February 28th, 2025 | 08:00 CET

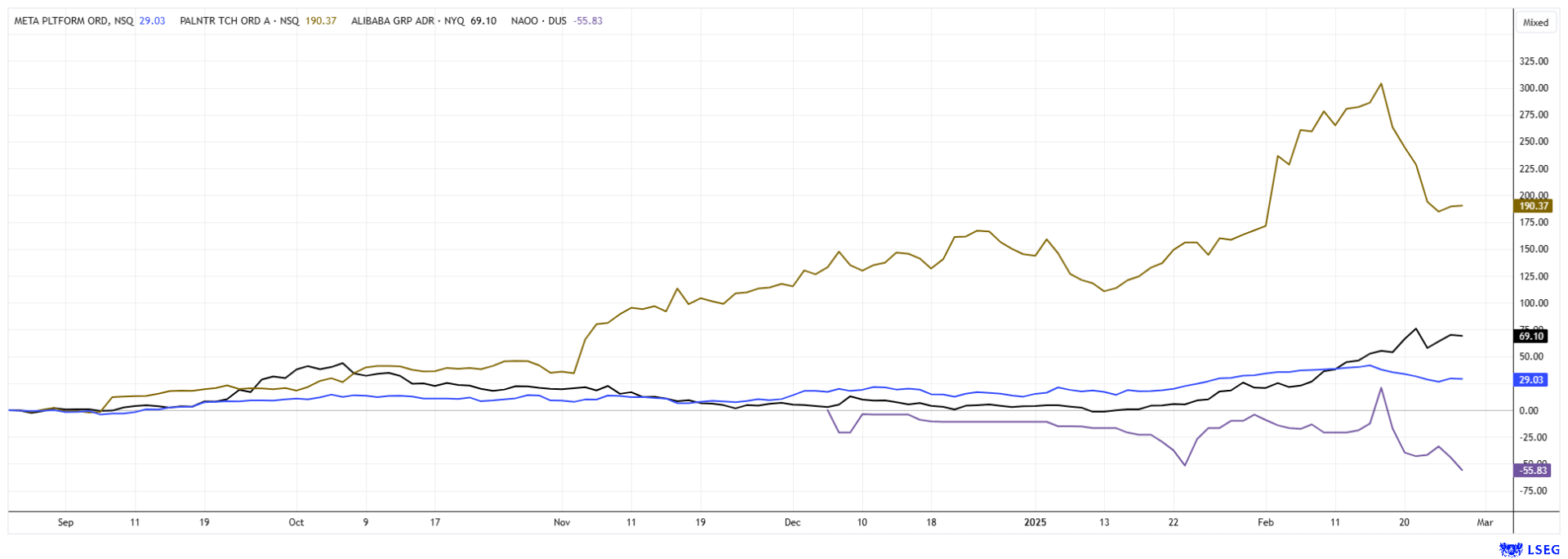

Caution - Nasdaq correction: Now, it is really starting with Palantir, Alibaba, Naoo AG, and Meta Platforms.

After a brief correction, the stock market is accelerating again. Alongside high-tech and AI fantasies, rumors of peace surrounding Ukraine are also gaining momentum. European stocks likely to play a role in any reconstruction are gaining a lot of attention. But high-tech is also back in demand. With Nvidia's figures exceeding market expectations, there is some minor profit-taking, but the strong trend should continue. Especially with Nvidia, investors have become accustomed to corrections being offset in a few days. Nevertheless, investors should be on their guard, as many valuations are already very ambitious. In the messenger area, we discovered Naoo AG, which was founded in Switzerland. With innovative approaches, a multifunctional app is being developed here that could potentially outperform even Meta in certain areas. A closer look makes sense.

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , ALIBABA GROUP HLDG LTD | KYG017191142 , NAOO AG | CH1323306329 , META PLATFORMS INC | US30303M1027

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Alibaba – Skyrocketing with Apple

The shares of the Alibaba Group, which are listed in Hong Kong, have been in high demand for several days and recently reached a four-month high of over USD 145. The background to this is the announcement that Alibaba has entered into a strategic partnership with Apple to develop AI functions for iPhones in China. Apple is said to have evaluated several systems from other Chinese tech giants, including Baidu, Tencent, ByteDance, and DeepSeek, but chose Alibaba. The decisive factors in the decision are Alibaba's extensive user data and deep technological expertise, which enable personalized services for Chinese users.

The long-beaten Alibaba share had already turned around in the chart about four months ago. After a sustained downward trend since 2020, the Chinese tech stock was able to break away from its lows in 2024 and is now striving higher almost daily. According to reports, Apple and Alibaba have already submitted their jointly developed AI features to the Chinese cyberspace regulator for approval. The launch of the services is planned for April. Alibaba is growing organically at around 10% per year and has a 2025 P/E ratio of 9.3, according to the analyst platform LSEG. Compared to Apple or Amazon, it is a real bargain.

Meta Platforms – With USD 200 billion against DeepSeek

The price of Facebook, Instagram, and WhatsApp parent company Meta Platforms has come under pressure in the last two weeks. From a high of over USD 740, the stock corrected to USD 620 in just 7 trading days. A shot across the bow because of DeepSeek? Meta is one of the so-called AI hyperscalers on Wall Street. This is the term used to describe large tech companies that invest enormous sums in AI development. In January, Meta announced it would invest up to USD 65 billion in AI infrastructure in 2025. It was recently reported that a new data center is to be built that will be used specifically for AI purposes. The estimated value of the project is said to be over the USD 200 billion mark. The competition for the best infrastructure is thus continuing to pick up speed, but it also raises significant doubts. The Chinese competitor model DeepSeek points out to investors that successful AI functionality does not necessarily require billion-dollar investments.

This is not necessarily good news for Meta shareholders because billions of dollars are being invested in futuristic software in the current environment. Analysts on the LSEG platform have also become somewhat more cautious. Although 65 out of 71 experts are voting "Buy", some studies are four months old, and the average 12-month price target of USD 750 has effectively been reached. Therefore, long speculators should tighten their stop rate closely to USD 585, where a very important zone must hold technically. Otherwise, there will be trouble.

Naoo AG – With a new multi-platform to success

New social media platforms are competing against tech giants such as Meta Platforms, Microsoft, Tencent, and ByteDance. The latter owns TikTok, a messaging app that is particularly popular among teenagers. ByteDance is a private company, about 60% of which is owned by global institutional investors like BlackRock, General Atlantic, and Susquehanna. In November 2024, the Company's value was estimated at just under USD 300 billion. But which platform is suitable for which user?

In Switzerland, resourceful programmers have launched a new social media platform that is owned by Naoo AG, which has been listed on the Düsseldorf stock exchange since December 5. The "naoo" app, launched in 2021, is characterized by a high level of user activity, valuable content, and detailed, personalized profiles. naoo incentivizes its users with a unique points system that rewards users for high-quality content and interactions regardless of their reach. The naoo points earned in this way can be exchanged for goods, services or cash, depending on availability. Gamification further increases the platform's attractiveness, and user profiles are becoming even more meaningful, increasing the added value for advertisers.

The naoo platform also links social media with brick-and-mortar retail and local services. Corporate customers benefit from high-performance campaigns that positively influence the sales of their products and services through direct user incentives and gamification – both online and directly at the point of sale. This approach has already been successfully implemented for well-known clients such as El Tony Mate, EUROBUS Rustexpress, and Swype. naoo Business is currently launching a powerful tool for companies that makes it possible to plan, implement, and analyze campaigns and link online activities of regional providers at the local point of sale in a simple, cost-effective, and efficient way.

naoo is developing dynamically, which makes Naoo AG attractive. The number of users has more than doubled in the past 12 months, and – although naoo has so far only focused on Switzerland – by the end of February 2025, there were over 90,000 downloads of the naoo app. The volume of advertising served via naoo has almost quadrupled over the same period, and the time spent by naoo users per session has roughly doubled. It is already clear that the total number of sessions on Android in February 2025 increased by over 70% compared to the previous year, while the total number of likes almost doubled before the end of the month. In terms of user ratings, the naoo platform is performing significantly better than the market and industry averages.

With a respectable market capitalization of EUR 95.7 million, the Company's market capitalization at the start was already at a relevant level that makes fund managers sit up and take notice. The shares are still listed on the general open market, but the plan is to move up to the primary segment in the medium term in order to enable interested investors to also trade on Xetra and Tradegate. Currently, the shares can be collected at around EUR 11 to 13. Yesterday, about 5,000 shares changed hands. Co-founder and major shareholder Thomas Wolfensberger (>50%) sees very high medium-term growth, which should be well above the industry average.

Palantir – Caution at the platform edge!

Palantir's stock continues to surf the AI and Big Data wave. Due to its close ties to governments for military intelligence, the creators of the Gotham software have now been given a security-relevant status. In global fund portfolios, the title has shifted from software to AI defense, justifying much higher valuations. One key point is immediately apparent: Due to ongoing geopolitical conflicts, states can currently borrow infinitely to protect their populations from the lurking dangers of war. Palantir, along with the entire defense industry, has become a popular problem solver in the field of cyber intelligence.

Incoming orders are rising, and so is the share price. In the last 6 months alone, the shares have gained around 300%. Is this the end of the road? With a view to the LSEG analysis platform, we now find a 2025 price-to-sales ratio of 70 for Palantir, with a P/E ratio of around 220. Although there are 17 "Buy" recommendations, the average price target in the 12-month focus is only USD 92. At its peak two weeks ago, the stock was around USD 125, so the experts had better do their math again after the numbers! A 30% correction down to USD 86 has already made many recent buyers tremble. Not for the faint of heart!

Donald Trump's sometimes obscure decisions are creating a strong differentiation among economic sectors. While armaments and high-tech continue their advance, other sectors are under pressure. Long positions in tech stocks should be hedged with trailing stops. Naoo AG is not yet very well known, but the social media platform combines many functionalities in one service. It is worth taking a first look!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.