July 13th, 2023 | 08:20 CEST

Batteries are the solution to the climate dispute! Varta and BASF explode, while BYD and Power Nickel step on the gas!

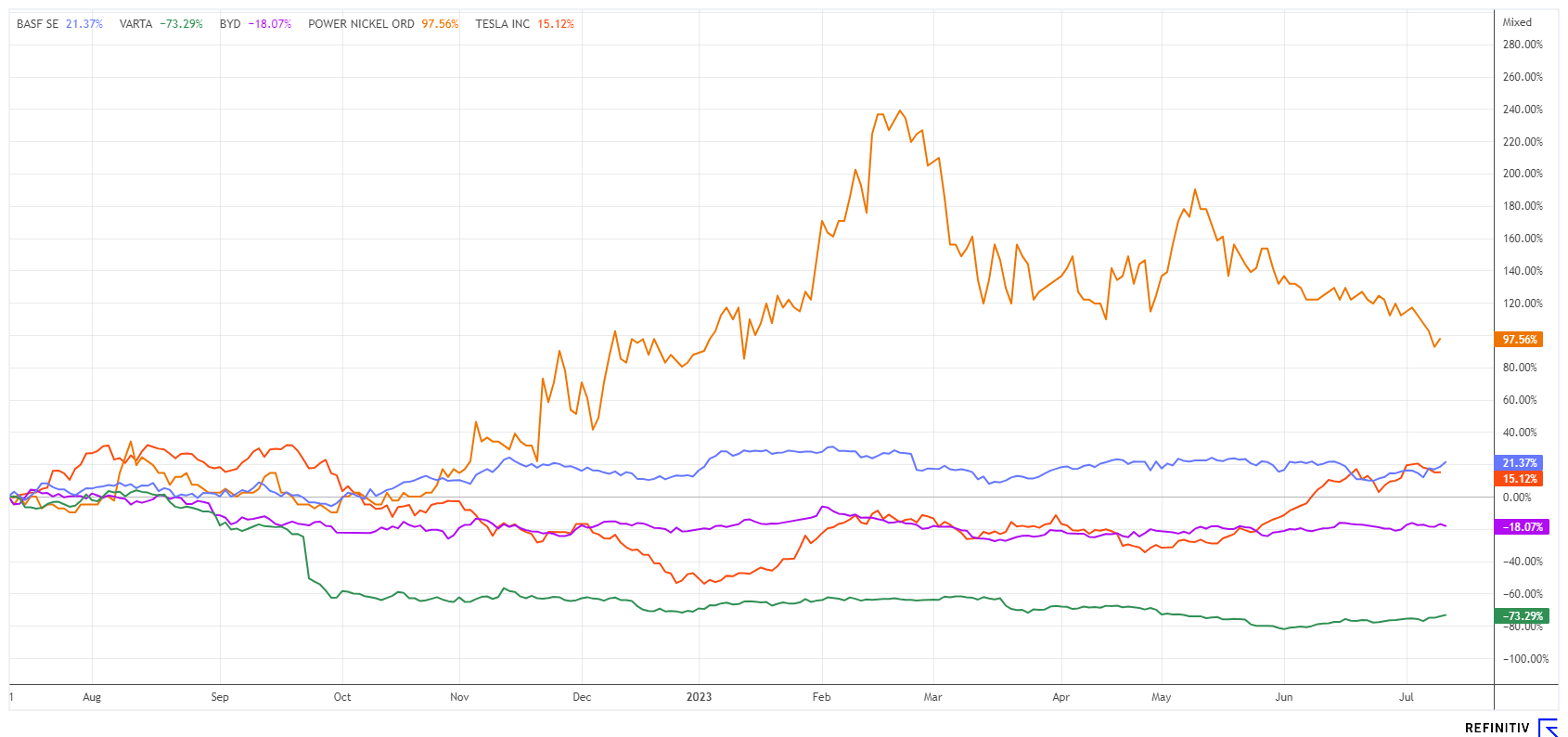

After months of losses, battery-related stocks are in high demand again. Varta and BASF are leading the way with up to 50% gains! Varta is delivering initial results from its restructuring efforts, reigniting investor enthusiasm. The China market leader in e-mobility, "Build Your Dreams" (BYD), has also made decent gains since its spring weakness. The Canadian company Power Nickel is preparing to supply the battery market with high-grade nickel. Which share should be preferred now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , BASF SE NA O.N. | DE000BASF111 , BYD CO. LTD H YC 1 | CNE100000296 , Power Nickel Inc. | CA7393011092

Table of contents:

"[...] China has become the manufacturing capital of the World, and because of its infrastructure, expertise and capabilities, Silkroad Nickel has strategically positioned itself to partner with Chinese companies in the Stainless Steel and EV industries [...]" Jerre Foo, Corporate Development Executive, Silkroad Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - Still a lot in the quiver in terms of sustainability

BASF's goal is to reduce its CO2 emissions by 25% by 2030 compared to 2018 and achieve net zero CO2 emissions by 2050. Increased use of environmentally friendly processing methods and raw materials is also on the agenda, as is the use of renewable energies at its sites, some of which are energy-intensive. In Asia, in particular, there is still much to be done. BASF is now among the global market leaders in the field of battery materials. Starting in 2025, the chemical company aims to use its innovations in cathode materials to double the range of a mid-size vehicle from 300 to 600 km, regardless of whether the air conditioning is running or the music is turned up to full volume.

Neither the Chinese nor the US economies are picking up speed, which is weighing on cyclical stocks. Despite this, BASF shares have been able to post an upward movement in recent days. From just under EUR 43, there was a dynamic rise to EUR 47. Analytically, the share is trading at a 2023 P/E ratio of 10 and still, 22 of 27 analysts on the Refinitiv Eikon platform recommend the entry with a median price target of EUR 51.20.

Power Nickel - Battery-quality nickel from Canada

Especially in the automotive industry, machine builders with a focus on solar or wind power, steel manufacturers, IT or the medical technology sector depend on a continuous supply of basic materials such as nickel. Indonesia is currently the world's largest supplier of nickel, ahead of the Philippines and Russia. Ongoing geopolitical instabilities are leading to a significant increase in market concentration due to trade restrictions, thus increasing the power of the main suppliers. For the emerging high-tech industry, this is a showstopper.

A new supplier of the sought-after metal may soon emerge in Canada under the name of Power Nickel (PNPN). The Company's concession area includes the extensive NISK property totaling 20 km in strike length with numerous high-grade mineralized intercepts. The Company also has other properties in the Canadian province of British Colombia and in Chile. In mid-June, Power Nickel announced some drill results, indexing up to 0.6% nickel and 0.5 grams of platinum and 0.11 grams of palladium over a length of 31.9 m.

The next 15,000 m of drilling will start in July, and a NI 43-101 standard resource estimate will be prepared by the end of Q3. Power Nickel completed a flow-through placement in June at CAD 0.50, raising CAD 4.8 million gross. PNPN shares have consolidated somewhat and are now available at a low CAD 0.21. A good opportunity for further positioning.

Varta - First successes in restructuring give hope

Surprising news from Ellwangen. After a challenging 2022, shareholders gave the green light for the future at the Annual General Meeting. After the general debate, in which the difficult developments of the past year were scrutinized, the shareholders approved the actions of the Executive Board and Supervisory Board.

The consequences of the global crises had caused Varta to correct its profits three times before it was able to agree to an austerity program in the fall with new capital from the major shareholder and some banks. The restructuring program was now formally signed at the beginning of July. A large part of the program involves cutting around 800 full-time jobs worldwide.

Analysts on the Refinitiv Eikon platform had recently attracted attention with negative ratings, including DZ Bank with "Sell" and a price target of EUR 10 and Warburg with EUR 15.5. As if the investors had completely different convictions, they pushed the share price back above the EUR 20 mark with ease. We had already taken a positive stance at EUR 18 and are continuing to strengthen the position at EUR 19.70. The figures for the second quarter will be published on August 11.

BYD - Tesla outbid in China

Not only Tesla reports record sales for the second quarter. Sales figures for Chinese competitor BYD doubled in the past three months to over 700,000 vehicles and reached new highs. Tesla delivered 466,000 units in the past quarter of the year, which still leaves it in the lead in Germany. According to figures from the Federal Motor Transport Authority, 36,400 new Teslas were registered from January to June, while the German top dog VW sold 34,400 pure electric vehicles and is breathing down the Texans' necks.

Tesla has had to cut prices in China three times now to keep up with the local competition because BYD enjoys strong advantages in its home country. Alongside CATL products, its Blade Battery is one of the best-selling units in e-mobility and is now being exported in large numbers. According to a recent research report by Goldman Sachs on China's automotive industry, the total overseas sales of China's automotive OEMs are expected to increase from 2.7 million units to 8.5 million units from 2022 to 2030. BYD will cover about 30-40% of this.

BYD shares recently showed strength again and are technically on the way up. After overcoming the EUR 30 mark, only the resistance at EUR 33.8 now stands in the way of the old high at around EUR 42. Caution, despite the popularity, the share is not cheap, with a 2023 P/E ratio of 28.

**Development in e-mobility continues apace, creating a huge demand for battery metals. BASF is one of the market leaders in raw materials, and BYD is very well-positioned as a producer. Varta is currently rehearsing the turnaround. The small-cap Power Nickel could emerge as a raw material supplier in 3-5 years.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.