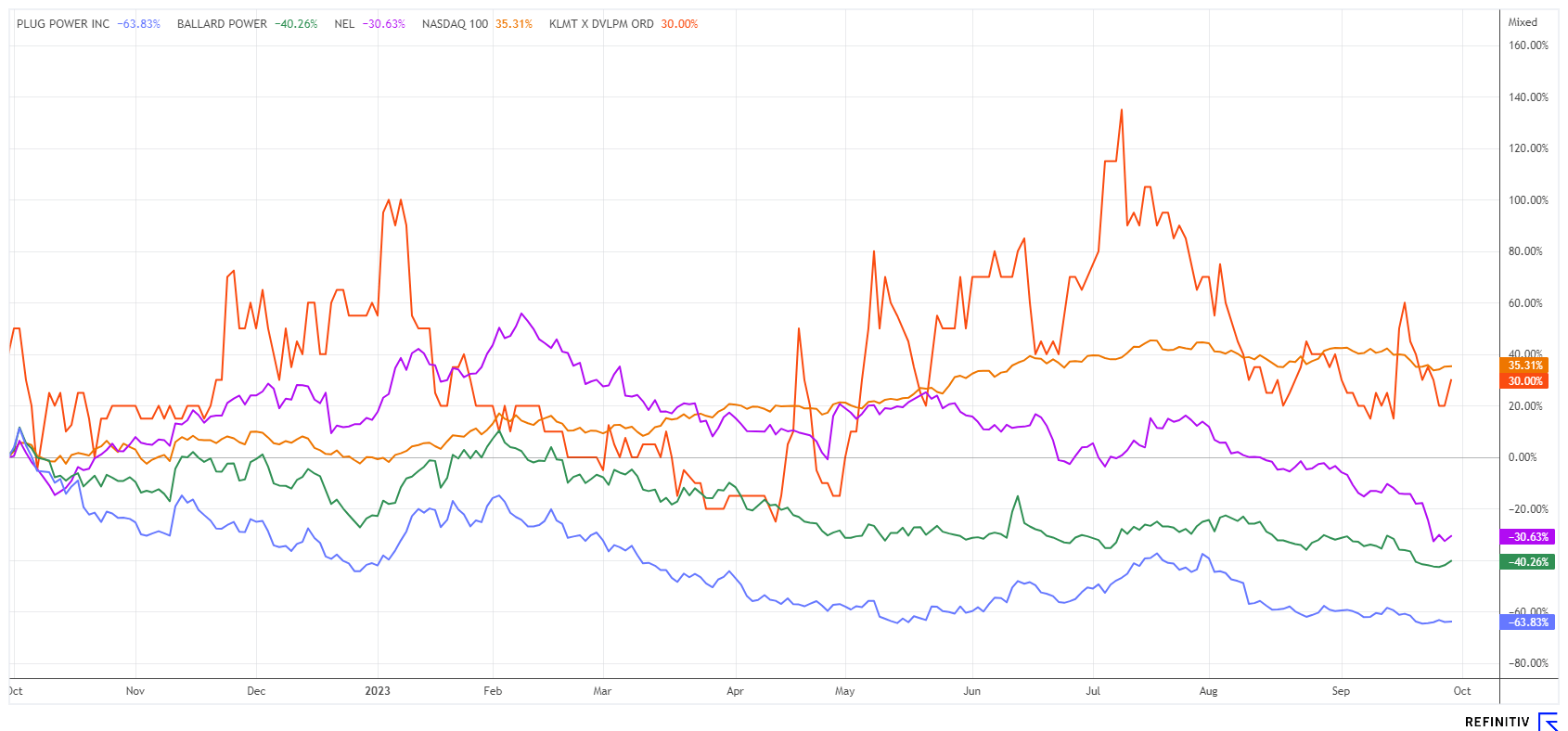

The world-renowned hydrogen stocks have been experiencing considerable attention on the stock market since 2019. With each political announcement, momentum increases, and the entire peer group is rapidly jolted upwards. However, in addition to Nel ASA, Ballard Power and Plug Power are also having a tough time on the stock market. After losses of 44% and 67% in the last 12 months, it is worth looking at the fundamentals.

The experts on the Refinitiv Eikon platform expect Plug Power to post a net profit of more than USD 500 million in 2027, while Ballard is not expected to break even until then. The investor, therefore, only has to look at the sales momentum to determine the corresponding growth factors. Plug Power is expected to grow from USD 1.3 billion in 2023 to USD 5.4 billion in 2027, while Ballard is expected to grow from 180 million to around CAD 1 billion.

In other words, the planned revenue increases until 2027 reflect their current market capitalization in nominal terms. Since there is still a lot of fantasy involved here, the entire sector remains a playground for risk-tolerant investors. However, media-driven, short and violent rallies can never be ruled out. This is what happened with Plug Power in the period from May to July 2023; the rally took the title from EUR 6.80 to EUR 11.90 - almost a doubling. At the end of last week, the title was trading at EUR 7.15 again. Ballard Power's stock, on the other hand, gained only about 20% over the same period, hitting a new 4-year low of EUR 3.30 at the end of September. Keep watch!

For those who want to invest in truly green, diversification is key. This is because the focus of preferred sectors is constantly changing in the media. From a technical point of view, the hydrogen sector is currently at the lower band; cyclically, a buyback could soon be in the offing here. Investors who think outside the box and are looking for direct participation with good opportunities will find an interesting admixture in the certificate specialist Klimat X. The on-site projects also have a lot of charm in the implementation of sustainable thinking.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.