February 25th, 2025 | 07:15 CET

CDU wins, and the stock market celebrates! Caution with Nel ASA, First Nordic Metals, Xiaomi, and Agnico Eagle

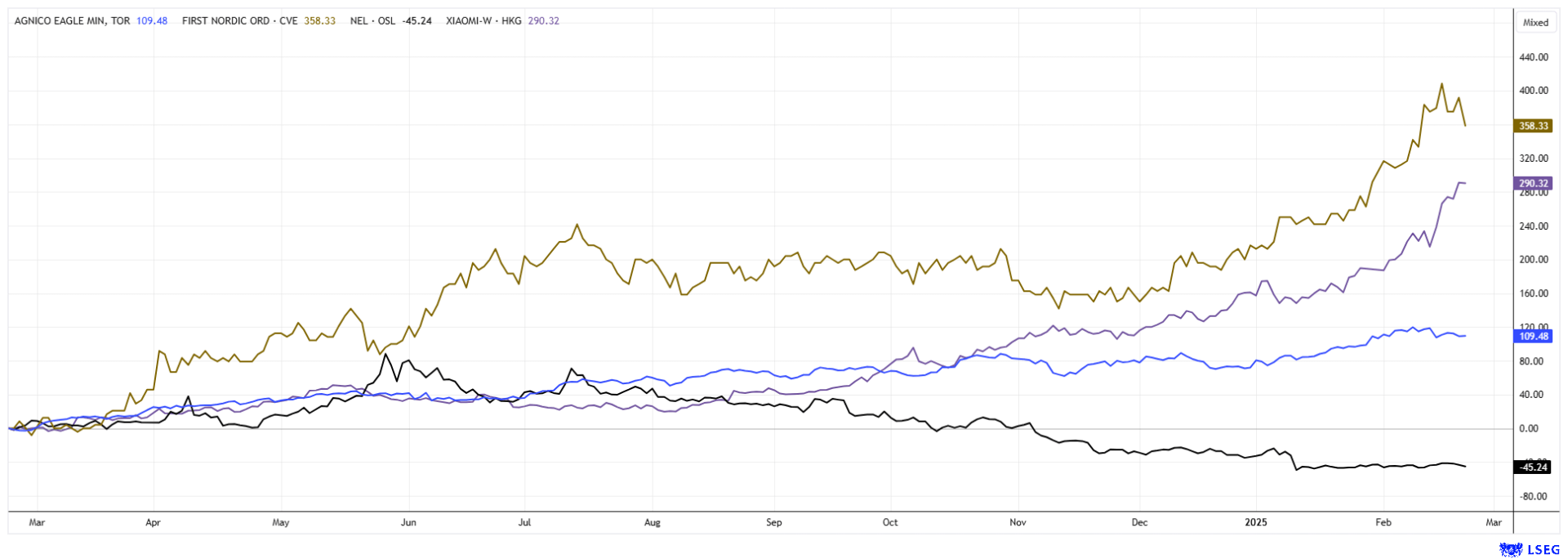

In addition to the stock indices constantly reaching new highs, gold has also reached new record levels above USD 2,950. After the tech indices climbed to new highs during February, there is now a slight correction. No one is talking about a trend reversal yet, as buybacks are still too present. Top performers like Palantir and Nvidia may have to take a hit in the short term, while low-valued securities and defense stocks are currently in demand again. Rheinmetall remains the top share in the DAX 40 index, with a plus of over 800% since February 2022. This year, the value is once again excelling with an increase of more than 50%. We highlight some opportunities.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , FIRST NORDIC METALS CORP | CA33583M1077 , XIAOMI CORP. CL.B | KYG9830T1067 , AGNICO EAGLE MINES LTD. | CA0084741085

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Gold – Winner of global currency devaluation

In times of economic uncertainty and rising inflation, gold repeatedly becomes the focus of investors. It has the reputation of being one of the oldest stores of value in human history, as it is considered a safe haven and stable protection against currency devaluation. But what makes gold so valuable? Unlike paper money, gold cannot be artificially produced or multiplied indefinitely. Global gold production is growing only slowly, and existing mines are constantly looking for new properties to extend their lifetimes. Precious metals such as gold, silver, platinum, and palladium have been considered safe havens for centuries and retain their value even in times of crisis. One point is repeatedly emphasized in the global financial bubble: unlike stocks or bonds, there is no issuer risk with physical gold – it cannot go bankrupt. Yesterday, the gold price reached a new all-time high of USD 2,956. Where should one invest now?

First Nordic Metals Corp. – With Agnico's Help to a Gold Blockbuster

Agnico Eagle is a leading gold company that impresses with a combination of strategic growth, risk minimization, and efficiency. Most of its mines are located in stable regions such as Canada, Finland, and Australia. This allows Agnico Eagle to minimize political and regulatory risks often arising in other countries. Not far from Agnico's properties in Sweden, we come across the Canadian explorer First Nordic Metals (FNM), which emerged from Barsele Minerals. The Canadian company's main projects are located in the mining region of Västerbottens Län in northern Sweden, 600 km north of Stockholm, and cover a total of 104,000 hectares with a total length of about 100 km. The flagship Barsele project is located at the western end of the Proterozoic Skellefte trend, a prolific belt of volcanogenic massive sulfide deposits that overlaps with the "Gold Line" in northern Sweden. This project has long been structured as a joint venture, with ownership stakes of 55% for Agnico Eagle and 45% for FNM. It spans nearly 25,000 hectares, and 165,000 meters have been drilled so far, with funding of USD 55 million from Agnico.

The new management under President Adam Cegielski and CEO Taj Singh expects large mineralizations in the unexplored zones. What has not yet been included in the valuation, with a market value of almost CAD 135 million, are the projects in Paubacken, Storjuktan, and Klippen. In addition, there is the huge Oijärvi project in Finland, which has only been explored to a depth of 215 meters. Diamond drilling has now commenced on the high-priority Aida target at the Paubacken project in Vasterbotten County in northern Sweden. The exploration target is approximately 40 km south of the resource-rich Barsele project. Aida is located approximately 4 km north of the operating Svartliden mill, which is currently processing ore from Sweden's newest gold mine, Fabodtjarn.

First Nordic plans to conduct 5,150 meters of diamond drilling in the first quarter on the Aida target area with up to two diamond drilling rigs. One drill rig is currently in operation and is operated by Finland-based Comadev Oy. A total of 24 diamond drill holes are planned to test over 3 km of the identified structural corridor. Based on the success of the first quarter drill program, First Nordic expects an additional 5,000 to 10,000 meters of drilling to be carried out at Aida in 2025, for which it is already fully financed.

Taj Singh, CEO of First Nordic commented, "It is an exciting time in the Gold Line Belt. At Aida, we are now embarking on the most extensive diamond drilling program ever conducted in the Gold Line Belt outside of our Barsele project." The Aida drilling program in Q1-2025 has been designed to build on the known mineralization and collect samples over a strike length of 3 km to explore the mineralization's size, geometry, and structural control within the shear corridor. The Company currently has sufficient funds in the treasury, and a planned listing on Nasdaq North in Sweden is to be followed by an expansion of the investor base. Due to the good news flow, FNM shares have doubled from CAD 0.30 to CAD 0.60 in the last 3 months, but the Company is likely to have some more good news in store. With the upcoming drill results, the revaluation should continue rapidly.

First Nordic Metals will be presented at the 14th International Investment Forum by President Adam Cegielski and CEO Taj Singh today, February 25, 2025. This story is a hot topic. Free registration under this link.

Nel ASA and Xiaomi – Two Worlds

We would like to provide a technical note for the much-publicized Nel ASA stock. After 3 years of downturn, the share price has now lost 84% of its value. A restructuring program is currently underway to compensate for the decline in orders in the Greentech sector. Tomorrow, February 26, CEO Hakon Volldal will report on the year 2024 and, at the same time, provide an outlook for 2025. Analysts expect a loss per share of NOK 0.0469 for Q4, with full-year revenue of NOK 1.53 billion. This leaves a full-year loss per share of NOK 0.17. Due to the high level of uncertainty, it is advisable to wait at this point until the first positive data emerges. The Company is not expected to turn a profit before 2028. Very speculative!

The situation at Xiaomi is diametrically opposed. The Chinese tech giant has gained a full 300% in one year. All business areas are running smoothly, and the Company is also doing great business in Europe. The 2024 annual figures are expected on March 18. Earnings per share are expected to be around CNY 0.2354. Xiaomi is growing at a constant 20% in revenue and currently has a P/E ratio of only 18.9 for 2025. The telecom giant has quintupled its valuation in the last 3 years to around EUR 158 billion. Investors should tighten their stop-losses and even consider selling before the figures if necessary, as the stock has already posted a 200% gain since mid-2024. The climate under Donald Trump could quickly become frostier if the US-China trade war reignites.

Germany has voted. For the next 4 years, a black-red coalition is set for the time being. We can only hope that the most pressing issues will be addressed, but it could also end in gridlock. Positive movements can be seen at Agnico-Eagle, First Nordic, and Xiaomi. Nel ASA will likely have to undergo a tough restructuring first to adjust to the lower demand for electrolysers.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.