May 25th, 2023 | 07:40 CEST

Caution with TUI and Varta! Smartbroker Holding with 85% price potential!

At around EUR 6, the TUI share is trading at an all-time low. Is now the time to buy into the tourism group? One analyst warns against it and believes the share price could fall by a third. Caution is also advised with Varta. The former German battery hopeful is fighting for survival. Analysts halve the price target and recommend selling the share. And the shareholders' association SdK is also sounding the alarm. A total loss cannot be ruled out. Instead of catching a falling knife, focusing on shares in an upward trend, such as Smartbroker Holding, is worthwhile. The share is one of the current year's high flyers, and analysts believe further price increases of over 80% are possible. Thanks to the new app, EBITDA could increase more than tenfold.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

TUI AG NA O.N. | DE000TUAG505 , VARTA AG O.N. | DE000A0TGJ55 , SMARTBROKER HOLDING AG | DE000A2GS609

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Smartbroker Holding: 10x EBITDA?

The share of Smartbroker Holding AG is one of the high flyers of the current year on the German stock market. The group operates Smartbroker - a multi-award-winning online broker - and wide-reaching stock market portals. Since the turn of the year, the stock has gained almost 60%. And there is still more to come. Several analyst firms recommend buying the share. The most optimistic is GBC Research, with a target price of EUR 17.70. The analysts at Montega consider EUR 14 realistic - representing more than 50% upside potential. The analysts agree on the price trigger: the relaunch of the smart broker in mid-2023, which should attract new customers and open up new sources of revenue.

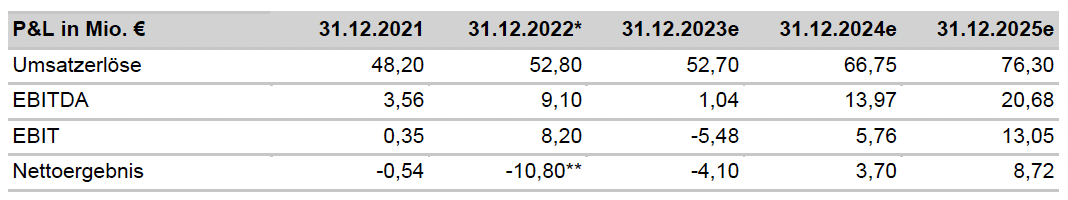

The management of Smartbroker confirmed at the investor conferences in Frankfurt and Munich in recent weeks that the app's release date can be met. The beta test is to take place in July, and then the official launch in August. There are high hopes associated with the new app. On the one hand, it is supposed to be the most modern, simple and intuitive broker app on the market. In addition, customers will also be able to trade new asset classes such as cryptocurrencies like Bitcoin & Co. By switching the background bank from BNP Paribas to Baader Bank, Smartbroker also taps into additional sources of revenue. They will participate in the interest income from "parking" customer balances at the ECB. All in all, this should lead to significant growth in turnover and earnings in the coming years. GBC Research expects sales of EUR 66.75 million as early as 2024 (2023: EUR 52.70 million). EBITDA is expected to increase more than tenfold from EUR 1.04 million in 2023 to EUR 13.97 million in 2024 and then climb again to EUR 20.68 million in 2025. The P/E ratio is expected to fall from 35.77 in 2024 to 15.18 in 2025. (to the research report: https://irpages2.eqs.com/download/companies/wallstreetonline/ResearchDownloads/SBH_AG_GBC_Update_27032023_DE.pdf)

Varta: SdK with horror scenario

Varta shareholders can only dream of such growth prospects at the moment. The battery pioneer is struggling with an eroding core business and liquidity problems. Yesterday, the share lost more than 9% of its value and is now trading below EUR 17. From Goldman Sachs' point of view, the price is still too much. Yesterday, the analysts halved the price target from EUR 30 to EUR 15. The recommendation was adjusted from "Neutral" to "Sell". The former German battery hopeful is struggling with overcapacities in its core business with lithium-ion button cells. Therefore, it is far from ruled out that the Company could miss its own forecasts. The Schutzgemeinschaft der Kapitalanleger (SdK) is even more critical about the prospects. In a YouTube video, Varta was critically examined, and numerous problems were highlighted. In addition to the issues in the core business already mentioned, these would be, for example, the massive share sales by the major shareholder. The recent capital increase was also a drop in the ocean. The negative cash flow in the first quarter already exceeded the inflow of funds from the capital increase. Insolvency and, thus, a total loss for shareholders cannot be ruled out (Youtube article https://www.youtube.com/watch?v=waYDCzxcURs).

TUI: A buy at EUR 6?

Like Varta, the TUI share is one of the most popular German shares and, at the same time, one of the problem children. After the past month's crash, many investors ask themselves: is the TUI share not a bargain at EUR 6? After all, prices for holiday trips are shooting up in the summer season that is now beginning. And the TUI share stood at EUR 20 just a few months ago. Nevertheless, at least analysts remain skeptical. For Bernstein Research, TUI is currently a "market perform". The price target is 590 pence and thus somewhat at the current price level. Jefferies is much more critical. Following the quarterly figures, the analysts continue to rate the TUI share as "Underperform". The price target is EUR 2.10. This means that the share could almost fall by three times again. Looking ahead to the summer, the analysts are quite optimistic about the operating performance of the travel group. However, the liquidity in the group is still a risk that should not be underestimated.

With TUI and Varta, one can only advise against catching a falling knife. While a countermove is always possible and may be of interest to speculators, both companies need to address their liquidity issues. The Smartbroker share seems more attractive. It is in an upward trend, the problems with the development of the new app seem to have been solved, and significant jumps in turnover and earnings are expected in the coming years.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.