July 17th, 2023 | 08:35 CEST

Breakout: 300% possible with hydrogen and silver! Nel and Plug Power set the pace, TUI and Defiance Silver in turnaround

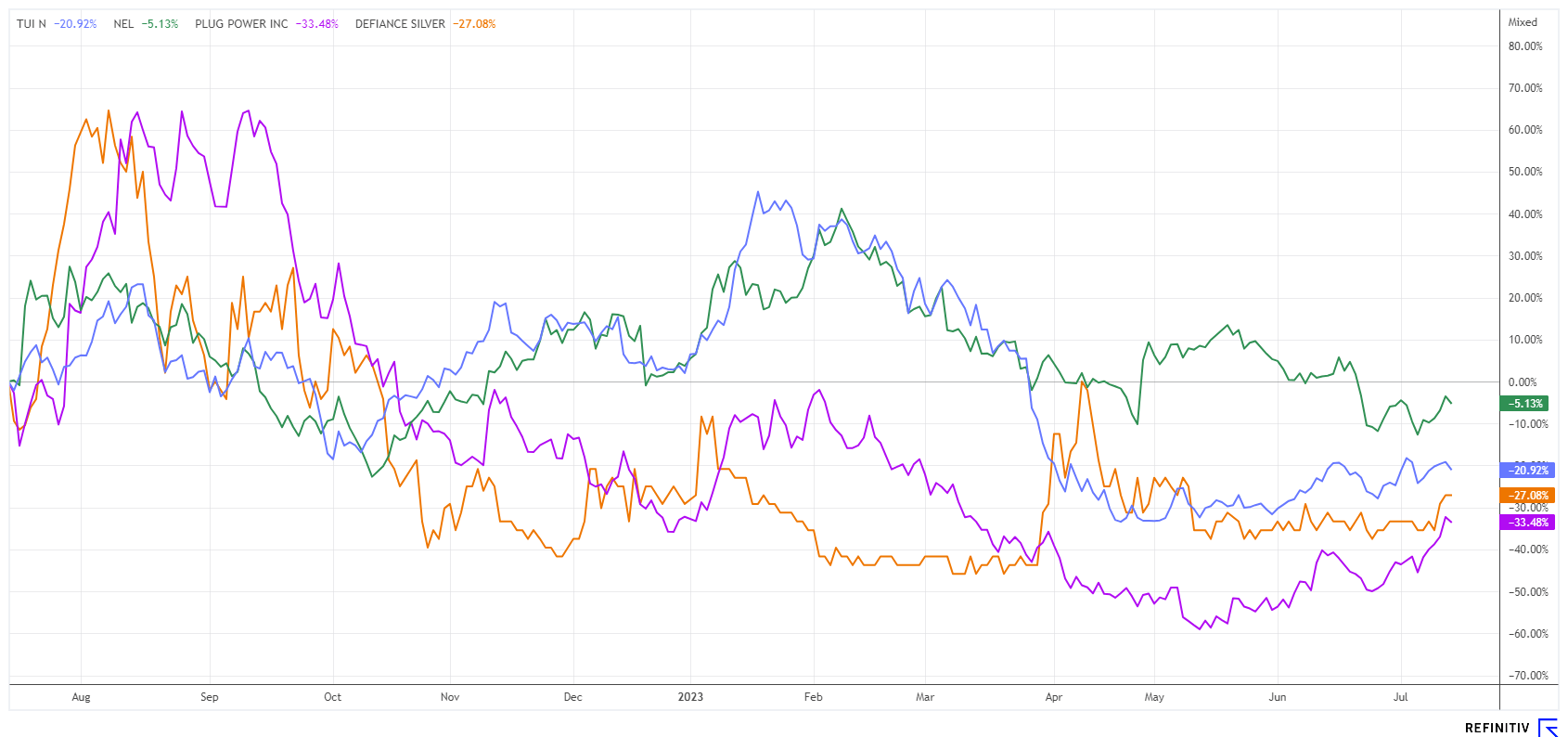

The stock exchanges ignite one firework after another. While the German leading index DAX has been busy recovering all its losses from July last week, the NASDAQ has already set new records. High-tech companies are leading the way, especially those with AI fantasy. Here, rosy times are expected while the European industry continues to struggle, as demonstrated impressively by BASF's profit warning. In addition to a nice recovery rally in the hydrogen stocks, silver also made a proper move upwards. Here is an overview of the possible "breakouts".

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , TUI AG NA O.N. | DE000TUAG505 , DEFIANCE SILVER CORP. | CA2447672080

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power - Quick turnaround after Nucera IPO

With the successful IPO of ThyssenKrupp Nucera, it was only a matter of reaction time before the peer group got going again. On the stock market, newcomer Nucera is valued at around EUR 2.7 billion after the placement of over 30 million shares. That is more than its Norwegian competitor Nel ASA weighs in at. Nucera emerged from the thyssenkrupp subsidiary Uhde Chlorine Engineers (UCE), which was renamed at the beginning of 2022. The artificial name is made up of "new," "UCE", and "era" and is intended to symbolize the dawn of a new era of innovation and transformation to green energy. Analysts started with positive comments and trust the largest German hydrogen stock to appreciate another 50%.

In analytical comparison, Nucera is on the road against Nel ASA and Plug Power with similarly high valuation factors. However, while the competition aims to become profitable only from 2025/2026, the German company is already reporting profits. The successful listing has brought a lot of fantasy back into the bombed-out sector. Nel recovered by 10%, and the top dog Plug Power shot up by over 40% with high trading volumes. Speculation in the hydrogen sector seems to have resumed after a 2-year hiatus. Interested investors should consider the sector's high valuation and volatility in their decisions.

Defiance Silver - Silver makes a move upwards

There is currently a good opportunity in the shares of Defiance Silver (DEF) from Canada. The exploration company is developing several silver projects in Mexico, primarily in the Fresnillo Belt. Historically, 10% of the world's silver production has already been mined here, with over 6 billion ounces, but geologists expect much higher quantities in the ground. Most recently, the flagship San Acacio project also produced good results of 157 to 380 grams of silver per ton of rock. In a rather small section, blockbuster values between 5510 and 6014 grams of silver equivalent were found. These are quantities that are, at best, historically known from the great days of the Mexican gold and silver rush. The Zacatecas Silver District is geologically one of the most silver-rich zones on Earth. Defiance Silver, therefore, holds all the cards to report major discoveries at Veta Grande.

From a chart perspective, both the silver price and the DEF share price give cause for hope because last week, silver gained 8% to just under USD 25 and Defiance Silver also moved up from CAD 0.155 to CAD 0.18. The approximately 227 million shares add up to a market capitalization of only CAD 40 million. In a possible takeover by a large neighbour like Fresnillo, MAG or Teck Resources, more than CAD 300 million would certainly have to be put on the table for the Defiance properties. There is also fantasy for the controversial Tepal gold-copper project. Here, the settlement of the open legal dispute can immediately lead to a strong appreciation.

TUI - Holiday season brings a good mood

Just in time for the start of the vacation season in Hamburg and Düsseldorf, there were again blockade actions by the "Last Generation" climate activists at the airports. Around 20,000 passengers were affected by the cancellations and delays, and incoming flights had to be diverted. The German judiciary seems unable to take action against these dangerous and senseless traffic disruptions, and the rights of travelers are also disputed. Because of the exemption clause of "force majeure", airlines are also not obligated to carry out rebookings or refunds.

For Germany's largest travel provider TUI, positive signs of a turnaround are increasing. Since the last capital increase in March, EUR 1.2 billion in debt has been repaid, and the operational side also gives cause for hope. Because after bookings were already above the pre-Corona year 2019 in May, June also made a plus of almost 12%. At the half-year, revenues increased by double digits, and the booking level in tourism increased by 18%.

Thus, in the last week, the TUI share price again conquered the EUR 7 mark, and the 200-day line at just over EUR 8 is coming back into focus. Fundamentally, earnings per share of EUR 0.92 to EUR 1.32 are expected from 2023 to 2025, so the rolling P/E ratio is currently between 7.5 and 5.2. The 8 TUI analysts on the Refinitiv Eikon platform are cautiously optimistic about the TUI share. With an average price target of EUR 9.17, the expected value for the next 12 months is 35% higher than last Friday's closing price. One should have the value on the radar again.

Summertime is usually consolidation time on the stock market. Thus, the DAX had to give up 5% at the beginning of July, but buybacks quickly set in again. Since the successful IPO of ThyssenKrupp Nucera, hydrogen stocks are back in popularity, also TUI gives hope again this summer. After the last pickup in silver, the Defiance Silver share should finally breathe some spring air.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.