September 5th, 2023 | 07:10 CEST

Changing of the guard in the bull market - Deutsche Bank, TUI and Viva Gold can score!

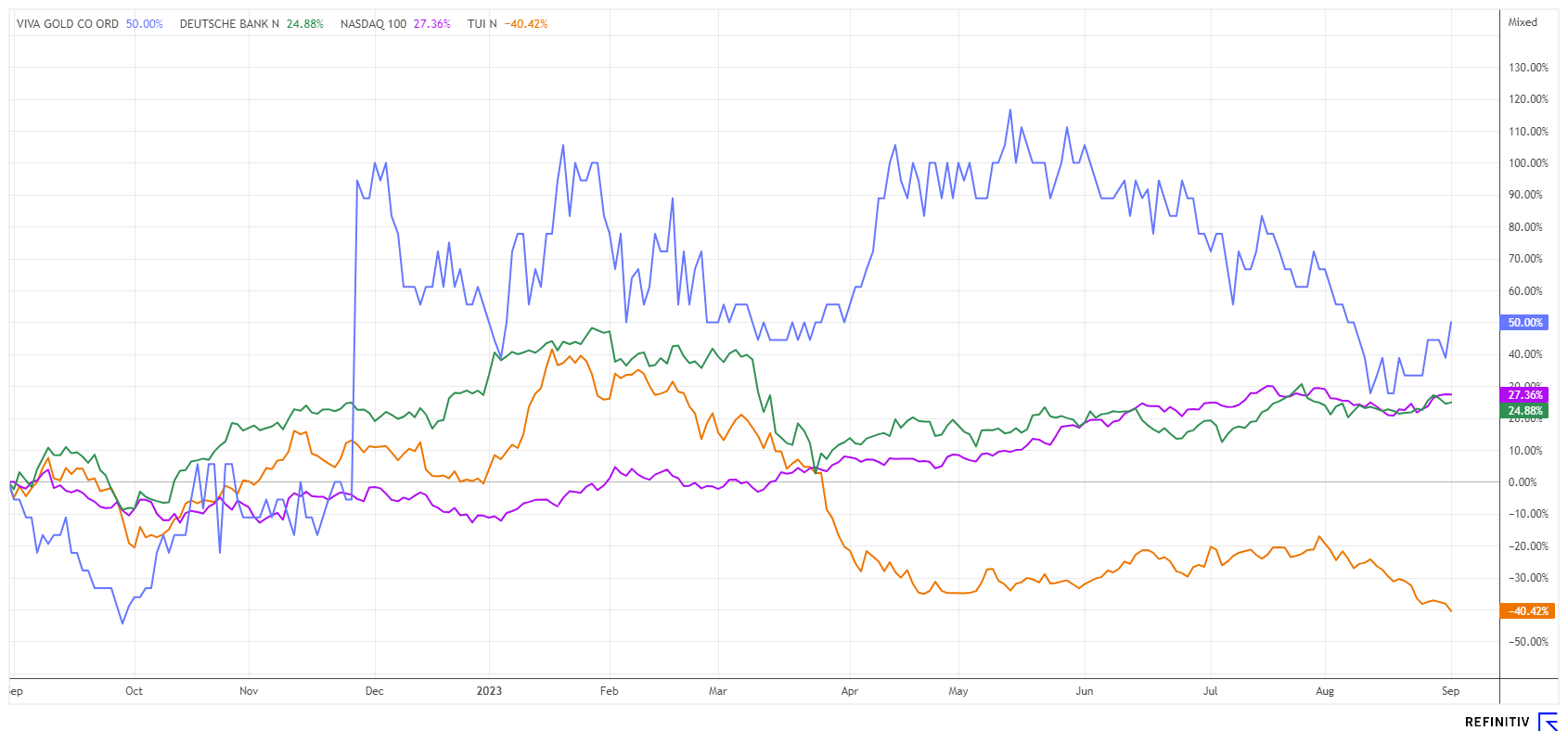

The valuation on the capital markets has developed quite differently in recent months. The DAX 40 index is currently valued at a P/E ratio of only 12, but this ratio is almost 24 for the growth stocks on the NASDAQ. Some clearly state: "In the DAX, industrial stocks dominate, whereas in the NASDAQ, growth-oriented tech companies prevail." Technology stocks accelerate many times over, even in times of crisis, if the business model fits the times. Nevertheless, they are also subject to interest rate causality, i.e. if refinancing becomes more expensive, the return on equity demanded by investors also increases. In August, the 30-year US bond exceeded the 4.25% yield mark. Historically, this has often signaled a temporary end to the tech bull market. Many second-tier stocks appear to be unjustly neglected. We name three potential beneficiaries of an upward turn in interest rates.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE BANK AG NA O.N. | DE0005140008 , TUI AG NA O.N. | DE000TUAG505 , VIVA GOLD CORP. | CA92852M1077

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutsche Bank - Promising developments

After a successful transformation until 2022, Deutsche Bank can show increasing revenues in the current year. Due to new margin fantasy in the lending business, net profit is improving quarter after quarter without significant contributions from investment banking. That is because IPOs and M&A transactions have become scarce. As Germany's largest commercial bank, the Frankfurt-based institution is thriving again in the private and corporate banking sector.

After several steps towards digitalization, Frankfurt is naturally thinking about a retail-oriented investment app. Scalable and Solidinvest from Munich have shown how to use clever marketing and good technology to bring interesting investment savings solutions to investors' smartphones. Here, the new private customer board member, Claudio de Sanctis, could score points right from the start because this segment is not yet part of the program. **According to media reports, the bank wants to cooperate with the neobroker Scalable for this purpose. The neobroker already has over 600,000 customers with an impressive EUR 15 billion. Neither Deutsche Bank nor Scalable wanted to comment on the emerging rumors. In order not to lose touch with the ever-increasing digital competition in the investment business, an investment solution would be conclusive.

Currently, the chart of the Frankfurt-based bank is moving straight towards the EUR 11.50 mark again. However, this process has already lasted for months, and the overcoming of the important chart hurdle simply does not want to succeed. Analytically, the DBK share is among the cheapest financial stocks worldwide, with a 2023 P/E ratio of 4.9.

Viva Gold - The next gold wave is rolling in

Since the recent setback in gold prices to USD 1,875, a lot has happened. For the US, it was announced that within one year, the debt has increased by USD 5 trillion from USD 28 to almost USD 33 trillion. One reason could be the dramatic development on the interest front, as the 30-year Treasury bond rose from 2.9% to 4.4%. Precious metals are not necessarily in demand in bullish interest rate phases, yet they have their relevance precisely as a means of preserving value. After all, the historic AAA status of the US Treasury has now been revoked by the rating agency Fitch.**

When looking at the gold and silver market from a long-term perspective, a recovery should take place in the current year, especially in the area of producing mines and promising exploration projects. Canadian explorer Viva Gold owns a 4,250-acre property in Nevada. It is located within the historically known Walker Lane with its Tonopah project, where Kinross, Coeur Mining, Augusta and Centerra also operate. A preliminary economic assessment evaluates a potential open pit operation with gold recovery by heap leaching. It is based on a measured and indicated resource of 394,000 ounces with gold mineralization of 0.78 grams per tonne. To this is added another 206,000 ounces as an inferred resource at 0.87 grams per tonne. There were additional results from seven drill holes into the summer. Two step-out drill holes discovered additional high-grade zones of mineralization, with grades of 15.7 g/t AU and 16.4 g/t AG encountered in the 11 follow-up holes. Work continues into the fall.

Viva Gold has issued 106.7 million shares, of which approximately 59% are held by institutional investors and management. At a share price of CAD 0.13, the Company is valued at a low CAD 14 million. Because of the manageable size and low free float, the share price can jump quickly in the next gold bull cycle. Excitement is also promised by the renewed prefeasibility study (PEA) in the fourth quarter of 2023.

TUI - Is this the long-awaited buy signal?

The TUI share reached a new all-time low of EUR 5.28 at the beginning of September. Those betting on the long-term turnaround here will need some patience. The last capital increase may continue to be cited as a burden because the dilution of shareholders only served to repay the debt of the last aid money from Berlin. This means that the Hanover-based company now has its back again and can concentrate on its operating business.

There has recently been an open dispute with a subsidiary called RTK. The disagreement escalated due to various violations in the use of customer data, but now, a solution seems to have been found. TUI is selling all RTK shares and, at the same time, acquiring the shares in TUI Travel Star previously held by RTK. The transaction still requires the approval of the Cartel Office, as it involves a 50% share. In the future, RTK offices will again be allowed to sell TUI travel under certain conditions. That means several uncertainties disappear, and TUI strengthens an important distribution channel.

A consensus estimate of just under EUR 19 billion in the current year would see TUI top 2018's top line of EUR 17.3 billion by about 10%. This could see a bottom line profit of EUR 0.45 to EUR 1.13 per share after three bitter years of losses due to the pandemic, according to the range on the Refinitiv Eikon platform. The German Alster Research estimates a conservative EUR 0.68 earnings per share for 2023 after a EUR 0.90 loss in the previous year. Even with this cautious valuation, the P/E ratio would only be at a low 8. For speculative investors, the favorable share tempts with a stock build-up at around EUR 5.50, even if the real turnaround is still in its infancy.

The stock markets are at a critical threshold. Seasonally, September is not bullish, yet the indices remain just below their historical highs. However, the important advanced-decline line is a warning signal; it has been running with high negative divergence for several months. However, laggards such as TUI, Deutsche Bank or Viva Gold can hold their own even in a correction. Gold may also have seen its bottom recently in a weak economic environment and ongoing geopolitical upheavals.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.