September 26th, 2023 | 07:45 CEST

Artificial Intelligence in Sellout! Nvidia, Defense Metals, ARM Holdings - Nothing works without rare earths!

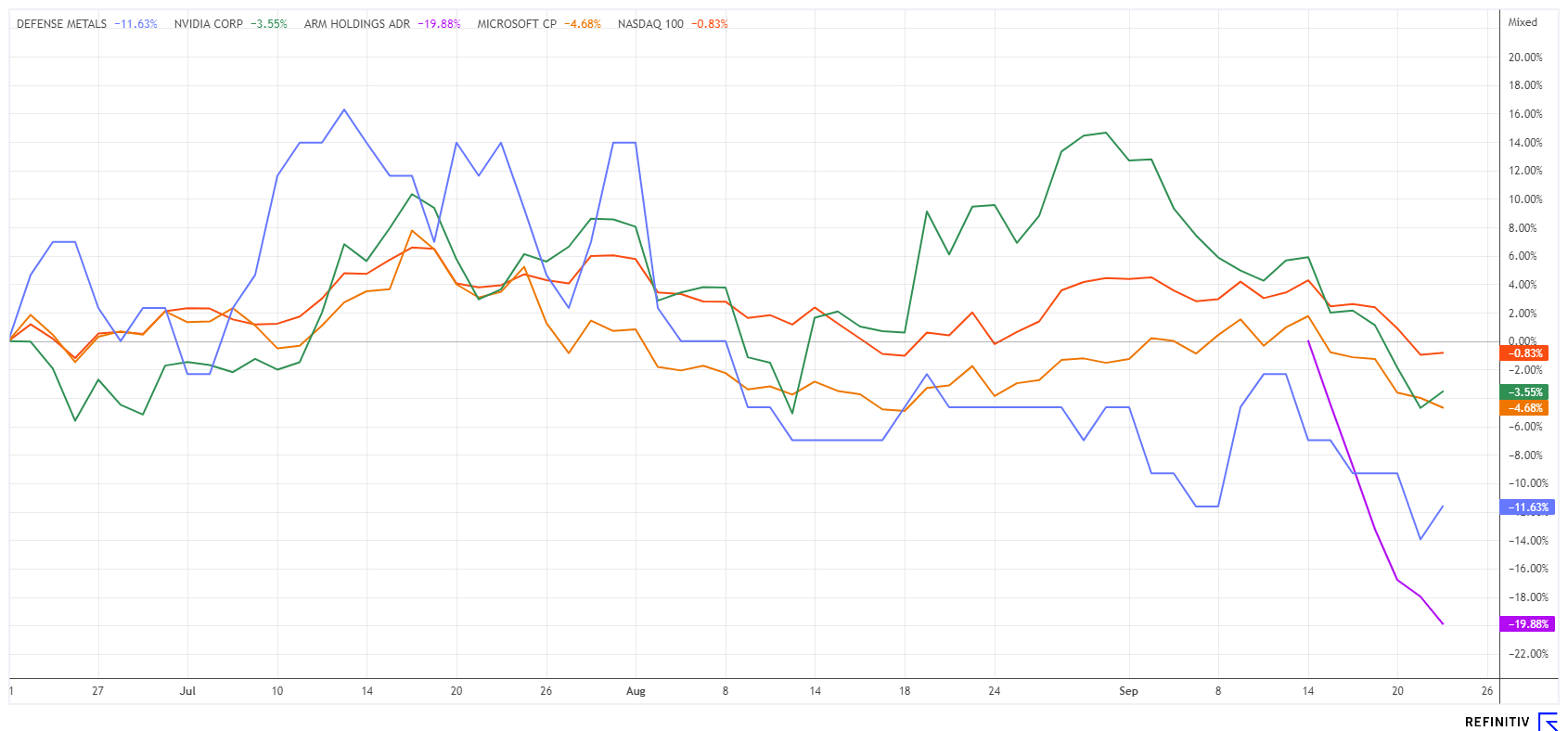

After long bull market movements, the stock market usually tends to rotate sectors, or the market enters a general consolidation. In the former case, investors can profit by reallocating their assets while exploring new investment opportunities. In the latter case, all stocks come down, and the capital market generally suffers from a change in sentiment and corrects recently exaggerated valuations. In the case of the new megatrend of Artificial Intelligence (AI), the stock market seems to sense a great need for correction. As if by magic, the blockbuster stock Nvidia rose by 250% in just 9 months. However, it has already retraced nearly 20% from its peak. Where do the opportunities lie for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , DEFENSE METALS CORP. | CA2446331035 , ARM HOLDINGS PLC ADR | US0420682058

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nvidia - The AI ecosystem is growing steadily

Many investors would have imagined differently. In a May analyst conference, Nvidia announced a doubling of its revenue in 2023. Whether one believes the outlook or not, experts had no choice but to set the price target for NVDA shares upwards due to the massive conciseness of the figures presented; currently, the mean value of all estimates is USD 616.

Strategically, the AI and chip giant also made an announcement last week. They revealed a partnership with one of the largest Indian IT companies, Infosys. With 230,000 employees and a turnover of over USD 12 billion, this partnership is on equal footing. The two companies have announced plans to collaborate in areas such as generative AI technologies and training. The technological foundation of the collaboration is the Nvidia AI Enterprise ecosystem., which utilizes specialized frameworks and toolkits like Nvidia NeMo, Nvidia Metropolis, and Nvidia Riva. The technology partnership is expected to make it easier for companies to implement generative AI applications in various industries.

According to the Refinitiv Eikon platform, Nvidia's revenue is expected to increase by more than 100% in the current fiscal year, from USD 26.9 billion to USD 54.6 billion. The reason for this is the AI "data center" segment. On the earnings side, there is an expected jump in earnings per share from USD 3.34 to USD 10.76. By 2026, this is expected to grow to just under USD 20. With a current P/E ratio of 37 and a price-to-sales ratio of 25, the NVDA stock is expensive but always worth a look because of its wide attention. After hitting a high of USD 502 exactly one month ago, the stock has already dropped by USD 90 from the top. Perhaps the trillion-dollar stock will consolidate a bit further. Keep watch!

Defense Metals - Strategic metals form the basis for all high-tech products

Strategic metals is a collective term for commodities of the technology metals and rare earths. They are called strategic because these materials play an increasingly important role in the implementation of political and social developments for many reasons. They are indispensable for the energy transition but also essential to meet the growing demand for technology products such as high-performance PCs, fiber optic cables, touch screens and LED lighting. Rare earths are particularly problematic; over 80% are mined and processed in China. The Western world's dependence on Beijing is currently a top issue for all sustainably-minded governments. Germany alone imported around 250 tons of REE concentrates in 2022.

At the rare earth explorer Defense Metals (DEFN) from Canada, there is new data from the 4,262-hectare Wicheeda Rare Earth project. A test plant has been there for a year, and a preliminary feasibility study has been commissioned. In accordance with NI 43-101, there is now an updated mineral resource estimate (MRE 2023). 6.4 million tons averaging 2.86% total rare earth oxides were recorded, and an indicated and suspected mineral resource of 27.8 million tonnes averaging 1.84% TREO and 11.1 million tonnes averaging 1.02% TREO in soil were determined, respectively. All metals can be mined at a cut-off grade of 0.5% TREO using a conceptual open pit mining method. The 2023 MRE represents a 17% increase in TREO based on contained metals or a 31% tonnage increase over the previous 2021 MRE. So, a significant tonnage increase in the resources in the property.

Excellent news for Defense Metals, the stock showed a 7% price jump to CAD 0.195. The entire Wicheeda project is currently valued at around CAD 50 million. Considering the strategic value, a multiple could be paid in a few years by a larger mine operator. Due to the partly very low valuations, there have already been eye-catching M&A transactions in the resource sector in recent months.

ARM Holdings - Cashed out and Sold off

Japanese technology investor SoftBank could not have timed its move better. Right at the peak of the AI hype in August, it decided on the NASDAQ IPO of its largest holding, ARM Holdings plc. The issue price for the shares was set at the high end of the range of USD 47 to USD 51. In the process, the UK-based company placed at least 95.5 million ADR shares out of 1.03 billion shares, marking the milestone for the largest IPO in 2023 with a valuation of about USD 54.5 billion at launch.

However, SoftBank, the investment company owned by Masayoshi Son, remains the main shareholder with around 90% of the shares. SoftBank acquired ARM in 2016 for about USD 32 billion and subsequently delisted it, so the stock is not really a newcomer. The British company develops special microprocessors for smartphones, which are installed in around 97% of popular models. After strong growth until 2021/22, sales stagnated at USD 2.68 billion in fiscal year 2022/23. However, adjusted EBIT increased by over 7% to USD 783 million, representing a high operating margin of 29%.

According to analysts on the Refinitiv Eikon platform, sales are expected to grow by 10 to 15% annually, and a surplus of USD 990 million is to be achieved in 2023/24. We are already familiar with a corresponding P/S ratio of 20 and a P/E ratio of 50 from Nvidia. It is no wonder that the value has already lost 20% in just 5 trading days. In addition to the first USD 5 billion from the subscription, we expect further sales from the main shareholder, SoftBank, and currently see few fundamental buying arguments in the valuation. **Courageous subscribers will still receive their allotment price back from the stock exchange. Therefore, do not wait too long; the selling pressure will continue.

Despite all valuation doubts, high-tech stocks remain hot commodities in the capital markets. For those looking to diversify, combining promising small-cap stocks alongside the major players is a good idea. With its Wicheeda project, the Defence Metals stock may not be too expensive as the fantasy lies in securing raw material properties of strategic importance.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.