Sportswear

Commented by Fabian Lorenz on February 4th, 2026 | 07:35 CET

DISAPPOINTMENT at Puma! RENK "Top Pick" or "Hold"? RE Royalties awakens!

We have repeatedly pointed to RE Royalties as an AI beneficiary and dividend gem. The stock has finally been gaining momentum for several weeks now. Nevertheless, the dividend yield is over 10%, and the company plans to continue to push ahead with electricity and energy storage for the AI boom. This suggests that prices will continue to rise. Puma's share price, on the other hand, has been disappointing. The new major shareholder paid EUR 35 per share, but the price on the stock market is below EUR 24. Analysts currently see no upside potential. A takeover could take place in 15 months at the earliest. This means that Puma's operational issues remain in focus. Analysts are divided on RENK. For some, the group is the "Top Pick" in the defense sector. For others, it is merely a "Hold" position.

ReadCommented by Armin Schulz on February 3rd, 2026 | 07:05 CET

Zinc boom, turnaround, and biotech growth: How to profit with Pasinex Resources, Puma, and Evotec

In volatile markets, investors are looking for exceptional opportunities. Three companies stand out in this regard. A commodities company with exceptional zinc projects, a sporting goods manufacturer undergoing radical transformation, and a biotech pioneer with a unique platform model. The combination of momentum, strategic turnaround, and long-term growth promises attractive return opportunities. We analyse the promising prospects of Pasinex Resources, Puma, and Evotec.

ReadCommented by Fabian Lorenz on January 29th, 2026 | 07:00 CET

Puma takeover is becoming more concrete! Should investors buy Evotec and Silver Viper shares next?

Takeover speculation has been swirling around Puma for some time. Now it has become more tangible: Anta has secured a 29% stake in the German sporting goods group, paying EUR 35 per share. However, the euphoria on the stock market is limited. Are there better opportunities for investors to profit from takeover speculation? One candidate in the hot silver market is Silver Viper. The Company is pushing ahead with exciting projects in Mexico. Its recent capital increase met with strong demand, and a financially powerful potential buyer already has a foot in the door. And what about Evotec? The perennial takeover candidate is still not gaining momentum. That said, the biotech company is benefiting from the sale of one of its own holdings, which is expected to bring in around USD 160 million.

ReadCommented by Carsten Mainitz on December 30th, 2025 | 11:15 CET

Stock Picking Alert! Power Metallic Mines – Set to Double? Puma and Evotec as Promising Turnarounds?

The 2025 stock market year has produced many winners, but also some losers. Bullish commodity markets and project progress led to a jump in the share price of Canadian commodity company Power Metallic Mines at the beginning of the year. In December, the share price corrected, but the upward trend quickly resumed, buoyed by good drilling results. The Canadian company holds one of the largest polymetallic deposits in North America, which has attracted many well-known investors this year. It is also worth taking a look at turnaround bets with takeover potential, such as Evotec and Puma.

ReadCommented by Fabian Lorenz on December 29th, 2025 | 07:10 CET

Three potential takeover candidates for 2026: Puma, RENK, and CHAR Technologies

Which companies could become acquisition targets in 2026, and where might shareholders benefit from strategic interest? Three names stand out. From the booming energy sector, CHAR Technologies is attracting attention. The Canadian company has only recently been listed on the Frankfurt Stock Exchange, but has already completed its development phase and is targeting strong revenue growth. CHAR benefits from strong partners such as ArcelorMittal, which could easily manage an acquisition. RENK is also a candidate: anchor shareholder KNDS could make good strategic use of an acquisition in the context of its IPO story, and the former RENK CFO is already on board. Things are also likely to remain interesting at Puma. According to analysts, a takeover premium of around 30% could be on the cards.

ReadCommented by Fabian Lorenz on December 19th, 2025 | 06:55 CET

Puma takeover at EUR 27.50? D-Wave wants a share of the government's billion-euro pot! Analysts believe Power Metallic Mines shares could rise 200%!

Will Puma be acquired at a price of EUR 27.50 per share? DZ Bank believes this is possible. Analysts believe a Chinese corporation is a likely candidate. The sporting goods icon does not seem to be able to spark any price speculation on its own at the moment. In contrast, Power Metallic Mines has made impressive progress in the current year, taking the Company to a new level. The share price does not reflect this. Analysts see 200% upside potential. The D-Wave Quantum share price is currently taking a break. Possible government contracts could bring new excitement. To land these, the quantum specialist is setting up its own business unit.

ReadCommented by Carsten Mainitz on December 16th, 2025 | 07:30 CET

Gold and silver on the rise: AJN Resources and Pan American Silver attractive, Puma on the verge of a major turnaround?

Gold and silver prices have recently reached new all-time highs once again, and there is no end to the rally in sight. Silver in particular has developed spectacularly after breaking through key technical resistance levels and has doubled over the past 12 months. Shares of major companies such as Barrick, Newmont, and Pan American Silver have also at least doubled over this period. Characteristically, the prices of exploration companies have lagged behind the performance of precious metal prices and blue chips. As the bull market progresses, there is much to suggest that explorers will outperform the broader market. One particularly exciting name in this segment is AJN Resources. Beyond the precious metals sector, there are also opportunities for investors to strike gold next year – in the case of Puma, a major turnaround appears to be taking shape.

ReadCommented by André Will-Laudien on December 16th, 2025 | 07:20 CET

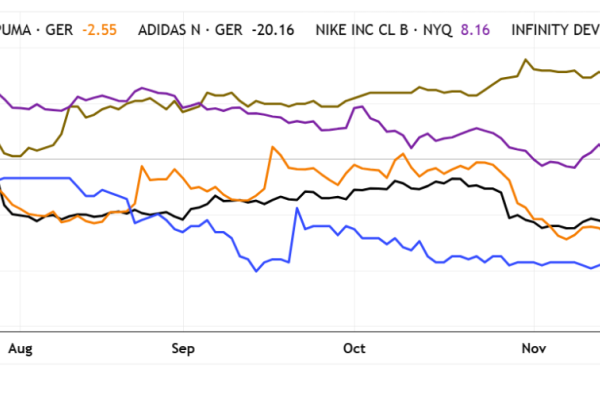

Impact investing, with super dividends into 2026 – Nike, RE Royalties, Adidas, Puma, and Infinity Development

Impact investing has become increasingly important in recent times as investors increasingly recognize that capital flows generate not only returns but also social and environmental impacts. In light of climate change, resource scarcity, and social imbalances, many market participants are no longer satisfied with using financial metrics alone as a benchmark. Regulatory authorities are promoting this development through stricter ESG requirements and greater transparency requirements for companies and financial products. At the same time, younger generations are demanding that their assets be consistent with their values and have a measurable positive impact. If you are looking for something, you will find suitable investments!

ReadCommented by Armin Schulz on December 12th, 2025 | 07:10 CET

Strong stocks, weak prices: Puma, RE Royalties, and TeamViewer - Where it might be worth getting in

While the stock markets seem to be moving in only one direction, selective price setbacks point to hidden opportunities. For investors with foresight, such moments can offer an opportunity to buy fundamental stocks at attractive prices. Three notable examples are sportswear manufacturer Puma, renewable energy financier RE Royalties, and software provider TeamViewer. Their current weaknesses raise a crucial question: Are these temporary setbacks or underestimated turning points? An analysis of Puma, RE Royalties, and TeamViewer shows where the opportunities lie.

ReadCommented by Fabian Lorenz on November 28th, 2025 | 15:40 CET

Takeover of Puma? Buy DroneShield and Antimony shares now?

A bombshell at Puma! Takeover rumors surrounding the sporting goods group are gaining momentum again. The share price exploded by over 14% yesterday. Could there even be a short squeeze? Commodity investors take note. Antimony Resources has established itself among investors this year, celebrated operational successes, and its shares still appear to be inexpensive. In the latest report, the resource estimate for the antimony project in North America was doubled. The potential for this critical metal is expected to be finalized as early as the first quarter of 2026. With an order in the bag, DroneShield's stock gained more than 20% this week. A rebound or a new upward trend?

Read