February 13th, 2024 | 07:00 CET

Bear market in Hydrogen versus Bull market in Artificial Intelligence - Nel ASA, First Hydrogen, Nvidia and ARM Holdings

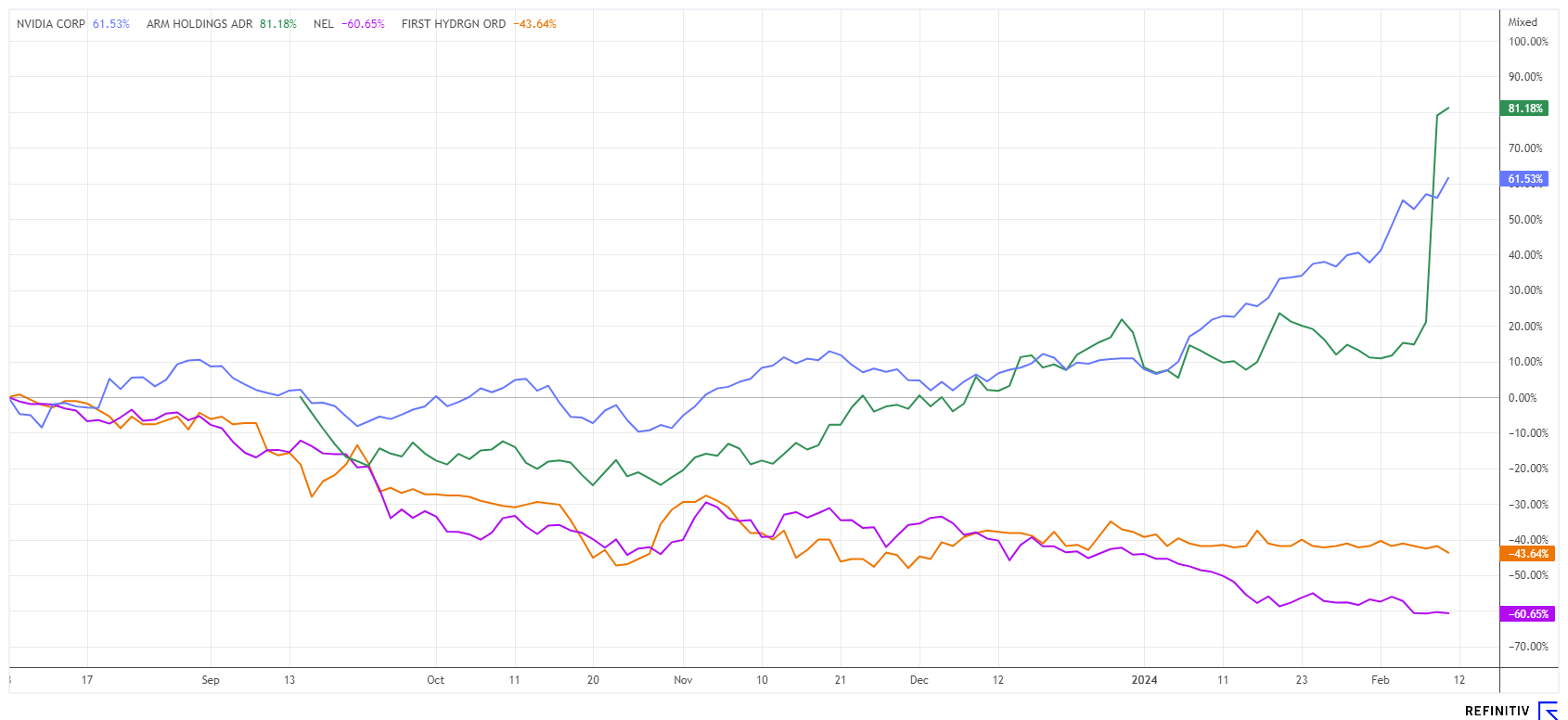

The stock market is relentless at the moment. While Nvidia has gained almost 50% in just 5 weeks, the stock market darlings Nel ASA and Plug Power continue to lose value. Small recovery attempts have been consistently sold off recently. No stone is being left unturned in this segment, and investors are eagerly awaiting the upcoming 2023 annual figures. Is there hope, or should we continue to write off hydrogen? On the other hand, some companies are making significant progress with a different business model, setting new records. So what to do? A brief update for active investors.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , First Hydrogen Corp. | CA32057N1042 , NVIDIA CORP. DL-_001 | US67066G1040 , ARM HOLDINGS PLC ADR | US0420682058

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - From low to low

A tragedy is currently unfolding for the Norwegian hydrogen pioneer Nel ASA. While the Company was unable to publish any decisive positive news for 2024, the market is pinning its hopes on a product offensive in the coming years. Therefore, a real recovery in the share price seems quite possible if the eagerly awaited figures on February 28 exceed expectations and the competitive position against rival companies ITM Power and Plug Power can be strengthened. Current consensus estimates put 2023 sales at EUR 145 million, with approximately half of that expected to result in a loss. Hopefully, Nel ASA can surpass these expectations!

Of 25 experts on the Refinitiv Eikon platform, only 5 recommend the share as a "Buy". If that is not a crystal-clear turnaround signal after two years of sell-offs, what is? Interested parties should pay attention to the rising momentum when entering the market and set a trailing stop 10% away from the entry price. If executed successfully, one can catch the stock at its lowest point and ride the overdue recovery well. However, the facts for the past year are important. If the share price falls below the low of EUR 0.408 again after publication, there is a risk of technical trouble.

First Hydrogen - Vehicle trials demonstrate various user benefits

Unjustly overlooked is the Canadian technology company First Hydrogen. The Company has been delivering numerous innovations for the H2 mobility market for several years. In addition to building a hydrogen-fuel cell-powered light truck (FCEV), the Company is also involved in the production of the coveted fuel. First Hydrogen has clearly set the goal of establishing green hydrogen as an energy source in the transportation sector.

The Company has just announced the start of one-month vehicle tests with the Wales & West Utilities (WWU) gas supply network. The H2 fuel cell vehicle (FCEV) to be tested on-site was developed to meet the requirements of fleet operators such as WWU. The zero-emission vehicle can cover long distances of more than 630 km on one tank, transport heavy payloads, and be refueled quickly. All points that are of great importance for efficient delivery and logistics transport.

WWU operates around the clock all year round to provide important gas network services. The trials with First Hydrogen are now specifically taking place in winter, precisely the time when the service provider is most frequently called out to emergency services. Typically, cold temperatures can reduce the range of battery electric vehicles (BEVs), affecting the reliability of fleet operators. The tests now being conducted could provide data showing the advantage of FCEVs over BEVs at lower temperatures.

Executive Director Steve Gill comments: "This trial is also testing a hydrogen-as-a-service model to show operators how practically we can support the transition to FCEV fleets." Surprisingly, First Hydrogen's shares are still suffering from poor sentiment in the sector but have held up quite well in the EUR 1.10 to EUR 1.20 corridor since the start of 2024. On February 21 at 15:30 CET, Francois Morin (VP Corporate and Business Development) will present at the 10th edition of the International Investment Forum and report on the latest company developments. It should be exciting. Click here to register.

Nividia and ARM Holdings - As if stung by a tarantula

Nvidia and ARM Holdings have been making headlines in recent days. While Nvidia has been exploding since the end of 2022, ARM Holdings has only recently embarked on a similar trajectory. The share had only started trading at USD 51 in New York in August 2023 and then moved sideways for several months. The chip designer headquartered in Cambridge, UK, whose processor architecture is found in practically every smartphone and is also increasingly used in data centres, forecasts sales of between USD 850 million and USD 900 million for the current quarter. Analysts on the Refinitiv Eikon platform had only expected an average of USD 778 million. There was a 40% surge last week, and the story will likely continue this week. Since the issue, the share has now more than doubled, and with a current P/E ratio of over 500, investors' enthusiasm appears unabated. The experts had a target price of USD 92 in mind, which has now been surpassed in flight.

The situation is similar for Nvidia. Out of 52 analysts, only 4 are still voting "Hold". Otherwise, there are only "Buy" recommendations. After all the upgrades, the community is confident that the story will continue. The only problem is that the average price target of USD 653 has long since been surpassed, and the USD 720 mark had to give way last week. The dream performer is currently flying into new spheres with an index beta of 3.5. Stock market history has long since been written. In just 14 months, the share price has increased sixfold to a current market capitalization of USD 1.78 trillion. **But there is no point in procrastinating, as the share is not the first tech title from the NASDAQ with a price/sales ratio of just under 30. However, it does take courage to chase after it.

The imagination in the field of AI and high-performance chips knows no bounds. Like the hydrogen industry in 2020/2021, share prices are rushing into new valuation dimensions. The story will likely continue, but investors should consider investing some AI profits into the bombed-out H2 sector. Who knows what developments Nel & Co. can demonstrate by the end of the year.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.