March 13th, 2023 | 13:12 CET

Armaments and e-mobility! Rheinmetall, Almonty Industries, Mercedes-Benz - Rare raw materials in demand as never before!

The climate and energy transition are taking their toll. Long approval phases, too little exploration and a lack of investment capital have caused the supply of raw materials to decline over the past 10 years. These deficits are increasingly showing up as a problem for industry. In copper alone, there is a USD 100 billion investment deficit. In the EU, it is estimated that there is an investment backlog of EUR 300 billion to even come close to achieving the proclaimed climate targets. To reach climate targets, copper, nickel, lithium, zinc, special metals like tungsten, and rare earths are needed. Which values should you bet on now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203981034 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall - Reconnaissance systems for Ukraine

The technology group Rheinmetall is an important buyer of industrial metals of all kinds. The Düsseldorf-based company is already involved in supporting Ukraine through several activities. Now it is supplying automated reconnaissance systems to Ukraine on behalf of the German government. The main purpose of these systems is to monitor sections of terrain with as few personnel as possible. Rheinmetall is cooperating on the project with the Estonian company DefSecIntel. The contract is worth tens of millions of euros.

The SurveilSPIRE mobile surveillance towers from Estonian manufacturer DefSecIntel are loaded onto trailers and can be moved quickly to their deployment location. Setup requires only three people, and operation is automated. The system features 4G and Starlink radio links for video transmission to mobile headquarters. Solar panels enable sustainable operation without power cables or dependence on operating supplies. The system employs autopilot reconnaissance drones that can conduct patrol or mission flights - just one high-tech example from Rheinmetall's product list.

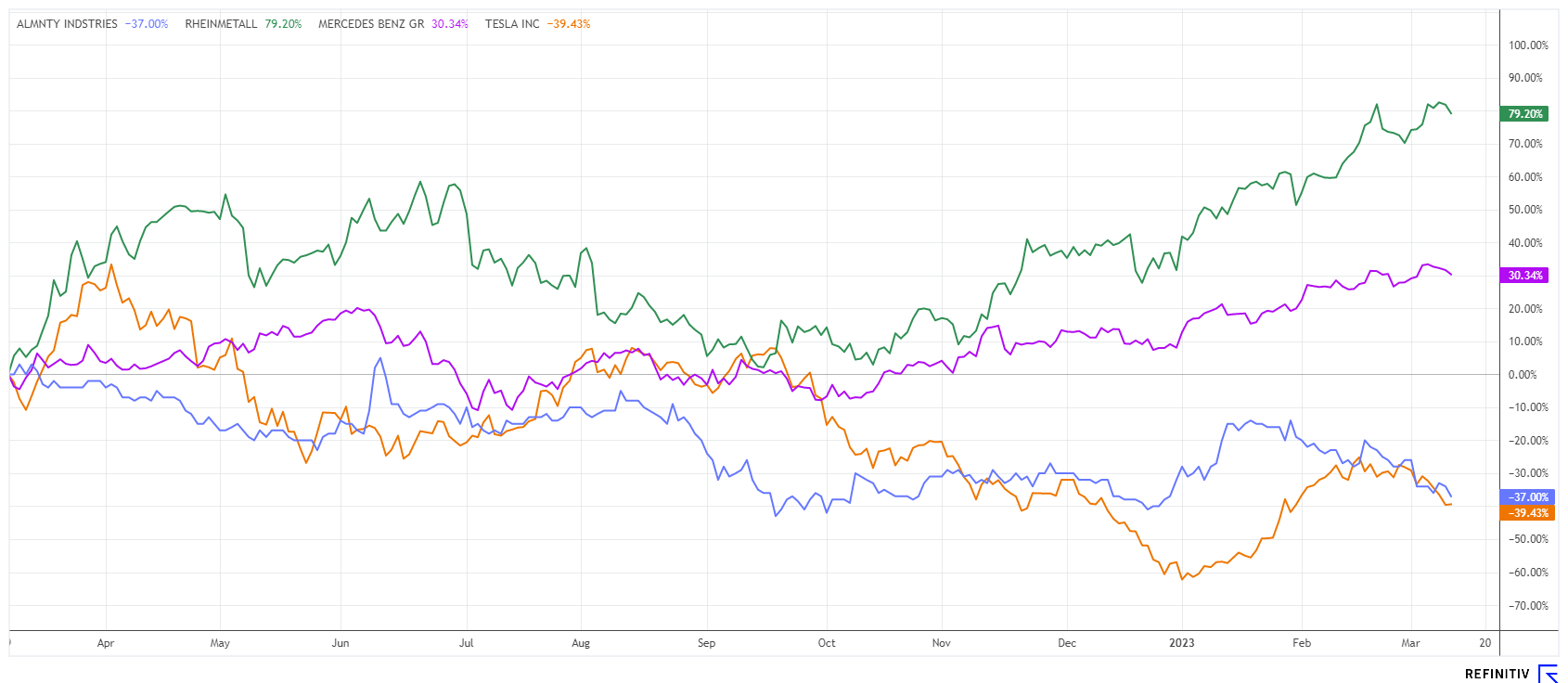

Rheinmetall shares are benefiting sustainably from the current flood of orders resulting from the West's renewed wave of rearmament in favour of Ukraine. Berenberg has left its "buy" recommendation with a price target of EUR 300, while DZ Bank sees a "buy" with 12-month price expectations at EUR 295. There is much potential for the MDAX title.

Almonty Industries - Tungsten production to start in 2023

Armaments and vehicles need the hardening metal, tungsten. It is a whitish metal of medium hardness, high density and strength, which is ductile in its pure state. At 3422 °C, it has the highest melting point of all chemical elements; at 5930 °C, it also has the highest boiling point. This makes tungsten essential in the production of more than 1,000 high-tech applications worldwide, and only a few people know that up to 1.5 kilograms of the rare metal are already used in e-mobility alongside lithium, graphite and copper.

Canadian explorer and producer Almonty Industries (AII) has already fully focused on this tight tungsten market with its 3 sites in Spain, Portugal and South Korea. The Company has acquired the know-how for the industrial extraction of tungsten through the Panasqueira mine in Portugal. Without experience, mining the rare metal is almost impossible. The operation in Portugal generated revenues of around CAD 18 million in the first 9 months of 2022, but from 2023/24, it will be significantly more. With the ongoing development of the Company's Sangdong mine in South Korea, world supply could shift by about 5% to a friendlier jurisdiction. That is where the sticking point is: tungsten is found in only a few parts of the world besides China and Russia.

Investments in infrastructure and the increasing mechanization of our lives are an accelerator for demand for the rare metal, which is why tungsten landed on the EU's list of strategic metals as early as 2020. Brussels wants to ensure that European industries have secure access to these metals by the end of 2025. Almonty's current share price (AII) in Canada is a low CAD 0.63, putting its market valuation at CAD 135 million. In addition, the debt capital (including from KfW) is being used to build the Sangdong mine. An update from Sphene Capital cited a target of CAD 1.66, and First Berlin previously also voted "buy" with a 12- to 24-month price expectation of CAD 1.70. Because of its critical relevance, Almonty Industries remains a hidden champion for 2023.

Mercedes-Benz - Now getting serious about e-mobility

After Mercedes-Benz announced far-reaching plans to build its own global fast charging network (HPC) in North America, Europe and China earlier this year, the Company is now giving more details. The buildup is scheduled to begin in Q4 2023 in the US as well as in the European countries of Germany and France, but the network will be comparatively small; the Company continues to rely on the involvement of public providers.

In the US, the first 20 charging parks, each with several charging points, are planned for this year; the number for Europe is not yet known. Management announced at the CES trade show that it would build its HPC network with more than 10,000 charging points. These are each to offer up to 350 kW of charging power and be open to the public but offer preferential access for Mercedes customers. For example, a 48H pre-booking can be made preferentially via a dedicated Mercedes charging app, which increases customer loyalty and creates additional usage incentives. Mercedes-Benz plans to invest a low single-digit billion amount over the next 3 years, but the Stuttgart-based company is not considering complete network coverage. There are currently 8 all-electric model series (EQ), with more to follow.

The Mercedes-Benz share is one of the high flyers in the DAX40. Since the low in July 2022, the share has risen from EUR 50.28 to over EUR 75. That is an increase of 50% in only 8 months. The current 2023 P/E ratio is 6.2, and the stock offers a generous 6.7% dividend. Analytically, the German premium manufacturer is undervalued by about 100% compared to Tesla.

Rare metals have become a critical resource with the current geopolitical changes. The EU is addressing the strategic issue of securing raw materials. Rheinmetall and Mercedes-Benz are currently performing well but are in a dependency situation and need secure supply chains. Almonty Industries will start production in 2023. The stock can currently be had very cheaply.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.