March 10th, 2025 | 08:10 CET

Attention: IPO fever, now it's really starting! Hensoldt, Power Metallic, Renk, and thyssenkrupp

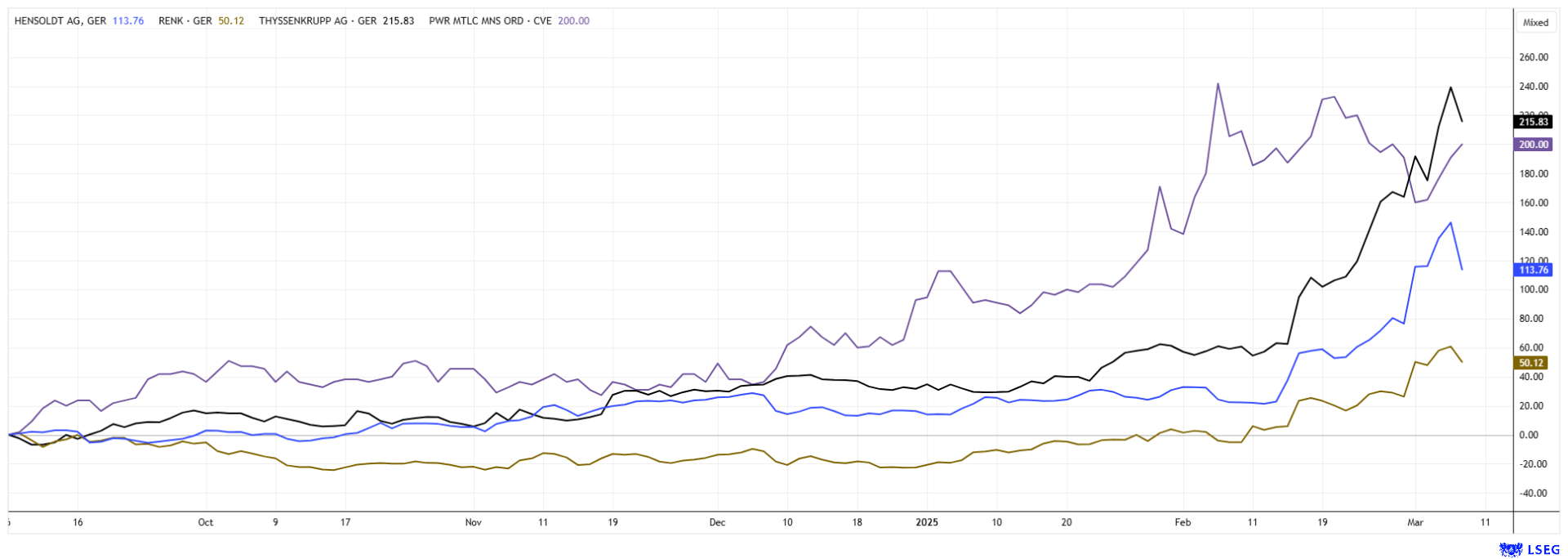

Before the election and after the election. At the beginning of the year, there was still a fight over the debt brake, but with the US pulling out of Ukraine aid, it seems that anything goes. Last week, in addition to an ECB interest rate cut, an EUR 800 billion package for armaments and infrastructure was proposed. This caused the DAX 40 index to surge, especially defense and construction stocks, which gained an average of 30%. Hensoldt and thyssenkrupp even made a giant leap upwards. The new all-time high for the index is now 23,475 points. Could there be an IPO from Essen soon? The probability for TKMS is increasing. However, it remains to be seen whether the significant premiums are sustainable; on Friday, there were initial sell-offs. Our specialty title, Power Metallic (formerly Power Nickel), continued to rise. We are looking into the crystal ball.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

HENSOLDT AG INH O.N. | DE000HAG0005 , POWER METALLIC MINES INC. | CA73929R1055 , RENK AG O.N. | DE000RENK730 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] China has become the manufacturing capital of the World, and because of its infrastructure, expertise and capabilities, Silkroad Nickel has strategically positioned itself to partner with Chinese companies in the Stainless Steel and EV industries [...]" Jerre Foo, Corporate Development Executive, Silkroad Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp – Speculation about the naval division

Investors reacted in a textbook fashion to the massive economic stimulus package from Berlin. Although the money has not yet been paid out, the announcement alone that the EUR 100 billion in special funds for the German armed forces will be followed by a further EUR 300 billion has sent the imagination skyrocketing. Since the end of January, thyssenkrupp shares have more than doubled in value, rising from EUR 4.50 to EUR 9.80. This was likely too much euphoria in the short term, and on Friday, after a correction, the share price was down to EUR 8.80. While the restructuring of the steel division is ongoing, investors are now looking to the naval division, TKMS. "We want to complete the IPO within the calendar year 2025. We are also preparing an extraordinary general meeting for this purpose," thyssenkrupp CEO Miguel López said in a podcast.

It is not to be an IPO but a spin-off to existing shareholders. This is very investor-friendly and is welcomed by investors. The same model was used by the Daimler Group with its truck division. In addition to its main shipyard in Kiel, the arms company TKMS also has a shipyard in Wismar in Mecklenburg-Western Pomerania, where it plans to build submarines in the future, as it does in Kiel and also produce combat ships. According to TKMS, its capacities are fully booked until the early 2040s. In December, the German parliament's budget committee approved the construction of four more modern Class 212CD submarines for the German Navy at a cost of EUR 4.7 billion. Market observers estimate the value of TKMS to be more than EUR 5 billion. This exceeds the market capitalization of the highly indebted parent company.

Power Metallic Mines – Golden financing at top prices

Since our extensive coverage, Canadian resource explorer Power Nickel has become a top pick in investor portfolios. The Company has now been renamed Power Metallic Mines. This is a fairer reflection of the properties around NISK & Co., as they are multi-metal resources with very high grades. The share price has already risen by over 300% in 2024, and good drilling results suggest a dream property in Quebec. The market is excited to see how the story continues.

In an environment of great geopolitical instability, industrial producers are seeking a secure supply of strategic metals. Power Metallic Mines could become an important supplier in the medium term because, with the NISK property, the Canadians have numerous high-grade intersections in a wide range of industrial metals and gold. The Company still has major exploration plans for 2025, and in February, the shares of Chilean Metals were also spun out. Almost 50% of the shares remain in the possession of Power Metallic.

At the end of February, the Company raised a massive CAD 50 million in refinancing. The highlight: CAD 40 million of so-called flow-through shares were placed at a price of CAD 2.85, and a further CAD 10 million was raised at a base price of CAD 1.45. A significant vote of confidence from shareholders. Thus, Power Metallic is starting the next drilling programs with a well-filled bank account, and the market is eagerly awaiting the results. The successful capital increase has caused the price to rise to CAD 1.95; on Friday, the securities were trading at just under CAD 1.70. The PNPN story is likely to continue to delight its fans like a sweet treat in 2025!

Hensoldt and Renk – Short-term exaggeration

Before the announcement of a comprehensive economic stimulus package for the benefit of Germany and Europe, Hensoldt's shares were trading at EUR 35 and Renk's at EUR 26. While Hensoldt more than doubled within 72 hours, Renk only reached a peak of EUR 41. Investors are on a dangerous trip with this rapid revaluation, as the package has not yet been fully approved by the committees. On top of that, there is a "threat" of a ceasefire or even peace between Russia and Ukraine. We Europeans would welcome this with all our hearts, but for those riding the defense wave, it could spell disaster for the share price. After all, what is the point of rearming to excess when peace is approaching? The gains could, therefore, quickly be reduced again, especially since Hensoldt, in particular, has already incorporated expected profit figures from 2030.

A glance at the LSEG research platform reveals how analysts feel about the two defense stocks: at Hensoldt, only 5 out of 11 experts dare to give a "Buy" rating with an average price target of EUR 58.50. Only Oddo and Warburg see EUR 69. All achievable price targets were already reached by Ash Wednesday. For Renk, which has little defense exposure (only about 25% of revenue comes from armaments), 12 out of 13 experts remain positive. A price of EUR 33.50 is expected. The price on Friday evening was just above that, at EUR 35.60. Be on your guard; stop-loss levels of EUR 63 and 34 make sense.

Leaps of joy on the stock market. An EUR 800 billion stimulus package for a faltering economy in Germany. Now, it remains to be seen whether the general weakness really affects the supply side or whether, in the end, the consumer is the missing link in the recovery. The defense stocks described here will likely need until 2027 to grow into their new valuation. Power Metallic Mines will most likely continue its surge unabated.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.