June 20th, 2024 | 06:30 CEST

Apple, Kraken Energy, Palantir - Network effect for market expansion, who is ahead?

Network effects play a decisive role for companies in securing and expanding market share. Apple is strengthening its consumer credit business through its partnership with Affirm. This will allow the Company to further expand its mobile payment solution in the US while it struggles with regulatory challenges in the EU. Kraken Energy is a US-based uranium exploration company strategically positioned in the global energy industry. With a focus on high-value projects such as the Apex Uranium Mine in Nevada, Kraken Energy is capitalizing on the increasing global demand for nuclear energy resources. Palantir, on the other hand, is actively expanding its business towards B2B customers, particularly through AI-driven data analysis. Which of the three companies is ahead in terms of network effects?

time to read: 6 minutes

|

Author:

Juliane Zielonka

ISIN:

APPLE INC. | US0378331005 , KRAKEN ENERGY CORP | CA50075X1024 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Apple relies on external credit partners instead of Apple Pay installments

Companies on the stock market use the so-called network effect to fend off or limit potential competitors. Apple is a master at retaining its customers and attracting new ones. With its intuitive iOS user interface, the Cupertino-based company creates a brand experience that makes it difficult to switch to another system. Anyone who has ever wanted to switch from an iPhone to an Android device will understand how unpleasant it can be when learned functions can no longer be used, as the Android smartphone responds to completely different commands. Apple offers various cloud services such as iCloud, iTunes and Apple Music, which are seamlessly integrated with the devices and software.

Apple is also continuing to expand in the financial sector. The tech giant has teamed up with the lending platform Affirm and will allow US users to apply for loans directly with Affirm when using Apple Pay. "By the end of the year, users worldwide will have access to installment loans offered through credit and debit cards and lenders when using Apple Pay," the Company said in a statement. The Company will also allow its Apple Pay users to redeem rewards and take advantage of "installment credit offers from eligible credit or debit cards" when they shop online or in an app using an iPhone or iPad.

This new credit offer replaces the Company's "buy now, pay later" system, which it introduced in the US just last year. Apple is thus outsourcing the credit component to an external partner and would do well to continue to wash its name in innocence.

The EU Commission in Brussels has just imposed a record fine of EUR 1.8 billion on the Company for anti-competitive practices in connection with music streaming services. According to the Financial Times, Apple has appealed against the fine. The Company is also the first technology company to face new charges under the EU's strict Digital Markets Act, which aims to promote competition in digital markets in Europe.

An agreement should help Apple avoid sanctions, such as a fine of up to 10% of the Company's annual global turnover. Under these conditions, Apple's revenue of USD 383 billion in 2023 would mean a fine of around USD 40 billion. Network effects for business growth are only good until states threaten to impose regulations.

Network effect in the uranium exploration industry: Kraken Energy focuses on strategic expansion and high-value projects

A network effect can also occur in sectors and areas where investors might not initially expect them. One example of a network effect is the US explorer Kraken Energy. Uranium exploration companies are part of a larger supply chain and industrial infrastructure that revolves around the extraction and processing of uranium. The US is the world leader in uranium utilization. In 2022, the United States was the world's largest consumer of uranium, with 18,050 metric tons of uranium. Uranium is best known as an energy source in nuclear power plants.

Kraken Energy has four high-grade uranium projects with significant potential, including the historic Apex Uranium Mine, which is responsible for more than 50% of Nevada's total uranium production. The region has high ore grades, with historical production values of up to approximately 0.25% U3O8. Surface samples have returned grades up to 3.19% U3O8 and 6.0% U3O8. The Apex Uranium Project covers 17.5 km of strike length along a mineralized trend. These projects are located in prime mining regions in the US states of Nevada and Utah.

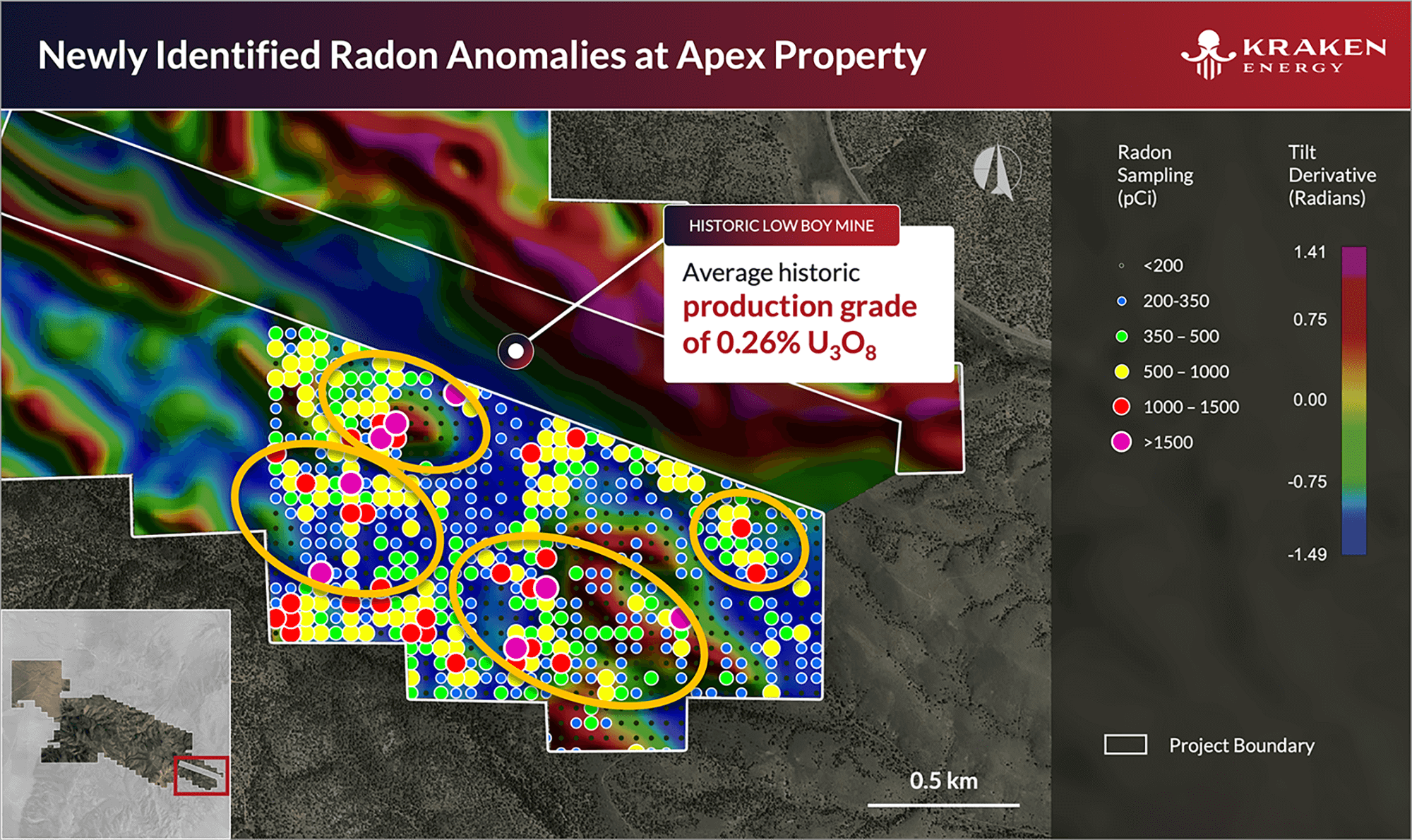

*"With the upcoming drill program at the historic Apex Mine, our team continues to generate exciting new uranium targets along the currently delineated 17.5 km mineralized trend on the Apex Property," said Matthew Schwab, CEO of Kraken. "Recently, we have identified additional strong radon anomalies indicative of potential uranium mineralization at depth, further supported by airborne geophysical surveys*."

Strong radon anomalies are located along the shoulder of magnetic high anomalies that correlate well with the known high-grade, shallow uranium mineralization at the historic Apex and Lowboy Mine. Four newly delineated priority target areas are shown in the following graphic:

In addition, the Company has valuable metal deposits such as silver and gold, bornite (copper) and molybdenum - raw materials associated with uranium. These valuable metals add to the overall value of Kraken Energy's mining operations.

Palantir expands B2B business with AI data interface for US companies

Palantir is mainly known for providing software solutions to support the US military or analyzing, interpreting and forecasting data in the healthcare sector. The public sector division provides stable revenues.

CEO Alex Karp is now expanding the business more towards B2B customers. Data-driven business will continue to grow in the future. In the clothing industry alone, AI-supported shopping platforms can analyze user behaviour and thus promote goods that do not take up storage space for long or, in the worst case, are produced for the landfill.

This strategically smart expansion into AI data analysis for US companies can strengthen Palantir's market position. It also makes use of the network effect by making its API accessible and thus introducing the data analysts on the other side of the group to the data results and familiarizing them with their use.

At AIPCon, Palantir customers such as United Airlines, Nebraska Medicine, AARP, and Wendy's QSCC presented their use of Palantir software. Thanks to Palantir's AIP Bootcamp initiative, these customers and others have made the leap from prototypes to AI readiness. These B2B customers are now acting as Palantir Ambassadors to promote their AI workflows to other customers and encourage participation in Palantir solutions. Palantir is giving the market what it wants.

In the first quarter, Palantir reported adjusted earnings of USD 0.08 per share on revenue of USD 634 million, slightly ahead of Wall Street expectations. The forecast for the current quarter is between USD 649 million and USD 653 million. For the full year, revenues of USD 2.68 to 2.69 billion are expected.

Apple outsources its financial business to a partner company. Affirm enables Apple Pay users to apply for and use loans directly via the platform. In Europe, Apple is facing a lawsuit for violating competition law due to its strong internal network. Kraken Energy is skillfully leveraging network effects in the uranium exploration industry to strengthen its presence in the US. With high-quality uranium projects such as the Apex Uranium Mine and a strong pipeline of new discoveries, the Company is well-positioned to capitalize on the growing global demand for nuclear energy resources. The home country is also the world's largest consumer of uranium, making the business a "home run" for Kraken Energy. Palantir is expanding its business activities towards B2B customers. Clients from the public sector are generating steady revenue, so analysts view this B2B push positively. Palantir has the opportunity to network so strongly with B2B companies that they will rely on its AI interface in the future. For investors, these three players in different sectors offer exciting investment opportunities. Apple seems to be strengthening its position in borrowed money by outsourcing its lending business to Affirm without losing its brand image. Kraken Energy enjoys a pole position due to the energy needs and demand of the US. Palantir is tapping into the B2B market with AI. The explorer share appears to be the least volatile in this context, as energy supply is the fundamental prerequisite in all areas and businesses.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.