July 25th, 2023 | 10:25 CEST

Attention - Turnaround ahead! TUI, Globex Mining, Vodafone, Deutsche Bank. Look closely now!

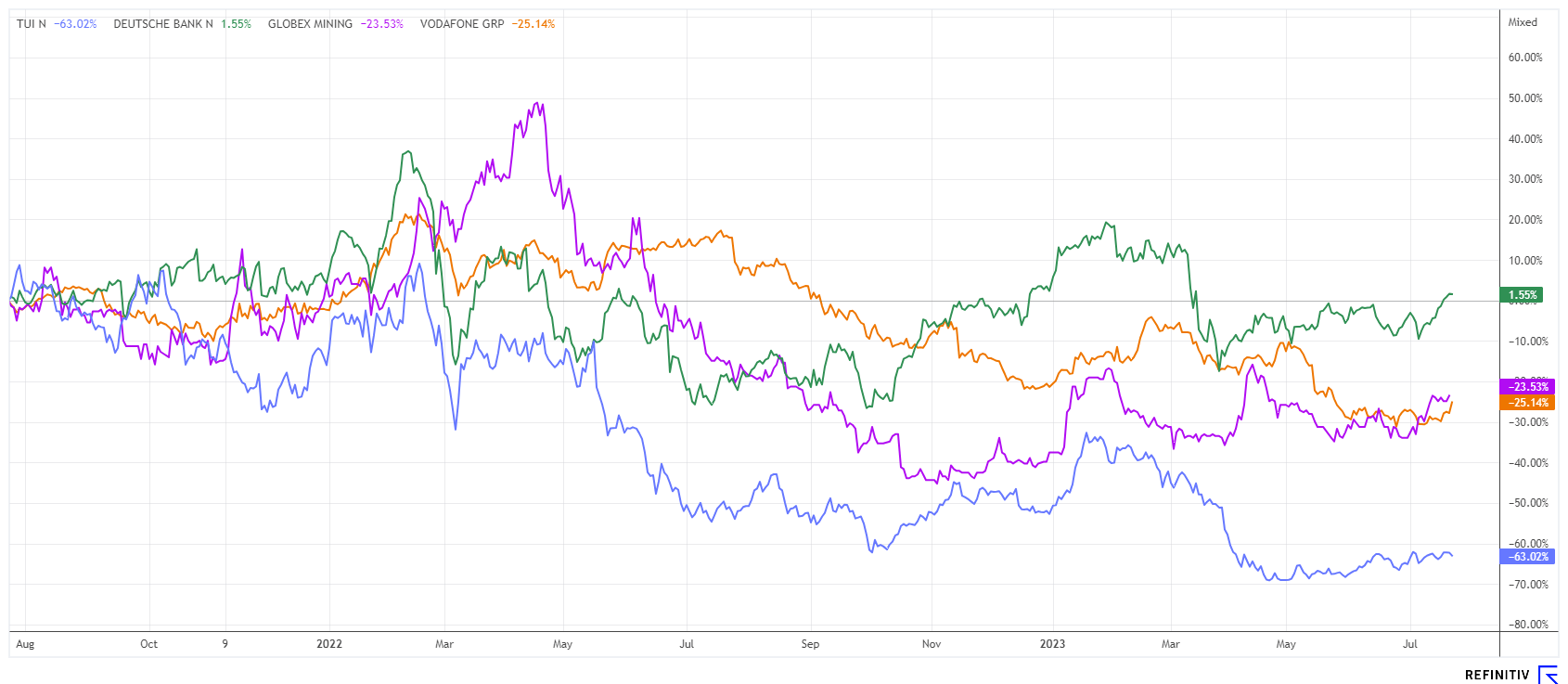

In strong upward movements on the stock market, there are always trend stocks that lead the cycle. So far in 2023, GreenTech, IT and AI stocks have consistently produced new highs. Measured by the DAX price index, the market is still 25% below its historic highs, and the NASDAQ 100, the index of technology stocks, is still 700 points or 5% short of its all-time high. However, there are noticeable stocks with promising prospects that have not yet been in the spotlight. Here are some examples.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , GLOBEX MINING ENTPRS INC. | CA3799005093 , VODAFONE GROUP PLC | GB00BH4HKS39 , DEUTSCHE BANK AG NA O.N. | DE0005140008

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TUI - First steps after the capital increase

**The TUI share demands a great deal of patience from its investors. First, the Corona pandemic hit the balance sheet, followed by the Ukraine war and the associated surge in inflation. For many families, travel has become an absolute luxury good, hitting the package tour target group of Europe's largest full-service provider particularly hard.

Nevertheless, the summer business is running better than expected. Germans are once again eager to travel, leading to a pleasing increase in bookings. After experiencing external price shocks, with hotel prices rising by 50% and significantly more expensive flights, prices for package tours have also risen. Currently, the Company from Hanover has reached pre-pandemic revenue levels, although the number of bookings has decreased. **Tour operators increased prices for domestic travel by an average of 14.5%, while popular foreign tours rose by around 10%. Destinations such as Greece and Majorca even saw prices rise by 13.5% in each case. TUI successfully extended the maturity of its existing bank debt totaling EUR 2.7 billion, by two years, creating breathing space for the operational turnaround for the time being.

The TUI share price is currently suffering from the cancelled trips to Rhodes and Corfu due to the forest fires, which prevent newcomers from flying to the islands. The brief excursion above the EUR 7 mark has thus come to an end. However, analysts on the Refinitiv Eikon platform expect an average 12-month target price of EUR 9.17, about 30% above the current level.

Globex Mining - Best positioned for the Commodity Super Cycle

Those investors looking for a solid stock in the explorer sector will come across Jack Stoch's resource portfolio. The commodity investment legend has been buying and selling holdings, mining rights and options since the 1980s. As such, his company, Globex Mining, is more of an investment fund for risky, small resource properties that could become valuable in an upcoming commodity boom. The portfolio includes over 200 properties.

GMX's main interest revolves around precious metals, but important industrial metals are often a rewarding side interest. That is because the availability of rare metals such as copper, nickel and lithium is crucial for the desired goals of decarbonization. These metals are on the list of strategic raw materials of Western industrialized nations. Governments are in the process of reducing their dependence on resource countries such as China and Russia. As a result, the large, unexplored deposits in North America are coming into focus.

On July 21, Globex was able to report on its latest deal. Partner Burin Gold Corp. has received conditional TSX approval for its agreement with Globex Mining to acquire a 100% interest in the Dalhousie project. The property comprises 31 claims located 53 km east of Matagami, Quebec. It hosts an ortho-magmatic nickel-copper-cobalt deposit, and historical drilling has shown a variety of geophysical anomalies.

Under the terms of the agreement, Burin will pay CAD 1.5 million upfront and issue 4 million common shares of the company to Globex. To do this, they will carry out CAD 5 million worth of exploration work over a four-year period to earn a 100% interest in the property. Again, a cash and asset deal that moves the Globex valuation forward. The current market capitalization of EUR 31.4 million represents a large cash balance and a well-defined resource holding. If you do the math carefully, you can see a significant undervaluation of GMX stock compared to the sector!

Vodafone and Deutsche Bank - The catch-up has begun

Vodafone and Deutsche Bank shares are also making conspicuous chart movements. Yesterday, the globally active telecommunications provider Vodafone published figures that turned out better than experts had expected. After long loss-making quarters in terms of the number of customers, Vodafone can now stop this trend in Q2. 24,000 new contracts compared with a minus of 11,000 from the first quarter. The providers Deutsche Telekom and Telefónica Deutschland (O2) are currently able to retain more customers, and their rates appear more attractive. After all, the share jumped 4.5% to EUR 0.90 after the figures and broke the downward trend that has persisted since December 2021. The next hurdle would be the head and shoulders pattern at around EUR 1.0. Deutsche Bank analysts upgrade to "Buy" with a target price of GBp 155 - around 50% higher than the last price.**

Deutsche Bank itself also made a whopping jump of over 10% since the beginning of July at EUR 10.25. Things will now get exciting here tomorrow, as there are fresh Q2 figures. A look at the analysts' estimates shows a sales expectation of EUR 7.1 billion after EUR 6.7 billion, but profits are likely to stagnate at best at EUR 1.38 billion, according to the forecasts. That is because, although there is again a margin in the lending business on the assets side, there is currently too little coming out of investment banking. In comparison, Deutsche Bank is still lagging well behind the European Bank Index. The latter has already gained 14% this year, but the DBK share is still down by 12%. From a technical standpoint, with a potential breakthrough of the EUR 11.60 level, a further increase to at least EUR 14 is likely to follow. Exciting!

Investing in so-called laggards requires staying power. Usually, there is a fundamental reason why performance leaves much to be desired. Deutsche Bank has just undergone a huge transformation, and Vodafone can surprise in earnings. Globex is in the trend of neglected explorer stocks, and TUI must first prove that the last capital increase is finally bearing fruit.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.