August 2nd, 2023 | 09:05 CEST

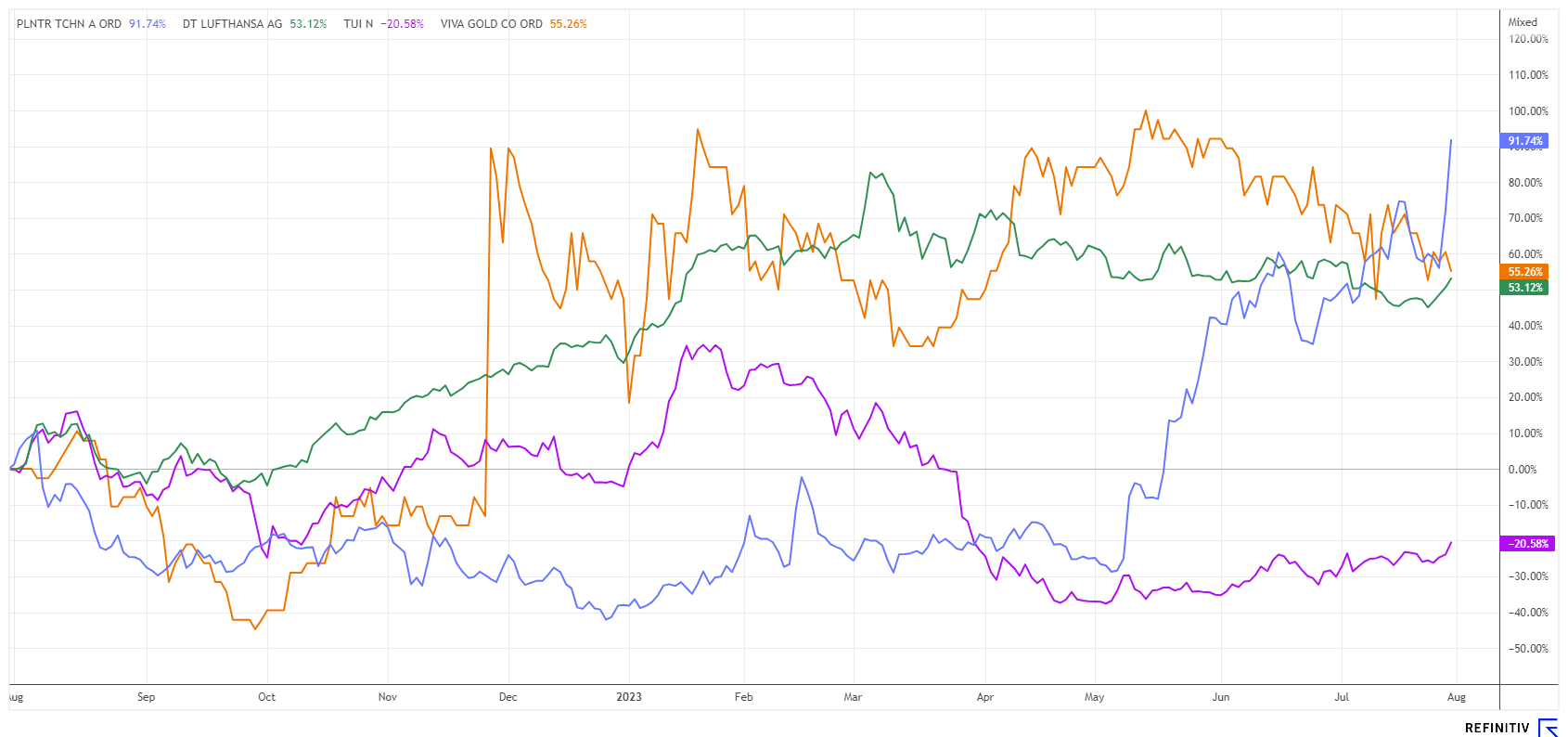

Artificial Intelligence - Now it is really taking off! Palantir, Lufthansa, TUI, Viva Gold - These shares are on the rise!

After extensive climate blockades at the airports in Hamburg, Düsseldorf and Munich, the environment minister of the Green Party, Robert Habeck, also spoke out: "The activists, who are now obstructing people from traveling on vacation, are doing massive damage to the cause of climate protection." Quite right! They also significantly disrupt traffic and cause considerable economic costs due to delays and cancellations. This could soon come to an end as the affected airport operators are filing criminal complaints. If real sanctions with imprisonment are finally imposed, the issue could be effectively addressed, and the government can demonstrate its ability to act anew. After all, many citizens now have doubts about the implementation of important public objectives, for which an expensive state apparatus is now responsible. What should investors pay attention to?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , LUFTHANSA AG VNA O.N. | DE0008232125 , TUI AG NA O.N. | DE000TUAG505 , VIVA GOLD CORP. | CA92852M1077

Table of contents:

"[...] One focus will be on deposits near the surface. These would be good arguments for a quick production decision using the low-cost heap leaching method. [...]" Brodie Sutherland, CEO, Tocvan Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir - Artificial Intelligence for Peacekeeping

Some companies have taken it upon themselves to support states in their security and freedom efforts. Artificial Intelligence (AI) is increasingly being used in this effort. After all, as with all data-related services, intelligent analysis systems can be useful in intelligence and compressing important data. Whether used for counterterrorism, against drug trafficking or other undesirable facts, artificial intelligence (AI) can analyze, compress and evaluate regularly occurring actions. The bottom line is to recommend courses of action for decision-makers who rely on "Big Data" in difficult situations to back up their actions with statistics or to legitimize them, if necessary.

The US company Palantir Technologies manufactures the "Gotham" software. The description of this database and investigation software sounds as plausible as it does dangerous. The software solution is capable of structuring and analyzing vast amounts of data, working out connections and visualizing them according to specifications. For authorities, it marks a turning point in investigative activities. Palantir's technology ranks right behind Microsoft and Nvidia in the relevance of new systems.

Meanwhile, the US government, the Ukrainian military leadership and several civilian corporations also rely on the clout of the Californian data analysts. No wonder the stock is going through the roof in 2023, as current fields of application are shooting out of the ground every day.

Nevertheless, the experts at Refinitiv Eikon have little confidence in the stock over the next 12 months. The consensus price target is USD 11.50 - only Wedbush Securities sets the mark at USD 25. Caution: The Palantir share has more than tripled since the beginning of the year from USD 6 to over USD 19. Profit-taking could also be stronger at times.

Viva Gold - Good drill results in Nevada

Gold has always been a proven means of transferring created value into a new order in uncertain times of geopolitical upheavals. In the two World Wars, it played a unique role in financing states. In the first quarter of 2023, Singapore and China stand out in the gold market with 68.7 and 57.9 tons of new acquisitions, respectively. Turkey also increased its holdings by 30.2 tons, while the aggressor Russia and the states of Uzbekistan and Kazakhstan have sold between 6.2 and 19.6 tons. Such is the balance sheet of the central banks.

Naturally, there is also a particular demand for gold reserves under the ground. Here, the charm lies in the future availability, which can be drawn when it becomes necessary. The gold price had consolidated neatly in recent months and is now back at USD 1,950, just below the USD 2,000 mark. Profitable mines are currently producing in the USD 950 to USD 1100 range. The top-positioned Canadian explorer Viva Gold owns a 4,250-hectare property in Nevada. It is located within the historically known Walker Lane, where Kinross, Coeur Mining, Augusta and Centerra also operate.

The Tonopah project has a positive preliminary economic assessment that allows for potential open pit mining with gold recovery by heap leaching and a pit-inferred measured and indicated resource of 394,000 ounces at 0.78 grams gold (AU)/tonne. An additional 206,000 ounces are indicated in an inferred resource at 0.87 grams AU/tonne. Recent drilling returned mineralization of 1.9 grams over a length of 59 meters. Management will continue work and expects further good results. Viva Gold has issued 106.7 million shares, giving a market value of just CAD 16 million at CAD 0.15. Management owns 2.3%. Other large investors account for 57% of the shares outstanding. The value is well positioned in the market and is not expensive for the reported reserves.

TUI and Lufthansa - The peak holiday season is cheerful

The two travel and tourism companies, Lufthansa and TUI, have really got going. After extensive state aid to cope with the Corona burdens, both have now settled their debts. Analytically, of course, the companies are in different positions.

When looking at TUI's balance sheet, substantial total liabilities of EUR 13 billion still stand out. Equity climbed back above EUR 560 million in 2022 after a temporary minus. The recent capital increase happened at an all-time low but sent the stock up successfully afterwards. After all, analysts believe that the Hanover-based company will again post profits in the region of EUR 0.77 per share. This puts the P/E ratio at a low 8.5 for 2023, and earnings per share are expected to reach EUR 1.26 in 2025. Presumably, the subscription price of the last capital increase marked the end of the dark chapter for the travel giant. The chart also appears promising, especially if the EUR 7.00 mark is held. Analysts on Refinitiv Eikon still trust the TUI share with a 12-month rise of 30% to EUR 9.25.

In the case of Lufthansa, 19 out of 21 analysts are positive and set the expected value at EUR 12.25. With expected earnings per share of EUR 1.30 and 1.58 for 2023 and 2025, respectively, the P/E ratios are 7.1 and 5.8. The aviation group has only about EUR 5 billion in debt and generates nearly EUR 40 billion in revenue, about twice as much as TUI. Those who want to be invested in the sector therefore tend to take the standard stock and sleep more soundly. But both companies will have to show in 2023/24 that they can also recoup the 30-40% higher prices from their clientele. The catch-up demand from the pandemic will not last forever.

The stock markets are bullish on a daily basis. Meanwhile, central banks are expected to consider interest rate cuts again soon. The inflation figures give hope, yet capital market interest rates remain high. A balanced portfolio can contain technology stocks that are in demand on all sides, such as Palantir, but this stock is analytically expensive. TUI, Lufthansa and Viva Gold currently appear favorable in the current environment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.