March 27th, 2023 | 09:31 CEST

American Lithium, Blackrock Silver and Standard Lithium - Lithium is increasingly scarce

Lithium-ion batteries are the most common battery technology for electronic devices, electric vehicles and energy storage due to their high energy density and long life. In addition, the critical metal is used in the aerospace industry, medical technology and metal processing. Demand is rising dramatically, while supply can hardly keep up, mainly due to the mobility shift. Producers of the scarce commodity will undoubtedly emerge as the beneficiaries of this overhang in the future.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

AMERICAN LITHIUM | CA0272592092 , Blackrock Silver | CA09261Q1072 , STANDARD LITHIUM LTD | CA8536061010

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Standard Lithium - Interesting constellation

With a market capitalization of CAD 761.92 million, the Vancouver, Canada-based company is one of the most promising players in the lithium market. Thus, in addition to its own advanced processing technologies and strategic partnerships, such as with global specialty chemicals company Lanxess AG, Standard Lithium should be able to bring the first new lithium project in the US into production in over 50 years. The Company's 437.5 sq km flagship project in southern Arkansas is the largest and most advanced lithium brine project in the US, with a resource of 3.94 million tons of lithium carbonate equivalent.

In support of the upcoming Preliminary Feasibility Study, a new drilling program has been initiated in Southwest Arkansas and includes two new locations and three re-drills of suspended and abandoned oil and gas wells. When an existing well is restarted, it is typically deepened to collect more data from the full thickness of the Smackover Formation that underlies the project area. The drilling program is intended to substantiate the resource definition, reduce the risk to the resource estimate, provide additional porosity and permeability data across the entire thickness of the productive zones in the Smackover Formation, and optimize the design of the production well.

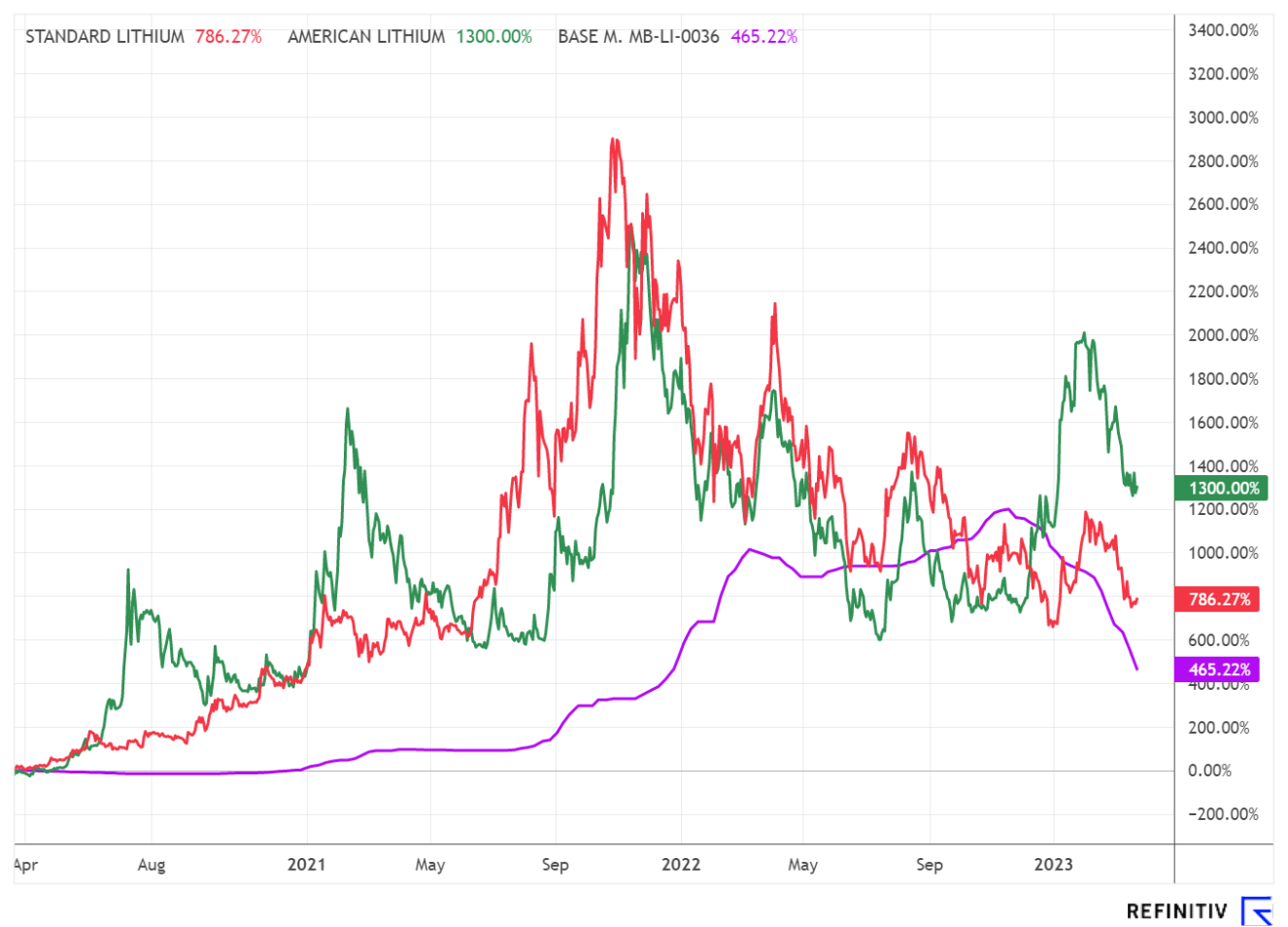

After rising 1,600% in the period between January and October 2021 to a high of CAD 15.92, the stock is now in correction. A sustainable bottom could now form in the area of CAD 4.30, which could be the starting point of a new upward wave.

Blackrock Silver - New player in the lithium sector

The Blackrock Silver share could not replicate the outperformance in the lithium sector but could make up for it in the expected upward movement. The reasons for this are manifold. For example, precious metals gold and silver corrected sharply in recent months and made a promising comeback in recent weeks, which should allow second-tier stocks to follow suit with significant leverage. Blackrock Silver focuses on developing silver and gold projects in the US state of Nevada. In doing so, Blackrock's flagship Tonopah West Project consolidates the western half of the famed silver district within the Walker Lane trend. The Tonopah Silver District has historically produced over 174 million ounces of silver and 1.8 million ounces of gold. In the process, the Canadians completed more than 150,000 meters of drilling on their project since the beginning of the decade. An initial mineral resource estimate indicated values of 2.97Mt at a block diluted grade of 208 g/t silver and 2.5 g/t gold for a total inferred mineral resource of 19,902,000 oz Ag and 238,000 oz Au or 446 g/t silver equivalent for 42.65M oz.

A surprising and prospective discovery was made adjacent to the Tonopah property in the northern part after Blackrock Silver staked 20 sq km of claims and identified broad lithium zones. Beginning near surface, drilling encountered grades of up to 1,217 ppm lithium in a 3km wide strip up to 56.4m thick, extending to 8m at surface. Of interest here is that right next to it is American Lithium's high-grade TLC uranium deposit, which according to a pre-feasibility study, has an after-tax net present value (8%) of USD 3.26 billion and an after-tax internal rate of return (IRR) of 27.5%.

In addition to Tonopah, Blackrock Silver controls Silver Cloud, another high-grade property measuring more than 45 sq km. The project is located 20 km south of the Midas mine and just 3 km from the Hollister mine along the prolific Northern Nevada Rift in northern Nevada. The exploration company is planning a Phase I drilling program at its Bonanza-hosted Northwest Canyon discovery well. Drilling plans have already been finalized to permit a 4,000-meter drill program.

With a market capitalization of CAD 57.28 million, Blackrock Silver could benefit from long-term rising silver prices, on the one hand, as well as advancing exploration at its Tonopah West lithium project, on the other. The Company recently completed a CAD 4.385 million private placement and is funded for its future plans.

American Lithium - Prospective with uranium fantasy

In close proximity to Blackrock Silver's lithium project is American Lithium's TLC- Lithium property. The project is also close to Tonopah's regional centre and county seat, near Tesla's Gigafactory in Nevada. Logistics with paved roads and power and water resources are prime for development. Late last year, the Company announced an updated mineral resource estimate that significantly increased the contained lithium resources for the TLC project. This MRE was completed as part of the process to prepare the first Preliminary Economic Assessment and was included in the mine plan for the first PEA, which was released on February 1, 2023. TLC currently hosts 4.2Mt of lithium carbonate equivalent Measured Resources, 4.63Mt of LCE Indicated Resources and 1.86Mt of LCE Inferred Resources.

Andrew Pollard, president and chief executive officer of Blackrock Silver, noted the importance of the district, "Tonopah is widely known as one of North America's great silver districts, but is rapidly gaining prominence as a world-renowned district in the lithium sector following the release of American Lithium's first PEA for its TLC project, which outlines a very robust, low-cost operation, and the announcement of our recent lithium discovery nearby."

In addition to TLC, American Lithium is advancing the development of the large Falchani hard rock lithium deposit and one of Latin America's highest-yielding uranium deposits, Macusani, following its acquisition of Plateau Energy Metals. Both projects are located in southeastern Peru. Like Standard Lithium, the stock remains in a consolidation phase at USD 2.31. The rising 200-day moving average runs at USD 2.06, which could serve as a prominent support in the long term.

The increasing demand for the critical metal should push the lithium price back into higher territory in the long term. Currently, stocks like Standard Lithium and American Lithium are in correction. Blackrock Silver should benefit twofold from a rising gold and silver price and its new lithium project.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.