June 20th, 2023 | 07:30 CEST

Blackout! Energy shares urgently sought: Plug Power, Varta, Altech Advanced Materials, BASF - Solar, wind or hydrogen?

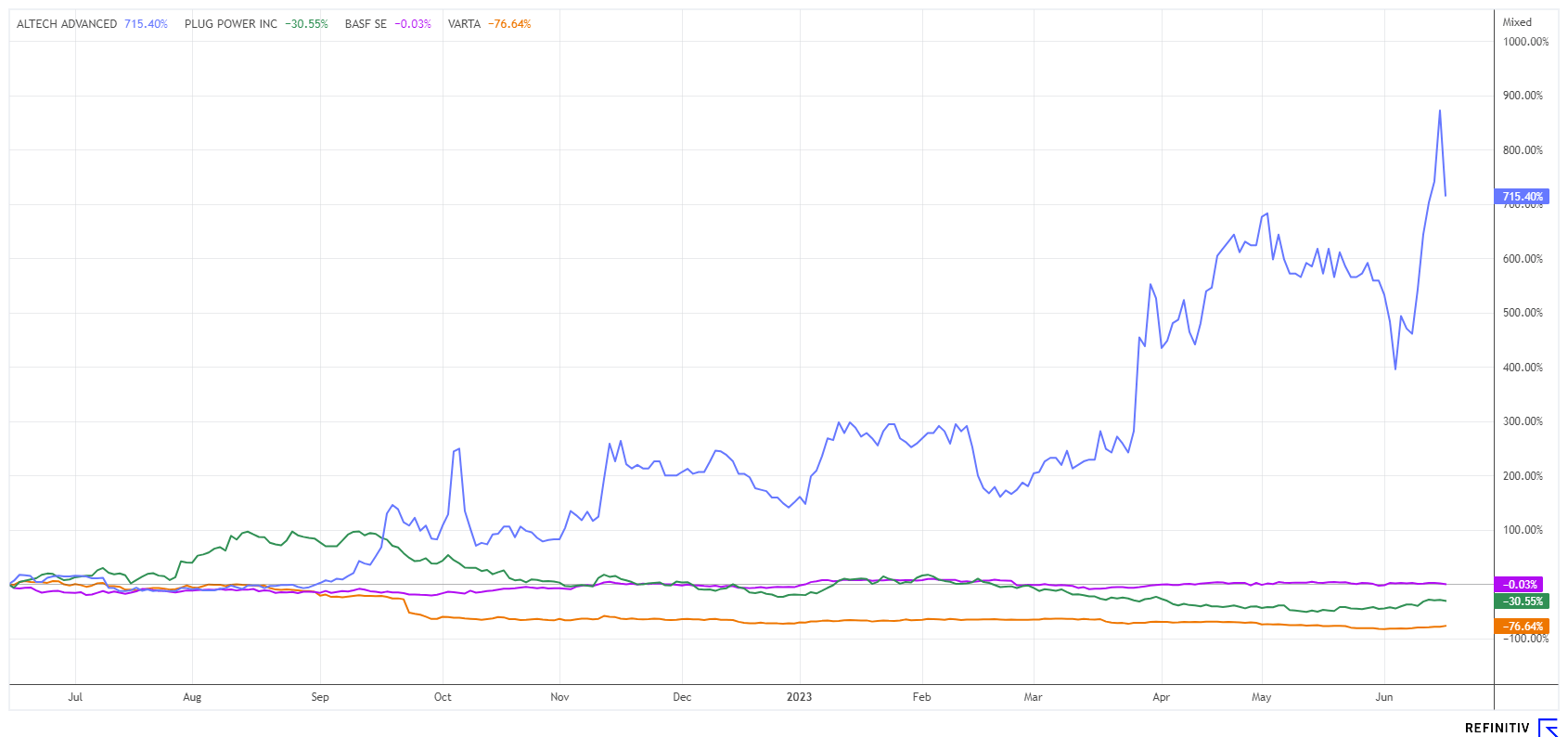

Now things are becoming clearer. Germany is unlikely to experience an energy shortage like a blackout, and gas supplies for the winter also seem secure, given a 20% drop in gas consumption compared to the average figures from 2018 to 2021. However, household prices remain significantly above the long-term average. Currently, energy suppliers are not passing on the purchasing advantages from the Leipzig power exchange to their customers. Wholesale gas prices have fallen by 85% since mid-2022, but these lower conditions are not reaching customers. What opportunities are there for resourceful investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , VARTA AG O.N. | DE000A0TGJ55 , Altech Advanced Materials AG | DE000A31C3Y4 , BASF SE NA O.N. | DE000BASF111

Table of contents:

"[...] Silumina Anodes® is a ceramic-coated graphite/silicon anode composite material that we plan to produce in Schwarze Pumpe, Saxony. Here, we aim to supply manufacturers of batteries for e-cars with an application-ready drop-in technology that is low-cost, high-performance and safe. [...]" Uwe Ahrens, Direktor, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - Several uncertainties weigh on the upswing

Despite new highs on the DAX 40, the BASF share remains in a holding pattern. Disconcerting news keeps raining down on investors and is currently not conducive to immediate entry. Currently, the focus is once again on lawsuits in the US, which have already cost other companies a lot of money. The current bone of contention revolves around so-called PFAS chemicals, widely known as "eternal chemicals". They are considered very harmful to health if they enter drinking water, for example.

In the US, there is already a case on this, which recently led to an out-of-court settlement worth USD 1.2 billion. The chemical companies affected are DuPont, Chemours, Corteva and 3M. They are all alleged to have polluted drinking water. Fines of up to USD 10 billion are now on the table, and BASF is also affected by the lawsuits. Historically, it is known that environmental lawsuits in the US can be very costly. The Bayer-Monsanto corporation has been on trial for 5 years due to the herbicide glyphosate from its acquired agricultural subsidiary.

Gas supply is also facing uncertain times. According to Economics and Environment Minister Robert Habeck, Germany is far from being through on the subject of gas shortages because the transit agreements between Russia and Ukraine expire in 2024. If the war continues, an extension is likely out of the question. This poses great dangers for Germany as an industrial location. Should the West's relationship with its trading partner China deteriorate, investments in the Far East are also at risk. With so many risks involved, investors prefer to turn to other investment topics and leave the Ludwigshafen-based company on the side. Despite all the risks, BASF is not expensive, with a P/E ratio of 9.6 and a dividend yield of 7.3%. Analysts on Refinitiv Eikon see an average 12-month price target of EUR 53.7, about 17% above the last price.

Altech Advanced Materials - Upcoming trade fair could be price-driving

The share price of Altech Advanced Materials AG (AAM) ignited a veritable fireworks display in the last trading week. At its peak last Friday, the share was quoted at EUR 18.10 in Düsseldorf. Approximately 58,000 shares changed hands, the highest volume ever recorded in a single trading day. However, this movement was likely driven by speculation, as no fundamental news from Heidelberg was found.

However, there is some positive news to report. AAM is one step closer to the planned series production of a novel solid-state battery for grid storage. Since the beginning of the research, AAM has been in the spotlight because the Heidelberg-based company could become the top climate change technology supplier in a few years. The key issue here is the low baseload capability and irregular power feed-in situation with renewable energies such as solar or wind power. Electricity is only generated when the sun shines, or the wind blows. At all other times, consumers should be able to rely on stored energy – that is the goal.

Yesterday, the important Advanced Automotive Battery Conference (AABC) opened its doors in Mainz. All developers, from garage tinkerers to mature technology companies, bring their latest inventions to the table. The e-automotive celebrities are also on-site and try to test the touted concepts for their mass suitability. The novel solid-state sodium-alumina battery could be an ESG-compliant solution for the entire industry, powering e-drives very easily and reliably while making lithium, graphite, copper and cobalt obsolete. Shares in the sector will likely start a decent price movement with each success story, but whether it will be 50%, like Altech last week, remains questionable. Due to the tightness of the market and the recent large swings, only limited orders are recommended for AAM shares. On an undiluted basis, the Company is already worth just under EUR 90 million; including all conversion rights and pending warrants, this could soon move in the direction of EUR 180 million.

Varta and Plug Power - Clear turnaround visible

This has been a week for Varta and Plug Power shareholders. Both energy stocks are currently benefiting from an obvious, chart-based turnaround, which can be traced not least by the strong performance of e-mobility giants BYD and Tesla. In addition to battery stocks, sentiment has turned specifically for hydrogen stocks in the medium term. They are currently under permanent suspicion that, at some point, they will be able to provide an alternative form of propulsion with a full climate bonus that is also economical compared to other fuels or battery drives. For this purpose, H2 technology must be available to produce green hydrogen highly efficiently and cheaply.

At the end of last week, Varta also announced the construction of a gigafactory for home storage at its central location in Ellwangen. Starting in the fourth quarter of 2023, production output will be around 500 MW hours per year, rising to 1 gigawatt hour by 2025. Around 120 jobs will be created at the new plant, in which Varta will invest more than EUR 20 million. In the course of the week, the bombed-out battery manufacturer rose further from EUR 15.50 to EUR 18.50. On the Refinitiv Eikon platform, there is no longer a buy recommendation for Varta. The market seems to have jumped on the turnaround train faster than the negative analysts.

In the case of Plug Power, a historic short quotation probably caused some investors to rethink, and a massive countermovement was born. With enormous trading volumes of over 250 million shares, the situation looks even more dramatic. If one believes the statements of the Insider Monkey platform, the shares of the US hydrogen expert are one of the world's most short-sold stocks, with over 20%. The first move pushed the price up by 50% from USD 7.50 to USD 11.90, but the stock remains highly volatile. Fundamentally, the share is still ambitiously priced with a 2023 price-to-sales ratio of 4. Yesterday was a holiday in the US, and PLUG shares were trading at USD 10.55 after hours on Friday.

There is movement in the battery sector. In addition to public subsidies, the industry is now mobilizing private investment because energy storage will remain a climate protection issue for years to come. This is a megatrend for BASF, the world market leader for battery materials, as well as for technological competitors such as Altech and Varta.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.