December 22nd, 2025 | 06:55 CET

Will 2026 start with another surge? We evaluate BYD, NEO Battery Materials, and DroneShield

In December, many market participants start thinking about the next investment period – in this case, the year 2026. The 2025 investment year was one of the best periods of the past 20 years for both the DAX and the NASDAQ, with gains of 18.7% and 20.8%, respectively. Even the Trump tariff crash in April was offset entirely within just two weeks. The drivers of the upswing remain the US administration's policy, which is perceived as "supportive," as well as ongoing geopolitical conflicts and still tolerable interest rates between 2.7% (Bund) and 4.0% (USD Treasury) in the ten-year range. For the coming year, some experts expect another wave of inflation, high commodity prices, and rising energy costs. These are all factors that could once again stifle the economic upturn and bring additional volatility to the markets. And let's not forget: AI and defense seem to be at their peak — so who will lead the next revaluation of the stock markets?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , NEO BATTERY MATERIALS LTD | CA62908A1003 , DRONESHIELD LTD | AU000000DRO2

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD – 2026 sets the course

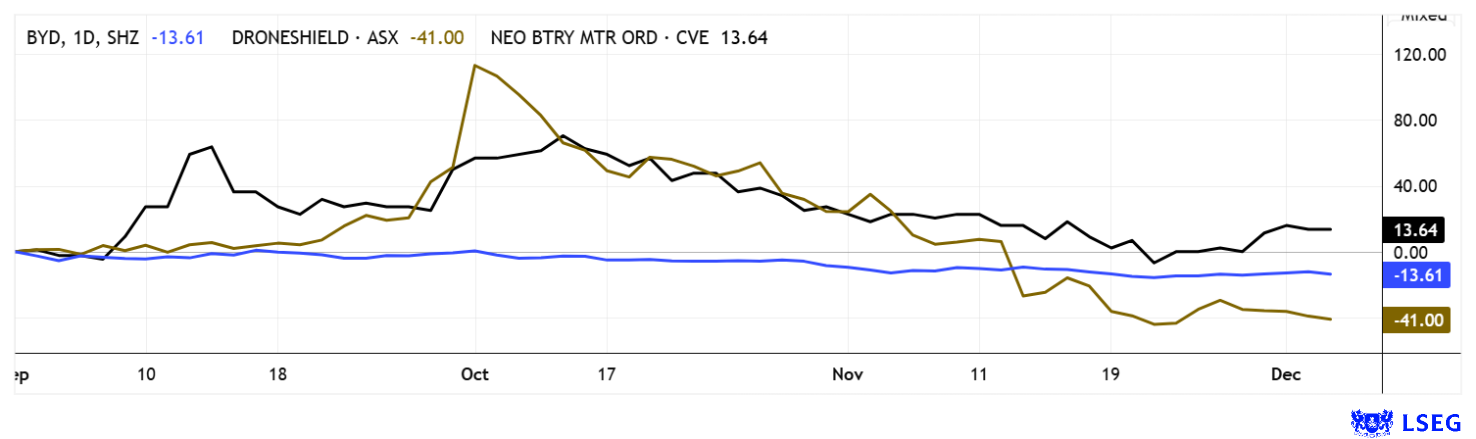

For many years, BYD ("Build Your Dreams") shares were among the best performers of all Asian blue chips traded in Europe and the US. However, the stock has not been able to achieve any growth in the last 12 months, with temporary highs of EUR 17.70 selling off to EUR 10.00 by the end of November. That was the end of the line for now, with the stock back to just under EUR 11 on Friday.

Operations appear to be going well. In November, BYD sold 480,186 NEV vehicles, 5.3% less than in the same month last year, but still an increase of 8.7% compared to the previous month. Of these, 474,921 units were passenger vehicles, while 5,265 units were commercial vehicles. In Germany, 4,026 new BYD vehicles were registered in November, which is also in line with previous months. All in all, the Chinese manufacturer now has a market share of over 1% in Europe, and the plant in Hungary is scheduled to open in 2026. This means that import duties will no longer apply to vehicles manufactured in the EU. With this setup, BYD remains on an upward trend, and the number of affiliated dealers is also expected to double across the EU next year.

Manager Maria Grazia Davino recently emphasized that proximity to European customers is crucial in order to compete with Volkswagen, Tesla, and increasingly Renault and Stellantis. Local presence in sales, service, and manufacturing is considered a key success factor. BYD will present its figures for the full year 2025 at the end of March. There are currently 28 "Buy" recommendations on the LSEG platform, with an average upside potential of 45%. With prices around EUR 10.35, the 2026 P/E ratio is only 10.7. Exciting!

NEO Battery Materials presents at the 17th International Investment Forum (IIF)

The e-mobility market depends on high-performance batteries. Around 90% of these are manufactured in Asia, namely China, Korea, and Japan. For newcomers, establishing operations in one of these regions therefore makes strategic sense. One company positioning itself innovatively is the Canadian firm NEO Battery Materials Ltd., which specializes in silicon-enhanced lithium-ion batteries for drones, UAVs, robotics, electric vehicles, and energy storage systems. Its patented manufacturing process enables significant cost reductions and addresses key requirements of modern energy storage systems. With its NBMSiDE® silicon anodes, the Company achieves high energy densities, ultra-fast charging times, and improved cycle stability. In-house developments focus on a wide range of applications, from EV powertrains and grid-scale energy storage solutions to robotics and defense-related drone technology. Strategically, NEO Battery has its sights set on the North American battery value chain.

SVP of Strategy & Operations Danny Huh provided deeper insights into the Company's business strategy during the 17th International Investment Forum. The goal is to unlock the full potential of electrically powered devices through NEO's battery solutions - particularly with regard to capacity and charging speed. He describes what makes NEO unique by drawing an analogy with Taiwan Semiconductors (TSMC). The world's largest chip company builds its successful semiconductors according to the specifications of renowned chip designers such as Nvidia and ARM. Similarly, NEO aims to deliver the best performance metrics with its silicon-enhanced solutions. A key feature of the technology used is the addition of silicon to the widely used Li-ion technology, enabling performance increases of up to 40%. The Company works very closely with its customers in its design process in order to deliver a perfectly tailored product. Compromise solutions are not on the agenda, which is why NEO is considered to be much better positioned than the mass of standardized Chinese offerings. This approach is what can make EVs, drones, and robots truly high-performance.

The combination of technological leadership, rapid expansion of production capacity, and new partnerships and orders in the battery supply chain lay a strong foundation for the next phase of the Company's growth. With the recent addition of the operational battery manufacturing facility, the Company has successfully transitioned from pure research and development to commercialization. The stock is traded in Canada under the ticker symbol NBM at around CAD 0.50 and is also available via Tradegate.

SVP of Strategy & Ops, Danny Huh, explains the details of his strategic positioning and the Company's medium-term growth strategy in an interview with IIF host Lyndsay Malchuk.

DroneShield – The rocky road to new confidence

Australian drone defense specialist DroneShield has fallen completely by the wayside. While the stock quickly attracted attention within Europe due to NATO decisions, internal events caused the upward trend to come to a complete halt. Just as the first orders from Brussels arrived and sales reached AUD 200 million, the employee bonus programs were activated. A full 5% of the circulating capital was issued as new shares overnight. Worse still, there were no restrictions on these shares, and both management and the board sold them off like hotcakes. When free shareholders got wind of this, they dumped the stock by the basketful. As a result, the defense stock, which had risen by over 1,000%, fell by almost 80% to EUR 0.85 within four weeks. Recently, there was a small technical recovery to EUR 1.42. From an analytical perspective, not much has changed, as the horrendous valuation has been adjusted somewhat closer to reality. However, with the next bonus shares already waiting to be issued once the AUD 300, 400, and 500 million revenue targets are reached, investors should really tread carefully with this stock. It is questionable whether confidence can ever be restored. DroneShield will likely remain an expensive casino stock.

Technology stocks were among the top performers in 2025. Megatrends such as artificial intelligence and high-performance computing were among the best-performing sectors. For 2026, risk-aware investors may want to take a look at BYD and NEO Battery Materials. BYD could very quickly gain acceptance with localized production in the EU, while NEO has been adding purchase orders from drone and robotics companies to expand its market reach, thanks to its highly specialized battery technology. In the case of DroneShield, it is more than questionable whether positive sentiment can be generated again.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.