October 31st, 2025 | 07:05 CET

BUYING OPPORTUNITY! Rheinmetall, Almonty, and MP Materials shares consolidate! The situation remains critical!

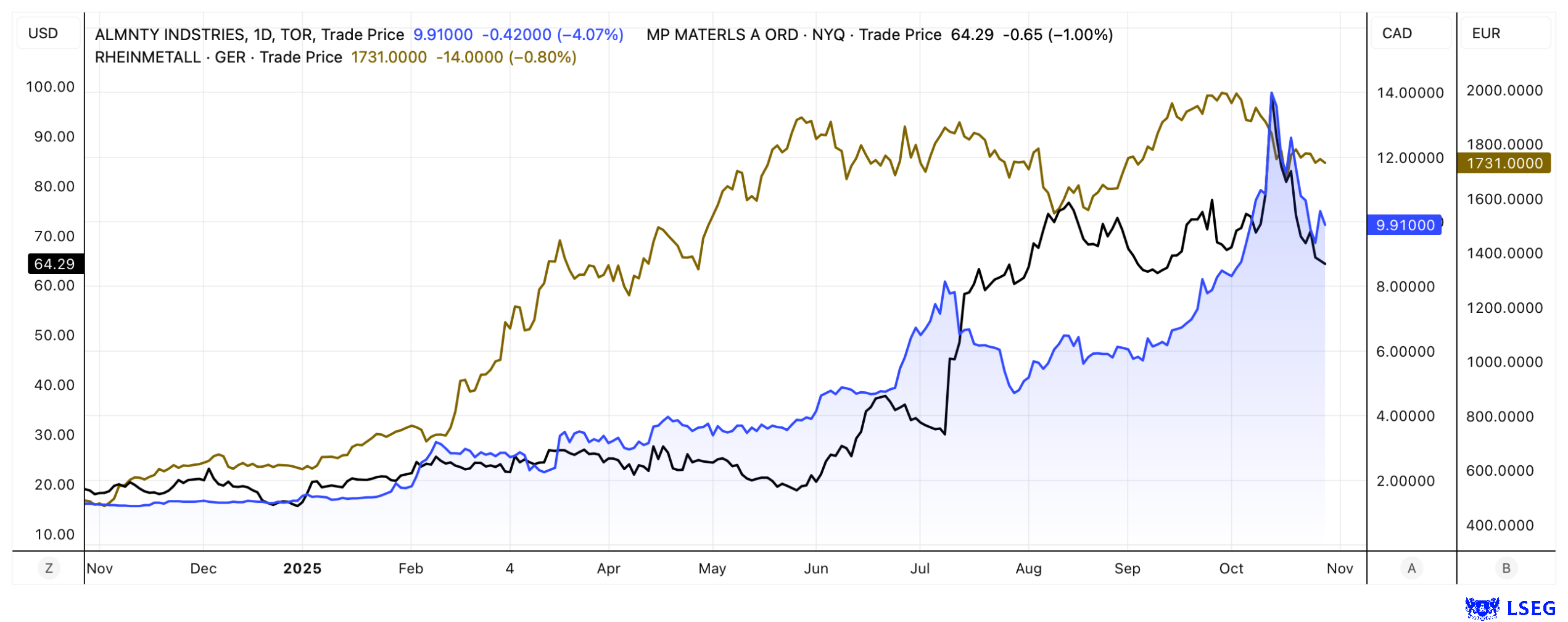

Shares in the defense and critical metals sectors are currently consolidating, which could present a clear buying opportunity. Analysts continue to see Rheinmetall's fair value at over EUR 2,200, as the long-awaited billion-dollar orders are finally being awarded. In the field of critical metals, investors have used US President Trump's trip to Asia to take profits. However, the trip clearly demonstrated that securing rare earths and other critical metals remains a top priority for the US. Agreements such as those now in place with China and Japan give the US the time it needs to bring its own deposits into production. MP Materials - and, as of this week, Almonty as well - are directly benefiting from this.

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203987072 , MP MATERIALS CORP | US5533681012

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Critical metals: MP Materials and Co. gain time

US President Donald Trump is currently on a trip through Asia. Although tariffs dominate the media headlines, the real focus behind the scenes appears to revolve around securing critical raw materials such as rare earths, as well as on defense and security issues.

In Australia, Trump reaffirmed the US's commitment to the AUKUS security alliance, including faster deliveries of nuclear-powered submarines and closer cooperation on defense technologies in the Indo-Pacific. Another significant development: South Korea has been granted permission to build nuclear-powered submarines, with production to take place in the US.

During his visit to Japan, Trump signed an agreement with Japanese Prime Minister Sanae Takaichi on jointly securing raw materials and processing capacities for rare earths. This was followed yesterday by talks with China. It was agreed that China would maintain its exports of rare earths for at least one year in exchange for US tariff concessions and closer cooperation in other areas. As usual, the US president sounded far more upbeat than his Chinese counterparts.

It should be clear to everyone that the agreement with China rests on very shaky ground. The situation could escalate again at any time. With these agreements, the US is essentially "buying" time to build up its own supply. The Trump administration is going full throttle on this issue – an approach we would also like to see from Europe. In recent months, the US has invested directly in raw materials companies and supported key projects. One of the best-known moves is its stake in MP Materials, which operates the only major rare earth production facility in North America, located in California. In addition to expanding production, the entire value chain is to be established in the US.

The US is even 100% dependent on imports for tungsten. But Almonty Industries could change that as early as next year.

Almonty Industries: Analysts expect profits to explode

Tungsten producer Almonty Industries is one of the top performers in the commodities sector this year. Compared to MP Materials, however, its valuation remains moderate. Almonty already produces tungsten at a mine in Portugal. Key drivers for the current year are the rising tungsten price and the new mine in South Korea. Commissioning is imminent, and it is expected to make Almonty the largest supplier of this critical metal outside China and Russia. CEO Lewis Black has already announced that much of the tungsten from South Korea will be shipped to the US. This is hardly surprising, as the country is the largest arms producer and the very hard tungsten is indispensable for the defense sector.

This week saw the next strategic milestone: the acquisition of a tungsten project in the US. The Gentung Browns Lake project, located in the state of Montana, is to be acquired for USD 9.75 million. The size of the project is not yet known, but the purchase price appears to be far from high, especially considering that production could already begin by the end of next year. This could make Almonty the first tungsten producer in the US. To this end, the Company even plans to refurbish and ship its own machinery from Europe.

https://youtu.be/BySd1SrveLo?si=-T2h4V11mQjm_fl-

With production sites in Portugal, South Korea, and the US, Almonty is set to generate millions starting next year. And then there is also the molybdenum project. This suggests that the current consolidation may well prove to have been a buying opportunity in hindsight.

Rheinmetall: Orders coming in, but the stock is weakening

Typical stock market behaviour. Investors wait a long time for billion-dollar orders, and when they finally come in, the share price corrects. This is currently the case with Rheinmetall.

Most recently, the joint venture Artec GmbH received an order to deliver a total of 222 Schakal wheeled armored vehicles worth EUR 4.7 billion to the German and Dutch armed forces. Of these, 150 Schakal vehicles are to be delivered to the German Armed Forces and 72 to the Dutch Army. The Schakal combines the chassis of the Boxer wheeled armored vehicle with the turret of the Puma infantry fighting vehicle. Rheinmetall is set to receive approximately EUR 3.4 billion of the order volume, with the remainder going to joint venture partner KNDS. In addition, several other orders worth hundreds of millions of euros have been reported.

Nevertheless, Rheinmetall shares have lost around 13.6% of their value in the past four weeks. Over the past six months, the gain has been a relatively modest 14.4%.

Analysts see the current weak phase as an opportunity to buy. Deutsche Bank recently raised its price target from EUR 1,950 to EUR 2,050. Goldman Sachs considers the fair value of Germany's largest defense contractor at EUR 2,200, and Jefferies even believes Rheinmetall shares are worth EUR 2,250.

Investors should not be unsettled by the current phase of weakness. Defense and critical raw materials will remain boom industries. Rheinmetall is a core investment in Europe. Almonty is taking a strategically smart approach and has an exciting few months ahead. Compared to MP Materials, the Company is anything but expensive.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.