January 5th, 2024 | 08:30 CET

Berlin abolishes the eco-bonus, so what now for e-mobility? Plug Power, Prospera Energy, VW and Porsche in focus

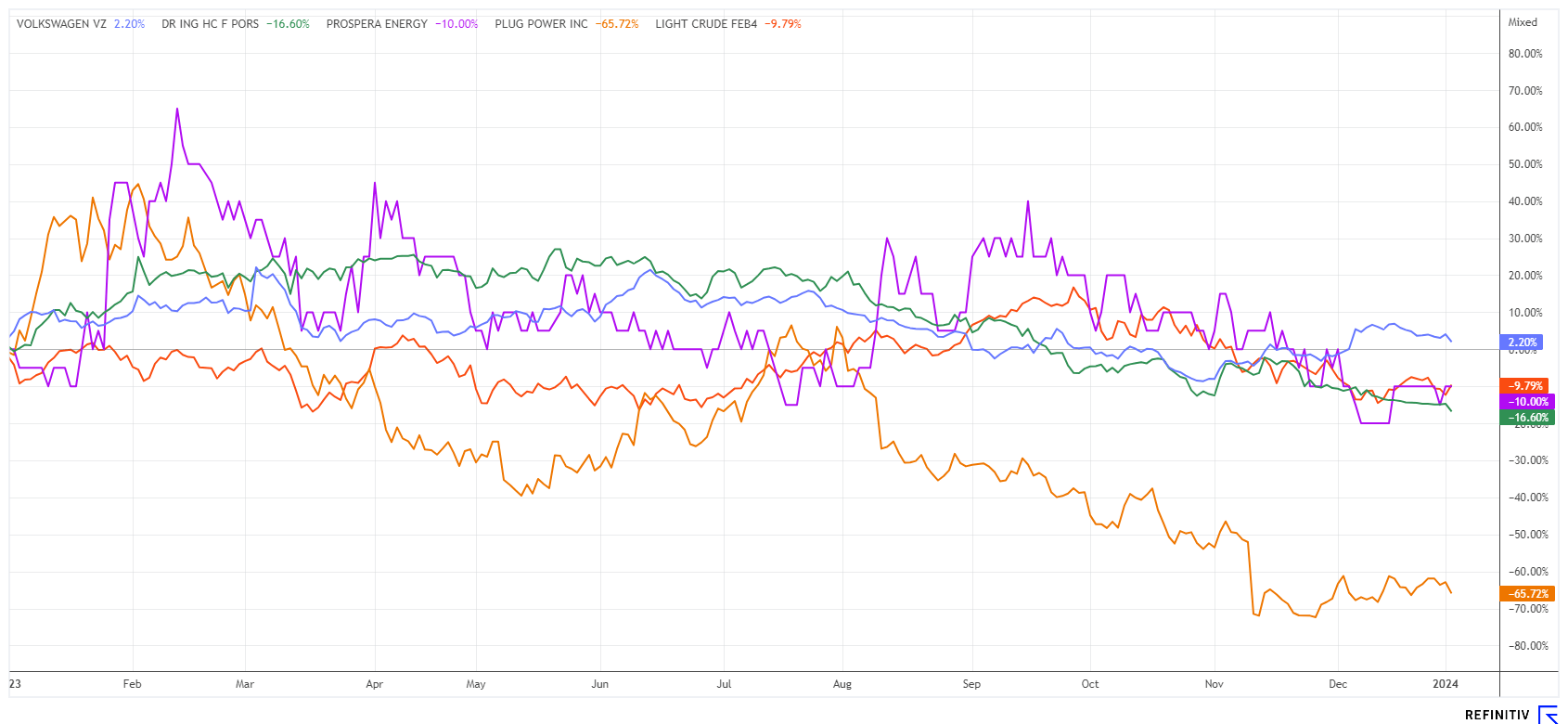

Investors who bet on green energy in 2023 took a big hit. Contrary to many forecasts for the future, the wind and hydrogen sector has yet to show any sustained positive development. Government budgets are simply insufficient to promote these still unprofitable forms of energy. Private investors want to see returns on their investments. State-of-the-art combustion technologies will likely remain available for years because they are efficient and work in all weather conditions. Those who experienced their electric vehicle running out of power on December 1, 2023, at minus 10 degrees with 1 meter of fresh snow can attest to the challenges. We look at titles that carry the essence of fossil energy approaches in their soul.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , PROSPERA ENERGY INC. | CA74360U1021 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , PORSCHE AUTOM.HLDG VZO | DE000PAH0038

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power: Can hydrogen replace black gold?

Environmental policy from Berlin often resembles a cabaret. Minister Habeck wants to build a massive hydrogen network but has yet to determine where the funds will come from. Investing in green infrastructure requires large tax and subsidy funds. Private investors shy away from expensive future investments that do not yield an obvious return and are based on questionable economic parameters. So far, there is no factual evidence that energy production from hydrogen can ever outperform fossil fuels. Existing electrolyser technologies are subpar in efficiency compared to well-operating fossil combustion processes using bio-diesel.

Plug Power is a good example of exaggerated expectations. The US company has been building fuel cells since 1997. The Company went public in 1999, and its market capitalization has since reached almost USD 50 billion, but the Company has never made a profit. From one hype to another, from one climate conference to the next, investors are always grasping at straws and reinvesting. However, those who wanted to make money with PLUG shares always had to wait for the next wave of hype and then consistently bail out again, as there was rarely a sustainable price gain.

Technically, however, it looks like the share is bottoming out again. Speculators can take a look at the share in the USD 4.15 to USD 4.25 range. An automatic stop at USD 3.75 is necessary; otherwise, the adventure could end with new lows. According to the consensus estimates of experts on the Refinitiv Eikon platform, Plug Power should be in the black as early as 2026. We will, therefore, continue to follow the stock actively. The risk/reward ratio has been significantly worse in the past.

Prospera Energy - Step by step into the next league

Oil prices initially rose noticeably at the beginning of the year, with the market pointing to tensions in the Red Sea, where important shipping routes for international trade and the transportation of crude oil run. Since the start of the war in the Gaza Strip, cargo ships in the Red Sea have been increasingly attacked by the Iranian-backed Houthi rebels in Yemen. Most recently, a container ship belonging to the Maersk shipping company was attacked, whereupon the Danish group of companies temporarily halted its shipments through the Red Sea. The fact remains that around 98 million barrels of oil are needed every day to supply the world. If deliveries fail to materialize or take an excessively long time, this drives up the spot price. After a brief spurt to just under USD 80, Brent crude returned to around USD 72.50.

As a country rich in raw materials, Canada is far removed from any international conflicts. Companies can develop here, as low energy prices are a clear locational advantage. Due to the supply insecurity in Europe, many new companies have set up in North America, clearly targeting the European market with their fossil fuels. Corresponding agreements were negotiated with the German government in Ottawa in spring 2023.

Prospera Energy Inc., based in Western Canada, has chosen Saskatchewan as its target area. The Company specializes in the exploration, development and production of crude oil and natural gas and has been working hard to increase production and market share since mid-2023. For example, production output was increased from 500 barrels of oil equivalent (BOE) to 1,800 BOE by the end of 2023. The new CEO, Samuel David, has done a great job getting the commodities specialist back on track.

With reserves of over 400 million barrels of BOE worth around USD 30 billion, Prospera now has excellent prospects of becoming a new player in the energy market. The Company aims to bring many more new developments online over the winter, which will boost sales and make it possible to self-finance future drilling sites. The 411.5 million shares issued currently indicate a fairly low market value of CAD 35 million. **The share price is quietly drifting in a range of CAD 0.08 to 0.11. It now offers good entry opportunities, as the Company value is currently approximately 50% below the net present value of the properties. Very interesting!

Volkswagen and Porsche - Where is Europe's largest automaker heading?

The automotive industry is dealing with the expiring eco-bonus for e-vehicles in different ways. Mercedes-Benz has decided to offer a special discount in January to compensate for the canceled purchase incentive from Berlin, ensuring that subsidy-driven purchases can still go through. During the rest of the year, the electric vehicles will face tough competition again. As a result, sales of "eco-friendly cars" are likely to slump considerably. In addition to the manufacturer's share, the Volkswagen brand is also taking over the previous state share of the environmental bonus. The arrangement is a gesture of goodwill and applies to private customers in Germany who have already ordered an eligible vehicle from the all-electric ID. family up to and including December 15, 2023.

The Group subsidiary Porsche is going along with the decisions from Wolfsburg and has recently come under pressure on the capital markets, even falling below its IPO price of EUR 80. The reasons for the selling pressure are obvious: analysts fear that the Macan would leave a sales gap due to the discontinuation of the combustion engine in Europe. In addition, sales figures in China, the most important sales market, have fallen, but the Company now wants to take countermeasures there. The VW Group is still struggling to catch up with Chinese suppliers and Tesla in the e-mobility business. Poor software, many complaints - things are simply not running smoothly. The share price of the parent company and Porsche reflect the current situation, which is unlikely to improve in the short term. **Both shares have been caught in a downward trend for the past 12 months; fundamentally, an entry would be worthwhile. However, nobody knows what major problems are still lurking around the corner this year.

The energy markets move up and down to the rhythm of international conflicts. Oil producers such as Prospera Energy are relatively unperturbed by this, as they achieve margins of over USD 30 per barrel at these spot prices. For automotive values, 2024 is likely to be a challenging year. Plug Power may need to dilute its shares significantly again if its coffers are soon empty.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.