December 12th, 2023 | 06:40 CET

Climate conference and Venice turns green! Oil remains in demand; goodbye hydrogen? Nel ASA, Prospera Energy and Plug Power in Focus

Too little, too slow, too half-hearted! Climate activists in Italy have drawn attention to themselves with a spectacular campaign. The "Extinction Rebellion" group members painted the famous Grand Canal in Venice fluorescent green. Some activists abseiled from the Rialto Bridge over the central canal of the northern Italian lagoon city on Saturday afternoon and poured dye into the water. Their action was intended to protest against the "ridiculous progress" made at the COP28 World Climate Conference in Dubai. "We are tired, we have had enough of being taken for fools by our governments and knowing that our future is in danger while politicians do nothing," they said in a statement to the press. How do we tackle the energy issues of the future? A look at selected energy stocks paints a clear picture.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PROSPERA ENERGY INC. | CA74360U1021 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

COP28 Climate Conference - There will be no vote against oil

It is the final sprint at the World Climate Conference in Dubai (COP28). Until this evening, politicians from almost 200 countries are wrestling with the next steps in the fight against the climate crisis. One of the most contentious issues is whether the countries can agree on phasing out coal, oil and gas. The problem is that every country has different natural resources and must use the available energy efficiently for its population. Although Germany has oil, gas and, above all, coal, it wants to move away from all fossil fuels by 2030. Exploiting its own natural resources is, therefore, not on the agenda.

Climate protection is not really achieved when fracking gas is simultaneously transported by ship from Canada to Europe. The ideologically formulated eco-balance of such undertakings should be demonstrated strikingly and convincingly by the Berlin traffic light coalition. However, facts are only provided in desired topics. The oil price currently has a relatively weak outlook, as oil reserves in the US have risen to their highest level since August. However, the ongoing geopolitical conflicts and the hope that the first interest rate cuts in 2024 will bring about an economic turnaround for the better are supporting the medium-term outlook.

Prospera Energy - The financing for 2024 is in place

Due to the rapidly growing population and the base effect in the global economy, energy consumption will remain high. Canada is a rich resource country with billions of oil and gas barrels in underground rock formations and oil sands. Technological possibilities allow these reserves to be exploited without causing major environmental damage. On the contrary, many smaller exploration and production companies create jobs in regions with low population density and historically low economic potential.

One of the up-and-coming Canadian oil producers is Prospera Energy. The Company will have increased its daily production to around 1,800 barrels of oil equivalent (BOE) by the end of the year following several re-activations of drilling fields. Seven horizontal wells were recently drilled, with three more expected before the end of the year. Prospera was completely restructured in 2023 and has a new CEO, Samuel David. He has done a great job and, in addition to operational progress, has also been able to demonstrate success on the financing side.

Prospera has completed a CAD 3 million financing with the participation of White Tundra, which includes a 1% royalty on Prospera's revenue from the Cuthbert properties and can be repurchased within 12 months for CAD 3.48 million. Amortization payments will increase by approximately 4.6% after November 30, 2024, unless at least CAD 250,000 is received from royalties each quarter. Funds from the transaction will be used to complete the horizontal well development program on the Company's Cuthbert properties. The initial royalty rate of 1% up to and including November 30, 2024, will increase to 16% after that date up to and including May 31, 2025, and 22% after May 31, 2025, if the royalty has not been repurchased by then. In addition to the above financing, an additional CAD 583,000 was raised in a private placement.

Prospera intends to use the funds raised for drilling, completion and tie-in, as well as for reclamation costs and the continuation of environmental, social and governance initiatives. The Company is thus committed to maintaining a high ESG standard. Prospera Energy currently has 400 million shares in circulation, valuing the oil producer's equity at CAD 32 million. Many projects are on the agenda for 2024. If the development continues as quickly as currently shown, the low company valuation should soon be history.

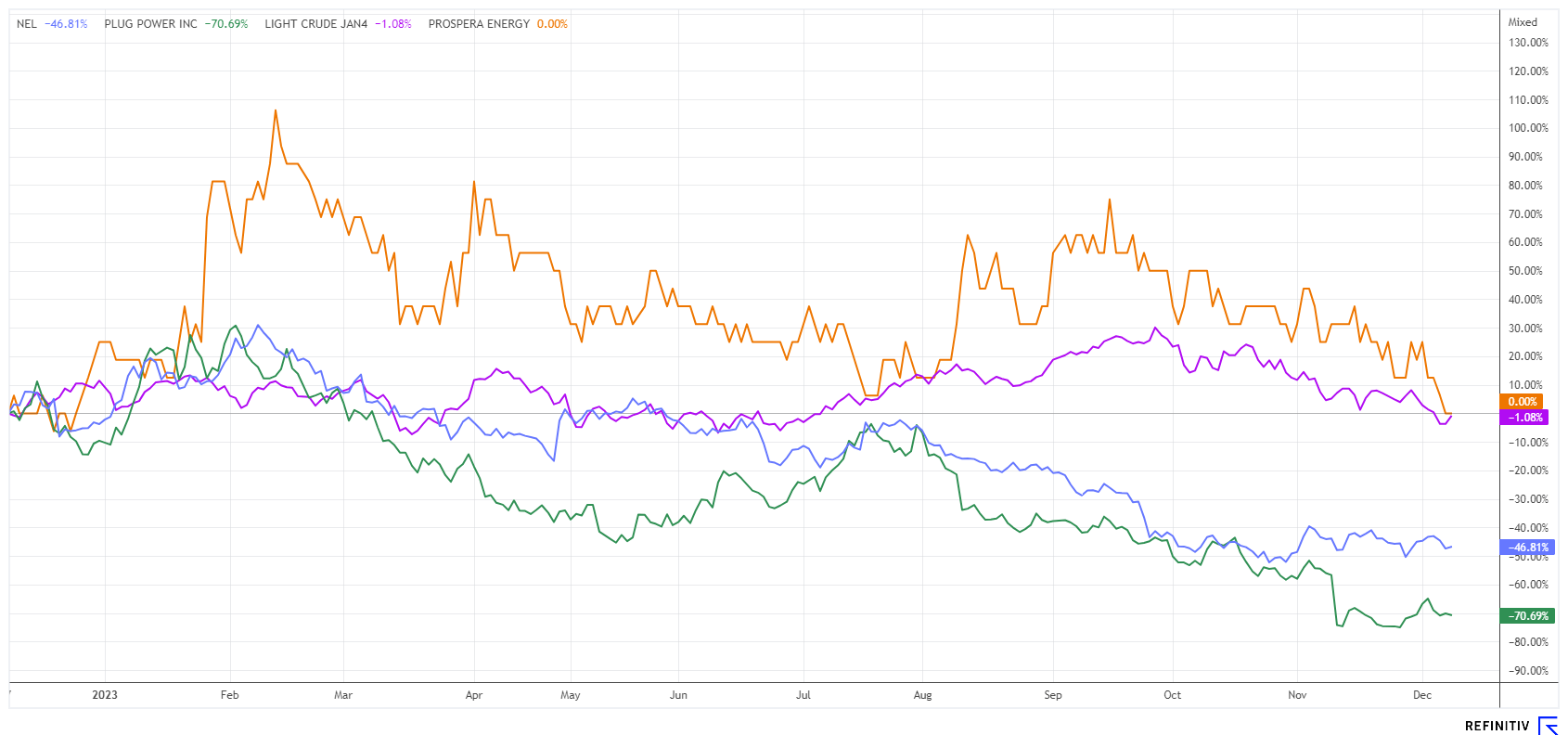

Nel ASA and Plug Power - Hydrogen remains on the sidelines

Another tough week for the hydrogen sector. Sales at Plug Power continued unabated. The share fell from EUR 4.40 to EUR 3.68 and is currently showing no signs of a recovery. The latest downgrade by the US investment bank Morgan Stanley, which has now given the stock an "Underweight" rating and set a price target of just USD 3.00, is having a negative impact. The bank currently sees a problematic situation for hydrogen projects in the global economy and is also concerned about Plug Power's liquidity. This could soon lead to a painful capital increase.

Nel ASA has suffered a weekly loss of 6.5%. Apparently, the appeals of the traffic light government in Dubai remain unheard, as Chancellor Olaf Scholz once again emphasized the importance of hydrogen technology and geothermal energy for achieving climate neutrality by 2045 yesterday, Monday. Companies specializing in these technologies, such as Nel ASA, Plug Power and Hexagon Purus, are thus moving into focus. However, investors are unlikely to want to jump on board at the moment, as the wave of private investment that has been missing so far is still lacking.

Nel ASA and Plug Power are currently caught in a downward trend, while the major indices are celebrating new highs every day. As a momentum-oriented investor, one can confidently observe the situation and wait for a significant turnaround.

It is highly doubtful whether the World Climate Conference in Dubai will succeed in uniting almost 200 countries with a joyful final communiqué. The energy markets remain tense due to the geopolitical situation, as demand for fossil fuels remains high. Whether hydrogen can take off in 2024 remains questionable. Oil should be able to hold the USD 70 mark in the medium term, meaning that Prospera Energy continues to look promising.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.