August 9th, 2023 | 09:10 CEST

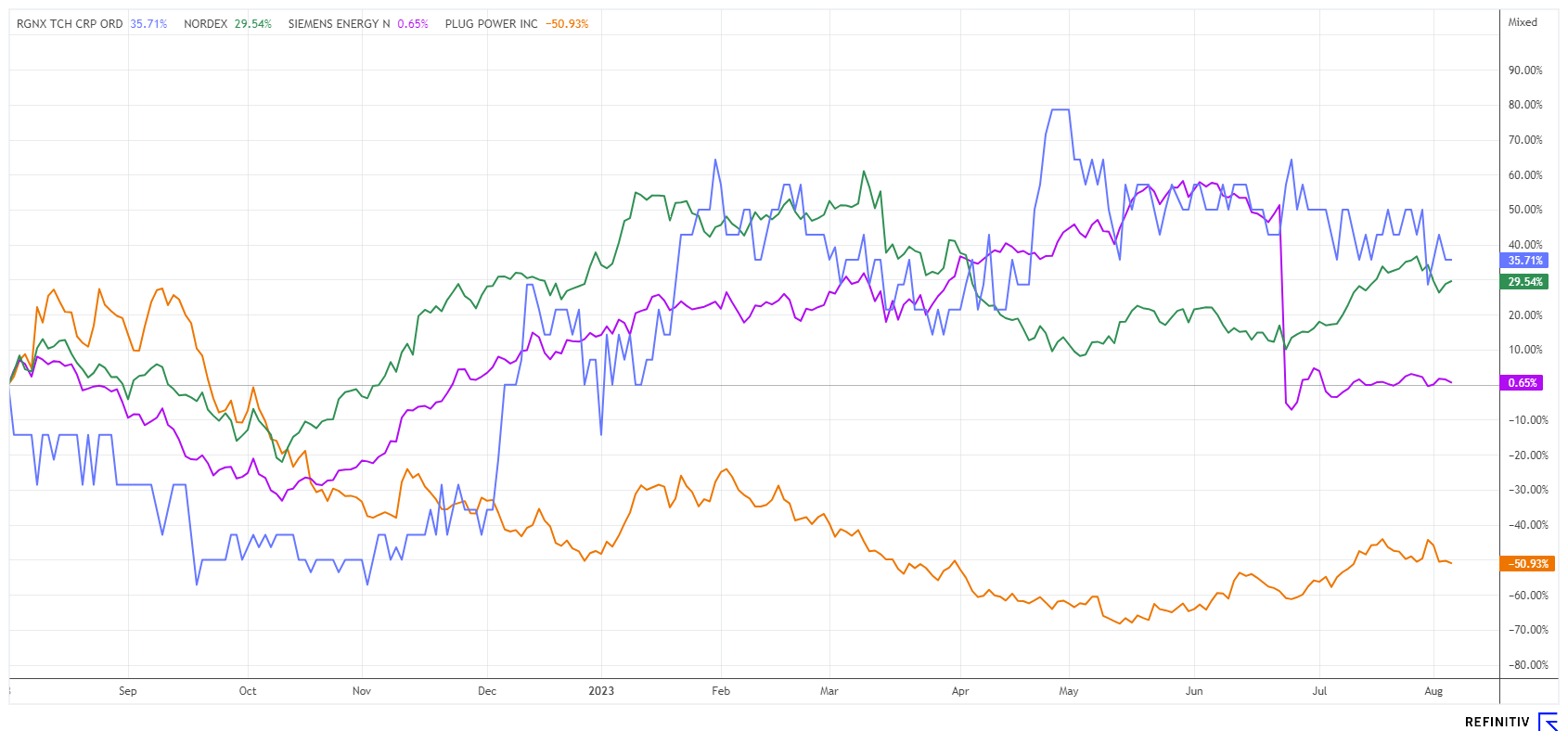

Clean energy clearly in buy mode! Plug Power, Siemens Energy, Regenx Tech, Nordex - Clean returns instead of summer blues!

The energy turnaround will be challenging, as is now well-known in Berlin. Those who wish to completely abandon fossil energy supply must make significant investments in the future. Alternative technologies for energy generation are already on the horizon, but the implementation up to the grid connection is complicated and requires resources. Unfortunately, the anticipated reduction in CO2 savings will only materialize after more than 15 years of operation, so the expected positive environmental scenario is also a long way off. It is also evident that high-quality and rare raw materials must be transferred to a circular economy, as their availability is limited. Where are the opportunities for investors in the long process of energy rebalancing?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , REGENX TECH CORP | CA75903N1096 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] When we acquire something, we want to make sure that the acquisition fits with our strategy and has the potential to be successful for our shareholders. [...]" John Jeffrey, CEO, Saturn Oil & Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy versus Nordex - Quality problems and margin pressure

Siemens Energy and Nordex are typical representatives of the alternative energy sector. Siemens is very broadly positioned in this respect; until a few years ago, the Munich-based company was one of the largest manufacturers of gas turbines and, thus, experts in the standard combined heat and power generation. However, since Berlin has been turning away from fossil fuels, Siemens Energy has only been building these large-scale plants abroad. The Company got into trouble with its costly takeover of the Spanish wind turbine manufacturer Gamesa. A green project that completely ruins the balance sheet.

First, the good news: Order intake for the past third fiscal quarter has risen to EUR 14.9 billion, bringing the order backlog to a record EUR 109 billion. The wind division of the Spanish subsidiary Siemens Gamesa, described as a future technology, is contributing well to the glittering order situation. But now the bad news: Siemens Energy will incur a loss of about EUR 4.5 billion in the current fiscal year because of this wind business. There are serious design defects, which could lead to total failure and complete replacement of the systems; the costs for this are estimated at up to EUR 1.6 billion. There are delays and contractual penalties in offshore projects. Talks are underway with suppliers of defective components on compensation. Until final clarification, the share is unlikely to move much from its current position. The share price is only EUR 4 away from its all-time low of EUR 10.25.

The situation looks slightly better for industry competitor Nordex. While the wind turbine manufacturer is also struggling with escalating costs, the half-year figures provide some rays of hope. Sales rose from EUR 2.1 billion to EUR 2.8 billion, and installed capacity increased from 1.9 GW to 3.1 GW. The EBITDA loss was reduced by around EUR 60 million to EUR 114.3 million, but the margin remained negative at -4.2%. Due to the good order intake, Nordex's Management Board is quite optimistic about the current fiscal year: sales are expected to reach between EUR 5.6 billion and EUR 6.1 billion, and the EBITDA margin could reach minus 2 to plus 3%; the strategic medium-term target has been set at plus 8%. Both shares remain attractive in the long term but still have a marathon ahead to achieve profitability.

Regenx Tech - A good approach to the circular economy

Due to recent high metal prices, input costs have increased dramatically for energy equipment manufacturers. Ongoing geopolitical conflicts and trade disputes with China threaten global supply chains. So-called Greentech metals, however, are indispensable, especially for the coveted wind and solar plants. Finally, the high momentum in the area of e-mobility is also leading to a constant increase in raw material consumption. Today, we know it will only work with efficient recycling processes. Precious metals, in particular, are extracted in costly chemical processes. But they are rarely used up and should be efficiently recovered from old equipment that is to be disposed of.

This recycling concept is being pursued by the Canadian company Regenx Tech. The focus is on diesel catalytic converters, which account for 67% of the world's motor vehicles and represent a market worth billions across all value chains. The Edmonton-based innovator extracts the rare substances palladium and platinum from spent catalytic converters. Both metals are no longer dispensable in diesel-powered vehicles as many governments aggressively target permissible pollution limits. Over 80% of the world's palladium production is currently used in exhaust gas purification systems, of which only about 30% is recovered to date, with the remainder still ending up in special landfills.

The technologies developed by Regenx are modular in design and are expected to process up to 10 tons of catalyst material per day. A pilot plant is currently being fed with used catalysts from US partner Davis Recycling. The low-CO2 processing approach promises global success if the necessary scaling can be implemented quickly. The CSE-listed company has 347 million shares outstanding, with a market capitalization of about CAD 33.5 million. For investors, the stock fits well as an admixture in an ESG Greentech portfolio.

Plug Power - High voltage ahead of the quarterly figures

Highest tension is building overseas: Plug Power, the fuel cell pioneer is set to deliver its Q2 numbers today after the market closes. A loss per share of about USD 0.266 is expected by polled experts. That would already be a sequential improvement of about 30% on the weak Q1 result. The trembling before the numbers is significant because the price of the Greentech company has been stumbling for two weeks.

So far, Plug Power has been able to navigate through the class action lawsuits without having to fear significant damages. The dazzling CEO Andy Marsh would do well to keep his recent promises this time, or even better: to exceed them! After all, the Company is still valued at a price-to-sales ratio of 5 and is not expected to reach operational breakeven until 2025. Investors' patience should not be overstretched again; otherwise, the important technical support at around EUR 9.70 could fall.

Optimists can certainly count on the CEO being able to present many new orders from all over the world this time. After all, it was only recently that Economics Minister Robert Habeck spoke to the EU Commission of a "breakthrough" regarding CO2-free energy procurement in Europe. Plug Power maintains its European headquarters in North Rhine-Westphalia and makes 50% of its sales outside the US. After falling below USD 11 yesterday, the stock is holding just above the lower edge of the Bollinger band. The probability is thus high that a technical countermovement will soon occur.

Greentech remains a good fantasy stock for investors. Where else in this sector can similarly large growth be expected in the coming years? Nordex, Siemens Energy and Plug Power are well-known representatives and standard stocks with very different developments. In the second-tier segment, Regenx Tech is making a name for itself with advanced recycling technologies.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.