December 12th, 2025 | 06:55 CET

Buy these stocks now?! Bayer, Gerresheimer, WashTec!

Bayer is undoubtedly one of the positive surprises of 2025 on the German stock market. Operations are running smoothly for the Leverkusen-based company, particularly in the pharmaceutical sector. And next year, the glyphosate disaster could also come to an end. Analysts have now raised their price target. WashTec shares are still at the beginning of an upward trend. Growth, improved margins, a dividend yield of 5%, and a share buyback program continue to argue in favor of buying the stock. Analysts share this opinion. Experts do not yet see the time as right to buy Gerresheimer shares. Although the stock appears to have bottomed out, investors are still advised to wait.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , GERRESHEIMER AG | DE000A0LD6E6 , WASHTEC AG O.N. | DE0007507501

Table of contents:

"[...] Having Investors like Robert Friedland and Rob McEwen come in with CVMR and Terra Capital really was terrific. [...]" Terry Lynch, CEO, Power Nickel Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

WashTec: Stock attracts buyers

We first reported on WashTec at the beginning of November. Since then, the stock has already gained over 10% and formed a solid upward trend. Even at the current level of EUR 46.50, there is much to suggest that prices will continue to rise. This is because the equity story of attractive dividends – EUR 2.40 per share was distributed in 2025 – growth, margin improvement, and share buybacks remain intact.

WashTec is the world's leading provider of solutions for professional vehicle washing. It sells innovative car washes and gantry systems. In addition, the after-sales business is gaining in importance with comprehensive services and easily predictable revenues. WashTec is offering customers increasingly more digital services to support them in the efficient operation of their systems. These recurring revenues and scalable digital services in particular are expected to drive margin growth in the coming years.

WashTec aims to increase its EBIT margin from 9.5% in 2024 to between 12% and 14% by 2027. This seems almost conservative in view of the Q3 figures for 2025, when the EBIT margin was already 11.8% on revenue of EUR 125.8 million. It is quite possible that WashTec will surprise with its revenue and EBIT.

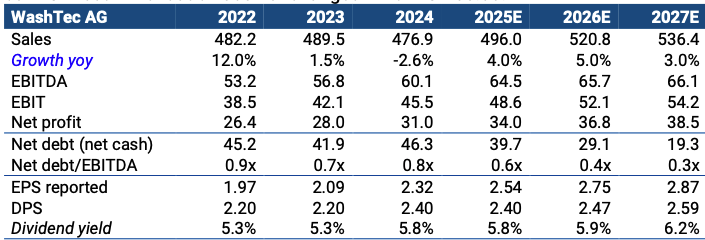

Analysts at mwb research certainly have high hopes for the Company. After revenue of EUR 496 million in the current year, they are expected to reach EUR 520.8 million in 2026 and EUR 536.4 million in 2027. EBIT is expected to climb from EUR 48.6 million in 2025 to EUR 54.2 million in 2027. The dividend is expected to increase to EUR 2.59 per share by then. Accordingly, analysts see the fair value of WashTec shares at EUR 55.

Gerresheimer: Has it bottomed out?

While WashTec has a healthy business model and its share price is on an upward trend, everything is different at Gerresheimer. At least the share price seems to have bottomed out at EUR 25 after losing more than 60% in the current year. However, the capital market's confidence has been severely shaken for the time being.

There are good reasons for this. In 2025, the Company reduced its sales forecast for the current year from growth of up to 5% to a decline of no more than 2%. In addition, the dividend has been cut. And to make matters worse, BaFin is investigating the balance sheets. Most recently, three members of the Executive Board, including the CEO and CFO, were replaced. Since November 1, the Company has once again been headed by Uwe Röhrhoff. He had already led Gerresheimer until 2017 and is now tasked with restoring calm.

Analysts remain cautious. UBS has confirmed its "Neutral" rating, with a price target of EUR 29. Experts believe that the recently published report by a short seller should not be overstated. It is well known that the Company has not fulfilled its reporting obligations optimally in the past. At the current price level, this uncertainty is already priced in. Berenberg also sees little upside potential for Gerresheimer at present. The publication of the figures for 2025 is awaited and scheduled for February 2026.

Bayer: Target price rises significantly

Bayer shareholders continue to have reason to be happy. The Leverkusen-based company's shares have gained over 80% in the current year. At EUR 35, the share price is at its highest level in around two years.

And from JPMorgan's perspective, there is still plenty of room for growth. This week, analysts doubled their price target for Bayer shares from EUR 25 to EUR 50. The recommendation was raised from "Neutral" to "Overweight." This makes the German company one of the analysts' favorites in the pharmaceutical sector. In addition to the improvement in business performance - Bayer has published surprisingly positive news from its pharmaceuticals division this year - there is now a chance that the negative consequences of the glyphosate disaster can finally be contained.

WashTec shares are at an attractive entry point. The chart looks healthy, operating performance is picking up speed, and dividends and share buybacks also point to a further rise in the share price. On the other hand, there are no compelling reasons to buy Gerresheimer shares at present. The Company is a turnaround candidate, but it would be wise to wait for the publication of its figures. The outlook for Bayer has brightened significantly, but the stock has already performed very well, and a consolidation should come as no surprise.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.