April 27th, 2023 | 09:00 CEST

Artificial intelligence is the new gold - TUI, Lufthansa and Star Navigation Systems with 100% chance!

The world of flight and travel is in a state of upheaval as artificial intelligence enters the decision-making world of humans. Quite unconsciously, various recommendations are creeping into the email boxes of citizens based on the usage behavior derived from Big Data collected over the past months or even years. The well-known IT giants collect data from our consumption and payment habits, analyze websites visited and build targeted advertising in the background, which wanders across our screens quasi "at random" in all situations in life. Although no one is really surprised here any more, 30% of our purchasing behaviour now comes from the Big Data machinery. Some stocks are making a name for themselves here.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , LUFTHANSA AG VNA O.N. | DE0008232125 , STAR NAVIGATION SYS GRP | CA8551571034

Table of contents:

"[...] In addition to campsite fees, Pathfinder Ventures has put itself in a position to offer all of these sought-after camping solutions. The only thing they don't sell is the RV itself. [...]" Joe Bleackley, CEO, Pathfinder Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Star Navigation Systems - Flight safety and surveillance rethought

Canadian company Star Navigation Systems Ltd. has taken on the challenges of the modern aviation industry. Real-time position and movement data have become the standard in air traffic control today, and they are also constantly evolving to meet military requirements. An important support tool here is the exploitation of Big Data and artificial intelligence. Because many events are reproducible, their appearance resembles certain patterns from the past. A sound analysis system can predict and anticipate certain actions of pilots or road users with a high degree of probability. This shortens reaction times when things get dicey in the sky, and other systems fail due to their outdated standard.

The In-Flight Safety Monitoring System (STAR-ISMS) is the heart of the STAR-A.D.S.® System. It provides real-time tracking capabilities, performance trending and probability-based incident prediction. It thus actively enhances flight safety and makes airlines' fleet management much easier and cheaper. Competition in the air has returned in full force since the COVID measures ended, forcing operators to control costs and margins strictly. The more data available, the better their analysis. In its Military & Defence division, Star Navigation also develops high-sensitivity, high-performance, mission-critical flat-panel displays for air defence cockpits and commercial aviation worldwide.

Following the recent stock exchange listing in Frankfurt, Interim CEO Anoop Brar said, "We have an ecosystem of hardware and software solutions that can modernize and optimize the aviation industry. It is ready for a modern, connected aircraft and is looking to Star Navigation as a partner for digital transformation." The sales performance in recent months has been outstanding, especially in Africa. Many letters of intent could drive sales up dramatically in the near future. The stock is trading at about CAD 0.04 in Canada, valuing the Company at about CAD 37.8 million. Highly interesting!

Lufthansa - Customer analyses steer the offer

Big Data is also a big topic at Lufthansa. In its Industry Solutions division, extensive data analyses and personalized offers help to increase customer loyalty and streamline billing processes. Digitization has been taking hold at the Frankfurt-based airline for a good ten years now. It has dramatically simplified many booking and ticketing processes, baggage acceptance, and tracking. Checking in on the website now takes about only 5 minutes, and pre-registered baggage is checked in at the electronic terminal within 2 minutes.

For airlines, a high degree of digitalization is essential to survive the cost war in the air. After all, customers' travel budgets are suffering from high inflation, and the flight experience is gradually becoming a luxury item. Big Data, artificial intelligence (AI) and machine learning form the basis for new opportunities. With these, airlines can significantly improve their value creation. However, the revolution is sweeping through all industries. In Germany, many companies are already achieving initial successes with AI, for example, by reducing business risks or tailoring products more individually to their customers. The potential of Big Data is becoming evident through the increasing use of machine learning processes.

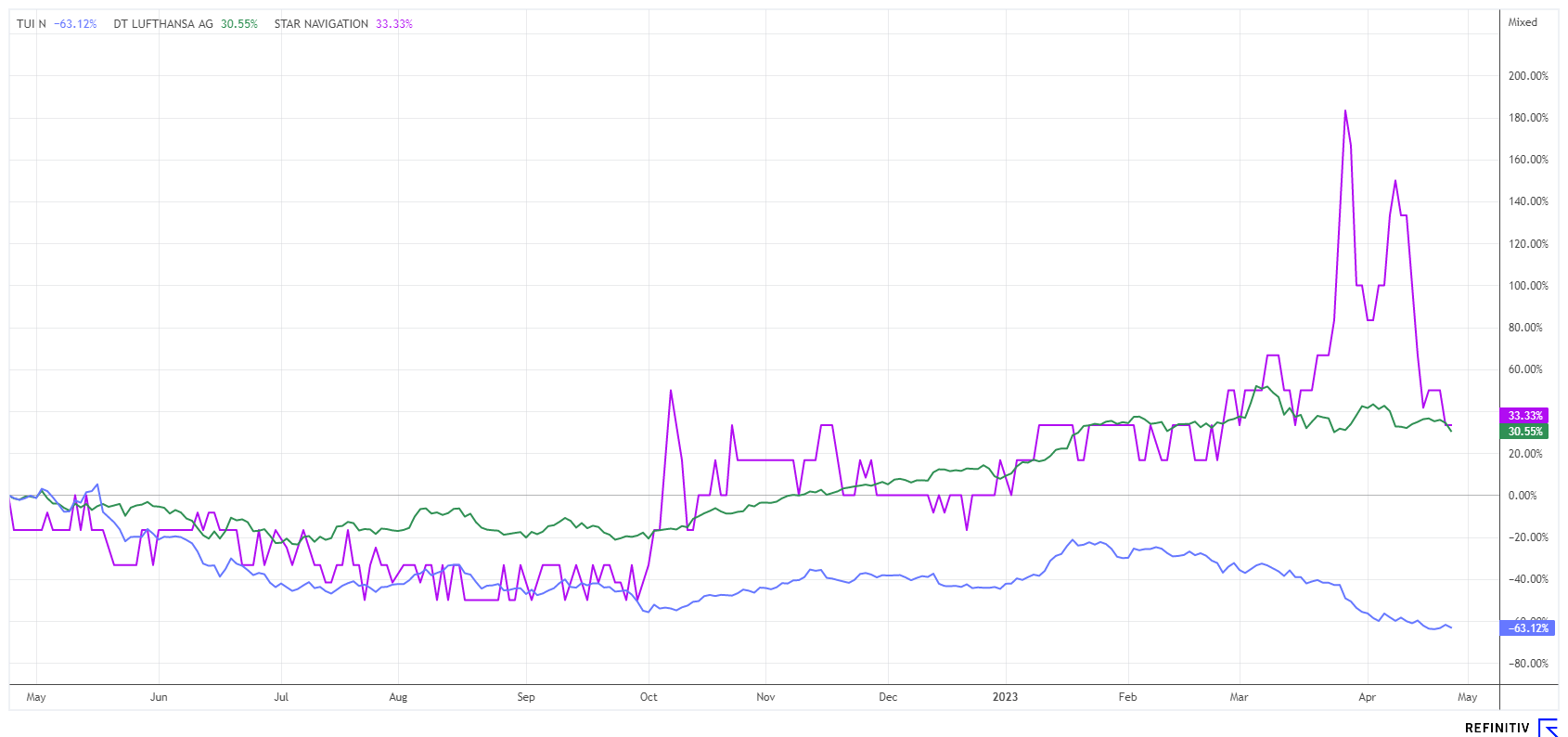

The Lufthansa share got off to a good start in the first quarter of 2023 and is up a full 33% in the 12-month view. A brief upward excursion delivered new highs above EUR 11, and the share price is currently consolidating slightly at EUR 9.4. From a chart perspective, everything is fine above EUR 8.50. Q1 figures are due on May 3, and the annual general meeting is on May 9. With a market capitalization of EUR 11.7 billion, the LHA share is valued at only 0.3 times the expected turnover of EUR 37.7 billion. In our opinion, this is disproportionately cheap.

TUI - There have been better capital increases

The last "emergency capital increase" at TUI will go down in the history books as a disappointment because, despite a growing desire to travel after the Corona break, the share price of the tourism group is once again taking a beating. The group only wants to settle its state aid, but the stock exchange sees further risks and sets the price at a new low for the year of EUR 5.70. During the 3-week subscription period, the subscription right had even collapsed from an initial EUR 7 to EUR 0.58 on the last day. Banks subscribed to the remainders only with significant price discounts in a so-called rump placement.

With the issue of around 329 million new shares, TUI nevertheless raised EUR 1.8 billion as planned. However, the Hanover-based company has now burned through 90% of its capitalization in the last 5 years, as the chart, adjusted for all capital measures, shows a high of around EUR 58. The current number of shares is about 650 million, which puts the market value at EUR 3.82 billion. Unfortunately, liabilities of around EUR 10 billion still lie dormant on the balance sheet. One crux of the capital raising this time was the exclusion of the long-standing major shareholder Alexei Mordashov, who, before the capital increase, could still call a little more than 30% his own from a family basis. The Russian oligarch had played a major role in many capital measures in the past and thus also contributed to saving the Company during the pandemic. As a result of the completed capital increase, the share of the Russian investor is now significantly lower.

On the platform Refinitiv Eikon, one can find 9 investment opinions on the TUI share. Only 3 are in the "buy" range - but the calculated average of all price targets still shows a high EUR 9.11. The share remains a gambler's stock on a recovering travel market, which, however, will probably continue to stumble with the declining household budgets of the citizens after certain catch-up effects.

"Know Your Customer" is the buzzword of management consultants when it comes to the efficiency of customer relations and their best possible utilization. Artificial intelligence is slowly creeping into all planning tools and will likely become an indispensable digital control centre in five years at the latest. Star Navigation and Lufthansa are at the forefront, and if TUI can handle the investments, it will also lead to rising margins here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.