September 6th, 2023 | 10:10 CEST

Attention gold breakout, sell AI stocks? NVIDIA, Globex Mining, and JinkoSolar - these stocks are calling for a party!

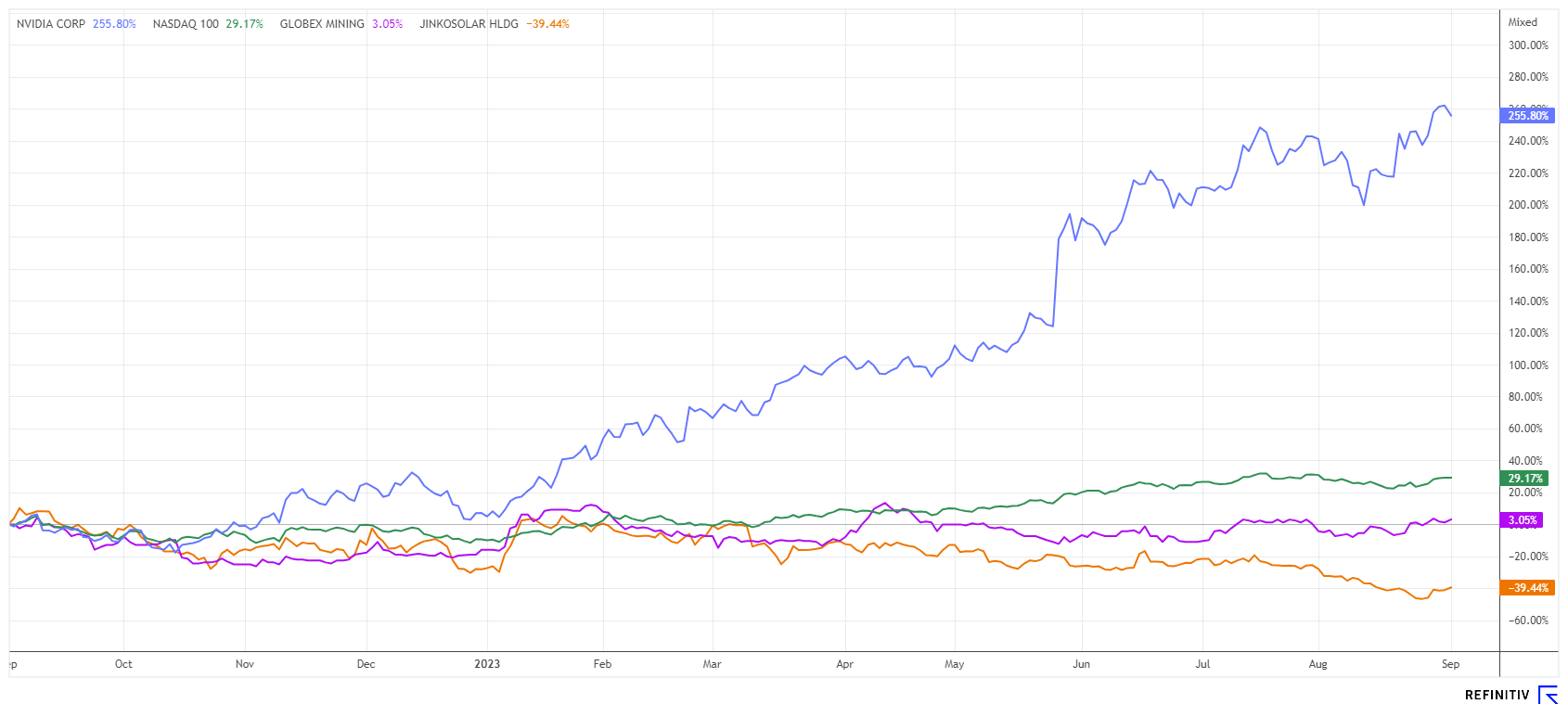

Artificial intelligence (AI) stocks have recently seen gains of up to 500%. Fund managers worldwide jumped on the new megatrend, but now many investors are wondering what is next! We do not want to deny the revolutionary AI trends; they will dramatically change many things. But do these disruptive trends justify price-turnover ratios of over 40? NVIDIA, the main protagonist, recently managed to increase its market value to over USD 1 trillion. Yet, the Company only achieved sales of USD 26.9 billion in the last fiscal year, with profits falling by as much as 44%. This feels like an exaggeration that is probably not yet widely perceived. We take a deeper look.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , GLOBEX MINING ENTPRS INC. | CA3799005093 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007

Table of contents:

"[...] As we look at four or more zones in more detail from the beginning, investors can expect a continuous news flow that will underscore our vision of the Holy Grail project as a giant opportunity. [...]" Nick Luksha, President, Prospect Ridge Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

NVIDIA - Dizzying valuation creates worry lines

A look at the financial data provides insight into the highly acclaimed company from Santa Clara (USA). NVIDIA gained over 200% in share value in 2023 alone, and in May, the stock market value reached the one trillion US dollar mark for the first time. According to Ernst & Young, the Californians are now the sixth most valuable company in the world. NVIDIA is a specialist for fast graphics processors, and in January 1999, the Company was admitted to the NASDAQ index. In the same year, they delivered the ten millionth graphics chip of the GeForce series. In the summer of 2022, the planned takeover of the chip manufacturer ARM failed. Instead, the Company is capitalizing on the high valuations and is now going public.

Although NVIDIA has to give price cuts of 20% to the market for its latest chip generation, analysts expect sales to double from USD 26.9 billion to USD 56.4 billion in the current fiscal year. This is due to the stormy development in the "Data Center" segment. Here, services for AI-related services are offered, which is currently fueling the enormous valuation fantasies. Earnings per share are expected to increase approximately fivefold in 2023 to USD 9.75. For 2024, the experts on the Refinitiv Eikon platform see a further increase in profits of 70%. Even with the increased revenue forecast for 2023, NVIDIA is currently trading at a price-to-sales factor of 20 and a P/E ratio of 49. This is tight and reminiscent of the tech bubble from the year 2000.

Globex Mining - The Silver Treasure in Saxony

Beyond high valuations, one comes across Globex Mining (GMX) in the commodities sector. The investment holding company, operating since the 1980s, buys and sells interests, mining rights and options. Founder and CEO Jack Stoch does not like big risks; he acquires assets only after careful consideration and looks for business partners who can fulfill their exploration obligations within the agreed-upon time frame. The portfolio now spans 232 properties, primarily in gold, but industrial metals also appear as an admixture.

Some assets are located in Europe, specifically in the German state of Saxony. In the Silver City concession area, soil sampling was completed in 2022 on the Ader Peter, Grauer Wolf, Harta and Frauenstein targets. The program's objective was to test the geochemical response along the section of known mineralization and identify new drill targets. Induced polarization surveys were completed in Q4 2022. Results have now been sighted and partner Excellon outlined its next steps in a recent press release. Silver City, located in the heart of the German Ore Mountains, comprises four mineral concessions totaling 340 sq km (164 of which are owned by Globex). Excellon has invested CAD 8 million in exploration in recent years and has completed a total of 22,000 m of the drilling program, 13,300 m of which are in the Globex license area.

Partner Excellon believes that the current time is favorable for mineral exploration in Europe, as the EU has adopted extensive measures to secure domestic raw material supplies. A new Saxon Raw Materials Strategy has recently been published, highlighting the importance of fostering a local mining industry. Excellon will evaluate the capital market for a spin-off of the project. The focus is on raising sufficient capital to fund the next exploration campaign. The proposed spin-off could see a significant uplift in value for both Excellon and Globex.

The current market capitalization of Globex at CAD 45 million is at a significant valuation discount for a total cash and securities portfolio of over CAD 25 million, including 232 properties. Separate listings of individual projects could potentially propel the value of the holding into a completely different dimension.

JinkoSolar - The solar boom continues

The crash of the Greentech star JinkoSolar gives food for thought. Last year, sales of the solar panel producer had doubled, but the profit margin declined by 30% due to more expensive raw materials. Sales are maintained this year, but margins remain under pressure. What is interesting, however, is that analysts expect a significant easing in the next few years. The share price has been under pressure for the past 12 months, currently at only EUR 31.70, compared to over EUR 60 in September 2022.

The bankruptcy of the real estate developer Evergrande and the difficulties of the highly indebted project developer Country Garden are depressing the valuation of Chinese shares and causing foreign investors to withdraw their money. The US plans to impose further import duties on the modules of Southeast Asian manufacturers, who are said to have tried to circumvent existing duties by exporting from Malaysia, Thailand and Vietnam. JinkoSolar is said to be unaffected by the punitive measures and can continue to meet the high demand with its highly efficient modules. With a P/E ratio of 4 for 2023, the stock is cheaper than ever.

Currently, the stock market is in a tech frenzy. Business models in the direction of Artificial Intelligence can achieve substantial price gains, although they will not become profitable for several years. In commodity stocks, the recent strength in gold could be a game changer, and Globex is excellently positioned for it. The high growth figures continue to speak in favor of the Greentech star JinkoSolar.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.