July 24th, 2023 | 08:20 CEST

BYD, Varta and FREYR - who will build the perfect battery? First Phosphate with a big deal!

E-mobility is still in its infancy globally, with just 25.9 million pure electric vehicles on the road out of around 1.3 billion vehicles worldwide. The share is, therefore, just under 2%. Nevertheless, sales are growing strongly, especially in China, Europe and the US. China is the most important production country for electric cars. It is forecast that around 13 million e-cars will be produced in the Middle Kingdom in 2023, more than in Germany and the US combined. The production costs of e-cars are still significantly higher than those of combustion engines. The main price drivers are the batteries, which use rare metals in their production. China's dominance in the field of battery innovations is currently still very pronounced. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , VARTA AG O.N. | DE000A0TGJ55 , Freyr Battery | LU2360697374 , FIRST PHOSPHATE CORP | CA33611D1033

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

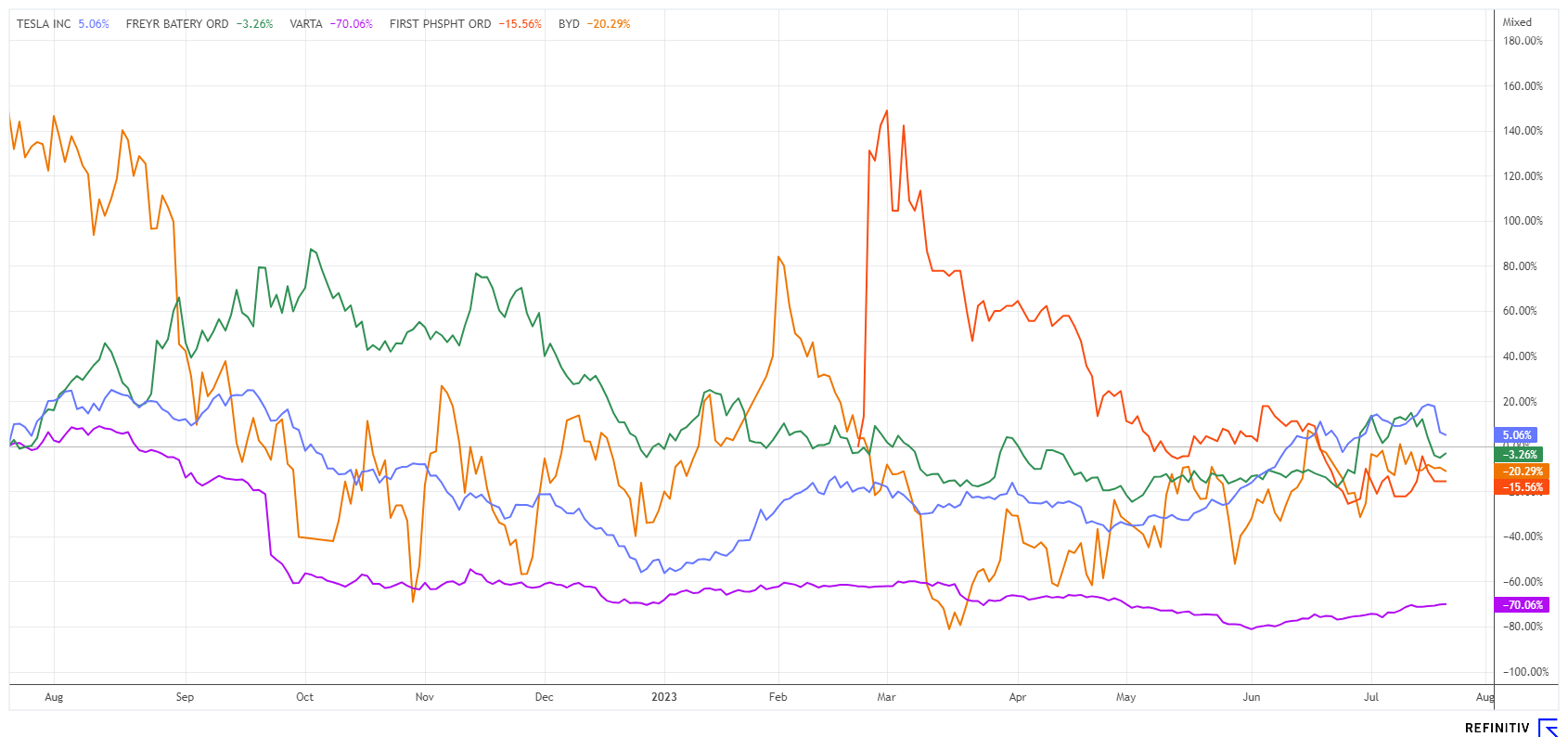

BYD - Clearly ahead of Tesla in China

Elon Musk can currently show little of his winning smile when he thinks of China. The competitors in the e-mobility market there have neatly outstripped him despite multiple price reductions. The top dog BYD is present with its vehicles in more and more countries besides China. This is clearly reflected in the sales figures. In the first half of 2023, more than 1.25 million NEVs were sold worldwide, an increase of 96% compared to the same period in 2022. Tesla, on the other hand, was only able to sell around 900,000 vehicles.

Because of its closed production chain, BYD is among the global market leaders not only with its vehicles but also with its new battery product, "Blade". The battery, which is manufactured entirely in-house, is considered to be the newest and, at the same time, safest battery technology for electrically driven vehicles that has been launched on the market to date. It results from many years of development work and expresses BYD's enormous expertise in battery technology. In terms of service life, the engineers are talking about around 5,000 charging cycles and more than 1.2 million total kilometers. The manufacturer, therefore, grants a warranty of 8 years or 160,000 km on the high-voltage battery, which is also rare in the industry.

Just a few days ago, BYD had pre-announced a strong jump in profits for the first half of 2023. Thus, net income was about EUR 1.46 billion, which means a jump of about 200% compared to the same period last year. The Company will not present its detailed half-year report until August 28. The stock is trading at a solid EUR 30.50 and is still in a recovery cycle since bottoming at EUR 20.70 in November 2022.

First Phosphate - A partnership with Glencore raises eyebrows

Battery production requires a lot of metals, but those looking to the future are also thinking about alternative technologies outside of the mainstream Li-ion technology. As BYD was quick to recognize, fast charge cycles and long ranges are required for smooth operation. This requires a solid technical design and a much longer service life, as is currently the case. Unfortunately, manufacturers are still thinking far too short-term here because recycling worn-out batteries is complex, expensive and currently not even legally secured. In Europe, so-called "electronic waste" must be taken back free of charge by the dealer network. Tesla has not yet made such a concession.

Canadian company First Phosphate (PHOS) is focusing on this potential game-changer in the electric mobility revolution and is betting on phosphate. An expected growth in global markets of nearly 20% per annum is luring investors to consider alternative materials and develop better technologies. Phosphate offers the technical possibilities to finally replace highly toxic elements like cobalt.

First Phosphate signed a non-binding memorandum of understanding (MOU) on July 17 with NorFalco Sales, a division of Glencore Canada Corp., to secure sulfuric acid supplies for its future industrial facilities in Quebec. The acid is needed for phosphoric acid production and other industrial processes. Both companies intend to enter into a substantial supply relationship. With the parent company Glencore, PHOS gains a strong partner for the extraction and purification of phosphate and the production of active cathode material for the lithium iron phosphate (LFP) battery industry. A project with a promising future!

The PHOS stock currently has a market cap of just CAD 18 million, making it relatively small, but the Company's technological approach argues for a premium. An exciting addition to an international battery portfolio.

Varta or FREYR Battery - Where to put the leverage?

The share of the battery and storage manufacturer Varta has truly brought joy in the last 3 months. This does not necessarily apply to long-term investors, but courageous investors who followed us at just under EUR 17 were rewarded. In the past week, the stock has cleared the EUR 22 hurdle without any significant announcements and is preparing to approach the resistance zone at EUR 25 to 27 with great momentum.

Fundamentally, the next steps in the restructuring program are already being taken, as the shareholders gave the green light for the Company's future at the Annual General Meeting. Varta launched a rigid savings program in the fall of 2022. Part of the concept results in a worldwide reduction in staff of about 800 full-time positions, but the entire business model is to be examined. This all sounds promising, so we remain invested but put a safety stop at EUR 19.80. The Q2 figures on August 11 should be exciting.

Meanwhile, bombshell news comes from the Norwegian competitor FREYR Battery. The EU Commission has concretized its EUR 3.6 billion Clean-Tech program, and FREYR Battery is among the current funding recipients with e-mobility relevance. The Norwegian company will receive EUR 100 million from the EU pot for the construction of its "Giga Arctic" battery cell factory. Admittedly, the FREYR share is still somewhat ambitiously valued with a capitalization of over EUR 1 billion, as the Company does not plan to reach EBIT breakeven until 2027. The high valuation seems to have prompted many investors to sell all "sell on good news" shares, causing the share price to drop by a good 15% last week. We, too, find the share interesting only from EUR 5, but in the current bull market, it could take a few more months for the price to fall. The next figures will be published on August 9.

The global battery market is in turmoil. Currently, 95% of the market is focused on Li-ion technology, but the game-changers are already in the pipeline. When investing in the industry, look for good diversification in individual stocks both technologically and geographically. BYD is a standard stock, and Varta and First Phosphate are suitable as speculative admixtures.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.