February 16th, 2023 | 21:58 CET

Attention. Climate and Tech Rally 3.0 continues - Are Alibaba, PayPal, Alpina Holdings and TUI in the Champions League?

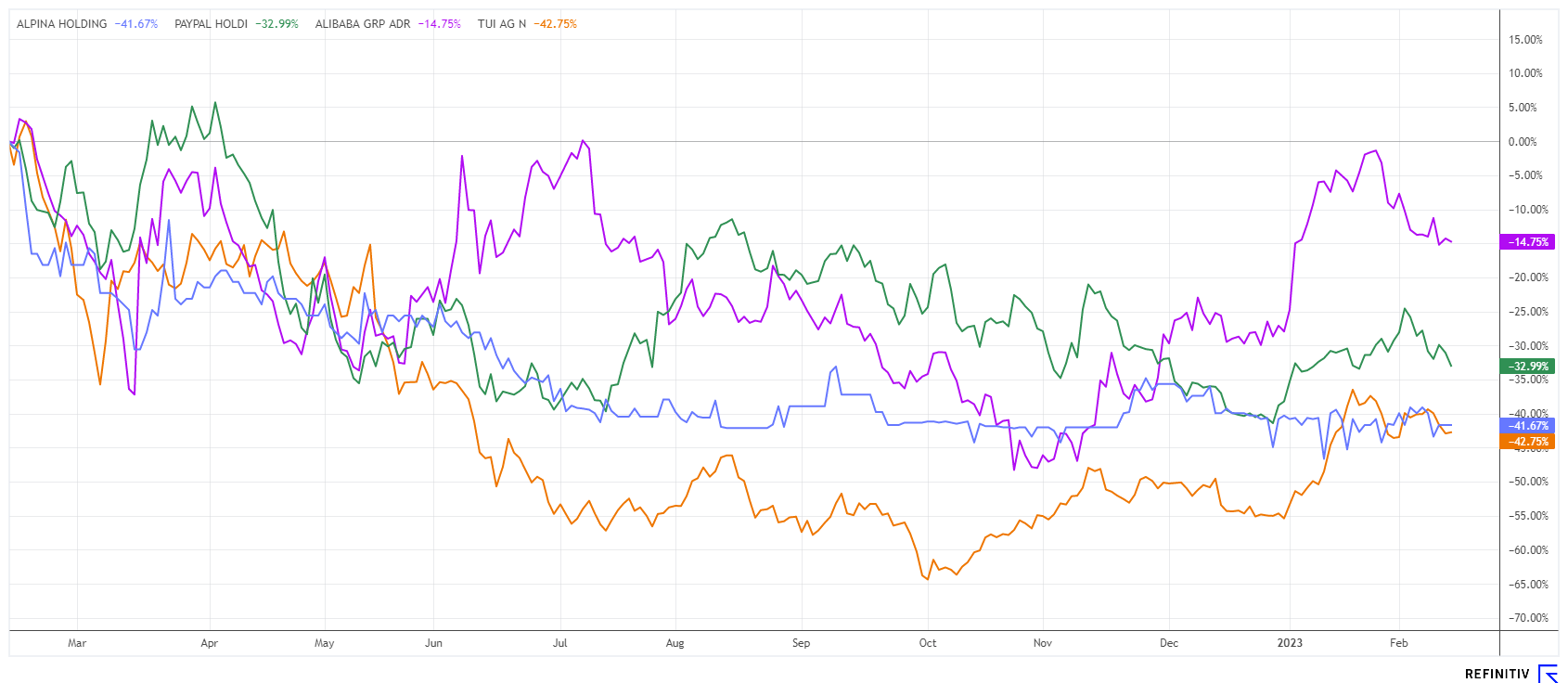

The year is only just six weeks old, and already big winners can be spotted on the stock market. The correction of tech stocks in 2022 prompted many investors to open a new bet in 2023, and they were broadly right. Tesla is up 100%, Alibaba is up 80%, and Infineon is at least 50% higher. The IPO of Ionos has not been convincing so far, and as is well known, what is not can still be because the share is not expensive. We go in search of the next climbers.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

ALIBABA GR.HLDG SP.ADR 8 | US01609W1027 , PAYPAL HDGS INC.DL-_0001 | US70450Y1038 , ALPINA HOLDINGS LIMITED | SGXE21011833 , TUI AG NA O.N. | DE000TUAG000

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Alibaba versus PayPal - Asia ahead of US tech?

Since the turn of the year, growth stocks have been heading steeply north again. Shares from the Greentech sector are particularly in demand. Nordex and Siemens Energy were at the top of the wave, while Asian tech stocks such as Alibaba and Tencent seem to have already put part of their recovery rally behind them. They were the big losers of 2022 but have already gained more than 50% from their lows. One reason can be quickly found: Asian stock markets are not suffering as much from the current inflation and the associated rise in interest rates because their economies are now back in the investor spotlight after the Corona slump of recent years. Since November, the Hang Seng Index has gained 55%, while the US technology exchange NASDAQ has only gained 17% in the same period.

A fundamental comparison between the online giant Alibaba and the payment service PayPal is exemplary. Alibaba will generate revenues of around EUR 129 billion in 2023 and trade with a price-to-sales ratio of 1.9. The Company is growing consistently at 12 to 15% per year and currently has a P/E ratio of 12. PayPal already scaled back its growth expectations twice but was able to convince with its last report for the final quarter. This stock is also not too expensive, with a 2023 price/sales ratio of 2.6 and a P/E ratio of 13. The exemplary key figures are garnished with friendly prospects for the current year, in which PayPal continues to aim for respectable growth. The consumer crisis has not had much of an impact so far, and if management has its way, it will stay that way. Both shares are currently very attractively valued at EUR 96.2 and EUR 71.8, respectively.

Alpina Holdings Ltd - A boom region continues to appreciate

In Asia, industrial companies are booming, and real estate is feeling the wealth growth of the broad middle class. For years, the metropolises have been growing at constant rates in special zones such as Hong Kong and Singapore, even somewhat more strongly because building land is scarce here. The city-state of Singapore is a pioneer in digitalization. The city is modern and offers young people good prospects; it is one of the Asian metropolises with the highest Western profile. With a manageable size of only 725 sq km, the population density is high at 5.8 million inhabitants. No wonder real estate prices have been rising for years, lifting GDP to a region of nearly USD 400 billion.

Local resident Alpina Holdings Limited is a renowned real estate and construction services company with a 17-year track record. Its business model includes integrated building services (IBS), mechanical and electrical (M&E) engineering services, and alteration and addition (A&A) work for public and private sector projects. With a revenue of SGD 52 million and a profit of SGD 9.3 million, 2021 was an exceptional year in terms of development. Many projects were completed and billed. As a precaution, management recently indicated that the 2022 figures will be lower but will still end with about SGD 4.5 million profit. Company policy is to distribute 50% of the profit to shareholders; for 2021, this delivered a dividend yield of over 7%.

The stock has been tradable in Germany since mid-December, turnover is still low, but awareness is increasing. The 184.34 million outstanding Alpina shares are majority held by CEO Siong Yong Low (45.5%) and Executive Director Yoon On Tai (37.2%). Currently, the Company has a market capitalization of SGD 32.2 million. The good operating margin of over 20% and a continued high payout ratio lead to low share price fluctuations and reward the long-term investor.

TUI - Is this the last capital increase?

Looking at the price trend of the TUI share, the inclined observer wonders whether the visible crisis mode will ever end. Shareholders have needed thick skin for years. The near bankruptcy of the Corona pandemic, which could only be averted with state aid, is now being followed by the imponderables of the Ukraine conflict. Due to the considerable cost burden on household budgets, travel has become a luxury for many citizens; ultimately, the volume of travel will painfully adjust to this situation. Due to the permanently inflationary environment, long-distance travel and hotel accommodation, in particular, are now a good 50% more expensive than in 2019. Gradually, the travel industry must submit to a new era in terms of climate change. Although climate activists also like to fly to faraway places, air travel is clearly losing social status.

Yesterday, the travel group reported record figures with pre-Corona character, with sales of EUR 3.8 billion in the first quarter. The generated revenue corresponds to an increase of 37% compared to the same period last year, and also, the seasonal minus in the operating result was almost halved to EUR 153 million. With a total of 8.7 million bookings for the winter season 2022/2023 and the upcoming summer 2023, TUI board member Sebastian Ebel sees an "encouraging booking trend." Prices are, on average, 8% above the previous year, but that is keeping few people from catching up on their long-awaited vacation.

The Group's most important goal is to continue reducing debt. In the past fiscal year, TUI had already begun to repay the first government aid from the pandemic times. The money from the economic stabilization fund is to be repaid in full. With another capital increase worth billions, TUI wants to use all means to reduce net debt and cut its interest costs. The share price has set its sights on the EUR 2 mark again, a whopping 80% rise since the October lows. Speculative!

The stock market has started the new year in a good mood. Since September, the fluctuation indicator VDAX has fallen from almost 30 to below 20. This is evidence of calm waters, which brings an increase in value to well-diversified portfolios. The mix of sectors and regions significantly reduces risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.