July 8th, 2025 | 07:20 CEST

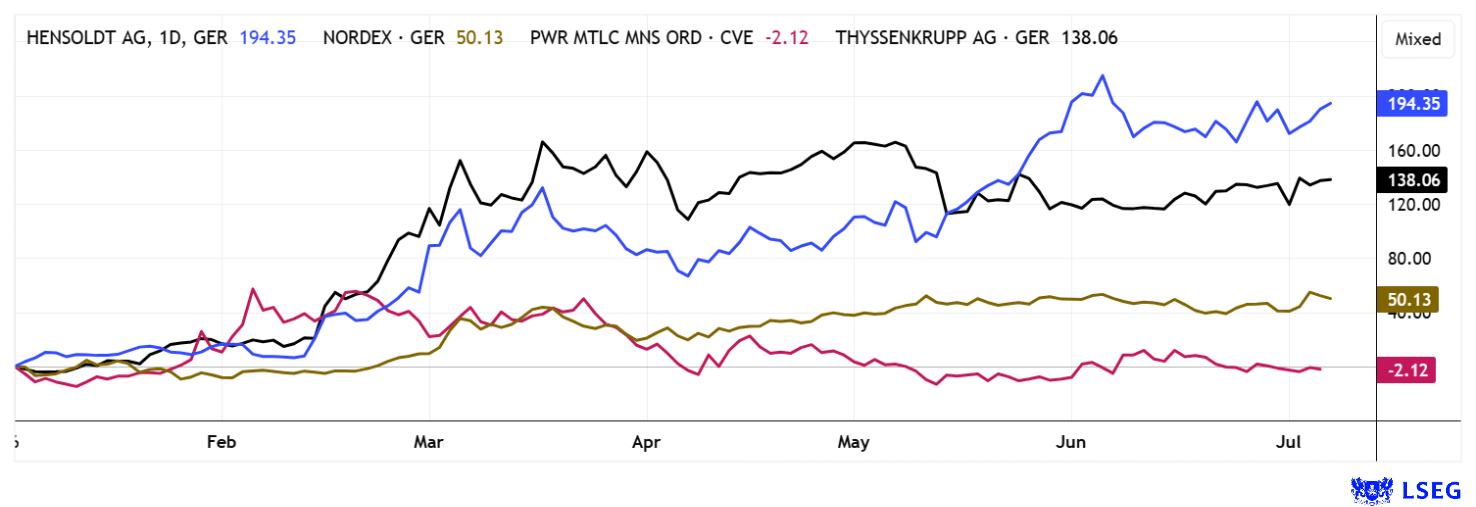

Attention: Critical Metals as Future Boosters! thyssenkrupp, Power Metallic, Hensoldt, and Nordex

The start of the second half of the year is bringing new record highs, but volatility remains high. The stock markets are currently in turmoil, with prices changing direction almost daily. This is driven by new headlines about trade tariffs, geopolitical power games, and the question of global security. While the world is currently focused on armed conflicts, a key issue is increasingly coming to the fore for stock market traders: critical metals. These raw materials, ranging from rare earths and copper to gallium and titanium, are the backbone of modern technologies, green transformation, and military strength. In the defense industry, shortages of critical metals could now become a strategic risk, a fact that many still underestimate. Western industrialized nations are therefore increasing efforts to secure raw material sources and reduce their dependence on geopolitically fragile suppliers. Where are the new high-yield champions for your portfolio?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP AG O.N. | DE0007500001 , POWER METALLIC MINES INC. | CA73929R1055 , HENSOLDT AG INH O.N. | DE000HAG0005 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nordex – Already performing very well

The wind energy sector is a major consumer of critical metals, especially rare earths. In the European wind energy market, Nordex has recently come into the focus of investors. After a phase of strong operational fluctuations, the Company is now showing an improvement in its operations, with positive effects on earnings and the share price. At over EUR 18, the share price reached a three-year high last week, driven by convincing figures at the start of the year. In the first quarter, Nordex achieved EBITDA of EUR 80 million, corresponding to a margin of 5.5%, a significant improvement on the previous year. Although revenue declined slightly to EUR 1.44 billion, a strong 21% increase in order intake reassured investors, thanks in particular to growing service business and major orders in Europe. With 2.2 GW of turbines delivered, production is now at a stable level, even though weather-related delays in installation were noticeable. The order backlog of over EUR 11 billion also ensures solid planning for the coming quarters. Experts expect margins to improve further to up to 7% in 2025. Uncertainties due to fluctuating raw material prices and slow approval procedures remain, but Nordex is countering these with a broad supplier base and efficient project management. One downside should be mentioned: at a 2025 P/E ratio of 27, the valuation is already very ambitious.

Power Metallic Mines – New licenses increase potential

Power Metallic Mines from Canada is causing quite a stir amid global commodity turmoil. Investor interest is correspondingly strong. CEO Terry Lynch has demonstrated his seriousness about growth plans with the recent acquisition of 313 additional mineral concessions. The seller, Li-FT Power Ltd., is well-known in Germany for its sharp stock movements during the last lithium boom. Since lithium is only one part of the critical metals supply chain, it makes sense to transfer these legacy holdings into more strategic management. The TSX Venture Exchange has accepted the documents relating to the purchase agreement between Power Metallic Mines Inc. and Li-FT Power for review. Under the terms of the agreement, the Company has acquired a 100% interest in various properties adjacent to the Company's existing Nisk property in the province of Quebec. In exchange for the properties, Power Metallic will make a cash payment of CAD 700,000 to the seller upon closing of the transaction and issue an additional 6 million common shares. In addition, Li-FT Power will retain a net smelter return (NSR) of 0.5% on the properties. A fabulous deal for Power Metallic with good long-term prospects!

The current triggers for Power Metallic (PNPN) shares are the high-grade, multi-metal deposits it owns, which are of the highest strategic importance. This is precisely where the industry is looking for reliable sources of copper, nickel, gold, and platinum group elements. North America is increasingly becoming the focus of attention with its own resources. Dependence on Asia is gradually declining. Thanks to government support programs and political stability, the projects are among the most exciting on the market. Shareholders can ride this wave 100%!

CEO Terry Lynch provided insights on this at the 15th International Investment Forum at the end of May: Click here for the video...

thyssenkrupp – The stock market is expecting too much

There is a big scramble for shares in the long-established German industrial conglomerate thyssenkrupp. The debate surrounding the marine subsidiary TKMS is intensifying: contrary to earlier plans, the German government will not venture a direct entry into the marine division after all. Instead, the Duisburg-based group is looking for a strategically suitable minority investor, preferably from German industry or other European countries. Thales and Fincantieri, both with maritime expertise and a European focus, have already been brought into play. However, thyssenkrupp wants to retain a majority stake and remain in charge. At the same time, new details are emerging that suggest a German financial investor with a stake of around 25% is also seen as a realistic option. It is important for Berlin that the national roots of the Company are preserved.

This model also seems to be gaining ground for the loss-making steel business, as the long-discussed complete sale to Czech billionaire Daniel Křetínský is becoming increasingly unlikely. Instead, a solution involving a minority stake of around 20% is emerging, supported by billions in federal subsidies, as green steel remains on the surreal wish list of German industrial dreamers. Around EUR 2 billion in subsidies are on the table for the green restructuring of steel production, a key condition for maintaining competitiveness. Nevertheless, thyssenkrupp shares remain sluggish: despite positive momentum, they have not managed to break through the psychologically important EUR 10 mark on a sustained basis. LSEG analysts currently estimate the share price potential at a rather modest EUR 8.85. Investors should therefore carefully consider whether the wind will soon change direction or whether the rough seas will continue.

Hensoldt – Quite ambitious

A brief comment on Hensoldt. The Swedish government recently announced the procurement of seven fire units for the IRIS-T SLM air defense system from German defense contractor Diehl Defence. The order volume is around EUR 810 million, significantly lower than comparable IRIS-T SLM deals in other countries. The reason for the comparatively low price is likely to be that Sweden has not ordered all system components. According to information from well-informed sources, the package only includes two TRML-4D radars from Hensoldt, although one such sensor is normally required for each fire unit. However, it is considered likely that additional radars will be ordered at a later date. Hensoldt shares nevertheless responded to the news with strong gains. At EUR 99.50, the estimated 2026 P/E ratio is now 44, and the stock is trading at around 4 times revenue. Investors should start to exercise caution!

Secure sources of raw materials in stable regions are more in demand than ever, with North America at the top of the list. In the US under Trump and also in Canada, mining permits are now being issued much more quickly. Companies such as Hensoldt, Nordex, and thyssenkrupp are heavily reliant on reliable supply chains for critical metals; otherwise, production would come to a standstill. Power Metallic offers a real opportunity for the future with its top Canadian property.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.