February 19th, 2025 | 07:00 CET

Defense and critical metals – the pressure is rising! Where are Rheinmetall, Renk, Hensoldt, and XXIX Metal headed?

Since August 2023, the Chinese government has continuously issued export control measures for high-tech metals that are important for the semiconductor industry and green technologies. The sharp rise in energy commodities is hindering electrification projects. Copper is indispensable for these projects and will become one of the key raw materials in the coming years, around which innovations revolve. The red metal is an essential component of a completely new energy infrastructure, and trends such as Web 3.0, high-performance computing, cloud computing, and artificial intelligence are exacerbating the scarcity situation. The tech giants, worth billions, want to invest because they need the infrastructure for their business. In Europe, the defense industry is on the verge of reaching new all-time highs. A closer look is required.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005 , XXIX Metal Corp. | CA9013201012

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Armaments in focus – The security conference speaks volumes

At the Munich Security Conference, which took place from February 14 to 16, NATO's armaments plans were the focus of intensive discussions. Given Russia's ongoing war of aggression in Ukraine and a change in US foreign policy under President Donald Trump, European states are facing the challenge of significantly increasing their defense spending, because the US withdrawal from European security concerns is forcing the community to take its security into its own hands. The need for increased defense spending poses significant financial challenges for European countries. Proposals such as the introduction of an "armament bank" by EU and NATO members or the relaxation of debt rules are being discussed to secure the financial resources for defense. European leaders expressed concern, while Latvian President Edgars Rinkēvičs compared the transatlantic relationship to couples therapy. Other European leaders emphasized that Europe must chart its own course.

Rheinmetall, Renk, and Hensoldt – Defense Made in Germany

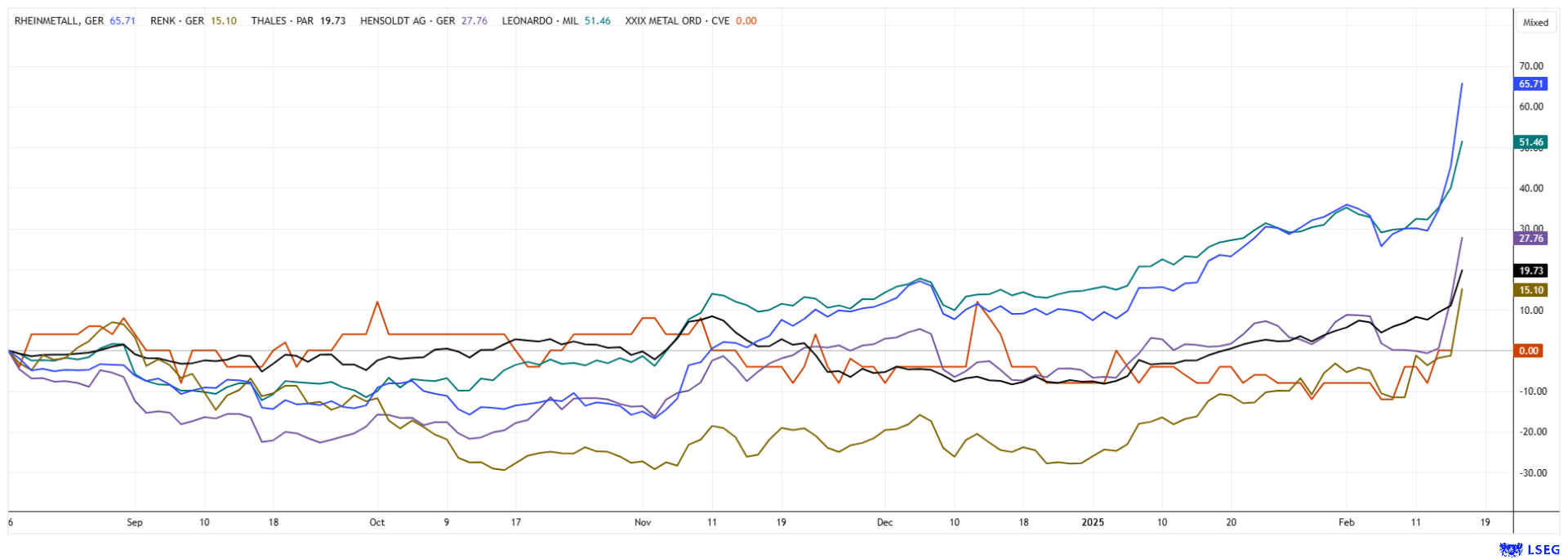

Under these conditions, defense industry stocks have been unstoppable since the beginning of the week. Rheinmetall, with a new high, is closely followed by the second-tier stocks, such as Renk or Hensoldt. Investors are not thinking about valuations at the moment because the strong momentum is proving them right. The prospect of a political turnaround in Germany towards more growth and future investments is also making hearts race.

It is worth taking a quick look at the LSEG analysis system to understand the valuation ratios of the stocks. After all, the three protagonists are involved in the distribution of the defense budget to varying degrees. Rheinmetall has the highest defense share, with 70% of its revenue coming from this sector, while the others are between 20 and 40%. For Rheinmetall, revenue estimates predict an increase from around EUR 9.9 billion in 2024 to over EUR 20 billion in 2027. The current P/E ratio of 41 could fall to around 16.5 due to the expected increase in profits. The price-to-sales ratio is currently 3.5 – which can be described as favorable compared to Renk and Hensoldt, especially since Rheinmetall is twice as strong as its industry competitors.

A similar picture from a chart perspective. While Renk has not yet quite reached its March 2024 high of around EUR 37, Rheinmetall and Hensoldt are in uncharted territory. From a European perspective, NATO will not be able to avoid these stocks, as ammunition, electronic defense systems, and specialized gearboxes will be needed if the armies are to be modernized accordingly. The road to revaluation could, therefore, be longer than expected. It is best to hedge long positions with trailing stops; a short strategy currently seems less promising.

XXIX Metal – The potential is huge

Investing in the defense industry also places the investor in the copper market. Ammunition, housings, and printed circuit boards contain plenty of the red metal. So, in addition to the flourishing high-tech and AI industries, further demand can be expected in the copper market. A key indicator of the current shortage is the rebounding copper price, which, after months of consolidation, has recently set its sights on the USD 10,000 mark.

Copper has been mined on a large scale in the Canadian government districts of Quebec and Ontario for a long time. The copper mining complex "Opemiska", a former high-grade copper producer in Quebec with a property size of over 13,000 hectares, is located in the middle of active mines belonging to the mining giants Vale and Glencore. The most recent resource estimate showed a substantial 2.1 billion pounds of copper equivalent in measured and indicated resources. The property is owned by XXIX Metal. CEO Stephen Stewart has his eye not only on his main project, "Opemiska", in the Chibougamau District, but also on another copper project called "Thierry" in Ontario.

The current news relates to Opemiska. XXIX Metal Corp. has planned a 20-hole drilling program in the so-called Saddle Zone. This program is expected to build on the 2024 mineral resource estimate, which consists of copper, gold, and silver mineralization. This drilling aims to expand and further increase the high-grade mineralization. The new drilling data should be incorporated into the Opemiska resource model ahead of the PEA. In addition, XXIX Metal has completed an extensive data validation and reinterpretation process for the Thierry project. These efforts resulted in a modern, consolidated geological model for the K1 deposit, which is estimated to contain 53.6 million tons grading 0.38% copper, 0.10% nickel, 0.03 g/t gold, 0.05 g/t platinum, 0.14 g/t palladium, and 1.8 g/t silver. XXIX Metal Corp. aims to fully unlock the asset's value through timely updates, and the markets will likely be eager!

XXIX Metal shares are actively traded in Canada and Frankfurt. A total of 258.8 million shares have been issued, bringing the market capitalization to around CAD 31.1 million. This makes XXIX Metal no small explorer, and the current copper rally should give the share price a decent boost again after the recent consolidation.

**Overall, the Munich Security Conference highlighted the urgent need for Europe to rethink its defense strategy in order to meet the current security challenges of the international community. Defense stocks are benefiting greatly from this, but the scarcity of raw materials can act as a brake on the necessary investments. With its properties in Quebec and Ontario, commodity explorer XXIX Metal is ideally positioned for the future.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.