February 27th, 2023 | 14:53 CET

BYD, First Hydrogen, Daimler Truck - Battle of the drive systems

In recent years, the debate about the future of mobility has focused heavily on conventional passenger cars. Yet it is commercial vehicles that are responsible for the majority of emissions. Here, the competition between electromobility and hydrogen as drive systems for trucks and vans is now moving into the focus of the discussion. While electromobility has been on the rise for several years, hydrogen is also gaining in importance as an alternative drive system. In contrast to batteries, fuel cell vehicles can achieve a significantly greater range with hydrogen. Another advantage of hydrogen as a propulsion system is the short refueling time. Today, we look at three companies that are taking different approaches.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , First Hydrogen Corp. | CA32057N1042 , Daimler Truck Holding AG | DE000DTR0013

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

BYD - Sales decline in January

According to Bloomberg, Chinese electric vehicle (EV) maker BYD has overtaken Tesla to become the world's best-selling EV maker, with 1.87 million deliveries in 2022 compared to Tesla's 1.3 million. Most of its sales are in China, and it is mainly passenger cars that are sold. The commercial vehicle segment is primarily focused on electrified buses. The Company is aiming for global expansion in the future. It has already entered the Japanese market, and two factories are to be built in Europe.

After the sales figures in 2022 had rushed from one record to the next, there was a first setback in January. While 235,197 vehicles were produced and 235,197 sold in December, the figures for the first month of 2023 were only 154,188 units produced and 151,341 sold - a drop of almost 35% compared to the previous month. Compared to January 2022, there is an increase of 62%. January is generally one of the weakest months in China, as the New Year festival is celebrated.

The upcoming sales figures should therefore be looked at more closely. On the positive side, BYD did not have to lower its prices in China, unlike competitors like Tesla and Nio. Charlie Munger is also impressed by this, although he has recently sold many shares with Buffet's Berkshire Hathaway. The reason for this is the significantly increased valuation. These statements are likely to be one of the reasons for the recent correction. Currently, the share is quoted at EUR 26.34. It remains to be seen whether the vehicles will be as popular outside China as they are in the Middle Kingdom.

First Hydrogen - First pictures of the 2nd generation vehicles

First Hydrogen has collaborated with Ballard Power and AVL Powertrain UK to develop a hydrogen-powered delivery van. The first test vehicles received road approval in mid-October and have been undergoing extensive testing since November. Compared to electric vans, the vehicles have a more extended range of 400 to 600 km and can be refueled with 700 bar within a few minutes. Operational testing will start in March 2023. Fleet operators will then use the vehicles in the UK's Aggregated Hydrogen Freight Consortium, which includes national supermarkets, utilities, breakdown services and healthcare providers. First Hydrogen also plans to develop refueling stations and move into green hydrogen production.

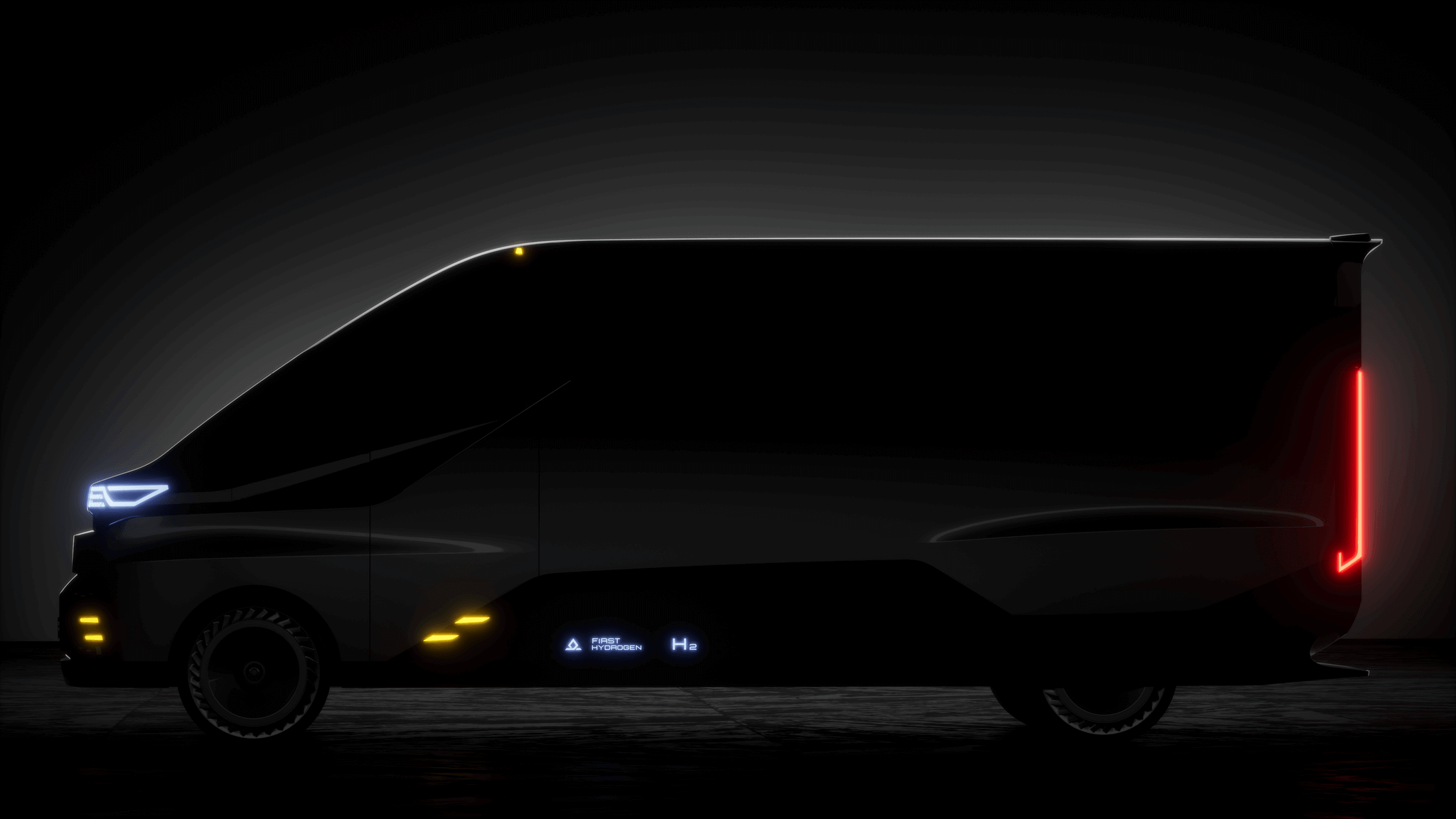

In parallel, the Company is working with EDAG Group on the 2nd generation of its zero-emission light commercial vehicles. The first images were released on January 27. The designs can be scaled to different vehicle heights and lengths, creating modular vehicles that can be adapted to operational use and used for various applications. The EU's Green Deal Industrial Plan, which provides hundreds of billions of euros for a carbon-neutral EU industry, comes at the right time for First Hydrogen, as light-duty vehicles are also expected to roll across Europe's roads early 2024. To this end, potential fleet operators are currently being identified.

On February 21, the Company was recognized as one of the top 50 companies on the TSX Ventures Exchange. CEO Balraj Mann commented, "The Company's Hydrogen-as-a-Service model is a driving force behind our success." For more information, visit researchanalyst.com or watch the Company presentation from the 6th International Investment Forum that is available on YouTube. The stock has been in consolidation since December and has now reached its support zone of CAD 3.38 to CAD 3.64, from where the rebound should occur. Currently, the share can be bought for CAD 3.58.

Daimler Truck - Cooperation with Deutz

While Daimler Truck initially focused on electric mobility, the Company has since rethought its approach and is now pursuing a two-track strategy. Even if the electric drive has a head start in development, the Company wants to be able to offer customers a suitable solution in the future, depending on the area of application. After all, the current advantages in refueling time and range could tip the scales in favour of hydrogen drive for freight transport in the future.

This fits with the news that Daimler Truck North America has teamed up with researchers at Oregon State University to develop a heavy-duty fuel cell truck for regional and long-haul transportation. The truck is expected to have a range of 600 miles (965 km) and maintain payload capacity thanks to new power electronics, motors and energy management tools. The project targets a fuel cell life of 25,000 hours. The Daimler Truck subsidiary received a USD 25.8 million grant for the project from the US Department of Energy's SuperTruck 3 program.

Most recently, the news has focused on the Company's collaboration with engine manufacturer Deutz. Deutz has secured access to Daimler engines and on-highway IP rights. In return, Daimler Truck will receive a mid-double-digit million amount and around 5.285 million shares. That gives Daimler Truck a 4.19% stake in Deutz AG. The share is currently available for EUR 30.00, giving a dividend yield of just under 5%. If the Group succeeds in implementing hydrogen technology, the share has upside potential.

Depending on the application area, both drive systems probably have their reason to exist. Sooner or later, the transport industry will have to replace its diesel fleets if it wants to become climate-neutral. For the first time in a long time, BYD has not been able to report any new sales records. First Hydrogen is progressing well with the 2nd generation of its light commercial vehicles. Daimler Truck wants to catch up in the hydrogen sector and will work more closely with Deutz AG in the future.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.