September 14th, 2023 | 09:05 CEST

Artificial Intelligence in practice? Nvidia, NorCom, Palantir - The next 100% with Big Data

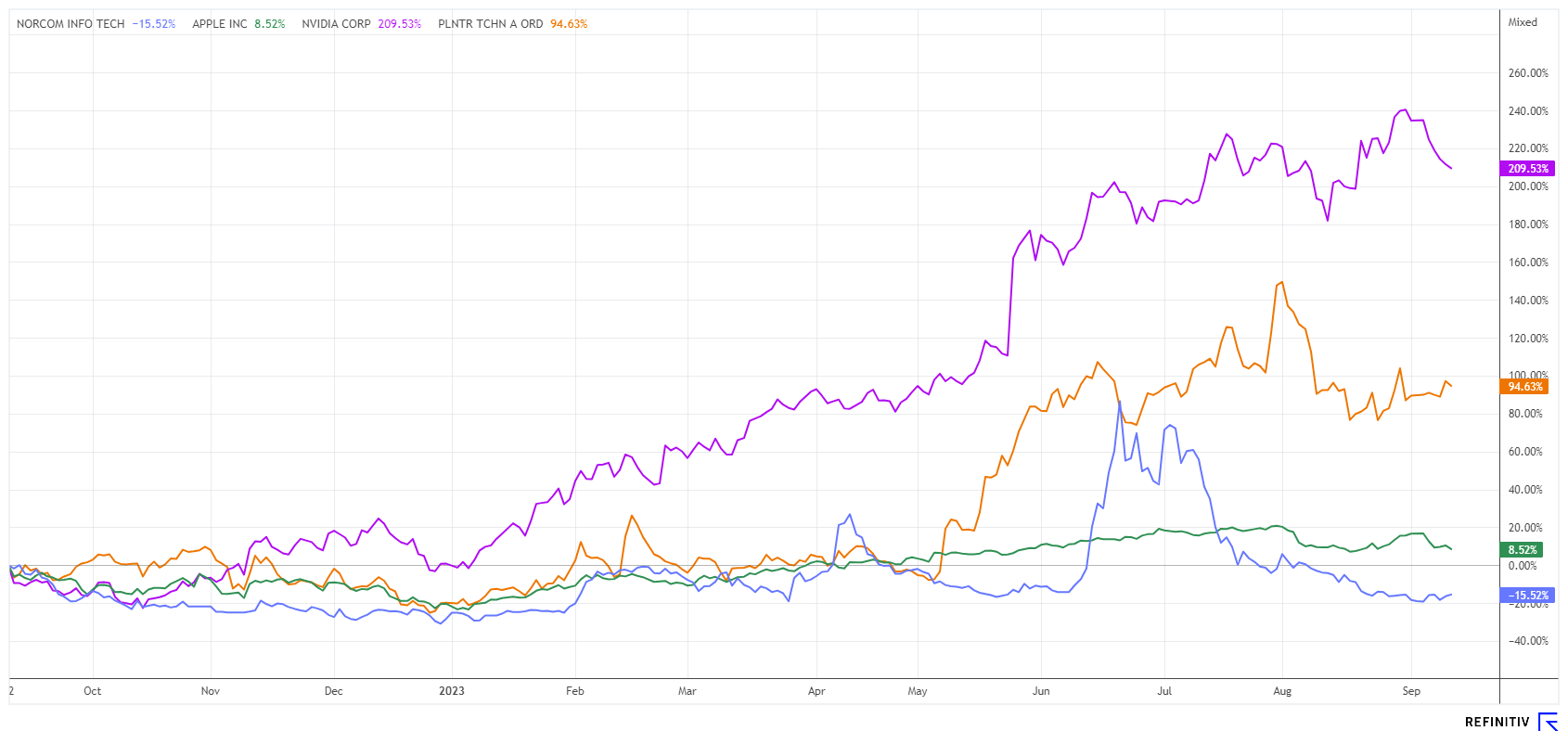

The stock market is not a one-way street. Investors are trying to ride the wave of "Artificial Intelligence" (AI), and corresponding stocks such as C3.ai, Nvidia, Microsoft, or Palantir are performing well in 2023. A new megatrend is underway here, which, according to experts, will continue for several years. However, because of the high valuations in the entire sector, it is worth taking an analytical look. After all, no one knows how long the AI boom will continue to generate decent returns on the stock market. Opportunity-rich stocks still exist in the second and third tier. We are taking a closer look.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , NORCOM INF.TECHN. INH ON | DE000A12UP37 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nvidia - Can the AI high-flyer double its sales in 2023?

After Nvidia rose to over USD 500 by the end of August, the valuation of the popular AI stock quickly reached the trillion-dollar mark. This makes the chip and data specialist another "Trillion Dollar Club" member, which was formed in 2019 by the fabulous rise of Apple stock. In the meantime, even Tesla was part of the group, but the share lost more than 65% of its value at the end of 2022 and had to say goodbye to the elite club. Currently, in addition to Apple and Nvidia, Microsoft, Amazon, and Alphabet are still in the running.

Nividia has quadrupled in valuation at its peak since mid-2022. The inclined observer may wonder what has led to this enormous increase in value. Artificial Intelligence applications require a huge data analysis platform. Nvidia can provide that. The surprising explosion in demand in the data center segment hit the market like a bomb because it is precisely this business that is likely to grow even faster in the future due to the AI boom. But other or adjacent technologies could also bring about a paradigm shift in the future. For example, the IOT applications of smart home, machine learning or automated driving are coming to the fore. Recently, however, rumors have been accumulating that large investors in Nvidia are also said to have contributed to the growth in sales with corresponding orders. More transparency will likely come on the scene in the coming months.

The share is currently consolidating at a high level and has already moved down by 10%. With a price-to-sales ratio of 25, the Company is anything but cheap. There are 52 ratings on the stock on the Refinitiv Eikon platform, including only one negative rating. The median 12-month price target is a hefty USD 614, almost 30% above yesterday's price. The high valuation is based on the assumption that Nvidia can more than double its sales in the current year from EUR 26.5 billion to EUR 54.4 billion. **Buy arguments exist very well in the long-term view, but investors should exercise caution in the short term.

NorCom - AI Integration and Data Retrieval made easy

With a market capitalization of EUR 13 million, the German company NorCom is a comparatively small technology company. NorCom offers technological solutions for issues which today present enormous challenges to almost all large corporations as well as public administrations: Working quickly and securely with large volumes of data, exchanging it and "information governance". By and large, every company is concerned with legally compliant data lifecycle management. **In recent years, the use of artificial intelligence and data analytics for the rapid search and retrieval of information has come into play. The Munich-based software house sees its primary competence in asset-based consulting, i.e. the integration and creation of a reliable IT structure in a wide variety of application areas. In doing so, the Company works primarily within self-developed software frameworks or in open-source projects.

The largest customer has been the Federal Employment Office in Nuremberg for exactly 20 years, and the Company is also on board with the Federal Audit Office and the Mercedes Group. Since 2017, the Company's revenue has been in the range of EUR 9 to 12 million. The areas of AI services and operations play an important role, and this is also where the Company sees the greatest growth opportunities for the coming years. NorCom's proprietary platform, DaSense, maps the entire data structure of the company and has extensive data search and analysis tools. DaSense allows the use of AI applications such as ChatGPT or Dolly. In documents, it is possible to search for all metadata, duplicates, language, and text components that are recognized, even if the templates are already decades old. An attractive USP is that new documents from the history can be easily and quickly regenerated, and results generated by AI are verified by the user and fed back. Another application area is the creation and maintenance of a company's own specialist language.

NorCom enables its customers to use artificial intelligence productively in their everyday work and to automate tedious and time-consuming tasks. The proprietary platform enables data exchange with third parties and ensures optimal data protection. In the administration and autonomous driving research sectors, for example, the data analytics revolution has only just begun, and NorCom is ideally positioned for this. **In terms of the chart, the share price is in a highly interesting zone at EUR 6.65 following a major consolidation. Collect!

Palantir - Caution at the platform edge

Palantir Technologies Inc. is a US provider of software and services specializing in the analysis of large amounts of data. In addition to Big Data, however, the investment community has recently been interested in the secret algorithms with which the Company sifts through large amounts of data and can even provide military bodies with instructions for action. Founded in 2004, Palantir's first customers included federal agencies such as the US Intelligence Community (USIC). Governments have since commissioned Palantir to conduct scientific analyses of observable behaviors in the population, trends in society, or geopolitical developments for use in decision-making processes. Important here are analogies and movement patterns, which can be excellently evaluated with big data and even predicted for the future. AI systems read and learn simultaneously and constantly improve their own algorithm. Like NorCom, Palantir can generate solid and valuable partnerships for companies. In cooperation with the Ukrainian Armed Forces, Palantir will contribute to the exchange of data and experience that will support the implementation of world-leading technologies.

Plantir is one of the best-performing stocks in the Nasdaq 100 index, up 140% year-to-date. With a market cap of USD 34 billion, expected revenues in 2024 of approximately USD 2.6 billion are valued at a factor of 13, and the current P/E ratio is just under 70. **From a chart perspective, the share price must first rise above EUR 18 to generate new buy signals. It is better to stay on the sidelines at the moment!

**The price fantasy on the NASDAQ is primarily fueled by high-tech and AI stocks. Since leaving the downward trend at the beginning of 2023, the index has already gained over 40%. Nvidia and Palantir shone with returns between 100 and 200%. The relatively unknown NorCom is in the same sector and could really take off in the current year.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.