May 6th, 2024 | 07:30 CEST

Attention e-mobility 2.0, now China is in demand! BYD, Almonty Industries, VW, and Mercedes in focus

Even though e-mobility has stuttered in Germany since the scrapping of the environmental bonus, the production of new vehicles "Made in China" is running at full speed. Manufacturers are still trying to pack more range, durability and stability into the units. Conceptually, electric vehicles only make sense if inexpensive electricity can be used for charging. Fast charging stations on the highway cost between 55 and 95 cents per kilowatt hour; Tesla charges an average of 43 cents but asks external customers to pay up to 64 cents. Without the tax disadvantage, optimized diesel vehicles have the same operating costs as electric vehicles. Where the combustion engine clearly scores points, however, is in winter operation, independence, and range. What is more, the battery in an electric vehicle needs to be replaced after 10 years, while the diesel engine has only just warmed up with 150,000 km of performance. Where are the opportunities for shareholders?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , ALMONTY INDUSTRIES INC. | CA0203981034 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Heading West with cheap exports

When a BYD freighter unloaded its cargo for the first time in Bremerhaven in February, 3,000 brand-new vehicles from the Chinese automaker emerged from the ship's hold. 200 such ships will now be built in Asia by 2026 to flood the world with Chinese cars. The route to Europe passes through Vlissingen in the Netherlands, then on to Bremerhaven, further to Zeebrugge in Belgium, and back to China. There, the next load awaits shipment.

This new freighter is just a foretaste of what currently threatens car manufacturers worldwide. BYD, Xiaomi, Chery, Geely and Nio have been building one factory after another in their home countries for years. Europe has slept through the evolution to the e-car, so the competence now lies with the first mover in Texas and, above all, in China. The factories there are now producing with huge overcapacity, and the economic principle of "economics of scale" has been implemented. There is still a lack of purchasing power at home, and China's industry is currently unable to get rid of the volume of vehicles. When the new roll-on roll-off ships are launched, the sales price in Europe will no longer play a role. Even without the new ships, China has already overtaken Germany and Japan as the largest vehicle exporter.

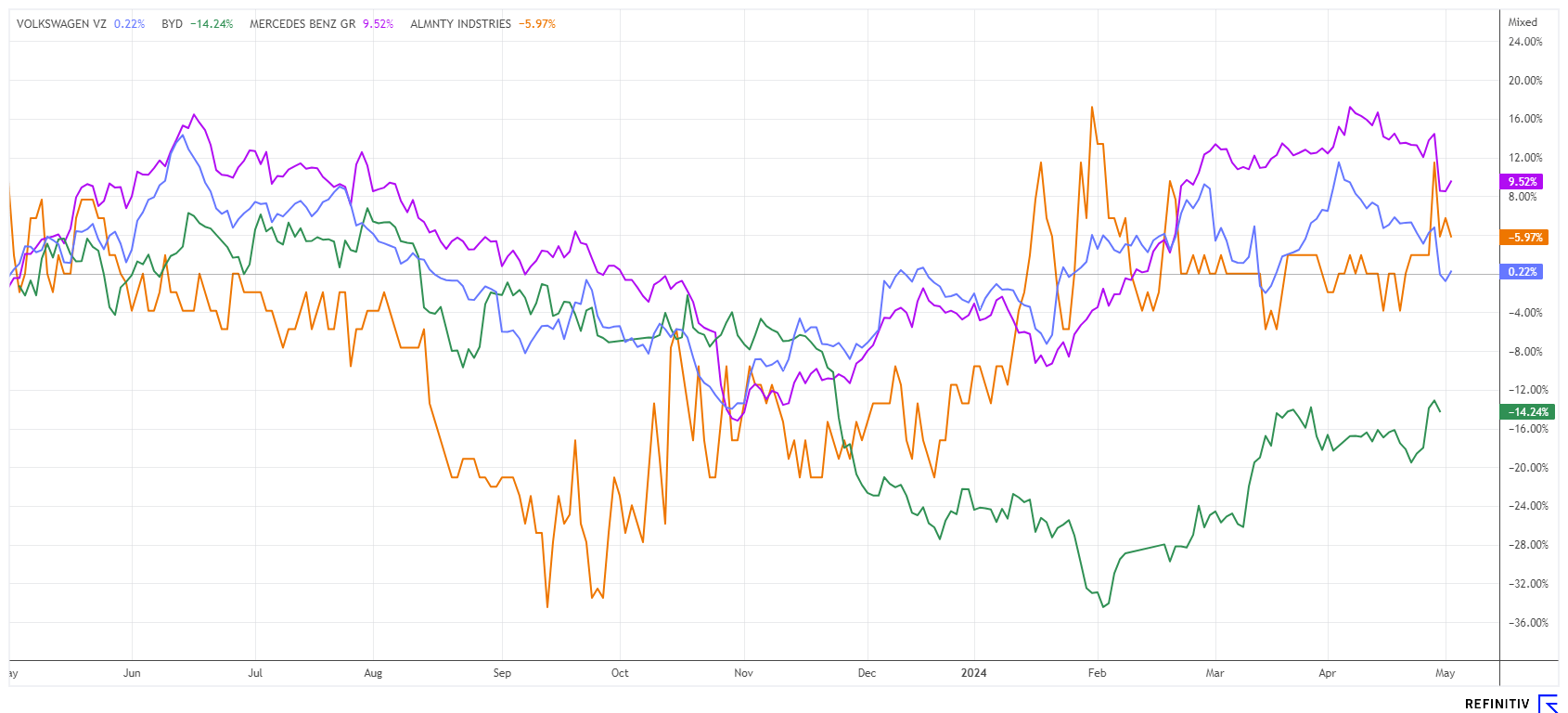

BYD management recently called on China's political decision-makers to extend its NEV purchase subsidies until 2025 in order to promote the continued positive development of e-mobility. In the first quarter, 626,236 electric vehicles were sold, a noticeable decline compared to 944,779 in the fourth quarter of 2023. However, this was still an increase of 13.4% compared to the previous year. BYD shares have been trading between EUR 20 and EUR 26 for 6 months; the high of EUR 42 from 2022 seems a long way off. However, a small technical breakout to the upside was achieved at the end of last week. If the resistance at EUR 30 falls, BYD could start climbing again.

Almonty Industries - Critical metals in focus

Industrial manufacturing on a large scale involves a whole basket of critical raw materials. The heat-resistant hardening metal tungsten is in demand in the automotive, high-tech and defense sectors. As with many metals, there has been a dependency on China for years, as 70% of global demand is mined here. The geopolitical changes between the US-dominated West and the newly formed BRICS group of states appear dangerous. They are casting a spell over more and more countries that have wanted to say goodbye to the US dollar area for years. Tungsten, in particular, could become a difficult metal to obtain.

A perfect opportunity for the Canadian company Almonty Industries. It owns four properties of the rare metal in the western-oriented zones of Europe and South Korea. Also, it has a large accumulation of molybdenum, which is used in electrical engineering and for hardening steel. Western countries are hopeful about the new deposits and are already reaching out. The high-ranking visit by the US Department of Commerce to the Panasqueira mine in Spain at the beginning of 2024 is significant. The start of production at Sangdong is planned for the end of 2024 to mid-2025. It is important for international customers that alternatives to China are created within a reasonable time frame.

Almonty Industries has just successfully raised over CAD 3 million. The share price had already risen by around 40% in 2024 and has recently switched to a sideways trend. With the current mine development, the project is also becoming attractive to large mining companies and institutional investors. The first production from the new Sangdong mine should, therefore, find industrial buyers very quickly. Given the above prospects, Almonty Industries is valued extremely favorably at just under EUR 100 million.

**On April 17, 2024, CEO Lewis Black gave some insights into the current status of the mine development at Sangdong at the 11th International Investment Forum. Here is the link to the IIF video.

VW and Mercedes - Stuck in the past

There was a remarkable change in German car production in 2023. According to available statistics, the VW Tiguan has replaced the VW Golf as the most-produced car in Germany. With 225,000 vehicles produced last year, the popular SUV sent the Golf into second place with 215,000 units. The picture was very different in 2016: The Golf dominated the list with almost 800,000 vehicles built, well ahead of the Tiguan, which had a production figure of around 300,000 at the time. However, VW now offers interesting variants in the Golf size with the ID.3, the T-Roc and the T-Cross. However, foreign competition in the mid-size segment is growing noticeably. Tesla has already sold 195,000 units of the Model Y, ahead of the BMW 3 Series, putting it in 7th place in Germany.

In China, the situation is much more difficult. This is because new suppliers such as Xiaomi are entering the market with models that give even German premium models a run for their money. The SU7 model looks like a Taycan, delivers top equipment and good driving performance, but at EUR 39,000 costs only a third of the Porsche. This also puts the top electric models ID.7 and Mercedes EQE in the shade. At Mercedes-Benz, business in 2024 is no longer going as well as it should. Unit sales fell in the first quarter, turnover fell accordingly, and the operating result slumped by 30% to EUR 3.9 billion. The adjusted return on sales in the passenger car segment fell by 6 percentage points from 15% to 9%. Model changes and delivery bottlenecks had a negative impact on business, with only vans performing better. However, sales of German e-models in China are developing poorly; currently, the only way to grow there is with top-of-the-range combustion engines. However, this misses the mass market and only focuses on the Chinese upper class.

The shares of VW and Mercedes have lost almost 10% in the depressed economic environment even before their AGM date. Dividends of 7 to 8% will now be paid out in May. Let's see how long it takes this time to make up for the dividend losses.

The automotive sector will completely reinvent itself after the first wave of e-mobility. While China relies 100% on affordable electric models, European premium manufacturers can only score points in the high-price segments. However, it will only be possible to sell fully developed combustion engines for just under another 10 years. The raw materials from Almonty Industries, on the other hand, will find suitable customers for decades to come.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.