September 13th, 2022 | 11:34 CEST

BioNTech, Cardiol Therapeutics, Bayer - Caution, turnaround!

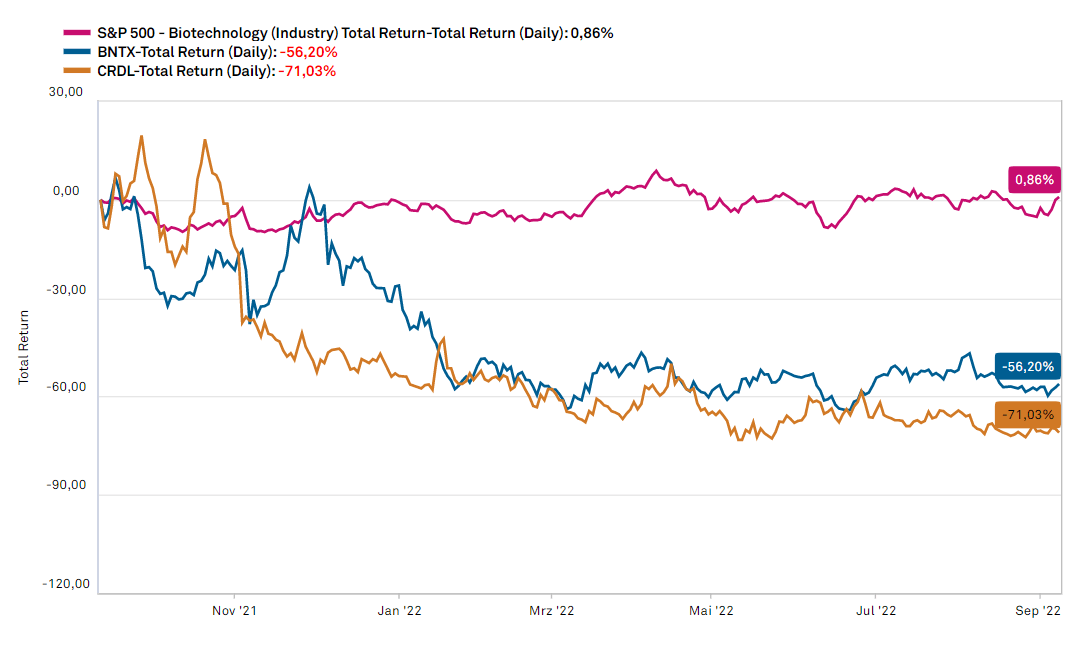

The market correction due to geopolitical uncertainties and fears of further interest rate hikes mainly affected growth stocks in recent months, with the capital-intensive biotech sector losing disproportionately. However, the industry is growing dynamically and will become increasingly important in the coming years in the fields of application of the pharmaceutical and chemical industry, in the agricultural and food sector and in environmental protection. Due to the market correction, there are currently enormous opportunities for a turnaround in selected stocks.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , CARDIOL THERAPEUTICS | CA14161Y2006 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

BioNTech - Expansion in all areas

Both spatially and in terms of the product pipeline, the signs are pointing to expansion for the Mainz-based pharmaceutical company BioNTech. At "An der Goldgrube 12", the number of employees is to increase from 3,000 to 5,000 in the next few years. According to a report in the VRM newspapers, including the "Allgemeine Zeitung" published in Mainz, BioNTech is also expanding its operations in the Hessian city of Marburg. Another production site is Idar-Oberstein in Rhineland-Palatinate.

The biopharma company is currently expanding its research and production facilities in Mainz. According to the VRM report, total investments of several billion euros are planned in the coming years.

The vaccine manufacturer, which currently has only one product on the market, can also report positive news at the product level. At the European Society for Medical Oncology (ESMO) congress, the Mainz-based company presented further encouraging data from a Phase I/II study with the CAR-T program BNT211 in difficult-to-treat solid tumors. The trial evaluates the safety and efficacy of BNT211 in patients with relapsed or refractory advanced solid tumors. The results showed encouraging signs of anti-tumor activity. A controllable safety profile continued to be observed at both dose levels studied.

Analysts are optimistic about the biotech company. The Hamburg-based Berenberg Bank has left its rating at "buy" with a price target of USD 312. Currently, the share price stands at USD 150.81. The analysts therefore see a price opportunity of more than 100%.

.

Cardiol Therapeutics - Bottoming out and enthusiastic analysts

Cardiol Therapeutics, an emerging life sciences company, has not been immune to the market correction. Since the beginning of the year, the share price has halved. Cardiol shares have corrected by around 88% from the peak price in February 2019. For months, however, a bottoming out has been taking place in the area of USD 1.10, which could come to an end with the breakout from the downward trend formed since November at currently USD 1.35. It is also important to bear in mind that the stock is one of the most highly shorted stocks on the Nasdaq, at around 30% in some cases.

Fundamentally, the Canadian company, which uses highly pure cannabidiol to treat cardiovascular diseases, is clearly on a growth course with its most important product, CardiolRx. It is currently in clinical development for use in cardiovascular medicine. CardiolRx is being investigated in a multinational, randomized, double-blind, placebo-controlled Phase II/III study. This LANCER study aims to evaluate the efficacy and safety of CardiolRx™ as a cardioprotective therapeutic agent to reduce serious cardiovascular and respiratory events in hospitalized COVID-19 patients with pre-existing cardiovascular disease or risk factors for CVD and to evaluate the impact of CardiolRx™ on key biomarkers of heart disease.

In addition, Cardiol Therapeutics received IND approval to conduct clinical trials to evaluate the efficacy and safety of CardiolRx for two orphan drug indications. The first patient was enrolled in the ARCHER study, which is in the Phase II clinical development program. The study will evaluate the safety and tolerability of CardiolRx and its effects on myocardial regeneration in patients with acute myocarditis. A total of 100 patients from major cardiac centers in North America, Europe, Latin America and Israel will be enrolled.

Analysts at Canacord Genuity Capital Markets are optimistic. The Canadian research house spoke with the CEO of Cardiol Therapeutics, David Elsley, on the occasion of its 42nd annual growth conference. The analysts were enthusiastic about CardiolRX due to the variety of indications for the Company's lead product and believe that the product has the potential to become a successful anti-inflammatory and anti-fibrotic therapy. The verdict for the Nasdaq stock is "buy", with a price target of USD 7.00. Compared to the current share price, which is quoted at USD 1.15, this means a price potential of more than 500%.

Investors wanting to meet the CEO of Cardiol Therapeutics, David Elsley, can make a note of September 27, 2022. On this day, the 4th IIF - International Investment Forum will take place live via Zoom, and Mr Elsley will present his company. Participation is free of charge.

Bayer AG - Optimistic data

Like BioNTech, pharmaceutical and agricultural giant Bayer presented at ESMO, the largest European cross-indication cancer congress, and delivered positive trial data on its prostate cancer drug darolutamide (Nubeqa). The data show that the active ingredient darolutamide improves overall survival in patients with metastatic hormone-sensitive prostate cancer (mHSPC) and prolongs the time to worsening disease-related symptoms and pain, the Company announced at ESMO. The pharmaceutical and agricultural group calculates that Nubeqa will generate sales of more than EUR 3 billion per year.

Meanwhile, the chart picture continues to brighten. After successfully testing the support at EUR 51.84 and leaving the downward trend formed since June, the share price was able to turn north again. The next resistance zone is at EUR 55.12, after which the already rising 200-day line at EUR 56.21 beckons.

Biotechnology is becoming increasingly important in many areas of our lives. Nonetheless, the shares in this sector have been hit hard by the general market correction but now have significant upside potential at a lower price level. In addition to Bayer and BioNTech, the Nasdaq company Cardiol Therapeutics, which is equipped with a bulging product pipeline, is also promising.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.