October 16th, 2023 | 07:05 CEST

Attention: Turnaround with 100% chance! Hydrogen stocks Nel and Plug Power are looking for the bottom and dynaCERT with large orders

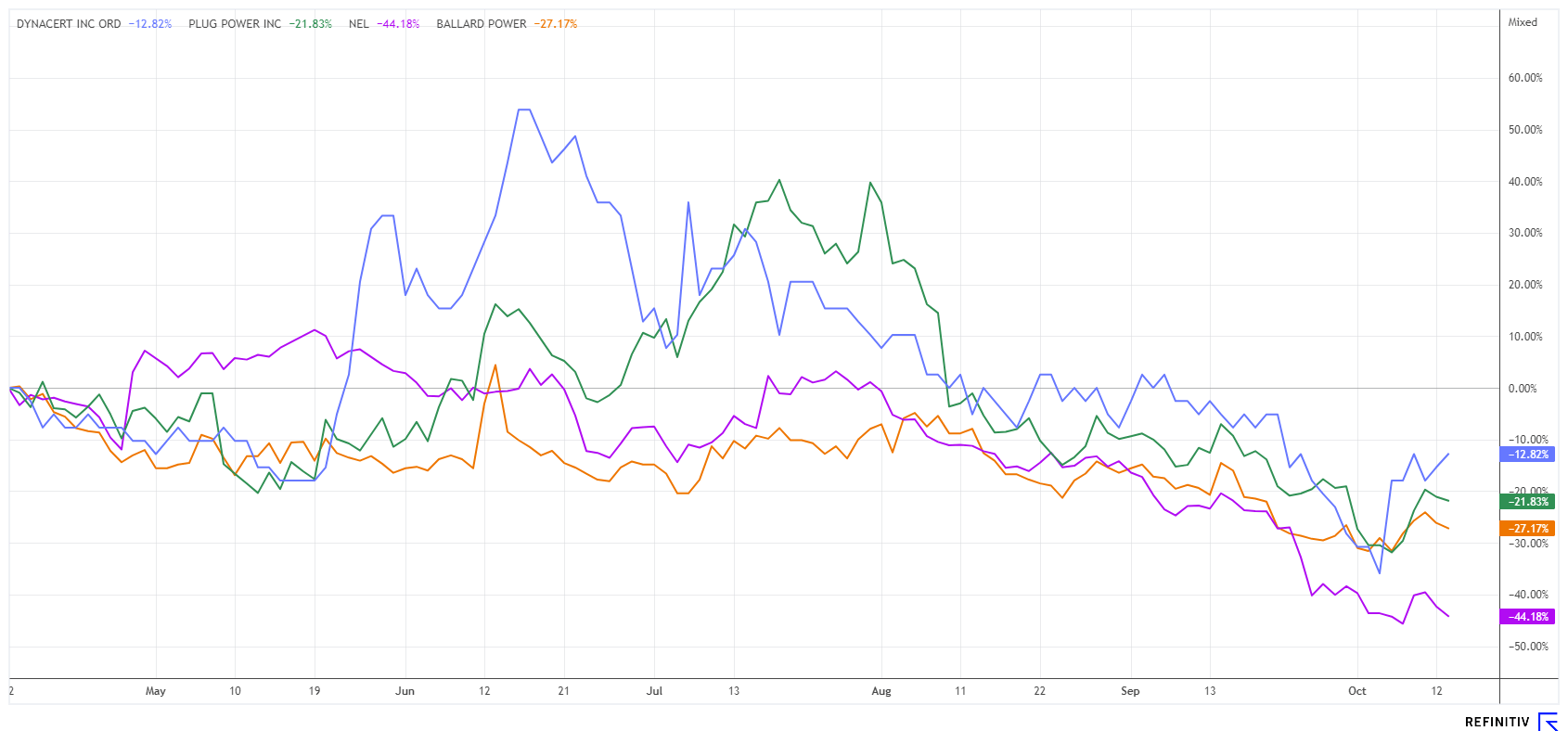

Consolidation has now gripped the entire market, as the sharp rise in interest rates and the remaining high inflation are taking their toll on growth stocks. For the first time, the major indices have come under great pressure, with the DAX-40 also making acquaintance with the all-important 15,000 mark. However, there are also positive signs. The hydrogen market has been undergoing a substantial correction since the end of 2021, which resulted from prolonged overvaluation. Market participants were expecting a new megatrend due to numerous political initiatives, but it has yet to materialize as quickly as anticipated. Now, however, the cards of the protagonists look better. Valuations are now at a low point, and new orders are coming in. We take a look at some interesting stocks.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power - The US takes the next step

The United States government, with the Department of Energy (DoE), has just fired the next H2 rocket. Seven of the coveted hydrogen gigahub sites have now been identified. They span the country; states that win the bid are in favor of further follow-on investment. Plug Power hopes the extensive letters of intent from politicians will provide a good portfolio of orders for the next few years, and it wants to take advantage of the tax incentives that have been announced. According to analyst consensus estimates, Plug Power's revenue will increase from USD 1.2 billion to USD 5.6 billion within the next 5 years. Strong statement.

"Unlocking the full potential of hydrogen - a versatile fuel that can be produced in virtually any part of the country from nearly any energy resource - is critical to realizing President Biden's goal of an American industry powered by American clean energy, providing American families and businesses with less volatility and more affordable energy options," said US Energy Secretary Jennifer M. Granholm. "With this historic investment, the Biden-Harris Administration is laying the foundation for a new US-led industry that will drive the global transition to clean energy while creating high-quality jobs and providing for healthier communities in all parts of the country."

US-based hydrogen specialist Plug Power provided promising newsflow this trading week around its symposium. Morningstar analysts were enthusiastic, reiterating their positive rating for PLUG stock with a price target of USD 11.50. Unfortunately, the Latham, New York-based company has little cash reserves left in its coffers to pre-fund growth. What form the company will take to raise the necessary funds remains an open question. According to Morningstar, Plug Power is currently evaluating primarily non-dilutive forms of financing. A large bond issuance is expected but will burden the balance sheet with interest payments. Chart-wise, the USD 8.60 line needs to fall before significant follow-on buying ensues. For now, Plug Power remains a plaything of speculators. Keep watch!

dynaCERT - Significant follow-up contracts from South America

While the industry as a whole is making slow progress, dynaCERT, a specialist in the provision of fuel-saving H2 applications, has little to complain about at the moment. Their order books are filling up more and more. The Toronto-based company has just reported an order for an additional 161 HydraGEN units through its sales partner, H2 Tek. The units will be supplied to several mining customers in South America, with payments to be made before the end of 2023. This helps conserve the Canadians' cash reserves and allows for swift delivery.

Joao Araujo, Vice President of Global Operations and Partner at H2 Tek, said: "Our customer is a major mining operator in South America. The HydraGEN solution aligns perfectly with its commitment to improving performance through clean energy and reducing greenhouse gas emissions in its operations and value chain. This project is just the first step for us in supporting our customer's ESG goals."

H2 Tek has already installed dynaCERT's HydraGEN technology in certain mining operations in Chile, Peru, Brazil, Argentina and Australia as pilot projects to introduce local companies to the benefits of the technology. The focus is on large engine applications because of the potential to make a significant contribution to reducing carbon emissions and pollution. Mine operators, in particular, are under pressure to meet imposed environmental and ESG requirements for their operations. The ecological benefits of emissions reduction offer significant cost reductions in addition to increasing reputation. As part of the growing global hydrogen economy, dynaCERT's patented technology creates a unique on-demand electrolysis system for hydrogen and oxygen. Transportation and mining companies can easily install it in their trucks.

Furthermore, the completion of the all-important VERRA certification is expected soon. With this news, dynaCERT's stock ended its consolidation at around CAD 0.12 and shot up over 30% with high trading volumes. The current market capitalization of CAD 65 million is even below the development costs of recent years. A further boost in sales from additional deals could quickly accelerate the stock further upward.

Nel ASA - Nervously heading into the reporting season

The next 10 days will be very exciting at Nel ASA. On October 25, the Norwegian hydrogen pioneer is set to report on the third quarter. Analysts surveyed expect an average loss per share of NOK 0.105, or about one Euro cent. The Company's chart suggests that a negative surprise may be looming. Some experts anticipate costs to remain high and margins to be under pressure, as the high purchase prices for manufacturing materials and rising labor costs cannot be passed on directly to sales prices. This is a situation that can only be resolved over time.

Due to the significant drop in the share price, however, the fundamental framework parameters have become somewhat more affordable. Based on estimated sales of NOK 2.5 billion for 2024, this currently results in a price/sales valuation of 4.6. In the past, this ratio has been in double digits. Furthermore, the break-even point is not expected until 2026. According to the half-year results, the Norwegians are still sitting on a liquidity cushion of around NOK 4.1 billion and can, therefore, easily pre-finance sales for the next 2 years. As we described in our last reports, the devaluation process is ongoing. Last week, the stock accelerated to EUR 0.725, only to exit the market again at EUR 0.66 on Friday. The positive sign: Turnover on the stock market is enormous - it already looks suspiciously like a final sell-off. At the moment, only traders have their pleasure with the share!

The hydrogen sector is waiting for major government investments because it still makes little sense for the private sector to enter. Green hydrogen should be provided by public producers to start momentum. Nel ASA and Plug Power have reduced their valuation by over 80% and already appear somewhat more affordable. Over time, dynaCERT has developed top technology that allows significant emission reductions on-site and requires only a manageable investment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.