January 14th, 2021 | 18:50 CET

BYD, Deutsche Rohstoff AG, Ballard Power - There is huge potential here!

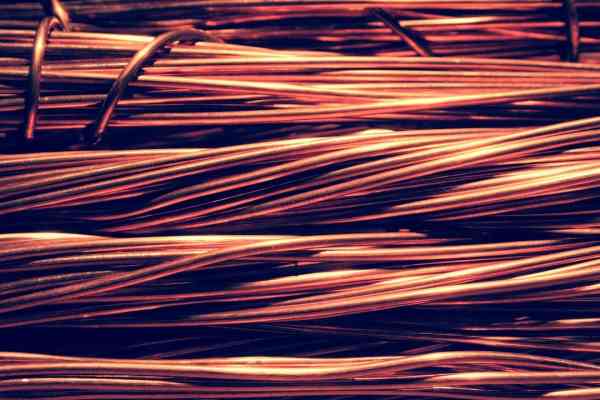

Since the historic crash last March due to the Corona pandemic, the oil price has stabilized well above USD 50.0. The large investment houses assume further rising prices of the black gold. Experts also see most commodities rising sharply due to the ever-increasing demand caused by new technologies. The scarcity of the required materials will increase enormously in the next few years. As a result, prices are likely to climb dramatically.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

DE000A0XYG76 , CNE100000296 , CA0585861085

Table of contents:

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

German craftmanship

German Rohstoff AG, based in Mannheim, has been tackling this problem since 2006. The group around the experienced CEO Dr. Thomas Gutschlag develops and operates various subsidiaries and sites in Germany, Spain, Canada, the United States and South Korea. The investment holding Company's portfolio currently consists of 4 oil and gas producers from the United States, the German Rhein Petroleum, and the Canadian tungsten Company Almonty Industries.

Corona as an opportunity

The Mannheimer was not able to escape the decline of the oil shares in the past year either. The share price fell from over EUR 26.0 to below EUR 6.0. Currently, the shares of the German commodity Company are trading at EUR 9.50. A breakout above the EUR 10 mark would generate a strong buy signal, which would be justified in fundamental terms. Last year, Gutschlag used the crisis to acquire new drilling fields at bargain prices. Also, the Company's own oil production was significantly reduced, so that the valuable raw material is 'not given away'..

The pumps are running

Due to the oil price recovery above USD 50, production has now once again been ramped up. Overall, Deutsche Rohstoff AG is planning net production of 5,700 to 6,300 barrels of oil equivalent per day (BOEPD) and 2,300 to 2,600 barrels of oil per day (BOPD) from existing wells during 2021. Starting in March 2020 during the Corona Crisis, a portfolio of liquid equity and bond investments in mining companies, especially gold, and oil companies was built up and performed exceptionally well. As a result, EUR 3.5 million income has already been achieved, and according to management, there are additional gains of EUR 8.0 million.

Pearl in Asia

With its 12.8% stake in Almonty Industries, Deutsche Rohstoff may have hit the jackpot. After years of development, the Canadian Company is on the verge of completing a megaproject. The largest tungsten mine in the world is to be built in Sangdong in South Korea. At full capacity, the mine will account for up to 10% of the global supply. The financing agreement with KfW-IPEX Bank has already been signed. The project financing is for USD 75.1 million. A buyer for the tungsten concentrates, which are to be produced in Sangdong from 2022, has been found in the current major shareholder, the Austrian Plansee Group. A successful production start should provide an enormous tailwind for both the Almonty share price and Deutsche Rohstoff AG's share price.

Largest order in history

Chinese electric vehicle manufacturer BYD has been operating in Colombia since 2012. In 2018, the first buses were shipped to Medellín. The Warren Buffet-backed Company reports the largest order in the Company's history outside of China for electric buses. 1,002 units are to be delivered to the Colombian capital Bogotá, and the entire order is expected to be completed by mid-2022. Colombia aims to improve air quality and reduce inner-city noise levels by switching to electric mobility. The Chinese already delivered 270 e-buses to Bogotá last year.

Conversion everywhere

The promotion of greener, cleaner transport, and increasingly stringent emissions standards is not only prompting the South Americans to rethink their approach. In Great Britain, too, the Company is responding to the growing demand for zero-emission vehicles. BYD's British subsidiary announced that it would assemble the chassis of its electric solo and double-decker buses for the British market directly at ADL's plants in the United Kingdom starting in July 2021 with its partner Alexander Dennis Limited. According to a press release, since 2015, the number of electric buses delivered and ordered has increased to more than 500. More than 70% of the electric buses launched in the UK during that period were delivered by BYD and its partner Alexander Dennis Limited, it said.

Target price increased

According to analysts at CMB International Securities, a new EV model should further boost sales. Likewise, stronger batteries should ensure better sales figures. The experts maintain the buy recommendation for the "Build Your Dream" Company and increase the price target from HKD 230.0 to HKD 300.0. The Company's share is currently running from high to high and was quoted at the equivalent of EUR 27.72 yesterday. In the long term, we see good opportunities for the Chinese to establish themselves as the most important electric car brand alongside Tesla.

Order by order

Scotland has also expressed its wishes. They want to achieve a climate protection target of net zero emissions by 2035 at the latest. The fuel specialist Ballard Power is to help with this. Ballard Power Systems has received an order from Arcola Energy to supply fuel cell modules. The Ballard Power fuel cell units are intended to power a passenger train to be demonstrated during the 2021 UN Climate Change Conference in Glasgow, Scotland, in November. The goal is to convert a Class 314 passenger train provided by ScotRail into an operational and certified platform to develop hydrogen-powered trains.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may in the future hold shares or other financial instruments of the mentioned companies or will bet on rising or falling on rising or falling prices and therefore a conflict of interest may arise in the future. conflict of interest may arise in the future. The Relevant Persons reserve the shares or other financial instruments of the company at any time (hereinafter referred to as the company at any time (hereinafter referred to as a "Transaction"). "Transaction"). Transactions may under certain circumstances influence the respective price of the shares or other financial instruments of the of the Company.

Furthermore, Apaton Finance GmbH reserves the right to enter into future relationships with the company or with third parties in relation to reports on the company. with regard to reports on the company, which are published within the scope of the Apaton Finance GmbH as well as in the social media, on partner sites or in e-mails, on partner sites or in e-mails. The above references to existing conflicts of interest apply apply to all types and forms of publication used by Apaton Finance GmbH uses for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and etc. on news.financial. These contents serve information for readers and does not constitute a call to action or recommendations, neither explicitly nor implicitly. implicitly, they are to be understood as an assurance of possible price be understood. The contents do not replace individual professional investment advice and do not constitute an offer to sell the share(s) offer to sell the share(s) or other financial instrument(s) in question, nor is it an nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but rather financial analysis, but rather journalistic or advertising texts. Readers or users who make investment decisions or carry out transactions on the basis decisions or transactions on the basis of the information provided here act completely at their own risk. There is no contractual relationship between between Apaton Finance GmbH and its readers or the users of its offers. users of its offers, as our information only refers to the company and not to the company, but not to the investment decision of the reader or user. or user.

The acquisition of financial instruments entails high risks that can lead to the total loss of the capital invested. The information published by Apaton Finance GmbH and its authors are based on careful research on careful research, nevertheless no liability for financial losses financial losses or a content guarantee for topicality, correctness, adequacy and completeness of the contents offered here. contents offered here. Please also note our Terms of use.