August 31st, 2023 | 09:25 CEST

BRICS Realigns: Gold, Silver and Bitcoin in Turnaround! Is this the starting signal for TUI, Desert Gold and Adyen?

The acronym BRIC was coined in 2001 by Jim O'Neill, the Chief Economist of the major bank Goldman Sachs. The now frequently used acronym represents the initial letters of the countries Brazil, Russia, India, and China. At the time, it referred to the four fastest-growing emerging economies outside the Western industrial community G7; later, South Africa was added as the "S". At the August meeting of the BRICS countries in South Africa, a further 40 countries registered their interest in joining, 6 of which were admitted directly by January 2024. Thus, a strong community of states is emerging, covering a full 30% of the world's GDP and 46% of the global population. They all share a common goal: to reduce dependence on the US and the US dollar - thereby lessening Western influence. There are even long-term considerations of a shared currency. A wake-up call for Gold, Silver, and Bitcoin.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , DESERT GOLD VENTURES | CA25039N4084 , ADYEN N.V. EO-_01 | NL0012969182

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Desert Gold - African Gold and BRICS Fantasy

G7, G20, NATO - all these associations are considered Western-dominated, characterized by the familiar block of Europe and North America. The Ukraine war and Western sanctions against Russia, in particular, have given many countries in Asia, South America, and Africa the political choice of joining either the West or those sympathetic to Russia. Under China's leadership, the new inclusion of Iran, Saudi Arabia, UAE, Egypt, Ethiopia, and Argentina in the new BRICS Plus grouping signals a dynamism toward closing ranks with the previously dominant West. The introduction of a new BRICS currency could impact the status of the US dollar and bring alternatives like Gold, Silver, or Bitcoin into focus.

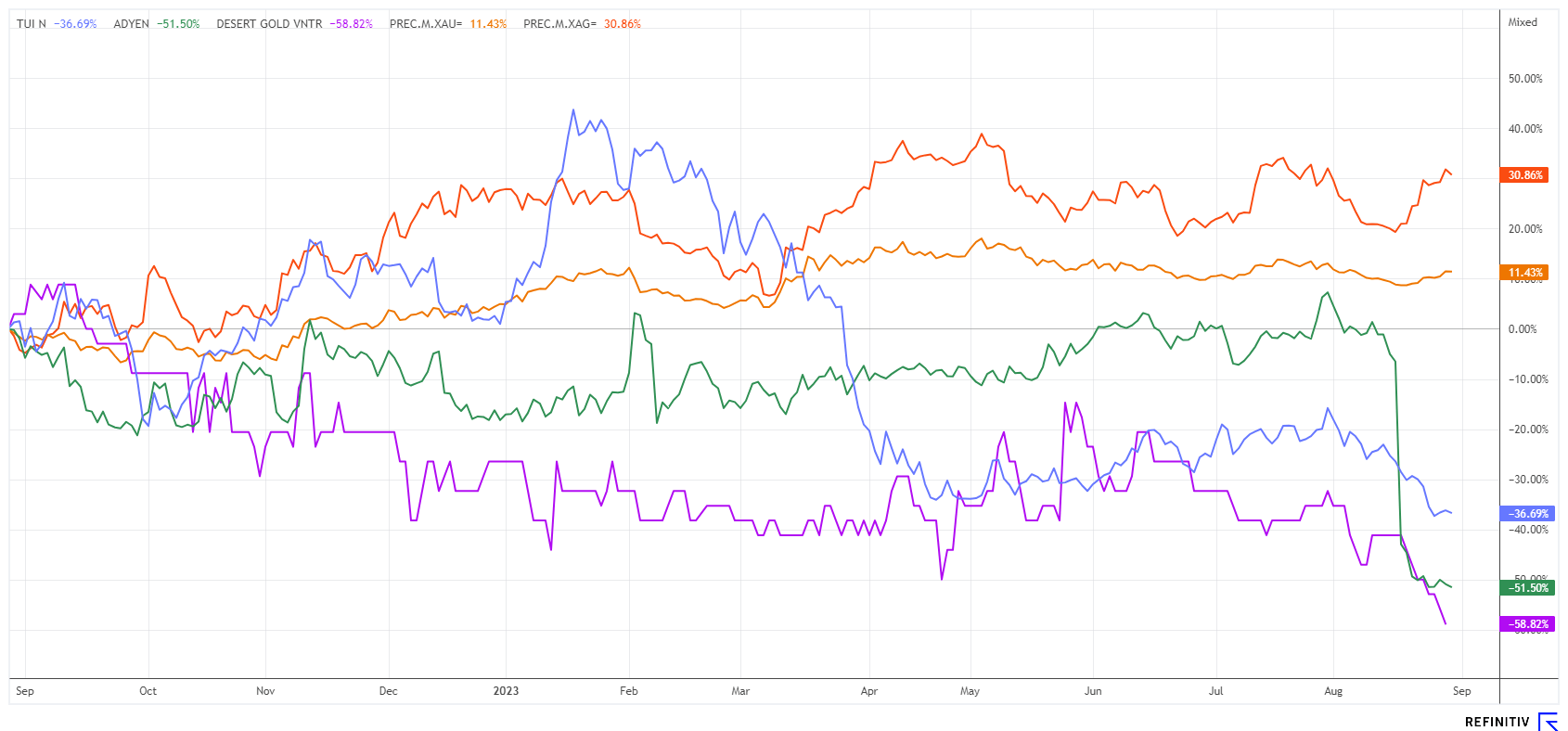

First reactions to the political turnaround have already been seen, as the precious metals market was able to report a positive turnaround at the end of August with rising gold and silver prices. After lows of USD 1,880 and USD 22.50, respectively, in May, gold and silver reached spot prices of USD 1,948 and USD 25.03 again yesterday. As some technical analysts predicted early in the summer, the current mixed situation could lead to a run on the precious metals. The upcoming halving of Bitcoin in 2024 is also casting its shadow. With rates around 1.094, the US dollar is also showing unusual weakness.

With the recent inflationary movements, Africa is once again moving into the focus of gold producers. The Canadian explorer Desert Gold Ventures (DAU) specializes in the Senegal-Mali-Shear-Zone (SMSZ). Here, they are in good company with other large mine operators. Explorers who can deliver good drill results automatically find themselves on the acquisition lists of Barrick, B2Gold and Allied. That is because mine expansions at local majors are much less expensive than building completely new sites that require permits. With the signing of Axiom founder Doug Engdahl as a Director, Desert Gold is clearly betting on further exploration in the fall. The current quiet news cycle should fill up soon. A market cap of about CAD 8 million is strikingly cheap for the presumed million-ounce deposit in gold!**

TUI - Turnaround is a long time coming

The TUI share is currently far from displaying positive price dynamics. Despite being in the midst of the peak travel season and bookings exceeding expectations, the chart tells a different story. Possibly, the recently weak ifo Business Climate Index has caused concern among the top executives of the travel company. At 13.8 points, the index for the tourism sector was down another 3.6 points on the July figure.

For TUI, it would be important that the catch-up effects from the Corona pandemic continue for a few more years, as it had to repatriate more than EUR 1 billion in borrowed funds in the current year due to using aid funds. To this end, the Hanover-based company carried out a historic capital increase and again heavily diluted its shares. Whether the operational turnaround can be saved into the winter will have to be seen in the bookings in the fall. Unfortunately, the purchasing power of private households in Germany is declining increasingly due to extensive inflationary pushes on vital expenditures. What will be cut first is vacations because they consume the surplus of several labor-intensive months. TUI shares are trading near their all-time low at EUR 5.50. We keep the stock on the watch list but remain on the sidelines.

Adyen NV - Sell-off is not over yet

Also heavily affected is the online payment expert Adyen NV. Despite a new wave of euphoria on the NASDAQ due to strong prospects in the AI sector, the shares of the Dutch company continue to lurch southward. The former fintech highflyer is now trading at a three-year low, and to make matters worse, it is now facing downgrades from some well-known analyst firms. Particularly noteworthy is the drastic new price target set by Swiss UBS, which, with a "Hold" recommendation, has nearly halved its 12-month price target from EUR 1,641 to 854. **According to calculations by JP Morgan, Adyen could also be replaced for MunichRe or ING in the next STOXX index weighting.

The news that star investor Cathie Wood and her investment company ARK have increased their stake by almost USD 10 million did not help the stock get back on its feet either. Perhaps the investor needs some breathing space here because even the additional purchase of Tesla shares at the beginning of 2023 did not really pay off for ARK investors until late summer. At around EUR 24 billion, however, Adyen is still valued at 15 times revenue even at the halved level. The expected P/E ratio in 2023 will rise to over 40 with the currently ongoing recalculations by analysts. For reduced growth in a stumbling economy, this provides little buying incentive. Therefore, wait calmly for the necessary revaluation of the highflyer.

The stock market is rarely as volatile as it is currently. Nevertheless, the measured fluctuation indices remain low, thanks to the trading algorithms of professional market participants. The high capital market interest rate, continuing inflation and declining profit prospects of industrial companies should continue to drive the precious metals market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.