March 9th, 2023 | 10:54 CET

Aspermont, Amazon, Shop Apotheke - These shares embrace digitization!

Companies like the Canadian media company Aspermont are among the pioneers of digitization and are thus miles ahead of their competitors. With their unique platform solution, the original mining trade magazine publisher can quickly scale into other segments and keep both industry and experts up to date with the latest knowledge. The value of successful digitization is also evident in the Shop Apotheke business figures now published. The digital mail-order pharmacy, which is accessible in Europe, is able to score points despite a change in the management board. In the US, Amazon is one step further, launching 24/7 digital patient care operations through One Medical.

time to read: 4 minutes

|

Author:

Juliane Zielonka

ISIN:

ASPERMONT LTD | AU000000ASP3 , AMAZON.COM INC. DL-_01 | US0231351067 , SHOP APOTHEKE EUROPE INH. | NL0012044747

Table of contents:

"[...] Having Investors like Robert Friedland and Rob McEwen come in with CVMR and Terra Capital really was terrific. [...]" Terry Lynch, CEO, Power Nickel Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Aspermont - Flexible platform model scalable to additional sectors

Aspermont is the leading provider of media solutions for the global commodities industry. The Company has developed an innovative XaaS model for B2B media that delivers high-quality content to an ever-growing global audience. "Anything-as-a-Service" (XaaS) describes a general category of cloud computing and remote access services.

"Aspermont is in a growth phase where we are focused on expanding our operational capabilities and developing knowledge capital across all business units." announces CEO Alex Kent. The media company serving the mining industry owes much to the pioneering spirit of its founder, Andrew Kent, in going digital at the dawn of the connected world. Andrew Kent has expanded the product offering beyond mining to agriculture, energy, construction, logistics and a range of other sectors, using a digital platform to drive the Company's growth from the start. The underlying theme of the Company has always been a determination to maintain a 15% growth rate and a 15% return on investment.

With Alex Kent, the Company has a Microsoft Group-proven CEO who has management in his blood. "When entering a new market or sector, you either had to acquire brands or databases to gain access. But we have developed a solution that we believe we can apply to any other sector and market to compete and win," explains Alex Kent.

Aspermont's flexible platform model can be easily expanded to capture new business in different countries and languages. The ever-growing number of paying subscribers provides Aspermont an excellent opportunity to monetize data, which the Company is actively leveraging.

Shop Apothecary - Impresses with FY 2022 results despite board changes

The internet-based Shop Apotheke is looking for a new CEO. Stefan Feltens is leaving the Company after four years. Feltens, who joined the Company in 2018 from pharmaceutical group Teva Pharmaceutical, has decided not to renew his contract, which expires at the end of April, for personal reasons. He will stay on until after the annual general meeting on April 26, 2023, to ensure a smooth handover for his successor. Under his leadership, customers have tripled to 9.3 million, and sales have risen to EUR 1.2 billion (from EUR 500 million previously).

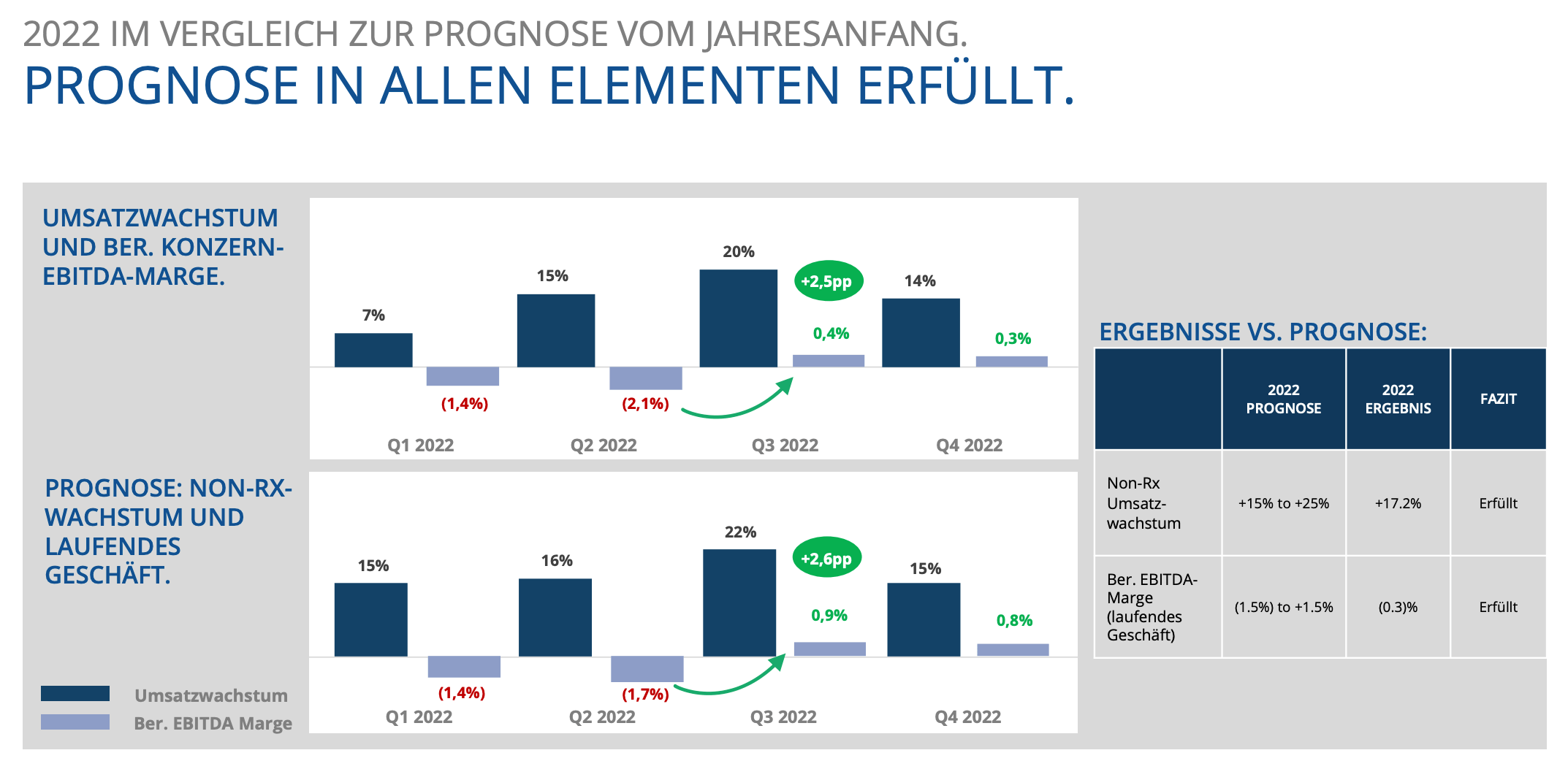

In the current year, a growth rate of 10-20% is targeted in the area of trading with non-prescription medicines. Last year, the online retailer posted a 17.2% increase in sales to EUR 1.07 billion. Total sales rose 13.6% to EUR 1.2 billion. Jefferies Group analysts take a positive view of these figures, with sales guidance in particular seen as very strong. Despite the prospect of a profit turnaround, the share price of the SDAX-listed company slipped more than 3%.

Chief Financial Officer Jasper Eenhorst commented, "Execution will continue to improve in 2023 as we drive both operational efficiencies and scale and remain focused on the fast, healthy growth of the giant e-pharmacy in our markets. We expect to deliver positive adjusted EBITDA margin and plus-minus zero free cash flow while continuing to grow organically at double-digit rates."

Amazon - On the rise with 24/7 digital patient care in the US

Amazon launches 24/7 digital patient care in the US with One Medical.

While online and digital doctor visits are still in their infancy in Europe, Amazon is again taking a step forward in the US. After the Seattle-based company bought digital health company One Medical, they are now rolling out services under the Amazon flag.

One Medical's seamless inpatient and around-the-clock virtual care services, on-site lab testing and programs for prevention, chronic disease management, common illnesses and mental health issues have been helping users for 15 years. Together, Amazon and One Medical aim to provide exceptional health care to more people for better health outcomes, better care experiences, and more value in a better care team environment.

"We are on a mission to make it much easier for people to find, choose, afford and use the services, products and professionals they need to get and stay healthy, and working with One Medical is a big step in that journey," said Neil Lindsay, senior vice president of Amazon Health Services. One Medical provides complete primary care tailored to individuals, including preventive and everyday health checks, care for chronic conditions, and mental health in various locations across the US.

Members have 24/7 access to virtual care services through the One Medical app to maintain care from the comfort of their home or on the go, whether for acute needs at odd hours or to manage follow-up and prescription renewals. The healthcare market in the US is worth EUR 766 billion. 65% of revenue from this segment comes from patient care.

Make or buy is the order of the day at Amazon. After its own attempt at a digital healthcare pilot faded into obscurity, the Company acquired an experienced digital player in the healthcare scene with the acquisition of One Medical. Health has its own regulations and requires different rules of the game than e-commerce. The extent to which pioneering spirit pays off can be seen in the media company Aspermont. Their platform solution is so well positioned that they can now easily scale into areas other than mining. Also scaling this year will be Shop Apotheke. Sales of non-prescription drugs are expected to grow between 10 and 20% in 2023.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.