March 6th, 2024 | 11:40 CET

Bitcoin soon at USD 100,000? The music is also playing at Rheinmetall, Renk, Manuka Resources and BYD!

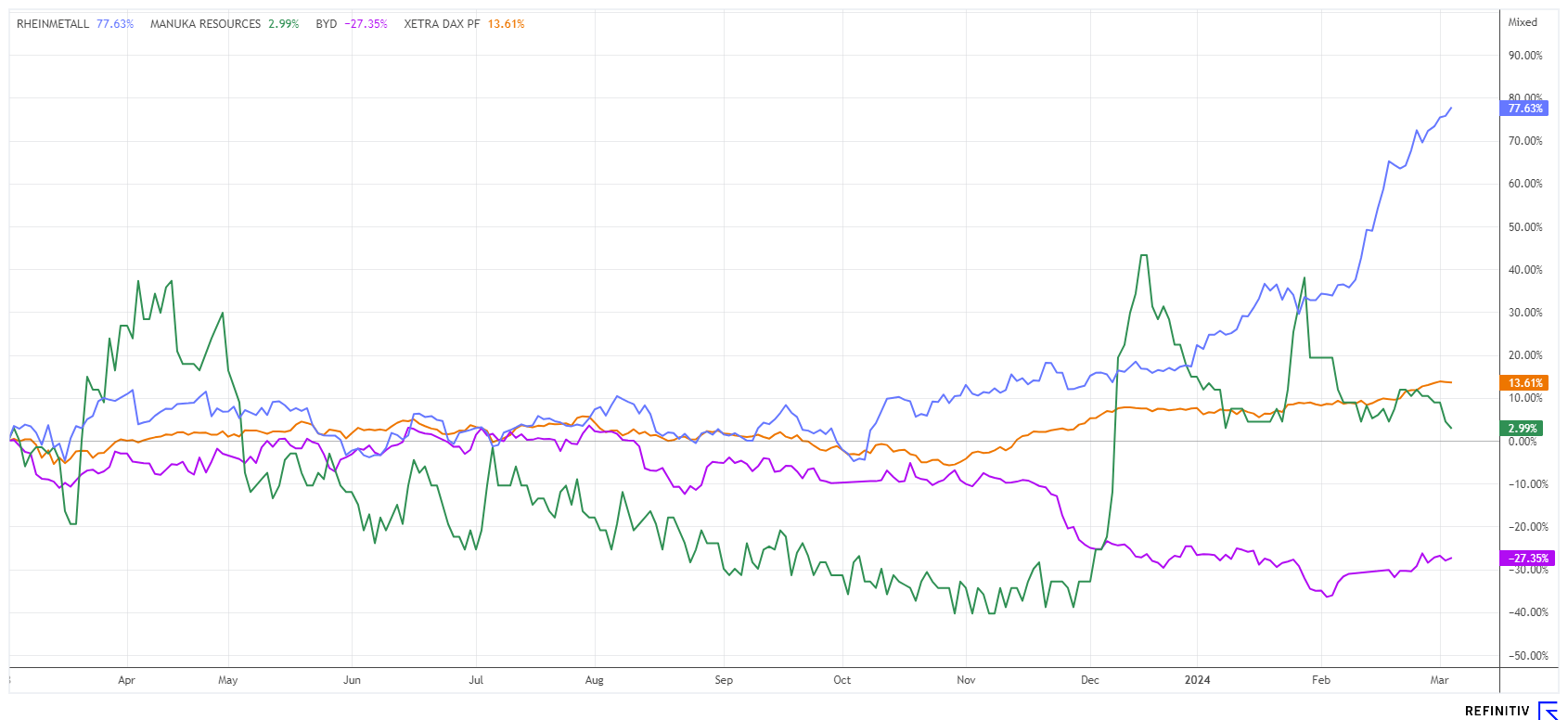

The stock market is not a one-way street. While Bitcoin reaches new highs daily, many stocks are still on the sidelines. Only 21% of all listed shares reached a new high in 2024, yet the Nasdaq 100 and the DAX 40 index are at their all-time highs. Only a few stocks are gaining favour with investors; others are being left behind. The current focus is on high-tech stocks that enable ever-greater computing power, such as in mining or artificial intelligence. In addition to gigantic amounts of data, mining requires trillions of computing operations to be carried out in a very short time. There are rewards in the form of new bitcoins for confirming transactions on the blockchain, but they will be halved by the next "halving" event in April. Armament values, on the other hand, seem to be heating up. So how much time is left to reap further leaps in returns?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , RENK Group AG | DE000RENK730 , Manuka Resources Limited | AU0000090292 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - The harsh reality of e-mobility

For months, electric vehicles (EVs) led the charts in new car sales. However, shortly before the turn of the year, the tax subsidy from Berlin ended, and the so-called environmental bonus was cancelled. Now, a fierce competition has broken out among major car manufacturers for the last e-mobility believers. The true, unsubsidized demand appears to be much lower than the political proponents had hoped. Planned sales are currently over 30% below expectations, according to experts, while the discount battles are likely only just beginning. Meanwhile, German manufacturers such as VW, BMW and Mercedes are experiencing a spring awakening in combustion engine orders.

BYD's figures for 2023 are expected on March 27. It is hoped that the Chinese giant will meet the experts' expectations with its results, as it is already clear that the planned 30% increase in sales in 2024 is unlikely to materialize. The management will, therefore, have to row back considerably due to the decline in margins and falling revenue. However, caution is advised: the share, which has a rather ambitious valuation, should not fall below the last technical support level of around EUR 20. Investors should act with a tight stop.

Manuka Resources - This could move quickly now

The year 2024 could be a game changer for the Australian gold and commodities company Manuka Resources. As the debate about safe countries of origin for critical metals continues, gold is being mined again from the historic Mt Boppy property to generate cash flow. With gold prices of over USD 2,125, it is generating a good income, which, together with the funds recently raised, can be used for debt repayment and expanding the promising South Taranaki Bight (STB) vanadium property.

Adding to the equation is the political shift in New Zealand. The new right-wing conservative Prime Minister Christopher Luxon has unleashed an ambitious reform package in his first weeks in office, causing a stir across the country. Luxon is in the process of reversing many of the key programs of the previous social democratic government, including the stringent environmental regulations for mining. According to Luxon, the Pacific region should once again become a stable partner for Western industrial nations and facilitate the extraction of important resources. Manuka Resources' huge vanadium property could soon take centre stage. The Company is valued at only AUD 45 million, which is too low even for the existing silver and gold deposits. If the government follows the announced path consistently, Manuka could quickly prove to be a tenbagger.

Rheinmetall and Renk - The EU's red carpet has been rolled out

Among the German stock market darlings are the defense stocks Rheinmetall and Renk Group. Renk almost doubled after its successful return to the stock market, while the DAX newcomer Rheinmetall, which moved up in 2023, was able to gain a full 70% in just 12 months. Both stories are technically intact and benefit daily from the geopolitical uncertainties surrounding the formerly peace-loving Europe. Now there are new political decisions favoring a reduced dependence on the US.

According to the European Commission, the EU must become significantly less dependent on partners such as the US for the procurement of armaments such as fighter jets, drones or ammunition. According to a recent reading, the member states should invest at least 50% of the funds earmarked for the procurement of armaments in the European internal market by 2030. This is a massive turnaround, as around 80% of spending currently goes to countries outside the EU, primarily the US. As the US, for its part, is demanding more commitment to security from its NATO partners, the new procurement agenda could be expected to significantly strengthen local producers. The EU Commissioner for Competition, Margrethe Vestager, describes the current dependence of alliance partners on third countries as unsustainable. Financial incentives are also expected. The Commission aims to quickly mobilize EUR 1.5 billion from the EU budget to kick-start the plans.

The already full order books of Rheinmetall, Renk, Hensoldt and Co. should therefore continue to benefit from the EU's new sentiment. At the moment, however, the trends of the stocks in question seem to be running hot technically. Watch out for intraday reversals, which could herald a consolidation and allow investors to enter at a much lower level.

Healthy returns can currently only be achieved with high individual value risks. While the price of the majority of listed stocks is falling, there is no stopping some high-tech stocks. Rheinmetall and Renk are benefiting from the flood of public orders, in stark contrast to BYD. E-mobility is noticeably sluggish and margins are falling significantly. Manuka Resources is ideally positioned for the energy transition as it sits on one of the world's largest vanadium deposits.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.