March 14th, 2023 | 11:33 CET

Bank failure and new heaters! Nordex, Defense Metals, JinkoSolar - Greentech shares in the focus of investors

German Economics Minister Habeck wants to stick to his controversial plans to ban the installation of new oil and gas heating systems from 2024. In press releases, he describes the "heat turnaround" as mandatory. However, criticism of the plan is getting louder rather than quieter. What other countries do not even discuss is to be implemented here as quickly as possible due to a lack of fossil raw materials. The government in Berlin is worried about the climate targets set by law and still believes in the prosperity-securing transformation of the German economy and private households. The financing side of these projects is being forgotten because not everyone will be able to afford the purchases. FDP parliamentary group leader Dürr sent Habeck's plans back to the "assembly hall" for the time being on the talk show "Anne Will" because of various construction defects. The crux of the matter is energy availability, which is crucial for a green transformation. Which values now belong in the portfolio?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NORDEX SE O.N. | DE000A0D6554 , DEFENSE METALS CORP. | CA2446331035 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nordex - Sales are in line, but order intake declining

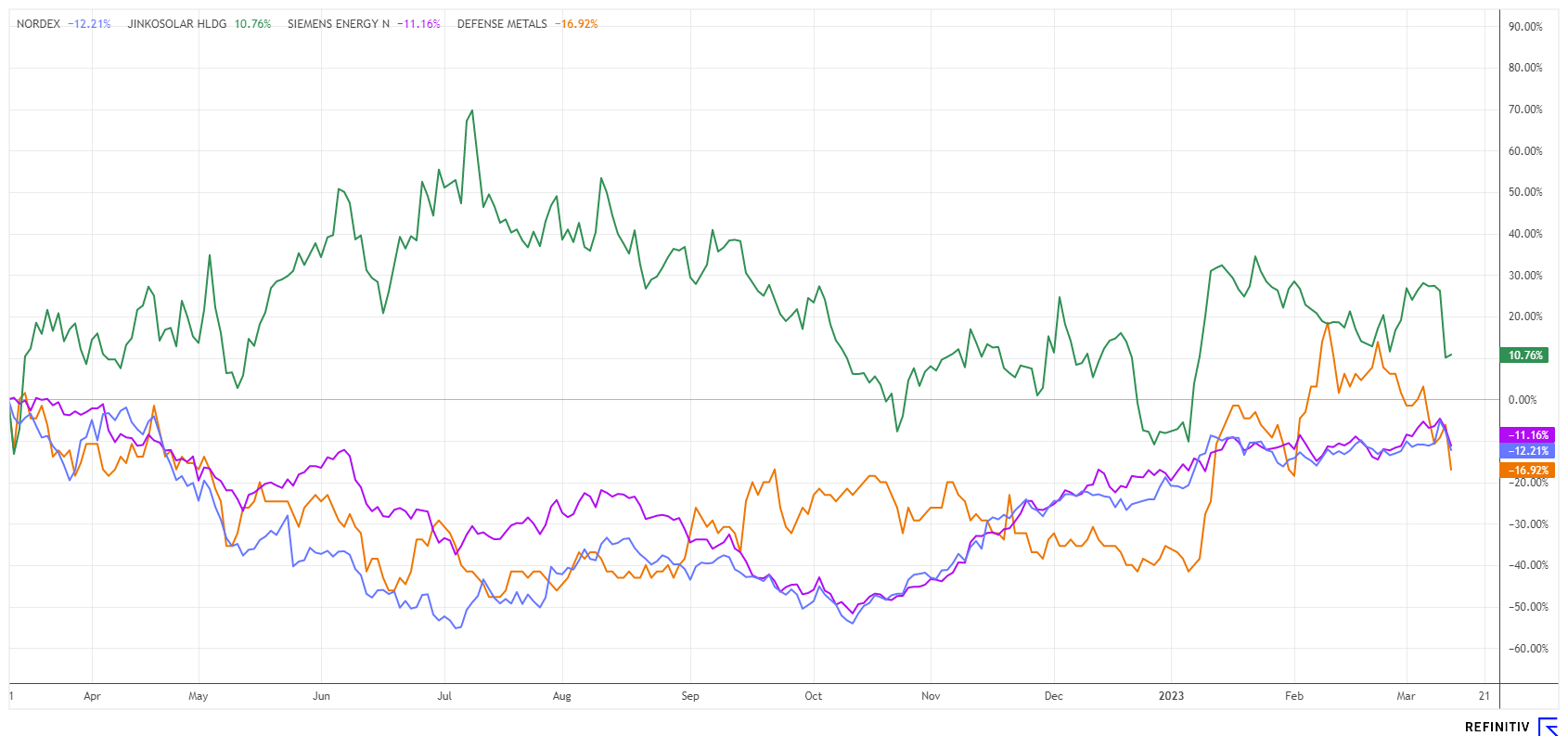

Fossil energy supply is becoming more and more costly. A wide variety of Greentech solutions for power generation are therefore more in demand than ever, with wind and solar systems, in particular, remaining the focus of investment in the climate protection sector. The Hamburg-based company Nordex specializes in large wind turbines and energy parks. After three profit warnings in 2022, the share price crashed to below EUR 7. Currently, the value is experiencing a revival.

The wind turbine manufacturer has now presented its preliminary figures for 2022. Sales increased slightly, but order intake declined. Nordex generated revenues of EUR 5.7 billion in 2022, up from EUR 5.4 billion in the previous year. Sales were thus at the upper end of the range of the previously reduced guidance. At the same time, however, an operating loss of EUR 244 million was recorded, and the EBITDA margin remained negative at minus 4.3%. Nordex was unable to defy the volatile macroeconomic environment, struggling with both supply chain issues and product quality problems. Capital expenditures were EUR 205 million last year, down from EUR 169 million in 2021, but order intake was a reduced 6.33 GW, down from 7.95 GW. The forecast for the current year 2023 will be presented on March 31, when Nordex will also present its audited figures. It should be exciting to see whether the Hamburg-based company can turn Corona-related setbacks into positive growth, as the Greentech sector is booming like never before.

Defense Metals - Rare earths from Wicheeda

All green or high-tech products contain some amount of rare earths. As the name suggests, they are rare and found mainly in China, where they can be mined profitably. However, because of their supply dependence on Beijing, Western industrialized countries are developing strategies to bring other suppliers to the market.

Defense Metals Corp. operates a rare earth deposit called Wicheeda near Prince George, British Columbia. The Company will prospectively supply materials from this deposit that typically have applications in the power market, military and national security. However, these rare metals are especially important in the production of green energy technologies because they enable high-strength alloys for reinforcing components. Examples of applications include magnets for generators, wind turbines and electric motors.

There is new data to prepare a feasibility study, as the Defense Metals technical team has now completed updating the 3-D geological model. More than 10,000 meters of additional drilling in 47 diamond drill holes completed in 2021 and 2022 following the completion of the preliminary economic assessment (PEA) is now available. A new resource estimate of the Wicheeda deposit is being prepared, which will significantly contribute to the planned prefeasibility study (PFS).

Geologist Kristopher Raffle states, "The updated geological model of the Wicheeda rare earth deposit, incorporating over 10,000 meters of new post-PEA drilling, represents a significant milestone for the project and the culmination of two years of targeted exploration." Defense Metals (DEFN) shares have risen from CAD 0.20 to CAD 0.39 in the last 3 months and are currently trading at CAD 0.29. With the good news, the stock should be back in focus soon.

JinkoSolar - Doubling sales is not enough

JinkoSolar Holdings Co. Ltd. is one of Europe's leading suppliers of solar panels and wafers. Thus, the Chinese photovoltaic manufacturer shipped more than 46 gigawatts of solar modules, solar cells and wafers in 2022. In total, this exceeded the 130-gigawatt mark for solar modules shipped, but net income was less than USD 100 million. Market estimates were significantly higher.

Analysts had already expected a 105% increase in sales to USD 12.1 billion; this growth is mainly attributable to the growth in solar modules. JinkoSolar put the gross profit achieved at just under USD 1.8 billion, or an 85% increase over 2021, but net profit fell sharply short of expectations, down 7.7% to USD 96.4 million. "We finished a challenging 2022 with satisfactory results as we showed strong operational and financial performance in the fourth quarter," said Xiande Li, CEO of JinkoSolar.

The year 2022 was not the year for manufacturers, as they had priced their products very early and were hit by sharp increases in input product prices toward the end of the year. Seasonal imbalances between the supply of polysilicon and the demand for photovoltaic products, combined with inventory adjustments, had a particular impact. Jinko shares corrected by more than 20% to EUR 43.18 last week and have so far only been able to recover weakly to around EUR 46. The Refinitiv Eikon analysis platform shows a low consensus P/E ratio of around 7.6 for 2023, which means the stock is cheaply valued again. Sales should increase by about 25% in 2023, and the margin should now also be more calculable after the experience from 2022.

Greentech cannot do without strategic metals. Leaving the field to China without a fight would be grossly negligent. After a feasibility study, Defense Metals could enter the market as a new producer, and JinkoSolar and Nordex would then be potential customers. All three stocks have their appeal in a risk-adjusted portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.