October 29th, 2024 | 07:00 CET

Barrick Gold, Desert Gold Ventures, Newmont: The Opportunity for Gold in a Commodity-Scarce World

Imagine being part of a gold company before it catches the attention of the market's major players – an opportunity that investors like Ross Beaty have already recognized. At a time when the world's largest gold producers, such as Barrick Gold and Newmont, are struggling with stagnating production volumes and rising costs, companies like Desert Gold Ventures (WKN: A14X09 | ISIN: CA25039N4084 | Ticker Symbol: QXR2) are gaining immense importance. Strategically located next to industry giants such as Allied Gold, B2Gold, and Barrick Gold, with a license for gold production planned as early as 2025, Desert Gold Ventures could be the next takeover candidate. This article explains why now is the right time to invest and what the current market situation means for investors.

time to read: 3 minutes

|

Author:

Mario Hose

ISIN:

BARRICK GOLD CORP. | CA0679011084 , DESERT GOLD VENTURES | CA25039N4084 , NEWMONT CORP. DL 1_60 | US6516391066

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

The hidden gold treasury: Desert Gold Ventures and its lucrative location in the heart of West Africa

Desert Gold Ventures has secured a vast area of 440 km² in West Africa, in the immediate vicinity of industry heavyweights such as Allied Gold, B2Gold, and Barrick Gold. This neighborhood could be the key to significant value appreciation as Desert Gold establishes itself as the next major player. Why this area in particular? Desert Gold Ventures' management has already identified 1.1 million ounces of gold in the ground as part of their exploration, and production is set to begin soon. Those who get in early could benefit significantly from such a strategic location.

Gold Reserves with Potential: An Ounce for Just USD 10.00?

With a market capitalization of only around USD 11 million, each ounce of gold in the ground at Desert Gold is currently valued at around USD 10.00 – this presents remarkable potential compared to the current spot market price of over USD 2,700.00 per ounce. Such a discrepancy in valuation could hardly be more enticing for investors. If gold production starts as planned in 2025, Desert Gold Ventures could become a true insider tip for those looking to benefit from its current valuation.

The road to production: Preliminary Economic Assessment as the next milestone

Desert Gold Ventures is currently preparing a preliminary economic assessment (PEA) that will clarify the details for production from 2025. This data is a critical milestone in demonstrating the project's true potential. Once this assessment is available, Desert Gold could enter an entirely new growth phase. Investors who get in now could reap the rewards of a dynamic increase in value before the mass market discovers the stock.

Revenue from gold sales: A leap into the future

Once gold production begins and initial revenues start flowing, Desert Gold Ventures will be elevated to a new level. The Company could be in a position to further explore the remaining 440 km² area from its own funds, thus continuously increasing its potential. The current valuation will then possibly be nothing more than a memory of times gone by. Share buybacks and dividend payments are also scenarios that could make the Company even more attractive to investors in the future.

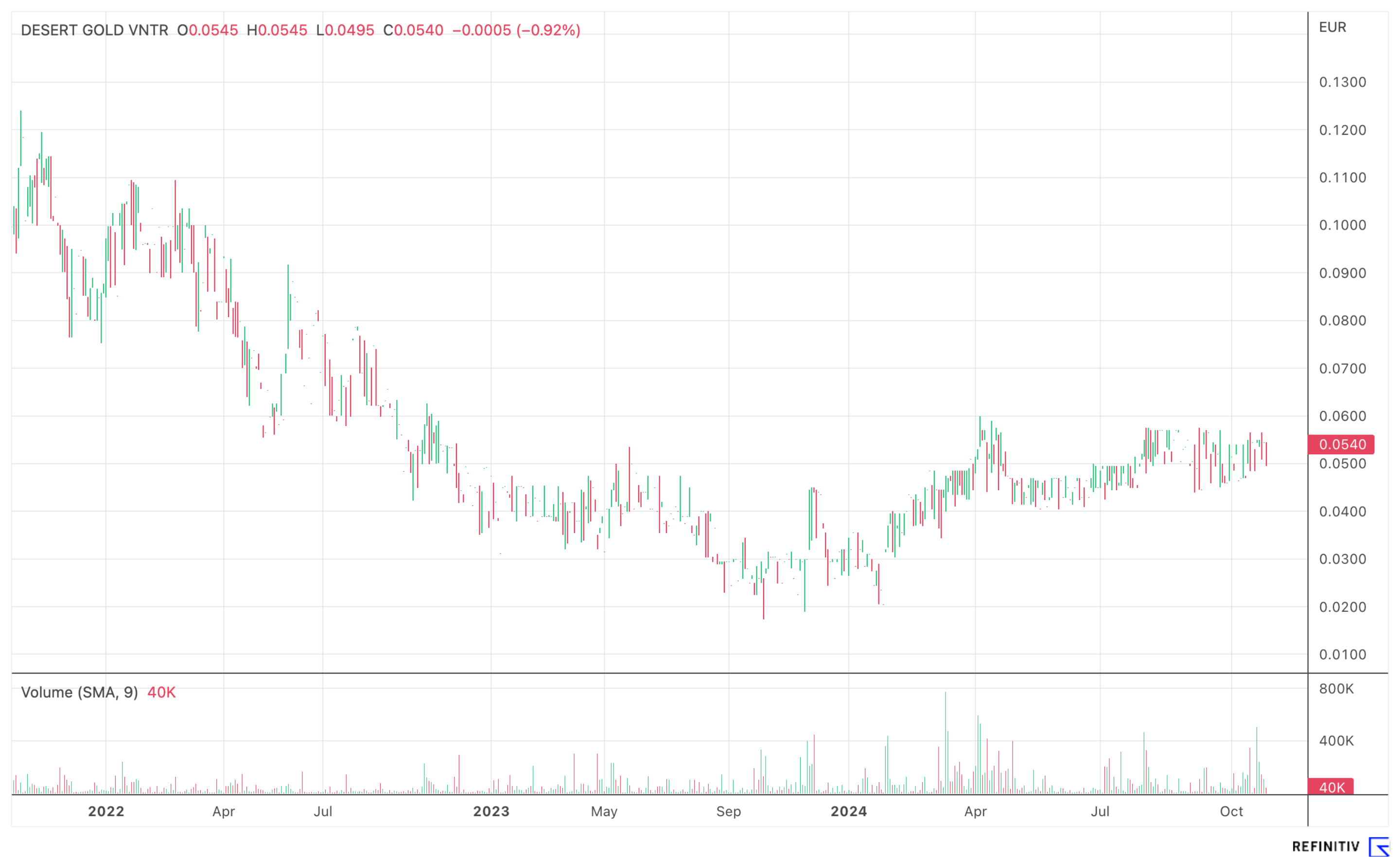

Bargain price of CAD 0.08: A value buy with the prospect of higher profits

On its home exchange in Toronto, Desert Gold shares were recently trading at CAD 0.08. While trading volume has increased in recent weeks, the stock still appears to be in a phase of relative undiscovered potential. However, this low valuation may soon be a thing of the past. The stock is also tradable in Germany, making it easily accessible for investors.

Buy recommendation with target price: Analyst sees potential up to CAD 0.425

Analyst Matthias Greiffenberger of GBC Investment Research has issued Desert Gold Ventures a clear "Buy" recommendation, setting a target price of CAD 0.425. This recommendation speaks for itself: Desert Gold is a company with enormous potential that may soon see its value multiply. Those who invest now could benefit from future gains and accompany the Company on its path toward sustainable growth.

Conclusion: A unique investment in the gold industry

For investors who do not want to miss a favorable entry point, Desert Gold Ventures (WKN: A14X09 | ISIN: CA25039N4084 | Ticker symbol: QXR2) offers a unique opportunity. With production expected to begin in 2025 and a valuation gap that holds the potential for substantial gains, Desert Gold Ventures could be one of the most exciting stocks in the coming days and weeks. Successful Canadian star investor Ross Beaty is already invested in Desert Gold Ventures.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.