January 20th, 2023 | 13:50 CET

Cameco, Tocvan Ventures, Barrick Gold - Shining in new splendor

The era of hefty interest rate hikes is coming to an end, but high inflation remains. That is bad news for the economy and society. But for precious metals, which serve as inflation protection, this is grist to the mill. In addition to the gold price, another metal has celebrated a comeback recently. Uranium was able to bottom out after a bear market that lasted for years. With demand rising due to climate change, stocks in this sector should promise sustainable gains.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

CAMECO CORP. | CA13321L1085 , TOCVAN VENTURES C | CA88900N1050 , BARRICK GOLD CORP. | CA0679011084

Table of contents:

"[...] Our SMSZ project is the largest contiguous land package of any exploration company in the region at 400km2 and overlays a 38km portion of the prolific Senegal Mali Shear Zone. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

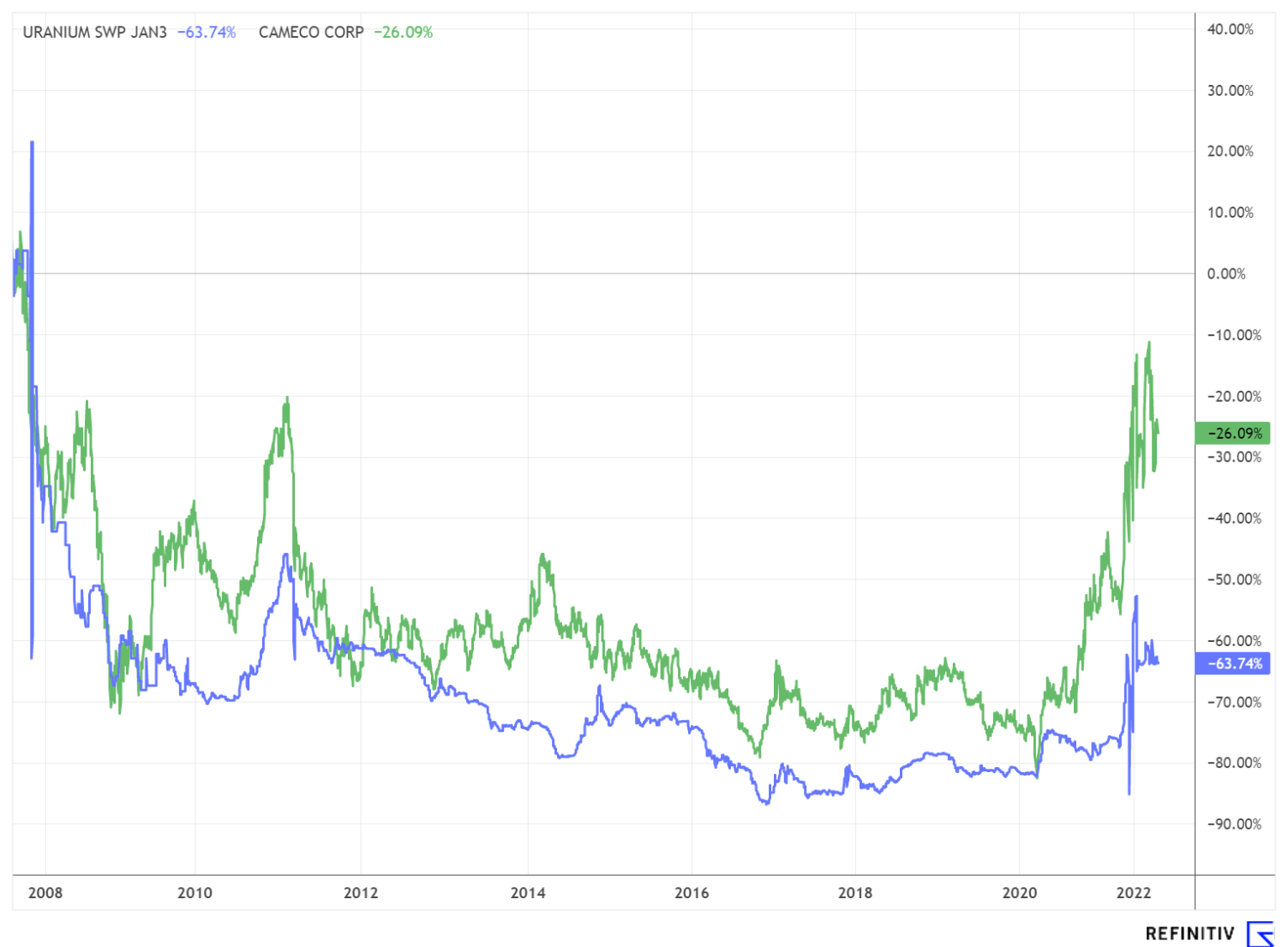

Cameco - Glowing news

The momentum of the uranium market is increasing, and the bear market that lasted more than a decade should soon be history. That is because the demand for nuclear energy is increasing day by day, except, of course, in Germany. Since the energy crisis and the blown-up supply chains, the expansion of uranium production in domestic, western territories is on the rise. The top priority of governments now is to minimize dependencies on Russia and China. And it is in the procurement of uranium oxide that the US dependence on countries like Kazakhstan and Russia is enormous. While the United States purchased more than 45 million pounds of uranium in 2021, making it the world's largest consumer, domestic production was a tiny 21,000 pounds of uranium oxide U3O8. Thus, domestic production is not nearly enough to meet the needs of the country's nuclear power plants.

Cameco, one of the world's largest uranium producers, sent a clear positive signal to the market by resuming production at the McArthur River mine. Production was suspended for about four years, starting in January 2018, due to continued weakness in the global uranium market. In February, however, it was announced that this would be resumed after the four-year hiatus due to improved market conditions.

In addition, Cameco received government support. The Canadian Nuclear Regulatory Commission decided to extend the license for Cameco Fuel Manufacturing's nuclear fuel plant in Port Hope, Ontario, for 20 years. The Canadian Nuclear Safety Commission said in a statement that it had approved an increase in the annual production limit to 1 650 t of uranium under the new license, which will be valid from March 1, 2023, to February 28, 2043.

Tocvan Ventures - Brilliant results

The precious metals markets also continue to show signs of recovery due to geopolitical uncertainties and continued high inflation. Should central banks continue to slow the pace of interest rate hikes or even return to the ultra-loose monetary policy to avoid greater damage to economies and sovereigns, gold, in particular, should be seen as soon returning to spheres beyond USD 2,000 per ounce. While major players such as Barrick Gold and Newmont have already distanced themselves from their lows of the past year, smaller producers and exploration companies remain at cheapened and attractive levels.

Although Tocvan Ventures has also been able to start a recovery rally since the end of November, it is still down around 45% year-on-year. Once again, Tocvan Ventures was able to come up with excellent drilling results.

With Pilar and El Picacho, the Canadians own two gold and silver projects in the state of Sonora. About 40% of Mexico's gold is mined in Sonora. Both of Tocvan's projects are located near producing mines or major projects that are moving toward development. Near Pilar alone, there are three major projects within a radius of up to 80 km: Osisko Development's San Antonio project, Minera Alamos' Sanatana mine, and Argonaut Gold's La Colorada mine.

Surprisingly strong drill results have now been announced from the El Picacho secondary project. 10 drill holes totalling 1,075.1 m were completed on the San Ramon property to test low-grade mineralization adjacent to historic underground workings that returned high-grade gold and silver. Drilling was aimed at testing various structural orientations to determine the best way to target the mineralization. Mineralization associated with the historic underground workings was confirmed, and the most significant mineralization was discovered in a 100 m step-out from the historic workings of the San Ramon property, confirming the model that mineralization continues at depth in a west-dipping system.

The most significant results returned 44.2 m at 0.6 g/t gold, including 12.2 m at 2 g/t gold and 7 g/t silver from a drill hole depth of 41.2 m. The market capitalization of Tocvan Ventures is currently EUR 15.35 million. Both projects have high potential. With a sustained increase in the gold price, the share could thus mutate into an outperformer on the gold market.

Barrick Gold - Marginally below guidance

The second-largest gold producer will announce its final quarterly and annual results on February 15. The preliminary figures for the full year 2022 showed gold production and sales of 4.14 million ounces. The Toronto-based company thus missed its targets by a marginal 1%. However, the fourth quarter showed an upward trend with a 13% increase in production compared to the third quarter. In the copper segment, on the other hand, the target corridor of between 420 and 470 million pounds was met with total production of 440 million pounds.

Preliminary results for the fourth quarter show sales volumes of 1.11 million ounces of gold and 99 million pounds of copper and preliminary production of 1.12 million ounces of gold and 96 million pounds of copper. The average market price for gold in the fourth quarter was USD 1,726 per ounce, and that for copper was USD 3.63 per pound. Preliminary gold production in Q4 improved from Q3, making it the strongest quarter of the year, with Cortez, Carlin and Tongon posting better results. This was partially offset by lower production at Pueblo Viejo, which ended the year in line with guidance.

For a detailed update on the preliminary full-year and quarterly results, read here.

Precious metals markets bounced off their lows due to geopolitical and economic uncertainties. Barrick Gold's annual production was just below the set targets. Tocvan Ventures delivered surprisingly strong drill results. Demand for uranium should boost one of the largest producers, Cameco.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.